As filed with the Securities and Exchange

Commission on December 18, 2020

Registration No. [ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM F-3

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

TANTECH HOLDINGS LTD

(Exact name of registrant as specified

in its charter)

|

British Virgin Islands

|

|

Not Applicable

|

|

(State or other jurisdiction

|

|

(I.R.S. Employer

|

|

of incorporation or organization)

|

|

Identification No.)

|

c/o Tantech

Holdings (Lishui) Co., Ltd.

No. 10

Cen Shan Road, Shuige Industrial Zone, Lishui City, Zhejiang Province 323000

People’s

Republic of China

+86 (578) 226-2305

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

CT Corporation System

28 Liberty St.

New York, NY 10005

+1-212-894-8940 — telephone

(Name, address including zip code, and

telephone number, including area code, of agent for service)

With a copy to:

Anthony W. Basch, Esq.

Kaufman & Canoles, P.C.

Two James Center, 14th Floor

1021 East Cary Street

Richmond, Virginia 23219

+1-804-771-5700 — telephone

+1-888-360-9092 — facsimile

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of

this registration statement as determined by the registrant.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box: ¨

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities

Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall

become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the

following box. ¨

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company x

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised accounting standards provided to Section 7(a)(2)(B) of

the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

Title of each class of

securities to be

registered

|

|

Amount

to be

registered(1)

|

|

|

Proposed

maximum

aggregate price

per share

|

|

|

Proposed

maximum

aggregate

offering price

|

|

|

Amount of

registration fee

|

|

|

Common shares, $0.001 par value, issuable upon exercise of common share purchase warrants(2)

|

|

3,305,788

|

|

$

|

1.81

|

|

$

|

5,983,476.28

|

|

$

|

652.80

|

(3)

|

|

Common shares, $0.001 par value, issuable upon exercise of placement agent common share purchase warrants(4)

|

|

363,637

|

|

$

|

1.815

|

|

$

|

660,001.16

|

|

$

|

72.01

|

(3)

|

|

TOTAL

|

|

3,669,425

|

|

|

|

|

$

|

6,643,477.44

|

|

$

|

724.81

|

|

|

(1)

|

All shares registered pursuant to this registration statement are to be offered for resale by the Selling Shareholders (defined below). Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers such indeterminate number of additional common shares of the registrant, par value $0.001 per share (the “Common Share”), issued to prevent dilution resulting from stock splits, stock dividends or similar events. No additional consideration will be received for such additional number of Common Shares, and therefore no registration fee is required pursuant to Rule 457(i) under the Securities Act.

|

|

|

|

|

(2)

|

As described in greater detail in the prospectus contained in this registration statement, the Common Shares to be offered for resale by selling shareholders include an aggregate of 3,305,788 Common Shares underlying warrants issued to the investors in connection with a private placement transaction on November 24, 2020.

|

|

|

|

|

(3)

|

Calculated pursuant to Rule 457(g) under the Securities Act.

|

|

|

|

|

(4)

|

As described in greater detail in the prospectus contained in this registration statement, the Common Shares to be offered for resale by selling shareholders include an aggregate of 363,637 Common Shares underlying a warrant issued to the placement agent in connection with a private placement transaction on November 24, 2020.

|

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of

the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant

to said section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is

not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject

to Completion, dated December 18, 2020

PROSPECTUS

Up to 3,669,425 Common Shares underlying

Warrants

Offered by the Selling Shareholders

TANTECH HOLDINGS LTD

This prospectus relates to the resale,

from time to time, by the selling shareholders (the “Selling Shareholders”) identified in this prospectus under the

caption “Selling Shareholders,” of up to 3,669,425 of our common shares, par value $0.001 per share (the “Common

Share”), issuable upon exercise of certain outstanding warrants (the “Warrants”) to purchase Common Shares.

The Warrants include:

|

|

1)

|

the warrants (the “Unregistered Investor Warrants”) we issued to the investors pursuant

to a securities purchase agreement dated November 20, 2020 (the “Securities Purchase Agreement”), to purchase up to

an aggregate of 3,305,788 Common Shares at an exercise price equal to $1.81 per share, which warrants expire on November 24, 2025;

and

|

|

|

2)

|

the warrant (the “Univest Warrant”) we issued to Univest Securities, LLC (“Univest”),

the placement agent in connection with the Securities Purchase Agreement, pursuant to a placement agency agreement dated November

20, 2020, as amended on December 8, 2020 (the “Placement Agency Agreement”), to purchase up to an aggregate of 363,637

Common Shares at an exercise price equal to $1.815 per share, exercisable between May 24, 2021 to November 24, 2023.

|

We are not selling any Common Shares under

this prospectus and will not receive any proceeds from the sale of Common Shares by the Selling Shareholders. We will receive proceeds

from cash exercise of the Warrants which, if exercised in cash with respect to all of the 3,669,425 Common Shares, would result

in gross proceeds of $6,643,477.44 to us. The Selling Shareholders will bear all commissions and discounts, if any, attributable

to the sale of the Common Shares.

The Selling Shareholders may sell the Common

Shares offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions

or through any other means described in this prospectus under the caption “Plan of Distribution.” The Common Shares

may be sold at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market price or at

negotiated prices.

Our Common Shares are listed on the Nasdaq

Capital Market (“Nasdaq”) under the symbol “TANH.” On December 15, 2020, the last reported sale price of

our Common Shares on Nasdaq was $1.43 per share.

Investing in our securities being offered

pursuant to this prospectus involves a high degree of risk. You should carefully read and consider the risk factors beginning on

page 15 of this prospectus, as well as those included in the periodic and other reports we file with the Securities and Exchange

Commission before you make your investment decision.

Neither the Securities and Exchange

Commission, any United States state securities commission, the British Virgin Islands Monetary Authority, nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this prospectus is ______,

___

TABLE OF CONTENTS

PROSPECTUS SUMMARY

This prospectus describes the general manner

in which the Selling Shareholders may offer from time to time up to an aggregate of 3,669,425 Common Shares issuable upon the exercise

of the Warrants. You should rely only on the information contained in this prospectus and the related exhibits, any prospectus

supplement or amendment thereto and the documents incorporated by reference, or to which we have referred you, before making your

investment decision. Neither we nor the Selling Shareholders have authorized anyone to provide you with different information.

If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus, any prospectus supplement

or amendments thereto do not constitute an offer to sell, or a solicitation of an offer to purchase, the Common Shares offered

by this prospectus, any prospectus supplement or amendments thereto in any jurisdiction to or from any person to whom or from whom

it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information

contained in this prospectus, any prospectus supplement or amendments thereto, as well as information we have previously filed

with the U.S. Securities and Exchange Commission (the “SEC”), is accurate as of any date other than the date on the

front cover of the applicable document.

If necessary, the specific manner in which

the Common Shares may be offered and sold will be described in a supplement to this prospectus, which supplement may also add,

update or change any of the information contained in this prospectus. To the extent there is a conflict between the information

contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided

that if any statement in one of these documents is inconsistent with a statement in another document having a later date-for example,

a document incorporated by reference in this prospectus or any prospectus supplement-the statement in the document having the later

date modifies or supersedes the earlier statement.

Neither the delivery of this prospectus

nor any distribution of Common Shares pursuant to this prospectus shall, under any circumstances, create any implication that there

has been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date

of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

As permitted by SEC rules and regulations,

the registration statement of which this prospectus forms a part includes additional information not contained in this prospectus.

You may read the registration statement and the other reports we file with the SEC at its website or at its offices described below

under “Where You Can Find More Information.”

Except as otherwise indicated by the context,

references in this prospectus to:

|

|

·

|

|

“we,” “us,” “our company,” “our” and “Tantech” refer to

|

|

|

·

|

Tantech Holdings Ltd, a British Virgin Islands company limited by shares (formerly Sinoport Enterprises Limited) (“THL” when individually referenced);

|

|

|

·

|

USCNHK Group Limited, a Hong Kong limited company (“USCNHK” when individually referenced), which is a wholly owned subsidiary of THL;

|

|

|

·

|

EAG International Vantage Capitals Limited, a Hong Kong limited company (“Euroasia” when individually referenced), which is a wholly owned subsidiary of THL;

|

|

|

·

|

Tantech Holdings (Lishui) Co., Ltd., a PRC company (“Lishui Tantech” when individually referenced), which is a wholly owned subsidiary of USCNHK ;

|

|

|

·

|

Euroasia New Energy Automotive (Jiangsu) Co., Ltd., a PRC company (“Euroasia New Energy” when individually referenced), which is a wholly owned subsidiary of EAG;

|

|

|

·

|

Shanghai Jiamu Investment Management Co., Ltd., a PRC company (“Jiamu” when individually referenced), which is a wholly owned subsidiary of EAG;

|

|

|

·

|

Lishui Xincai Industrial Co., Ltd., a PRC company (“Lishui Xincai” when individually referenced), which is a wholly owned subsidiary of Lishui Tantech;

|

|

|

·

|

Lishui Smart New Energy Automobile Co., Ltd., a PRC company (“Lishui Smart” when individually referenced), which is a wholly owned subsidiary of Lishui Tantech;

|

|

|

·

|

Zhejiang Shangchi New Energy Automobile Co., Ltd., a PRC company (“Zhejiang Shangchi” when individually referenced), which is a wholly owned subsidiary of Lishui Tantech;

|

|

|

·

|

Zhejiang Tantech Bamboo Charcoal Co., Ltd, a PRC company (“Tantech Charcoal”), which is a wholly owned subsidiary of Lishui Xincai; and

|

|

|

·

|

Lishui Jikang Energy Technology Co., Ltd., a PRC company (“Jikang Energy”), which is a wholly owned subsidiary of Lishui Xincai;

|

|

|

·

|

Zhejiang Tantech Bamboo Technology Co., Ltd, a PRC company (“Tantech Bamboo”), which is a wholly owned subsidiary of Jikang Energy;

|

|

|

·

|

Hangzhou Tanbo Technology Co., Ltd., a PRC company (“Tanbo Tech”), which is a wholly owned subsidiary of Lishui Xincai;

|

|

|

·

|

Hanzhou Wangbo Investment Management Co., Ltd, a PRC company (“Wangbo”), which is 95% owned by Xinyang Wang and 5% owned by Wangfeng Yan, and a consolidated affiliated variable interest entity controlled solely by Jiamu;

|

|

|

·

|

Hangzhou Jiyi Investment Management Co., Ltd., a PRC company (“Jiyi”), which is a wholly owned subsidiary of Jiamu:

|

|

|

·

|

Shangchi

Automobile Co., Ltd., a PRC company (“Shangchi Automobile”), which is 51% owned by Wangbo, 19% owned by

Jiyi, and 30% owned by an unrelated third party; and

|

|

|

·

|

Shenzhen Yimao New Energy Sales Co., Ltd., a PRC company (“Shenzhen Yimao”), which is a wholly owned subsidiary of Shangchi Automobile.

|

|

|

·

|

all references to “RMB,” “Renminbi” and “¥” are to the legal currency of China and all references to “USD,” “U.S. dollars,” “dollars,” and “$” are to the legal currency of the United States; and

|

|

|

·

|

“China” and “PRC” refer to the People’s Republic of China, and for the purpose of this prospectus only, excluding Taiwan, Hong Kong and Macau.

|

INFORMATION REGARDING FORWARD-LOOKING

STATEMENTS

This

prospectus and our SEC filings that are incorporated by reference into this prospectus contain or incorporate by reference forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than

statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other

financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning

proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements

of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of

the foregoing. The words “believe,” “anticipate,” “estimate,” “plan,” “expect,”

“intend,” “may,” “could,” “should,” “potential,” “likely,”

“projects,” “continue,” “will,” and “would” and similar expressions are intended

to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking

statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties.

We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed in our forward-looking statements

and you should not place undue reliance on these statements. There are a number of important factors that could cause our actual

results to differ materially from those indicated or implied by forward-looking statements. These important factors include those

discussed under the heading “Risk Factors” contained or incorporated by reference in this prospectus and in the applicable

prospectus supplement and any free writing prospectus we may authorize for use in connection with a specific offering. These factors

and the other cautionary statements made in this prospectus should be read as being applicable to all related forward-looking statements

whenever they appear in this prospectus. Except as required by law, we undertake no obligation to update publicly any forward-looking

statements, whether as a result of new information, future events or otherwise.

OUR BUSINESS

Our Company

We develop and manufacture bamboo-based

charcoal products for industrial energy applications and household cooking, heating, purification, agricultural and cleaning uses.

We have grown over the past decade to become a pioneer in charcoal products industry made from carbonized bamboo. We are a highly

specialized high-tech enterprise producing, researching and developing bamboo charcoal-based products with an established domestic

and international sales and distribution network. On July 12, 2017, we completed the acquisition of Suzhou E Motors

Co, which became known as Shangchi Automobile, a specialty electric vehicles manufacturer based in Zhangjiagang City, Jiangsu Province,

and our business includes the manufacture and sale of electric vehicles. In November 2020, we established two subsidiaries in Zhejiang

Province which will focus on production and sale of electric vehicles.

Below is a chart representing our current

corporate structure as of date of this prospectus:

We provide our products in the following

areas:

We oversee a national sales network that

has a presence in 19 cities throughout China. Through wholesalers, our products are also sold in Japan, South Korea, Taiwan, the

Middle East and Europe.

In addition to our bamboo charcoal products,

we also derive revenues from our trading activities, which primarily relate to industrial purchases and sales of charcoal.

Further, we own an indirect 18% interest

in Libo Haokun Stone Co., Ltd., a marble mining operating company, and an indirect 14.76% interest in Fuquan Chengwang Mining

Co., Ltd. (“Fuquan Chengwang”), a basalt mining company. In addition, Fuquan Chengwang is renewing a government-issued

mining permit which expired on May 20, 2019. Pursuant to an investment agreement amendment we signed, we extended the renewal

due date from June 30, 2020 to December 31, 2020.

We are headquartered in the bamboo rich

southwest of Zhejiang Province, in the city of Lishui. Zhejiang province, located in southeastern coastal China, is China’s

tenth largest province in population, with 58.5 million residents, and tenth in terms of population density as of the end of 2019.

The first province in China without any counties in the poverty-county list of the central government, Zhejiang has become one

of the wealthiest and most commercial provinces in China. Its province-wide GDP of approximately RMB 6.23 trillion in 2019 places

it as the fourth highest in China in absolute amount.

Lishui is a prefecture-level city located

in southwest Zhejiang province. Approximately 2.7 million residents live in the city as the end of 2019, and city-wide GDP is approximately

RMB 147.7 billion in 2019. Lishui’s primary industries include wood and bamboo production, ore smelting, textile, clothes

making, construction materials, pharmaceutical chemistry, electronic machinery and food processing. As to wood and bamboo production,

approximately 69% of Lishui prefecture is covered with forest, giving it the nickname “The Foliage Ocean of Zhejiang.”

|

Zhejiang Province

|

|

City of Lishui

|

|

|

|

|

|

|

|

We rely on a combination of patent, trademark

and trade secret laws and non-disclosure agreements and other methods to protect our intellectual property rights. We currently

own five patents in China covering our bamboo charcoal production.

For the years ended December 31, 2019,

2018 and 2017, three major suppliers accounted for approximately 76%, three major suppliers accounted for approximately 72% and

three major suppliers accounted for approximately 61% of the Company’s total purchases, respectively. Because we purchase

a material amount of our raw materials from these suppliers, the loss of any such suppliers could result in increased expenses

for our company and result in adverse impact on our business, financial condition and results of operations.

Bamboo and Bamboo Charcoal

As a company primarily focused on bamboo

charcoal, our business is in a sub-part of China’s bamboo industry. Government policies that encourage the use of bamboo

also benefit the bamboo charcoal industry. Accordingly, we provide a brief overview of bamboo and those elements of China’s

bamboo industry, insofar as they have an effect on the bamboo charcoal industry in general and our company in particular.

Bamboo

Bamboo plants are some of the fastest growing

plants in the world, with some varieties growing more than three feet per day. Moreover, Bamboo can be re-grown quickly following

harvesting, ensuring high frequency utilization without shortages. Unlike trees, individual bamboo culms emerge from the ground

at their full diameter and grow to their full height in a single growing season of three to four months. Over the next 2–5

years, fungus begins to form on the outside of the culm, which eventually penetrates and overcomes the culm. Eventually the fungal

growths cause the culm to collapse and decay. As a result, bamboo culms generally have life cycles of up to ten years, at which

point they must be cut down in order to preserve the environment of the surrounding forest. Optimal quality bamboo culms for carbonization

are cut at five years of age. Additional bamboo can be grown in the same area where previous culms grew.

Bamboo is considered environmentally friendly

because it takes in substantial amounts of carbon dioxide and gives off oxygen as it grows. Indeed, bamboo sequesters more carbon

dioxide than an equivalent region of plantation trees. Moreover, harvesting of bamboo is considered more environmentally friendly

than allowing it to live through the full life cycle, as such harvesting maximizes the amount of carbon dioxide the bamboo can

sequester because of the effects of fungus noted above.

The total value of China's bamboo industry

was approximately $35 billion, as of 2018. As of 2018, it employs more than 8 million people and has become a pillar industry of

development of economic society of China’s bamboo main producing area and major income source of peasants’ families.

Given bamboo’s importance in China, we believe that favorable government policies and regulations encouraging the advancement

of bamboo technology in China generally will create an environment favorable to our increased production of bamboo-based charcoal

products. The Chinese government is also working to develop its bamboo industry to meet its goals in environmental protection and

green economic development, as planting bamboo is both profitable and environmentally-friendly, according to the International

Network for Bamboo and Rattan (“INBAR”). Moreover, given the central government’s goal to reduce carbon dioxide

emissions per unit of GDP by 60 to 65 percent by 2030 compared to 2005, we expect the bamboo technology industry to continue to

be important to the country’s long-term planning.

China now produces approximately 80% of

the world’s bamboo and consumes approximately 60% of that production. According to statistics from INBAR, China has more

than 6 million hectares for bamboo production and over 500 bamboo species. In 2018, for example, the domestic industry was worth

$30 billion and employed more than 8 million people.

During a period of rampant deforestation,

China put in place restrictions on harvesting of natural wood and encouraged the country to make more use of bamboo. Under the

National Forest Protection Program (“NFPP”), China implemented natural forest logging bans that covered 17 provinces

in China. These bands required consumers of charcoal to look to other sources for creation of charcoal than the natural trees they

were most familiar with using. During this time, bamboo charcoal became a viable alternative in the country.

Bamboo has many desirable characteristics

compared to timber based products:

|

|

·

|

Culms are ideally allowed to reach 5-7 years of maturity prior to full capacity harvesting. The clearing out or thinning of culms, particularly older decaying culms, helps to ensure adequate light and resources for new growth;

|

|

|

|

|

|

|

·

|

Commercial growers can annually harvest between one-quarter and one-third of a bamboo grove that is at least three years old. Harvesting at such rates allows continuous, sustainable harvesting;

|

|

|

·

|

Bamboo will re-grow from same rootstalk (rhizome);

|

|

|

·

|

Plant tends to be drought tolerant

|

|

|

·

|

Bamboo minimizes carbon dioxide gases and generates up to 35% more oxygen than an equivalent area of trees. One hectare of bamboo can sequester 62 tons of CO2 /year, while one hectare of young forest can sequester 15 tons of CO2 /year.

|

The physical and environmental properties

of bamboo make it an exceptional economic resource for a wide range of uses. It grows quickly and can be harvested annually without

depletion of the parent plant and without causing harvesting damage or deterioration in soil quality; in addition bamboo is very

versatile and has many uses in the construction, culinary, furniture, pulp, pharmaceutical, and textiles industries. New uses for

bamboo are being developed as we understand its biological, chemical and physical characteristics.

The global bamboos market size was valued

at USD 68.8 billion in 2018 and is expected to grow at a compound annual growth rate of 5.0% from 2019 to 2025. There are about

39 genera of bamboo and more than 590 species in China with more than 6 million hectares of pure bamboo forest, which accounts

for 25% of the bamboo area in the world. With more than 6 million hectares of bamboo plantations as of September 2018 , China

is leading the world’s bamboo industry in its number of varieties, amount of bamboo reserves, as well as production output,

said Zehui Jiang, co-chair of INBAR’s board of trustees.

Zhejiang province is situated on the shore

of the East China Sea and has about thirty genera and four hundred varieties of bamboo. Bamboo products made there are sold all

around the world, with an annual output of RMB 48.6 billion ($6.9 billion) in 2017. Zhejiang province has almost one sixth of the

whole bamboo forest area in China.

Bamboo Charcoal

Bamboo charcoal has been documented in

China as early as 1486 AD during the Ming Dynasty in China. Bamboo charcoal has traditionally been used as a heating source, in

replacement of wood, coal or wood charcoal. As a source of heat, bamboo charcoal has a calorific value approximately half that

of an equivalent weight of oil, and similar to the calorific value of wood. In addition to being an efficient source of heat, bamboo

charcoal is considered by the International Tree Foundation less polluting than wood charcoal, because it burns more cleanly due

to a lower percentage of volatile matter. Smoke and pollution in charcoal burning relate largely to moisture content and volatile

matter. While careful processing can control the moisture content, the ratio of volatile matter is affected by the source of charcoal.

Because of the relatively higher pollution

levels in wood charcoal, it is estimated that the burning of wood fuel claims the lives of an estimated 4 million people every

year who inhale the smoke. Moreover, it takes between seven and ten tons of wood to produce one ton of wood charcoal, compared

with four tons of bamboo to produce one ton of bamboo charcoal.

In addition to use as a heating source,

bamboo charcoal has applications as an adsorbent, deodorizer, dehumidifier, purifier and electrical conductor. Nonactivated bamboo

charcoal is a versatile mineral matter with great porosity and consequently high absorption ability. Bamboo charcoal’s porous

surface area makes it an ideal air and water purifying agent, odor absorbent, additive, dehumidifier and electromagnetic wave absorber

(electromagnetic waves from computers, mobile telephones and other electronics can be conducted through bamboo charcoal to dissipate

their energy in the charcoal pores). While wood charcoal’s surface area may be as low as 20 m 2 /g, bamboo charcoal

generally ranges from 300-600 m 2 /g.

While bamboo charcoal has a high absorptive

capacity after carbonization, it becomes even more effective after activation. Activated bamboo carbon is bamboo charcoal that

has been taken through an extra step greatly increasing its absorptive abilities. Activated bamboo charcoal can be used for cleaning

the environment, absorbing excess moisture and producing medicines.

The carbonization process occurs in the

absence of oxygen and produces a brown-black liquid containing more than 200 organic compounds known as bamboo vinegar, or pyroligneous

acid. Following sedimentation two distinct layers appear: a light yellow-brown liquid (clarified bamboo vinegar) which can be refined

to produce acetic acid, propionic acid, butyric acid, carbinol and organic solvents, and a viscid oily liquid (bamboo tar) containing

large amounts of phenol substances. Bamboo vinegar is found in sanitary and health products as well as a range of horticultural

fertilizers and organic solutions.

EDLC Carbon (Divested Business)

On December 14, 2017, the Company

entered into a sale agreement and related agreements (the “Agreements”) to transfer its electric double-layer capacitor

(“EDLC”) carbon business (including intellectual property rights and equipment) to Zhejiang Apeikesi Energy Co., Ltd.

(the “Buyer”), a Chinese start-up company controlled by Dr. Zaihua Chen, our former CTO. After the completion

of the transactions, the Company focuses its core business on the development of specialty-used electric vehicles and traditional

charcoal products. Tantech’s Board of Directors approved the terms of the sale based on a valuation report obtained by the

parties and with knowledge that Dr. Chen was the Company’s CTO during the transaction. However, as part of the transactions,

Dr. Chen resigned from the Company’s CTO position on December 31, 2017.

The decision of the Company to divest its

EDLC carbon business was made based on business considerations, including the fact that (1) the Company’s EDLC carbon

business had been dependent on a very limited number of customers, (2) there existed capital constraints on additional substantial

investment on developing EDLC carbon products, (3) there existed a challenging market condition and unfavorable political

climate and (4) the Company intended to transition focus of its traditional charcoal business to its electric vehicle business.

Pursuant to the Agreements, Tantech sold

to the Buyer all of its intellectual property rights related to EDLC carbon and the equipment for research and development and

production. The Buyer paid Tantech a total purchase price of RMB 16 million. The payment will be made over 10 years. Other key

terms include the following: (a) the first payment of 28% of the total purchase price, or RMB 4.48 million, was made in 2017,

consisting of RMB 3.2 million in cash advancement and RMB 1.28 million as payment for Tantech’s EDLC carbon related intellectual

property rights; (b) the remaining balance of the purchase price will be paid evenly over the following nine years; (c) the

second payment of RMB 1.28 million of the purchase price and cash interests on the remaining cash receivable was made in 2018;

and (d) Tantech will lease its office space, including offices and EDLC carbon research and development and production facilities,

to the Buyer, subject to a concession of a free leasehold for the first two years.

Disposal of Tantech Energy

On June 26, 2019, our wholly-owned

subsidiary Tantech Bamboo entered a share transfer agreement to sell all of its shares in its wholly-owned subsidiary, Tantech

Energy, to an unrelated third party. The consideration is RMB 6,500,000 (approximately US$ 941,000). The Company completed the

disposition process in July 2019.

Electric Vehicles

Pursuant to the Call Option Agreement executed

on May 2, 2016, Supplemental Agreement I signed on December 22, 2016 and Supplemental Agreement II signed on July 12,

2017, the Company acquired a 70% equity interest of Shangchi Automobile, formerly Suzhou Yimao E-Motors Co., Ltd. The 70%

equity interest include a 19% equity interest owned directly by Jiyi and a 51% equity interest owned through a series of contractual

agreement with the owners of Wangbo. Jiyi is 100% owned by Jiamu, which is, in turn, wholly owned by Euroasia International Capital

(“Euroasia”), a 100% owned subsidiary of the Company. These agreements include an Exclusive Management Consulting and

Technology Agreement, two Equity Pledge Agreements, two Exclusive Call Option Agreements, two Proxy Agreements and two Power of

Attorney (collectively “VIE Agreements”). Pursuant to the above VIE Agreements, Jiamu has the exclusive right to provide

Wangbo consulting services related to business operations including technical and management consulting services. All the above

contractual agreements obligate Jiamu to absorb a majority of the risk of loss from Wangbo’s activities and entitle Jiamu

to receive a majority of their residual returns. In essence, Jiamu has gained effective control over Wangbo. Therefore, the Company

believes that Wangbo should be considered as a Variable Interest Entity (“VIE”).

Suzhou E-Motors was established in April 2011.

It changed its name to Shangchi Automobile in January 2019. It develops, manufactures, and sells specialty electric vehicles.

The company also offers solar cells, lithium-ion batteries, auto parts, and electric control systems in China. Its manufacturing

facility, located in Zhangjiagang City, Jiangsu Province is 15,000 square meters. Shangchi Automobile has been approved by Ministry

of Industry and Information Technology of the People's Republic China (“MIIT”) as qualified to manufacture electric

vehicles. It is also entitled to both central and local government subsidies with any approved electric vehicle (“EV”)

models. As of November 30, 2020, Shangchi Automobile has not updated the previous ten EV models and remained one fuel vehicle

model approved by MIIT.

Shangchi Automobile has to date developed

a full range of electric buses and a variety of specialty vehicles. It has developed more than ten models of electric buses, electric

logistics cars, and specialty vehicles, such as high-speed brushless cleaning cars, electric cleaning cars, special emergency vehicles,

and funeral cars. The sale region for current products is mainly within Jiangsu Province where the Shangchi Automobile locates.

In 2017, we sold 100 various types of vehicles, where 10 types of vehicles directly sold to Northern China, and over 90 types of

vehicles were used in Northern China. In 2018, we sold 110 logistic vehicles to Southern China. In 2019, we sold 117 electronic

logistic cars in fiscal 2019 on behalf of other vehicle manufacturers for commission income. Below are examples of the specialty

vehicles produced by Shangchi Automobile.

Urban

Sanitary Vehicles. The Urban Sanitary Vehicles work with high efficiencies with low operating expenses. They travel

(clean) around 20~30 km/hr with fuel consumption rates approximately 3.33 km/liter. The vehicles are equipped with professional

sanitary vehicle chasses, with front axle drives & front axle steering to strengthen their operations’ stability

and smoothness; the whole vehicle is made of strengthened steel plates and pipes, making it more durable and anti-collusive.

Tourist

Buses. The Tourist Buses are 12-meter-long and 7-meter-long lithium-battery-based buses whose interior noise is less

than 76 dBs and off vehicle acceleration noise is less than 82 dbs.

Logistic

Vehicles. The logistic electric vehicles are 4.2-meter-long, 810 kg standard load weight fully charged vehicles. Each

are a 100% electricity-driven vehicle specially designed for logistics companies. The batteries for this vehicle can be charged

and discharged quickly, and each vehicle is made of high quality steel stamping body which is highly durable. The internal structure

and the design of the car doors are both made for the deliverers’ convenience.

Below are the major vehicle components

we purchase for assembling the EVs:

|

|

·

|

Lithium-ion battery packs

|

|

|

·

|

Three-in-One electric control systems

|

In general, the purchase of the vehicle

chassis, electric motors, lithium-ion battery pack and three-in-one electric control system have covered two-thirds of EVs’

production cost. We purchase these components from four different but well-established suppliers in China.

We currently rely on local EV distributors

to sell our EVs to end-users. The primary reason for such a sales channel is the dependence on local government subsidy policies.

In general, local governments only allow the locally-licensed EV distributors to sell EVs, which are entitled to EV road permits

and subsidies.

Over the years, Shangchi Automobile has

had more than 15 EV core technologies and patents, including nanotechnology for raw materials for power lithium electronics, group

technology of power lithium electronics and battery management technology.

Due to China's revised new energy vehicle

subsidy policy and fierce competition in the electric buses market, we experienced declined customer orders in sales of EVs in

2019. We have temporarily suspended the sale of EVs in order to protect working capital. With continuing assembling vehicles for

other manufacturer, Shangchi Automobile has maintained a healthy working capital and flow. In the meantime, we were engaged with

research and develop team to seek new EVs models and set up two subsidiaries in Zhejiang province to produce and sell new energy

street sweepers. Based on Chinese government's environmental protection requirements, we have adopted a differentiation strategy,

focusing on new energy special vehicles, such as new energy logistics vehicles and new energy street sweepers. The newly developed

new energy street sweepers are expected to be produced in the first half of 2021, and sales are expected to begin at that time.

Corporate Information

Our principal executive offices are located

at c/o Tantech Holdings (Lishui) Co., Ltd., No. 10 Cen Shan Road, Shuige Industrial Zone, Lishui City, Zhejiang Province

323000, People’s Republic of China. Our telephone number at this address is +86-578-226-2305. Our Common Shares are traded

on Nasdaq under the symbol “TANH.”

Our Internet website, http://ir.tantech.cn,

provides a variety of information about our Company. We do not incorporate by reference into this prospectus any of the information

on, or accessible through, our website, and you should not consider it as part of this prospectus. Our annual reports on Form 20-F

and current reports on Form 6-K filed and furnished with the SEC are available, as soon as practicable after filing, at http://ir.tantech.cn/SEC-Filings,

or by a direct link to its filings on the SEC’s free website.

THE OFFERING

|

|

Common shares issued and outstanding as of December 18, 2020

|

|

35,894,097 Common Shares.

|

|

|

|

|

|

|

|

Common shares offered by the Selling Shareholders

|

|

Up to 3,669,425 Common Shares underlying the Warrants (3,305,788 Common Shares underlying the Unregistered Investor Warrants and 363,637 Common Shares underlying the Univest Warrant).

|

|

|

|

|

|

|

|

Common shares to be outstanding immediately after this offering

|

|

39,563,522 Common Shares, assuming the exercise of all of the Warrants for cash and without adjustment.

|

|

|

|

|

|

|

|

Terms of the offering

|

|

The Selling Shareholders, including their transferees, donees, pledgees, assignees and successors-in-interest, may sell, transfer or otherwise dispose of any or all of the Common Shares offered by this prospectus from time to time on Nasdaq or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. The Common Shares may be sold at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market price or at negotiated prices.

|

|

|

|

|

|

|

|

Use of proceeds

|

|

The Selling Shareholders will receive all of the proceeds from the sale of any Common Shares sold by them pursuant to this prospectus. We will not receive any proceeds from the sale of the Common Shares by the Selling Shareholders. We may receive proceeds in the event that any of the Warrants are exercised at their respective exercise prices per share which may result in gross proceeds of $6,643,477.44. Any proceeds that we receive from the exercise of the Warrants will be used for working capital and other general corporate purposes. See “Use of Proceeds” in this prospectus.

|

|

|

|

|

|

|

|

Listing

|

|

Our Common Shares are listed on Nasdaq under the symbol “TANH.” There is no established trading market for the Warrants and we do not intend to list the Warrants on any exchange or other trading system.

|

|

|

|

|

|

|

|

Risk factors

|

|

Investing in our securities involves a high degree of risk. See “Risk Factors” below, beginning on page 15, and in our Annual Report on Form 20-F for the year ended December 31, 2019, which is incorporated by reference herein, to read about the risks you should consider before investing in our securities.

|

|

|

|

|

|

The

number of our Common Shares issued and outstanding as of December 18, 2020 and after this offering as shown above excludes:

|

|

·

|

1,000 Common Shares issuable upon the exercise of an investor’s warrant issued in connection with a registered direct offering which closed on September 29, 2017 (the “2017 Closing”), at an exercise price of $0.001, which warrant expires on September 29, 2022;

|

|

|

·

|

132,391

Common Shares issuable upon the exercise of a placement

agent’s warrant issued in connection with a registered direct offering in the 2017

Closing, at an exercise price of $4.675, which warrant expires on September 29, 2022;

and

|

|

|

·

|

2,754,820 Common Shares issuable upon the exercise

of investors’ warrants issued in connection with a registered direct offering

which closed on November 24, 2020 (the “2020 Closing”), at an exercise price of $1.81, which warrants expire on November

24, 2025.

|

RISK FACTORS

Before you make a decision to invest

in our securities, you should consider carefully the risks described below, together with other information in this prospectus

and the information incorporated by reference herein and therein, including our Annual Report on Form 20-F for the fiscal

year ended December 31, 2019. If any of the following events actually occur, our business, operating results, prospects or

financial condition could be materially and adversely affected. This could cause the trading price of our Common Shares to decline

and you may lose all or part of your investment. The risks described below are not the only ones that we face. Additional risks

not presently known to us or that we currently deem immaterial may also significantly impair our business operations and could

result in a complete loss of your investment.

RISKS RELATED TO THIS OFFERING

You may experience dilution to the extent that our Common

Shares are issued upon the exercise of outstanding warrants or other securities that we may issue in the future.

You may experience

dilution to the extent that our Common Shares are issued upon the exercise of outstanding warrants, and if we issue additional

equity securities, or there are any issuances and subsequent exercises of stock options issued in the future. Up to 2,754,820 Common

Shares may be issued with the exercise of warrants issued to the investors in connection with a registered direct offering in the

2020 Closing at a per share exercise price of $1.81. Up to 133,391 Common Shares may be issued with the exercise of warrants issued

in the 2017 Closing offering (including the warrant issued to the placement agent for such offering), at a per share exercise price

of $0.001 for warrants issued to the investors in such offering and $4.675 for warrant issued to the placement agent in such offering.

These warrants also bear anti-dilution protections in the event of stock dividends or splits, business combination, sale of assets,

similar recapitalization transactions, or other similar transactions. Additionally, we have established a 2014 Share Incentive

Plan for Common Shares and options for our employees, non-employee directors and consultants, and as of the date of this prospectus,

this pool contains Common Shares and options to purchase an aggregate of up to 2,160,000 of our Common Shares, which was equal

to 10% of the number of Common Shares outstanding as of our initial public offering.

A large number of Common Shares may

be sold in the market following this offering, which may significantly depress the market price of our Common Shares.

The Common Shares sold in this offering

will be freely tradable without restriction or further registration under the Securities Act. As a result, a substantial number

of our Common Shares may be sold in the public market following this offering. If there are significantly more Common Shares offered

for sale than buyers are willing to purchase, then the market price of our Common Shares may decline to a market price at which

buyers are willing to purchase the offered Common Shares and sellers remain willing to sell our Common Shares.

In the event that our Common Shares

are delisted from Nasdaq, U.S. broker-dealers may be discouraged from effecting transactions in our Common Shares because they

may be considered penny stocks and thus be subject to the penny stock rules.

The SEC has adopted a number of rules to

regulate “penny stock” that restricts transactions involving stock which is deemed to be penny stock. Such rules include

Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Exchange Act. These rules may have

the effect of reducing the liquidity of penny stocks. “Penny stocks” generally are equity securities with a price of

less than $5.00 per share (other than securities registered on certain national securities exchanges or quoted on Nasdaq if current

price and volume information with respect to transactions in such securities is provided by the exchange or system). Our Common

Shares have in the past constituted, and may again in the future constitute, “penny stock” within the meaning of the

rules. The additional sales practice and disclosure requirements imposed upon U.S. broker-dealers may discourage such broker-dealers

from effecting transactions in our Common Shares, which could severely limit the market liquidity of our Common Shares and impede

their sale in the secondary market.

A U.S. broker-dealer selling penny stock

to anyone other than an established customer or “accredited investor” (generally, an individual with a net worth in

excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse) must make a special suitability

determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless

the broker-dealer or the transaction is otherwise exempt. In addition, the “penny stock” regulations require the U.S.

broker-dealer to deliver, prior to any transaction involving a “penny stock,” a disclosure schedule prepared in accordance

with SEC standards relating to the “penny stock” market, unless the broker-dealer or the transaction is otherwise exempt.

A U.S. broker-dealer is also required to disclose commissions payable to the U.S. broker-dealer and the registered representative

and current quotations for the securities. Finally, a U.S. broker-dealer is required to submit monthly statements disclosing recent

price information with respect to the “penny stock” held in a customer’s account and information with respect

to the limited market in “penny stocks”.

Shareholders should be aware that, according

to the SEC, the market for “penny stocks” has suffered in recent years from patterns of fraud and abuse. Such patterns

include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or

issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

(iii) “boiler room” practices involving high-pressure sales tactics and unrealistic price projections by inexperienced

sales persons; (iv) excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and (v) the

wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level,

resulting in investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market.

Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the

market, management will strive within the confines of practical limitations to prevent the described patterns from being established

with respect to our securities.

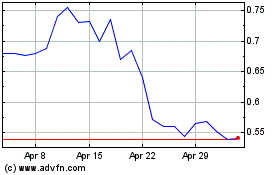

There has been and may continue to be

significant volatility in the volume and price of our Common Shares on Nasdaq.

The market price of our Common Shares has

been and may continue to be highly volatile. Factors, including changes in the Chinese bamboo industry and electronic vehicles

industry, changes in the Chinese economy, potential infringement of our intellectual property, competition, concerns about our

financial position, operations results, litigation, government regulation, developments or disputes relating to agreements, patents

or proprietary rights, may have a significant impact on the market volume and price of our stock. Unusual trading volume in our

shares occurs from time to time.

We have not paid and do not intend to

pay dividends on our Common Shares. Investors in this offering may never obtain a return on their investment.

We have not paid dividends on our Common

Shares since inception, and do not intend to pay any dividends on our Common Shares in the foreseeable future. We intend to reinvest

earnings, if any, in the development and expansion of our business. Accordingly, you will need to rely on sales of your Common

Shares after price appreciation, which may never occur, in order to realize a return on your investment.

RISKS RELATED TO THE CURRENT PANDEMIC

Public health epidemics or outbreaks

such as COVID-19 could adversely impact our business.

Our business, financial condition and results

of operations may be negatively impacted by risks related to natural disasters, extreme weather conditions, health epidemics and

other catastrophic incidents, such as the COVID-19 outbreak and spread, which could significantly disrupt our operations. In December 2019,

a novel strain of coronavirus (COVID-19) emerged in Wuhan, Hubei Province, China. The COVID-19 outbreak and spread has caused lockdowns,

quarantines, travel restrictions, and closures of businesses and schools worldwide.

In January 2020, the World Health

Organization declared the COVID-19 outbreak a global health emergency as the coronavirus outbreak continued to spread beyond China.

In compliance with the government health emergency rules in place, we temporarily closed our offices in varies provinces in

China and ceased production operations after the Chinese New Year. We gradually resumed operation and production in late February 2020

and fully resumed operation on March 23, 2020. During such temporary business closure period, our employees had very limited

access to our manufacturing facilities and we could not utilize the services of shipping companies and as a result, we experienced

difficulty delivering our products to our customers on a timely basis. In addition, due to the COVID-19 outbreak, some of our customers

or suppliers have experienced financial distress, delayed or defaulted on their payments, reduced the scale of their businesses,

and suffered disruptions in their business, and it may happen again in the future. If workers at one or more of our offices or

the offices of our suppliers or manufacturers become ill or are quarantined and in either or both events are therefore unable to

work, our operations could be subject to disruption. Further, if our suppliers become unable to obtain necessary raw materials

or components, we may incur higher supply costs or our suppliers may be required to reduce production levels, either of which may

negatively affect our financial condition or results of operations. Any increased difficulty in collecting accounts receivable,

delayed raw materials supply, bankruptcy of small and medium businesses, or early termination of agreements due to deterioration

in economic conditions could negatively impact our results of operations.

As of the date of this prospectus, the

COVID-19 outbreak in China appears to have slowed down and most provinces and cities have resumed business activities under the

guidance and support of the government. However, there is still significant uncertainty regarding the possibility of additional

waves of infections and the breadth and duration of business disruptions related to COVID-19, which could continue to have material

impact to the Company’s operations. The extent to which COVID-19 impacts our results for fiscal year 2020 will depend on

certain future developments, including the duration and spread of the COVID-19 outbreak, emerging information concerning the severity

of COVID-19 and the actions taken by governments and private businesses to attempt to contain COVID-19, all of which are uncertain

at this point.

DESCRIPTION OF SHARE CAPITAL

THL

was incorporated on November 9, 2010 under the BVI Companies Act, 2004 as a company limited by shares under the name “SINOPORT

ENTERPRISES LIMITED中港企業有限公司.” On April 15, 2013, SINOPORT

ENTERPRISES LIMITED中港企業有限公司changed

its name to “TANTECH HOLDINGS LTD 炭博士控股有限公司.”

On March 4, 2016, TANTECH HOLDINGS LTD 炭博士控股有限公司

changed its name to “TANTECH HOLDINGS LTD.”

Our authorized share capital consists of 50,000,000 Common Shares,

par value $0.001 per share.

Description of Common Shares

For a description of the Common Shares

being offered hereby, please see “Description of Share Capital” in the accompanying base prospectus. You should also

refer to our memorandum and articles of association, which are filed as exhibits to the registration statement of which this prospectus

is part.

Registration Rights

We entered into a registration rights agreement,

dated as of November 20, 2020, with the investors in the 2020 Closing (the “Registration Rights Agreement”) and

granted Univest the same registration rights with respect to the Univest Warrant that were granted to such investors. We are required

within 30 calendar days of November 20, 2020 to file a registration statement providing for the resale of the Common Shares

underlying the Unregistered Investor Warrants and the Univest Warrant. We have complied with such obligations in connection with

the filing of this registration statement, of which this prospectus forms a part. We are also required to use commercially reasonable

efforts to cause such registration to become effective within 60 calendar days (or, in the event of a “full review”

by the SEC, within 90 calendar days) of November 20, 2020 and to keep such registration statement effective at all times until

no Selling Shareholder owns any Unregistered Investor Warrants, the Univest Warrant or any Common Shares underlying the Unregistered

Investor Warrants and Univest Warrant.

Transfer Agent and Registrar

The transfer agent and registrar for our Common Shares is VStock

Transfer, LLC.

Nasdaq Listing

Our Common Shares are listed on Nasdaq

under the symbol “TANH.”

SELLING SHAREHOLDERS

The 3,669,425 Common Shares being offered

by the Selling Shareholders include (i) the 3,305,788 Common Shares issuable upon exercise of all of the Unregistered Investor

Warrants and (ii) the 363,637 Common Shares issuable upon the exercise of the Univest Warrant. For additional information regarding

the issuance of these securities, see “November 2020 Private Placement” in this prospectus. We are registering the

3,669,425 Common Shares in order to permit the Selling Shareholders to offer such shares for resale from time to time. Except for

the ownership of the Warrants and the transactions contemplated by the 2020 Closing transaction documents, none of the Selling

Shareholders have had any material relationship with us within the past three years.

The

following table sets forth certain information with respect to each Selling Shareholder, including (i) the Common Shares beneficially

owned by the Selling Shareholder prior to this offering, (ii) the number of Common Shares being offered by the Selling Shareholder

pursuant to this prospectus and (iii) the Selling Shareholder’s beneficial ownership after completion of this offering. The

registration of the 3,669,425 Common Shares does not necessarily mean that the Selling Shareholders will sell all or any of such

Common Shares, but the number of Common Shares and percentages set forth in the final two columns below assume that all Common

Shares being offered by the Selling Shareholders are sold. The final two columns also assume the exercise of all of the Warrants

held by the Selling Shareholders as of December 14, 2020, without regard to any limitations on exercise described in this

prospectus or in the Warrants. See “Plan of Distribution.”

The

table is based on information supplied to us by the Selling Shareholders, with beneficial ownership and percentage ownership determined

in accordance with the rules and regulations of the SEC, and includes voting or investment power with respect to Common Shares.

This information does not necessarily indicate beneficial ownership for any other purpose. In computing the number of Common Shares

beneficially owned by a Selling Shareholder and the percentage ownership of that Selling Shareholder, Common Shares subject to

warrants held by that Selling Shareholder that are exercisable for Common Shares within 60 days after December 14, 2020,

are deemed outstanding. Such Common Shares, however, are not deemed outstanding for the purposes of computing the percentage ownership

of any other shareholder.

This

prospectus covers the resale of up to an aggregate of 3,669,425 Common Shares that may be sold or otherwise disposed of by the

Selling Shareholders. These Common Shares are issuable to the Selling Shareholders upon the exercise of the Unregistered Investor

Warrants and the Univest Warrant. The Unregistered Investor Warrants are immediately exercisable on the date of their issuance

at an exercise price of $1.81 per share and expire five (5) years from the date on which they became exercisable. The Univest

Warrant is exercisable beginning six (6) months after issuance at an exercise price of $1.815, through the third (3rd) anniversary

of the issuance. See “November 2020 Private Placement” in this prospectus for further details relating to the Common

Shares underlying the Warrants and the Warrants.

|

Selling Shareholder

|

|

Total

Number of

Common

Shares

Owned

Prior to This

Offering(1)

|

|

|

Total

Number of

Common Shares

Underlying the

Warrants and

Offered Hereby(2)

|

|

|

Number of

Common

Shares

Owned

Following

This

Offering(3)

|

|

|

Percentage of

Outstanding

Common Shares

Owned

Following This

Offering(3)

|

|

|

Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B(4)

|

|

|

1,515,152

|

|

|

|

826,447

|

|

|

|

688,705

|

|

|

|

1.63

|

%

|

|

CVI Investments, Inc.(5)

|

|

|

1,515,152

|

|

|

|

826,447

|

|

|

|

688,705

|

|

|

|

1.63

|

%

|

|

Hudson Bay Master Fund Ltd(6)

|

|

|

1,516,152

|

|

|

|

826,447

|

|

|

|

689,705

|

|

|

|

1.63

|

%

|

|

Intracoastal Capital LLC(7)

|

|

|

1,515,152

|

|

|

|

826,447

|

|

|

|

688,705

|

|

|

|

1.63

|

%

|

|

Univest Securities, LLC(8)

|

|

|

0

|

|

|

|

363,637

|

|

|

|

0

|

|

|

|

-

|

|

|

TOTAL

|

|

|

6,061,608

|

|

|

|

3,669,425

|

|

|

|

2,755,820

|

|

|

|

6.52

|

%

|

|

(1)

|

|

The terms of the Warrants held by the Selling Shareholders include a blocker provision that restricts exercise to the extent the securities beneficially owned by the Selling Shareholders and their affiliates would represent beneficial ownership in excess of 4.99% (or, in the case of Hudson Bay Master Fund Ltd and Intracoastal Capital LLC, 9.99%) of our Common Shares outstanding immediately after giving effect to such exercise, subject to the holder’s option upon notice to us to increase or decrease this beneficial ownership limitation; provided that any increase of such beneficial limitation percentage shall only be effective upon 61 days’ prior notice to us and such increased beneficial ownership percentage shall not exceed 9.99% of our Common Shares (such limitation, a “Beneficial Ownership Limitation”). As a result, the number of Common Shares reflected in this column as beneficially owned by each Selling Shareholder consists of (a) the number of Common Shares subject to the Warrants exercisable for the Common Shares offered hereby and (b) other warrants that were issued to such Selling Shareholder in the 2020 Closing and the 2017 Closing, if any, in each case which such Selling Shareholder has the right to acquire as of December 14, 2020 or within 60 days thereafter and without it or any of its affiliates beneficially owning more than 4.99% (or, in the case of Hudson Bay Master Fund Ltd and Intracoastal Capital LLC, 9.99%) of the number of outstanding Common Shares as of December 14, 2020.

|

|

|

|

|

|

(2)

|

|

Represents the total number of Common Shares underlying the Warrants owned by each of the Selling Shareholders, assuming full exercise of the Warrants offered hereby.

|

|

|

|

|

|

(3)

|

|

The number of shares owned and the percentage of beneficial ownership after this offering set forth in these columns are based on 42,319,342 Common Shares outstanding on December 14, 2020, which includes 35,894,097 Common Shares issued and outstanding as of such date and assumes (1) full exercise of the Warrants that are exercisable for up to 3,669,425 Common Shares offered hereby, (2) full exercise of the warrants issued to the four Selling Shareholders in connection with the 2020 Closing that are exercisable for up to 2,754,820 Common Shares, and (3) exercise of a warrant issued to a Selling Shareholder in connection with the 2017 Closing for the remaining 1,000 Common Shares underlying such warrant. The calculation of beneficial ownership reported in such columns takes into account the effect of the Beneficial Ownership Limitations in any warrants held by the Selling Shareholders after this offering.

|

|

|

|

|

|

(4)

|

|

Ayrton Capital LLC, the investment manager to Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B (“Alto”), has discretionary authority to vote and dispose of the shares held by Alto and may be deemed to be the beneficial owner of these shares. Waqas Khatri, in his capacity as Managing Member of Ayrton Capital LLC, may also be deemed to have investment discretion and voting power over the shares held by Alto. Alto and Mr. Khatri each disclaim any beneficial ownership of these shares. The address of Ayrton Capital LLC is 55 Post Rd West, 2nd Floor, Westport, CT 06880.

|

|

|

|

|

|

(5)

|

|

Heights Capital Management, Inc. is the authorized agent of CVI Investments, Inc. (“CVI”), has discretionary authority to vote and dispose of the securities held by CVI and may be deemed to be the beneficial owner of these securities. Martin Kobinger, in his capacity as Investment Manager of Heights Capital Management, Inc., may also be deemed to have investment discretion and voting power over the securities held by CVI. Mr. Kobinger disclaims any such beneficial ownership of the securities. The address of the principal business office of Heights Capital is 101 California Street, Suite 3250, San Francisco, CA 94111.

|

|

(6)

|

|

Hudson Bay Capital Management LP, the investment manager of Hudson Bay Master Fund Ltd., has voting and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Hudson Bay Master Fund Ltd. and Sander Gerber disclaims beneficial ownership over these securities. The address of the principal business office of Hudson Bay Capital Management LP is 777 Third Ave, 30th Floor, New York, NY 10017.

|

|

|

|

|

|

(7)

|

|

Mitchell P. Kopin (“Mr. Kopin”) and Daniel B. Asher (“Mr. Asher”), each of whom are managers of Intracoastal Capital LLC (“Intracoastal”), have shared voting control and investment discretion over the securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under Section 13(d) of the Exchange Act) of the securities reported herein that are held by Intracoastal. The address of the principal business office of Intracoastal is 245 Palm Trail, Delray Beach, FL 33483.

|

|

|

|

|

|

(8)

|

|

The address of the principal business office of Univest Securities, LLC is 375 Park Avenue 1502, New York, NY 10152.

|

|

|

|

|

USE OF PROCEEDS

We

will not receive any of the proceeds from the sale of the Common Shares underlying the Warrants by the Selling Shareholders pursuant

to this prospectus. We may receive up to $6,643,477.44 in aggregate gross proceeds from cash exercises of the Warrants,

based on the per share exercise price of the Warrants. Any proceeds we receive from the exercise of the Warrants will be used to

for working capital and general corporate purposes. The Selling Shareholders will pay any agent’s commissions and expenses

they incur for brokerage, accounting, tax or legal services or any other expenses that they incur in disposing of such Common Shares.

We will bear all other costs, fees and expenses incurred in effecting the registration of such Common Shares covered by this prospectus

and any prospectus supplement. These may include, without limitation, all registration and filing fees, SEC filing fees and expenses

of compliance with state securities or “blue sky” laws.

We cannot predict when or if the Warrants

will be exercised, and it is possible that the Warrants may expire and never be exercised. As a result, we may never receive

meaningful, or any, cash proceeds from the exercise of the Warrants, and we cannot plan on any specific uses of any proceeds we

may receive beyond the purposes described herein.

See “Plan of Distribution”

elsewhere in this prospectus for more information.

PLAN OF DISTRIBUTION

We are registering the shares offered by

this prospectus on behalf of the Selling Shareholders. The Selling Shareholders, which, as used herein, includes donees, pledgees,

transferees, or other successors-in-interest selling Common Shares or interests in Common Shares received after the date of this

prospectus from the Selling Shareholders as a gift, pledge, partnership distribution, or other non-sale related transfer, may,

from time to time, sell, transfer, or otherwise dispose of any or all of their Common Shares on any stock exchange, market or trading

facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market

prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale,

or at negotiated prices.

The Selling Shareholders may, from time

to time, pledge or grant a security interest in some or all of the Common Shares owned by such shareholder and, if he defaults

in the performance of his secured obligations, the pledgees or secured parties may offer and sell the Common Shares, from time

to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of

the Securities Act amending the list of Selling Shareholders to include the pledgee, transferee, or other successors in interest

as Selling Shareholders under this prospectus. The Selling Shareholders may use any one or more of the following methods when disposing

of their shares:

• ordinary brokerage

transactions and transactions in which the broker-dealer solicits purchasers;

• block trades

in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal

to facilitate the transaction;

• purchases by

a broker-dealer as principal and resale by the broker-dealer for its account;

• an exchange

distribution in accordance with the rules of the applicable exchange;

• privately negotiated

transactions;

• short sales

effected after the effective date of the registration statement of which this prospectus forms a part;

• through the

writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

• broker-dealers

may agree with the Selling Shareholders to sell a specified number of such shares at a stipulated price per share;

• a combination

of any such methods of sale; and

• any other method

permitted pursuant to applicable law.

In connection with the sale of Common Shares

or interests therein, the Selling Shareholders may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of the Common Shares in the course of hedging the positions they assume. The Selling Shareholders

may also sell Common Shares short and deliver these securities to close out their short positions, or loan or pledge the Common

Shares to broker-dealers that in turn may sell these securities. The Selling Shareholders may also enter into option or other transactions

with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery

to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other

financial institution may resell pursuant to this prospectus (as amended to reflect such transaction).