Current Report Filing (8-k)

November 17 2020 - 4:20PM

Edgar (US Regulatory)

False000158568900015856892020-11-162020-11-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 16, 2020

Hilton Worldwide Holdings Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-36243

|

|

27-4384691

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

7930 Jones Branch Drive, Suite 1100, McLean, Virginia 22102

(Address of Principal Executive Offices) (Zip Code)

(703) 883-1000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

|

HLT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 8.01 Other Events.

On November 16, 2020, Hilton Domestic Operating Company Inc. (the “Issuer”), an indirect subsidiary of Hilton Worldwide Holdings Inc. (the “Company”), entered into a purchase agreement (the “Purchase Agreement”) by and among the Issuer, the Company, the other guarantors party thereto and J.P. Morgan Securities LLC, for itself and on behalf of the several initial purchasers named therein (the “Initial Purchasers”), providing for the issuance and sale of $800 million in aggregate principal amount of the Issuer’s 3.750% Senior Notes due 2029 (the “2029 Notes”) and $1.1 billion in aggregate principal amount of the Issuer’s 4.000% Senior Notes due 2031 (the “2031 Notes” and, together with the 2029 Notes, the “Notes”) in a private offering to qualified institutional buyers in accordance with Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and to non-U.S. persons in transactions outside the United States in reliance on Regulation S under the Securities Act. The Notes will be issued at 100% of their par value with a coupon of 3.750%, in the case of the 2029 Notes, and 4.000%, in the case of the 2031 Notes. Interest on the Notes will be payable semi-annually on May 1 and November 1 of each year commencing on May 1, 2021. The 2029 Notes will mature on May 1, 2029, and the 2031 Notes will mature on May 1, 2031. The offering is expected to close, subject to customary closing conditions, on December 1, 2020. The Purchase Agreement contains customary representations, warranties, conditions to closing, indemnification rights and obligations of the parties and termination provisions.

The Issuer intends to use the net proceeds of the offering of the Notes, together with available cash, to redeem all $1.0 billion in aggregate principal amount of its outstanding 4.250% Senior Notes due 2024 (the “2024 Notes”), all $900 million in aggregate principal amount of its outstanding 4.625% Senior Notes due 2025 (the “2025 Notes”) and to pay the related redemption premiums and all fees and expenses related thereto.

Certain of the Initial Purchasers and their respective affiliates have engaged in, and may in the future engage in, investment banking, advisory roles and other commercial dealings in the ordinary course of business with the Company or its affiliates. They have received, or may in the future receive, customary fees and commissions for these transactions. In addition, certain of the Initial Purchasers or their respective affiliates may be holders of the 2024 Notes and/or 2025 Notes and may receive a portion of the net proceeds from the offering that are used to fund the redemption of such notes.

The information included in Item 8.01 of this Current Report on Form 8-K is neither an offer to sell nor a solicitation of an offer to buy any securities of the Company or its subsidiaries.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HILTON WORLDWIDE HOLDINGS INC.

|

|

|

|

|

|

By:

|

|

/s/ Kevin J. Jacobs

|

|

Name:

|

|

Kevin J. Jacobs

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

Date: November 17, 2020

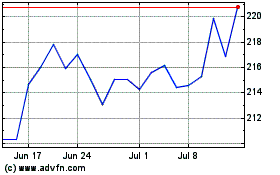

Hilton Worldwide (NYSE:HLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

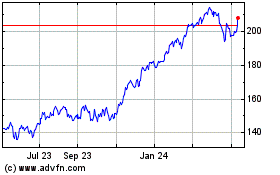

Hilton Worldwide (NYSE:HLT)

Historical Stock Chart

From Apr 2023 to Apr 2024