UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-A

FOR

REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT

TO SECTION 12(b) OR (g) OF THE

SECURITIES

EXCHANGE ACT OF 1934

KRAIG

BIOCRAFT LABORATORIES, INC.

(Exact

name of registrant as specified in its charter)

|

Wyoming

|

|

83-0458707

|

|

(State

of incorporation or organization)

|

|

(I.R.S.

Employer Identification No.)

|

|

|

|

|

|

2723

South State St. Suite 150

Ann

Arbor, Michigan

|

|

48104

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Securities

to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title

of each class to be so registered

|

|

Name

of each exchange on which

each

class is to be registered

|

If

this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective

pursuant to General Instruction A.(c) or (e), check the following box. [ ]

If

this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective

pursuant to General Instruction A(d), check the following box. [X]

If

this form relates to the registration of a class of securities concurrently with a Regulation A offering, check the following

box. [ ]

Securities

Act registration statement or Regulation A offering statement file number to which this form relates:

Securities

to be registered pursuant to Section 12(g) of the Act: Class A Common Stock, no par value

Item

1. Description of Registrant’s Securities to be Registered.

Our

original articles of incorporation authorized 60,000,000 shares of Class A common stock, 25,000,000 shares of Class B common stock

with no par value per share and 10,000,000 shares of preferred stock with no par value per share.

On March 18, 2009, we amended our articles of incorporation to provide for unlimited authorized shares, no par value, of Class

A common stock and Class B common stock, and preferred stock. In December 2013, we further amended our articles of incorporation

to designate Series A of the Company’s preferred stock, no par value; there are two shares of Series A preferred stock authorized.

There are no provisions in our charter or by-laws that would delay, defer or prevent a change in our control. As of the date hereof,

we have 854,410,001 shares of Class A common stock, 0 shares of Class B common stock and 2 shares of Series A Preferred

Stock outstanding. The Class B common stock is not listed on the OTCQB.

Common

Stock

Holders

of our Class A Common Stock are entitled to one vote for each share on all matters submitted to a stockholder vote; Class B common

stock does not have any voting rights.

Holders

of Common Stock do not have cumulative voting rights.

Holders

of a majority of the shares of Common Stock voting for the election of directors can elect all of the directors. Holders of our

common stock representing a majority of the voting power of our capital stock issued and outstanding and entitled to vote, represented

in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority

of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment

to our Articles of Incorporation.

Although

there are no provisions in our charter or by-laws that may delay, defer or prevent a change in control, we are authorized, without

stockholder approval, to issue shares of preferred stock that may contain rights or restrictions that could have this effect.

Holders

of both classes of common stock are entitled to share in all dividends that the Board, in its discretion, declares from legally

available funds. In the event of liquidation, dissolution or winding up, each outstanding share entitles its holder to participate

pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference

over the common stock. Holders of both classes of our common stock have no pre-emptive rights, no conversion rights and there

are no redemption provisions applicable to our common stock.

Dividends

Since

inception we have not paid any cash dividends on our capital stock. We currently do not anticipate paying any cash dividends in

the foreseeable future on our common stock, when issued pursuant to this offering. Although we intend to retain our earnings,

if any, to finance the exploration and growth of our business, our Board will have the discretion to declare and pay dividends

in the future. Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which

our Board may deem relevant.

Certain

Anti-Takeover Effects

Certain

provisions of Wyoming law may have an anti-takeover effect and may delay or prevent a tender offer or other acquisition transaction

that a shareholder might consider to be in his or her best interest. The summary of the provisions of Wyoming law set forth below

does not purport to be complete and is qualified in its entirety by reference to Wyoming law.

The

issuance of shares of preferred stock, the issuance of rights to purchase such shares, and the imposition of certain other adverse

effects on any party contemplating a takeover could be used to discourage an unsolicited acquisition proposal. For instance, the

issuance of the preferred stock, if the option to acquire such shares is exercised, would impede a business combination by the

voting rights that would enable a holder to block such a transaction. In addition, under certain circumstances, the issuance of

other preferred stock could adversely affect the voting power of holders of our common stock.

Under

Wyoming law, a director, in determining what he reasonably believes to be in or not opposed to the best interests of the corporation,

does not need to consider only the interests of the corporation’s stockholders in any takeover matter but may also, in his

discretion, may consider any of the following:

|

|

(i)

|

The

interests of the corporation’s employees, suppliers, creditors and customers;

|

|

|

|

|

|

|

(ii)

|

The

economy of the state and nation;

|

|

|

|

|

|

|

(iii)

|

The

impact of any action upon the communities in or near which the corporation’s facilities or operations are located;

|

|

|

|

|

|

|

(iv)

|

The

long-term interests of the corporation and its stockholders, including the possibility that those interests may be best served

by the continued independence of the corporation; and

|

|

|

|

|

|

|

(v)

|

Any

other factors relevant to promoting or preserving public or community interests.

|

The

outstanding Series A preferred stock can deter a takeover.

Because

our Board is not required to make any determination on matters affecting potential takeovers solely based on its judgment as to

the best interests of our stockholders, our board of directors could act in a manner that would discourage an acquisition attempt

or other transaction that some, or a majority, of our stockholders might believe to be in their best interests or in which such

stockholders might receive a premium for their stock over the then market price of such stock. Our Board of directors presently

does not intend to seek stockholder approval prior to the issuance of currently authorized stock, unless otherwise required by

law or applicable stock exchange rules.

The

description of the Registrant’s securities included in any form of prospectus subsequently filed by the Registrant with

the SEC pursuant to Section 424(b) of the Securities Act of 1933, as amended, shall also be deemed to be incorporated herein by

reference.

Item

2. Exhibits.

The

following exhibits are filed as a part of this registration statement:

|

|

(1)

|

Incorporated

by reference to the Registration Statement on Form SB-2 filed on September 26, 2007

|

|

|

(2)

|

Incorporated

by reference to the Registration Statement on Form S-1 filed on October 2, 2009

|

|

|

(3)

|

Incorporated

by reference to the Current Report on Form 8-K filed on November 22, 2013

|

|

|

(4)

|

Incorporated

by reference to the Current Report on Form 8-K filed on December 19, 2013

|

SIGNATURES

Pursuant

to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement

to be signed on its behalf by the undersigned, thereto duly authorized.

Date:

December 11, 2020

|

|

Kraig

Biocraft laboratories, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Kim Thompson

|

|

|

|

Kim

Thompson

|

|

|

|

President,

Chief Executive Officer and Chief Financial Officer

|

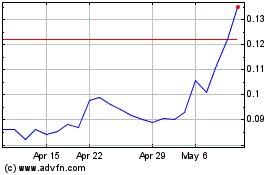

Kraig Biocraft Laborator... (QB) (USOTC:KBLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

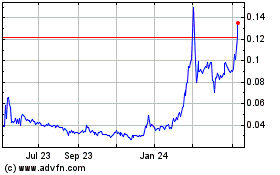

Kraig Biocraft Laborator... (QB) (USOTC:KBLB)

Historical Stock Chart

From Apr 2023 to Apr 2024