Zoom Fatigue Sets In Early -- Heard on the Street

November 30 2020 - 8:05PM

Dow Jones News

By Dan Gallagher

Zoom Video Communications' winter won't be one of discontent.

Spring might be another story.

The videoconferencing provider that has become an investor

darling during the pandemic posted another blowout quarterly report

Monday afternoon. Revenue more than quadrupled on a year-over-year

basis to $777 million for the fiscal third quarter ended Oct. 31,

exceeding the company's already-robust projection by 13%. Zoom also

projected similar growth for its fourth quarter ending in January

and expects to close out the fiscal year with operating earnings

between $865 million and $870 million. It made about $12.7 million

the previous year.

But unlike the cheering that accompanied Zoom's blowout numbers

three months ago, investors took this report badly. The stock

slipped 5% following the results in after-hours trading. Gross

margins slipped 4 percentage points from the second quarter, due in

part to growing public cloud costs to accommodate booming demand.

Walter Pritchard of Citi also noted "buy side expectations" that

had projected revenue north of $800 million for the third quarter

as a reason for the letdown.

The reaction could have been anticipated for a stock that has

boomed more than 600% this year -- well ahead of even other

pandemic-hyped names such as Peloton. It also reflects the

challenges Zoom is likely to face heading into next year. Recent

vaccine breakthroughs suggest strongly that life will begin

returning to something like normal by spring. Businesses -- still

Zoom's core market -- will no doubt continue to make robust use of

videoconferencing services well into the future. But Zoom noted

Monday that a "significant percentage" of recent usage comes from

both free and paid users from the education sector, which means

kids returning to school will create a drag on the company's

growth.

Longer term, Zoom's lofty valuation of more than 47 times

forward sales will also put the company under some pressure to show

what other tricks it has up its sleeve once the day comes that

people can actually drink, work out and study in person again.

Zoom's stated mission is to deliver happiness. As the next year

proceeds, though, happiness for a growing number of people will

mean a lot less Zoom.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

November 30, 2020 19:50 ET (00:50 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

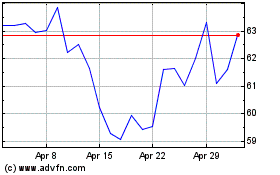

Zoom Video Communications (NASDAQ:ZM)

Historical Stock Chart

From Mar 2024 to Apr 2024

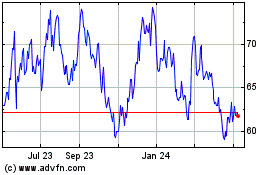

Zoom Video Communications (NASDAQ:ZM)

Historical Stock Chart

From Apr 2023 to Apr 2024