Accelerating Rally in Oil Prices Signals Optimism About Global Growth

November 24 2020 - 11:24AM

Dow Jones News

By Amrith Ramkumar

A recent rise in oil prices continued Tuesday, putting crude on

track for its highest close since early March with investors

wagering on a brighter economic outlook and higher demand for

fuel.

U.S. crude-oil futures for January delivery advanced 2.9% to

$44.32 a barrel, rallying for the sixth time in seven sessions and

eclipsing their peak closing level from late August. Oil started

the year above $60, briefly tumbled below $0 for the first time

ever in April as coronavirus shutdowns crippled demand, then

rebounded around $40 this summer.

Prices had hovered around the $40 level for months, but upbeat

coronavirus vaccine trial results in recent weeks are igniting

fresh gains. The data from Moderna Inc. and the duos of Pfizer Inc.

and BioNTech SE and AstraZeneca PLC and the University of Oxford

are fueling hopes that global consumers will be vaccinated more

quickly than previously expected and could resume traveling.

That would be a boon for energy producers like Chevron Corp. and

Exxon Mobil Corp. because oil demand rises when more people are

driving and flying and ships laden with goods are traveling all

over the world. The pandemic fueled a historic drop in fuel demand

early in the year and prompted a fresh selloff in late October, but

traders now expect a recovery in consumption to extend the oil

rebound into 2021.

"It's a total change of vibe," said Robert Yawger, director of

the futures division at Mizuho Securities USA. "Everything is much

more positive now."

In another sign analysts are more optimistic about future oil

demand, U.S. crude futures that expire next summer now cost more

than futures expiring later in 2021. That condition, known as

backwardation, signals higher expected consumption and sends a

bullish signal to investors who often have to sell contracts that

expire sooner and buy longer-dated futures.

Brent crude, the global gauge of oil prices, added 2.5% to

$47.21 a barrel Tuesday, also heading for its highest close since

March.

With the demand outlook brightening, hedge funds and other

speculative investors have lifted net bets on higher U.S. crude

prices in recent weeks, Commodity Futures Trading Commission data

show.

In addition to vaccine trial results, Wall Street analysts have

also cheered Democratic nominee Joe Biden's recent victory in the

U.S. presidential election. Many traders had feared a contested

outcome or disruptions related to mail-in voting that would leave

the result in doubt for weeks after election day and add to already

elevated levels of economic uncertainty.

Some investors are also pleased with Mr. Biden's expected

nomination of former Federal Reserve Chairwoman Janet Yellen to be

the next Treasury Secretary. Analysts expect Ms. Yellen to advocate

for more stimulus to support the economy as it recovers from the

pandemic.

"The assumption is that she would work with [current Fed

Chairman Jerome] Powell to get a supersized stimulus package"

involving both fiscal and monetary support, Mr. Yawger said.

That optimism about the global economy is prompting gains in

growth-sensitive assets across stocks, commodities and

currencies.

With oil prices climbing, energy producers have been among the

stock market's best performers in recent days. The S&P 500

energy sector is up more than 35% so far this month, with companies

like Diamondback Energy Inc. and Occidental Petroleum Corp. paring

some of their sizable 2020 declines. Some traders view the rebound

in energy stocks as a bullish sign for the commodity market because

shares of producers tend to be more extreme than oil prices, rising

faster when crude climbs but losing value more quickly when oil

drops.

Analysts are waiting to see whether the Organization of the

Petroleum Exporting Countries and allies like Russia continue

existing supply cuts following recent price gains. Earlier in the

month, analysts had expected OPEC Plus might have to deepen

production cuts to support falling oil prices amid a rise in

coronavirus cases around the world.

If the cartel and its partners roll back supply curtailments or

seem to be wavering on their support for the oil market, the recent

rally could fade, traders caution. While many analysts are

optimistic about the outlook for demand in 2021, there is also

concern that recent restrictions in Europe to curb the pandemic and

rising cases in the U.S. could lead to a short-term oversupply this

winter.

Elsewhere in commodities Tuesday, most actively traded gold

futures slid 2% to $1,800.50 a troy ounce, continuing a recent

selloff with traders selling the haven metal amid optimism about

the global economic outlook.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

November 24, 2020 11:09 ET (16:09 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

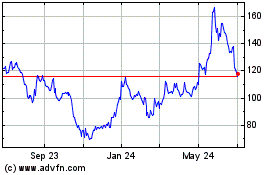

Moderna (NASDAQ:MRNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

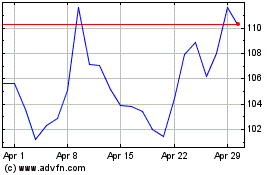

Moderna (NASDAQ:MRNA)

Historical Stock Chart

From Apr 2023 to Apr 2024