C3.ai Sets IPO at 15.5 Million Shares; Sees Pricing at $31-$34 Each

November 30 2020 - 7:13AM

Dow Jones News

By Colin Kellaher

C3.ai Inc. on Monday said it plans to sell 15.5 million shares

at between $31 and $34 apiece in its initial public offering.

At the $32.50 midpoint of that range, the Redwood City, Calif.,

enterprise artificial-intelligence software company said it expects

net proceeds of about $613.5 million, or roughly $684.2 million if

the underwriters exercise an option to buy an additional 2.33

million shares.

C3.ai Inc., founded by technology entrepreneur Tom Siebel, said

an affiliate of Koch Industries Inc. has agreed to buy $100 million

of common stock and Microsoft Corp. has agreed to buy $50 million

of common stock in a private placement at the IPO price.

C3.ai said it would have roughly 99.2 million shares outstanding

after the IPO and private placement, assuming exercise of the

overallotment option, for a valuation of about $3.22 billion at the

$32.50-a-share midpoint.

C3.ai said Mr. Siebel will hold or control about 72% of its

voting power following the IPO and private placement. The company

said it has been approved to list its shares on the New York Stock

Exchange under the symbol AI.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

November 30, 2020 06:58 ET (11:58 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

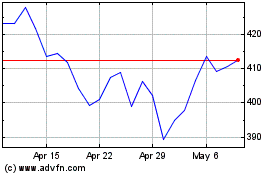

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024