Snowflake's Cloud is Particularly Dense -- Heard on the Street

December 03 2020 - 1:23PM

Dow Jones News

By Dan Gallagher

The beauty of a snowflake is that each one is unique. For

Snowflake the company, that also will prove to be a challenge.

The provider of cloud-based data warehousing services went

public in September in what has been the hottest stock debut so far

this year. Snowflake's share price more than doubled on its first

trading day and the stock gained another 15% ahead of its first

quarterly report as a public company on Wednesday afternoon.

That report turned out to be mixed. Revenue for the fiscal third

quarter surged 119% year-over-year to $159.6 million, beating Wall

Street's estimates. But the company's projection fell short, with

revenue expected to grow 88% year-over-year at the midpoint of its

range for the fourth quarter ending in January. Analysts had been

projecting growth of 102% for the period.

If the new projection holds, it will be the first quarter

Snowflake's revenue hasn't doubled on a year over year basis, at

least according to the limited financial history presented in its

initial-public-offering papers.

Surprisingly, a miss right out of the gate didn't melt the

stock. Snowflake's share price jumped 15% Thursday. Investors

remain enthralled with the long-term potential for the company'

services, which help businesses rapidly analyze information faster

than traditional database tools can. Demand boomed in the most

recent quarter, signified by remaining performance obligations --

contracted revenue not yet recognized -- exploding by 240%

year-over-year to about $928 million.

But Snowflake doesn't operate like a normal cloud software

company. Revenue isn't recognized until its service is actually

used -- a big difference from software-as-a-service, or SaaS,

business models that recognize contracted revenue on a ratable

basis over the contracted period. That makes Snowflake's actual

revenue much more difficult to forecast. The company noted on its

call Wednesday afternoon that new customers often take several

months before they are fully utilizing the service, even if they

have purchased a lot of service credits up front.

Thus, while most cloud software companies can predict revenue

with near-certainty a few quarters out, Snowflake's quarterly

results will be unique -- and much more volatile. That could be a

problem given the already nosebleed valuation that the stock

commands. The shares now trade at just under 100 times forward

sales. Besides Snowflake, the most richly-valued cloud stocks

currently garner multiples in the low-40 range. Post-IPO lockups

that begin expiring over the next three months add further

uncertainty.

Even perfect snowflakes tend to melt in the heat.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

December 03, 2020 13:08 ET (18:08 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

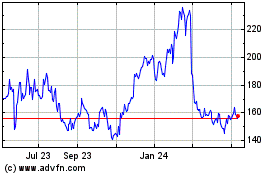

Snowflake (NYSE:SNOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

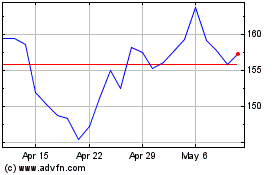

Snowflake (NYSE:SNOW)

Historical Stock Chart

From Apr 2023 to Apr 2024