Statement of Changes in Beneficial Ownership (4)

November 25 2020 - 4:38PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Jones Doug |

2. Issuer Name and Ticker or Trading Symbol

PennyMac Financial Services, Inc.

[

PFSI

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Mtge Bnkg Ofcr |

|

(Last)

(First)

(Middle)

C/O PENNYMAC FINANCIAL SERVICES, INC., 3043 TOWNSGATE ROAD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

11/23/2020 |

|

(Street)

WESTLAKE VILLAGE, CA 91361

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 11/23/2020 | | S | | 15000 | D | $57.6111 (1) | 96192 | I | The Jones Family Trust |

| Common Stock | | | | | | | | 51363 (2) | D | |

| Common Stock | | | | | | | | 300000 | I | Jones A LLC |

| Common Stock | | | | | | | | 300000 | I | Jones B LLC |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Nonstatutory Stock Option (Right to Buy) | $21.03 | | | | | | | 6/13/2014 | 6/12/2023 | Common Stock | 15882 (3) | | 15882 | D | |

| Nonstatutory Stock Option (Right to Buy) | $17.26 | | | | | | | 2/26/2015 | 2/25/2024 | Common Stock | 28216 (4) | | 28216 | D | |

| Nonstatutory Stock Option (Right to Buy) | $17.52 | | | | | | | 3/3/2016 | 3/2/2025 | Common Stock | 23829 (5) | | 23829 | D | |

| Nonstatutory Stock Option (Right to Buy) | $11.28 | | | | | | | 3/7/2017 | 3/6/2026 | Common Stock | 27771 (6) | | 27771 | D | |

| Nonstatutory Stock Option (Right to Buy) | $18.05 | | | | | | | 3/6/2018 | 3/5/2027 | Common Stock | 34626 (7) | | 34626 | D | |

| Nonstatutory Stock Option (Right to Buy) | $24.40 | | | | | | | 3/9/2019 | 3/8/2028 | Common Stock | 26467 (8) | | 26467 | D | |

| Nonstatutory Stock Option (Right to Buy) | $22.92 | | | | | | | 3/15/2020 | 3/14/2029 | Common Stock | 27744 (9) | | 27744 | D | |

| Nonstatutory Stock Option (Right to Buy) | $35.03 | | | | | | | 2/26/2021 | 2/25/2030 | Common Stock | 30366 (10) | | 30366 | D | |

| Explanation of Responses: |

| (1) | The price reported is the weighted average price of multiple transactions ranging from $57.27 to $58.05. The reporting person hereby undertakes to provide upon request to the SEC, the Issuer or a security holder of the Issuer the number of Common Stock and the prices at which the transactions were effected. |

| (2) | The reported amount consists of 19,134 restricted stock units and 32,229 shares of Common Stock. The restricted stock units are to be settled in an equal number of shares of Common Stock upon vesting. |

| (3) | This nonstatutory stock option to purchase 15,882 shares of Common Stock of the Issuer will vest as to one-third of the optioned shares on each of June 13, 2014, 2015 and 2016, subject to the Reporting Person's continued service through each date. |

| (4) | This nonstatutory stock option to purchase 28,216 shares of Common Stock of the Issuer will vest as to one-third of the optioned shares on each of February 26, 2015, 2016 and 2017, subject to the Reporting Person's continued service through each date. |

| (5) | This nonstatutory stock option to purchase 23,829 shares of Common Stock of the Issuer will vest as to one-third of the optioned shares on each of March 3, 2016, 2017 and 2018, subject to the Reporting Person's committed service through each date. |

| (6) | This nonstatutory stock option to purchase 27,771 shares of Common Stock of the Issuer will vest as to one-third of the optioned shares on each of March 7, 2017, 2018 and 2019, subject to the Reporting Person's committed service through each date. |

| (7) | This nonstatutory stock option to purchase 34,626 shares of Common Stock of the Issuer will vest as to one-third of the optioned shares on each of March 6, 2018, 2019 and 2020, subject to the Reporting Person's committed service through each date. |

| (8) | This nonstatutory stock option to purchase 26,467 shares of Common Stock of the Issuer will vest as to one-third of the optioned shares on each of March 9, 2019, 2020 and 2021, subject to the Reporting Person's committed service through each date. |

| (9) | This nonstatutory stock option to purchase 27,744 shares of Common Stock of the Issuer will vest as to one-third of the optioned shares on each of March 15, 2020, 2021 and 2022, subject to the Reporting Person's continued service through each date. |

| (10) | This nonstatutory stock option to purchase 30,366 shares of Common Stock of the Issuer will vest as to one-third of the optioned shares on each of February 26, 2021, 2022 and 2023, subject to the Reporting Person's continued service through each date. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Jones Doug

C/O PENNYMAC FINANCIAL SERVICES, INC.

3043 TOWNSGATE ROAD

WESTLAKE VILLAGE, CA 91361 |

|

| Chief Mtge Bnkg Ofcr |

|

Signatures

|

| /s/ Derek W. Stark, attorney-in-fact for Mr. Jones | | 11/25/2020 |

| **Signature of Reporting Person | Date |

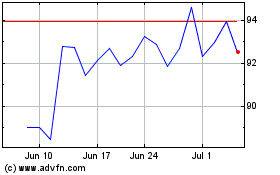

PennyMac Financial Servi... (NYSE:PFSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

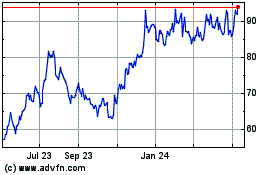

PennyMac Financial Servi... (NYSE:PFSI)

Historical Stock Chart

From Apr 2023 to Apr 2024