By Aaron Tilley

Salesforce.com Inc.'s proposed purchase of workplace

collaboration software pioneer Slack Technologies Inc. was prompted

by the pandemic, but its success will hinge on whether it delivers

in the post-lockdown world, analysts say.

Salesforce for years had explored potential deals with Slack,

including investing in the company, according to people familiar

with the talks. But it wasn't until Covid-19 sent millions of

people home to work remotely that Salesforce came to terms with the

app maker -- agreeing to pay more than 50% above Slack's closing

price the day before The Wall Street Journal broke news of the

talks.

Salesforce Chief Operating Officer Bret Taylor, one of the

architects of the $27.7 billion deal, including cash and debt, said

that how its customers and the wider business world reacted to the

health crisis, by more rapidly adopting digital tools, drove the

two companies together.

"The technology that Slack made felt more relevant than ever

before. That really motivated us to get into these discussions

now," Mr. Taylor said in an interview.

The deal will transform Salesforce into one of the largest

players in business software, and, analysts say, help turn it into

a more formidable opponent against Microsoft Corp., which has been

pushing its Teams software suite -- which includes Slack-like

functions -- as a new operating system for companies.

But the acquisition comes with challenges, and risks.

"Slack is a nice start, but it's not the end," said Gregg

Johnson, a former Salesforce executive who led development of the

company's private social-network product called Chatter and left

the company in 2016. "If Salesforce wants to compete head-to-head

with Microsoft, they need more than what Slack has to offer."

One area the company may need to beef up, Mr. Johnson said, is

in video technology -- a feature for which Microsoft and Zoom Video

Communications Inc. have drawn investor enthusiasm while Slack

largely missed out.

And the price Salesforce is paying for Slack "seems rich," UBS

analyst Karl Keirstead said, driving up the stakes to deliver an

attractive return for the investment. Analysts broadly trimmed

their expectations for Salesforce's profitability to reflect the

addition of Slack, which has been posting losses.

Salesforce, which spent $15 billion last year on data-analytics

platform Tableau Software Inc., has drawn analyst and investor

criticism for some of its deal making and the impact on its

profitability. Salesforce shares are down around 14% since the

Slack deal news first surfaced.

Mr. Taylor arrived at Salesforce through one of those

acquisitions, when the company bought document collaboration

startup Quip Inc. in 2016 for more than $500 million. The Quip

acquisition was part of an earlier effort by Chief Executive Marc

Benioff to break into the workplace-collaboration market, though

analysts say it hasn't become a meaningful success.

The company didn't respond to a request for comment on how Quip

is doing.

Salesforce said it would make Slack a primary interface its

customers will use to tap into its broader suite of software tools.

But some analysts argue that bringing Salesforce's software

together with Slack's could be a challenge or take time. When

Microsoft bought the business-focused social-media network LinkedIn

Corp. in 2016, it moved slowly on the integration in part out of

concern moving quickly could be disruptive.

Slack had long been considered an acquisition target by

analysts, but Chief Executive Stewart Butterfield pursued a solo

path as he preached a vision of an office in which collaboration

software was an alternative to office email and a platform around

which companies could integrate various business tools.

Slack rejected a takeover proposal from Microsoft in 2015, and

the startup went public last year.

To assemble the deal that was unveiled Tuesday, Mr. Taylor, a

former chief technology officer at Facebook Inc., and Mr.

Butterfield drew on personal ties built up over more than a decade.

The two executives, who both have a history working at startups,

got to know each other, Mr. Taylor said, when Mr. Butterfield ran

Flickr, the social photo-sharing platform that was bought by Yahoo

Inc.

"I've known Stewart for many years, and I've retained that

relationship since I've been at Salesforce," Mr. Taylor said. "That

has been really an asset in these discussions."

Mr. Butterfield, speaking at Salesforce's annual customer

meeting on Wednesday, said, "This is a pivotal moment and the

opportunity to really transform the way that we work so that we're

not as reliant on the physical office."

When Mr. Taylor and Mr. Butterfield put forward their idea for a

deal, Mr. Benioff said he was easily convinced to pay top dollar

for Slack. "This is bigger than I've ever thought it could be," he

told analysts on Tuesday, as Salesforce posted record quarterly

sales and a revenue outlook that beat Wall Street expectations.

The proposed transaction isn't just Salesforce's largest, it

also the latest this year in which a big tech company has used its

pandemic-fueled stock price to help pay for a costly

acquisition.

Graphics chip maker Nvidia Corp., whose shares soared as

videogaming took off with people quarantining at home, said it

would use stock in its planned $40 billion acquisition of

chip-design specialist Arm Holdings. And Advanced Micro Devices

agreed to buy chip maker Xilinx Inc. for $35 billion with

shares.

Salesforce shares were up around 50% this year when the Journal

first reported the company was in advanced talks to buy Slack. Mr.

Benioff said the company's success during the pandemic emboldened

it to strike. When the virus first struck, Salesforce was cautious,

he said.

"We were hiding, and we were like everyone else under our desks.

Then we've realized, wait a minute, we can succeed through

this."

Write to Aaron Tilley at aaron.tilley@wsj.com

(END) Dow Jones Newswires

December 03, 2020 12:47 ET (17:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

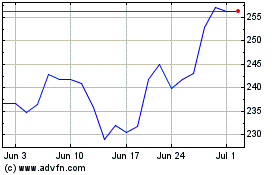

Salesforce (NYSE:CRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Apr 2023 to Apr 2024