By Mike Colias and Ben Foldy

General Motors Co. will no longer take an equity stake in

electric-truck maker Nikola Corp. under a stripped-down agreement

revealed Monday, a significant retrenchment from an earlier pact

that fueled investor enthusiasm for both companies.

Under the revised deal, GM still intends to provide Nikola with

fuel-cell technology but it has nixed plans to take an 11% stake in

the Phoenix-based startup in exchange for supplying engineering

work and other services.

The Detroit auto maker has also scrapped plans to build an

electric pickup truck called the Badger for Nikola, a key part of

an earlier agreement outlined in September. That deal got delayed

after a negative short seller's report raised questions about the

readiness of some aspects of Nikola's business, allegations the

company said were false and misleading.

The original agreement bolstered Nikola's status as one of

several highflying green-vehicle startups drawing attention from

Wall Street. GM lending its engineering and manufacturing

expertise, and being granted a spot on Nikola's board, had been

seen as a validation of Nikola's business model and growth

prospects.

For GM, the Badger piece of the deal had been seen as a boost

for its broader plans to license its electric-vehicle technology,

the potential of which has helped lift its share price in recent

weeks.

GM was to engineer and build the light-duty pickup truck for

Nikola, using its proprietary battery system that will be used in

many planned GM models.

Nikola shares were down about 24% in Monday morning trading

after releasing details about the nonbinding memorandum of

understanding with GM. GM shares were off about 1.6%.

The scaled-back deal with GM could be a blow to Nikola, whose

strategy involves striking alliances with other deep-pocketed

companies to collaborate on various parts of its business.

Emmanuel Rosner, an analyst at Deutsche Bank, wrote in a note

Monday that Nikola's outlook is highly dependent on whether it can

solidify cooperation on key technologies. "The lack of clarity on

these partnerships continues to keep us on the sidelines of Nikola

stock," he said.

Nikola revealed the revised deal with GM a day ahead of a

closely watched lockup period expiring for some early investors who

got shares as part of the startup's June listing. Starting Tuesday,

those investors can start selling off approximately 161 million

shares -- the majority of which are owned by founder and recently

departed Executive Chairman Trevor Milton.

A spokesman for Mr. Milton didn't have an immediate comment.

Executives and board members recently extended the lockup for

another 136.5 million shares through April, company filings

show.

While Nikola has yet to sell a single vehicle, its plans to

revolutionize the trucking industry with electric and fuel-cell

technology have excited Wall Street investors, causing its stock to

soar this summer.

In June, Nikola's market value briefly surpassed that of Ford

Motor Co., after Mr. Milton tweeted that the company would begin

taking reservations on the Badger pickup and show off a working

truck by the end of 2020.

Nikola had committed to pay GM up to $700 million to develop and

build the Badger in a deal valued at about $4 billion when it was

announced Sept. 3, including the equity stake.

Nikola's shares jumped on the news of the GM partnership, but

were slammed days later in the wake of the report from short seller

Hindenburg Research, which claimed that Mr. Milton made exaggerated

claims about Nikola's technology. Mr. Milton, who said he would

defend himself against the report's allegations, stepped down in

September.

Nikola faces continuing legal issues stemming from the short

seller's report. It disclosed earlier this month that it had

received subpoenas from the Securities and Exchange Commission and

U.S. Justice Department in September.

Nikola has said it was cooperating with the investigations. A

spokesman for the Justice Department declined to comment.

The fallout from the short seller's report also forced GM

executives to field questions about whether they had done their

homework on Nikola ahead of the deal. GM Chief Executive Mary Barra

has said that GM conducted proper due diligence and that the

companies had been introduced by Nikola Chairman Steve Girsky, a

former GM executive.

Nikola executives have said that the Badger was backed mainly by

Mr. Milton and have been seeking to refocus the business on its

commercial truck and hydrogen business since Mr. Milton's

departure.

"Heavy trucks remain our core business and we are 100% focused

on hitting our development milestones to bring clean hydrogen and

battery-electric commercial trucks to market," Nikola CEO Mark

Russell said.

The companies on Monday also said they will explore the use of

GM's electric-vehicle battery technology, called Ultium, in future

commercial trucks.

If the agreement outlined Monday comes to fruition, it would

mark the first commercial use of GM's hydrogen fuel cells, a

technology it began developing in the 1960s.

GM said Nikola would pay upfront for the capital investment

needed to engineer and build the fuel cells at a GM facility in

suburban Detroit.

"Providing our Hydrotec fuel cell systems to the heavy-duty

class of commercial vehicles is an important part of our growth

strategy," GM product-development chief, Doug Parks, said.

The technology uses on-board fuel cells to mix hydrogen and

oxygen to produce electricity, which drives the vehicle's electric

motors, emitting only water vapor. Several major auto makers have

accelerated efforts to develop hydrogen fuel cells for large

commercial trucks, maintaining they have advantages over batteries

for some uses.

RBC Capital analyst Joseph Spak said Monday that removing the

Badger pickup truck made sense for Nikola because it will keep the

focus on its core fuel-cell business plan. The startup also would

avoid diluting its shares by granting GM the planned 11% stake, he

said.

For GM, the new agreement is a solid resolution because it gives

the auto maker a potential fuel-cell customer that will fund the

capital investment needed to build the cells, Mr. Spak said.

Nikola's core business aims to build and lease hydrogen and

battery-powered heavy trucks to commercial customers such as

Anheuser-Busch InBev SA who are looking to cut down on the tailpipe

emissions of their logistics fleets. Nikola plans to provide not

only the trucks, but also the refueling stations and hydrogen fuel

necessary to power them.

The company has teamed up with other more established and

well-capitalized companies to collaborate on core parts of the

business. German auto supply giant Robert Bosch GmbH and European

heavy truck maker CNH Industrial NV hold equity stakes and board

seats, while providing technology for Nikola trucks.

The now-diminished deal with GM is the second potential alliance

disrupted since the publication of the short seller's report.

Nikola had also been in talks with companies including oil company

BP PLC to jointly build hydrogen fuel stations, but those talks

also stalled in September, The Wall Street Journal has

reported.

Nikola executives have said talks with potential partners on

hydrogen stations are ongoing and the company hopes to announce a

deal by the end of the year.

Write to Mike Colias at Mike.Colias@wsj.com and Ben Foldy at

Ben.Foldy@wsj.com

(END) Dow Jones Newswires

November 30, 2020 11:40 ET (16:40 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

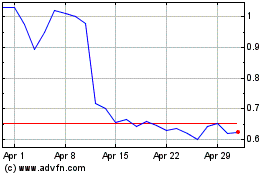

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Apr 2023 to Apr 2024