Aviva's Nine-Month Trading Resilient; Declares 1st Half Dividend

November 26 2020 - 3:07AM

Dow Jones News

By Sabela Ojea

Aviva PLC said Thursday that trading for the first nine months

of the year has been resilient and that it is declaring a dividend

for the first half.

The FTSE 100 listed insurer said performance was driven by its

core markets, partially offset by declines in the manage-for-value

portfolio as margin was prioritized over volume.

U.K. and Ireland Life new business sales rose 40% to 9.2 million

pounds ($12.3 million) for the nine-month period, with value of new

business increased 5% to GBP203 million.

In Continental Europe, present value of new business premiums

fell 21% to GBP9.3 billion, while net written premiums rose 4% to

GBP1.27 billion in the area, mainly due to rate increases in

France. Value of new business fell to GBP411 million from GBP510

million in the year-earlier period due to lower volumes.

At Sept. 30, the company's Solvency II ratio--which represents

capital strength--is expected at around 195%, from 194% for the

first half of the year, with a capital surplus of GBP11.8

billion.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

November 26, 2020 02:52 ET (07:52 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

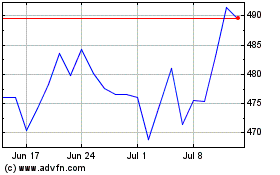

Aviva (LSE:AV.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviva (LSE:AV.)

Historical Stock Chart

From Apr 2023 to Apr 2024