Amended Tender Offer Statement by Issuer (sc To-i/a)

November 27 2020 - 6:05AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

TO

(Rule

14d-100)

Tender

Offer Statement under Section 14(d)(1) or 13(e)(1)

of

the Securities Exchange Act of 1934

(Amendment

No. 3)

SHIFT

TECHNOLOGIES, INC.

(Name

of Subject Company (Issuer) and Name of Filing Person (Issuer))

Warrants

to Purchase Class A Common Stock

(Title

of Class of Securities)

82452T

115

(CUSIP

Number of Warrants)

Amanda

Bradley

Head

of Legal

Shift

Technologies, Inc.

2525

16th Street, Suite 316

San

Francisco, CA 94103-4234

(855)

575-6739

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

with

copies to:

Martin

C. Glass

Jeffrey

R. Shuman

Jenner&

Block LLP

919

Third Avenue

New

York, NY 10022-3908

Tel:

(212) 891-1672

CALCULATION

OF FILING FEE

|

Transaction

valuation(1)

|

|

Amount

of filing fee(2)

|

|

$16,044,213

|

|

$1,751

|

|

1

|

Estimated

for purposes of calculating the amount of the filing fee only, in accordance with Rule 0-11(b) under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). Shift Technologies, Inc. (the “Company”) is offering

holders of all 7,532,494 of the Company’s public warrants outstanding as of November 4, 2020 (the “Public Warrants”)

the opportunity to exchange such Public Warrants for a combination of 0.25 shares of the Company’s Class A common stock,

par value $0.0001 per share (“Class A common stock”), and $1.00 in cash, without interest, for each warrant tendered.

The transaction value was determined by using the average of the high and low prices of the Warrants as reported on The Nasdaq

Capital Market on October 29, 2020, which was $2.13.

|

|

2

|

The

amount of the filing fee assumes that all outstanding Warrants will be exchanged and is calculated pursuant to Rule 0-11(b)

of the Exchange Act, which equals $109.10 for each $1,000,000 of the transaction value.

|

|

☒

|

Check

the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting

fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

Amount

Previously Paid: $1,751

|

|

Filing

Party: Shift Technologies, Inc.

|

|

Form

or Registration No.: Schedule TO

|

|

Date

Filed: November 5, 2020

|

|

☐

|

Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check

the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third-party

tender offer subject to Rule 14d-1.

|

|

|

☒

|

issuer

tender offer subject to Rule 13e-4.

|

|

|

☐

|

going-private

transaction subject to Rule 13e-3.

|

|

|

☐

|

amendment

to Schedule 13D under Rule 13d-2.

|

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ☐

EXPLANATORY

NOTE

This

Amendment No. 3 (“Amendment No. 3”) amends the Offer to Exchange Letter (the “Offer Letter”), a copy of

which was filed as Exhibit (a)(1)(A) to the Tender Offer Statement on Schedule TO originally filed by Shift Technologies, Inc.

(the “Company,” “us” or “we”), a Delaware corporation, on November 5, 2020 (the “Schedule

TO”). The Offer Letter and the related Letter of Transmittal and Consent, a copy of which will be filed with a subsequent

amendment to the Schedule TO, together with any amendments or supplements thereto, collectively constitute the “Offer”.

Concurrently

with the Offer, we will also solicit consents from holders of the Public Warrants to amend (the “Warrant Amendment”)

the Warrant Agreement, dated as of March 19, 2019, by and between the Company and Continental Stock Transfer & Trust Company

(the “Warrant Agreement”), which governs all of the Public Warrants. If the Warrant Amendment is approved, we will

not enter into the Warrant Amendment until at least 20 business days after the definitive proxy statement is sent to holders of

Warrants.

This

Amendment No. 3 is being filed to amend and restate certain provisions of the Schedule TO as set forth herein. Except as amended

hereby to the extent specifically provided herein, all terms of the Offer and all other disclosures set forth in the Schedule

TO and the exhibits thereto remain unchanged and are hereby expressly incorporated into this Amendment No. 3 by reference.

Item

7. Source and Amount of Funds or Other Consideration.

Item

7(a) of the Schedule TO is hereby amended and restated in its entirety as follows:

“(a)

Sources of Funds. Assuming 100% participation in the Offer, we will need approximately $7.5 million to pay the cash

portion of the Exchange Consideration for all of our outstanding Public Warrants. We estimate that the total amount of cash required

to complete the transactions contemplated by the Offer and Consent Solicitation, including the payment of any fees, expenses and

other related amounts incurred in connection with the transactions and the payment of cash in lieu of fractional shares will be

approximately $7.9 million. We anticipate that we will obtain all of the funds necessary to exchange Public Warrants tendered

in the Offer to pay related fees and expenses through our existing cash reserves. Consummation of the Offer is not contingent

on us securing any financing. As of November 24, 2020, the company has sufficient cash reserves for funding the Offer.”

Item

10. Financial Statements.

Item

10(a) of the Schedule TO is hereby amended and restated in its entirety as follows:

“(a) Financial

Information. Incorporated herein by reference are (i) the Company’s financial statements that were included

as Part II. Item 8 in its Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the Securities and

Exchange Commission (the “SEC”) on March 25, 2020 (the “Form 10-K”) and (ii) the Company’s financial

results for the quarter ended September 30, 2020, that were included in the Company’s Quarterly Report on Form 10-Q

filed with the SEC on November 16, 2020 (the “Form 10-Q”). The Form 10-K and the Form 10-Q are available for review

on the SEC’s website at www.sec.gov. In addition, the information set forth in the Offer Letter under “The Offer,

Section 10. Financial Information Regarding the Company” is incorporated herein by reference.”

Item

12. Exhibits.

Item

12 of the Schedule TO is hereby amended and restated in its entirety as follows:

|

Exhibit

Number

|

|

Description

|

|

(a)(1)(A)

|

|

Offer to Exchange Letter.

|

|

|

|

|

|

(a)(1)(B)

|

|

Letter of Transmittal and Consent (including Guidelines of the Internal Revenue Service for Certification of Taxpayer Identification Number on Form W-9)

|

|

|

|

|

|

(a)(1)(C)

|

|

Notice of Guaranteed Delivery.

|

|

|

|

|

|

(a)(1)(D)

|

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

|

|

|

|

(a)(1)(E)

|

|

Letter to be used by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees for their Clients.

|

|

|

|

|

|

(a)(1)(F)

|

|

Press Release issued on November 25, 2020 regarding the commencement of the Offer.

|

|

|

|

|

|

(d)(1)

|

|

Agreement

and Plan of Merger, dated June 29, 2020, by and among Insurance Acquisition Corp., IAC Merger Sub, Inc., and Shift Technologies,

Inc. (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed on June 29, 2020, File

No. 001-38839).

|

|

|

|

|

|

(d)(2)

|

|

First

Amendment to Agreement and Plan of Merger, dated August 19, 2020, by and among Insurance Acquisition Corp., IAC Merger Sub,

Inc., and Shift Technologies, Inc. (incorporated by reference to Exhibit 2.2 to the Amendment No. 5 to Form S-4 filed on September

23, 2020, File No. 333-239896, which is included as Annex A).

|

|

|

|

|

|

(d)(3)

|

|

Second

Amended and Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.1 to the Current Report on Form

8-K filed on October 14, 2020).

|

|

|

|

|

|

(d)(4)

|

|

Second

Amended and Restated Bylaws (incorporated by reference to Exhibit 3.2 to the Current Report on Form 8-K filed on October 14,

2020).

|

|

|

|

|

|

(d)(5)

|

|

Specimen

Warrant Certificate (included in Exhibit (d)(6)).

|

|

|

|

|

|

(d)(6)

|

|

Warrant

Agreement, dated March 19, 2019, between Continental Stock Transfer & Trust Company and the IAC (incorporated by reference

to Exhibit 4.1 to the Current Report on Form 8-K filed on March 25, 2019).

|

|

|

|

|

|

(d)(7)

|

|

Stockholders

Letter Agreement, dated October 13, 2020, by and among the Company and certain former stockholders of Shift identified on

the signature pages thereto (incorporated by reference to Exhibit 4.3 to the Current Report on Form 8-K filed on October 14,

2020).

|

|

|

|

|

|

(d)(8)

|

|

Sponsor

Letter Agreement, dated October 13, 2020, by and among the Company, Insurance Acquisition Sponsor, LLC and Dioptra Advisors,

LLC (incorporated by reference to Exhibit 4.4 to the Current Report on Form 8-K filed on October 14, 2020).

|

|

|

|

|

|

(d)(9)

|

|

Form

of PIPE Subscription Agreement (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K

filed on June 29, 2020).

|

|

|

|

|

|

(d)(10)

|

|

Amended

and Restated Registration Rights Agreement, dated October 13, 2020, by and among Insurance Acquisition Sponsor, LLC, Dioptra

Advisors, LLC, Cantor Fitzgerald & Co. and certain initial stockholders of IAC identified on the signature pages thereto

(incorporated by reference to Exhibit 10.33 to the Current Report on Form 8-K filed on October 14, 2020).

|

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated:

November 25, 2020

|

|

SHIFT

TECHNOLOGIES, INC.

|

|

|

|

|

|

|

By:

|

/s/

George Arison

|

|

|

Name:

|

George

Arison

|

|

|

Title:

|

Co-Chief

Executive Officer and Chairman

|

4

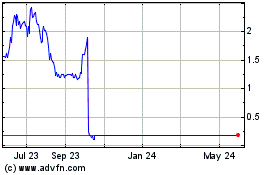

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Apr 2023 to Apr 2024