Security National Financial Corporation Reports Financial Results for the Quarter Ended September 30, 2020

November 16 2020 - 8:00AM

Security National Financial Corporation (SNFC) (NASDAQ symbol

"SNFCA") announced financial results for the quarter ended

September 30, 2020.

For the three months ended September 30, 2020,

SNFC’s after-tax earnings from operations increased 710.2% from

$3,617,000 in 2019 to $29,305,000 in 2020, on a 94.0% increase in

revenues to $146,205,000. SNFC’s after tax earnings for the nine

months ended September 30, 2020 increased 468.1% to $51,286,000

from $9,028,000 in 2019.

Scott M. Quist, President of the Company, said,

“For the quarter, revenues increased 94%, profitability increased

700%, and YTD we have a 26% return on equity. I believe our third

quarter is the best operational third quarter ever for each of our

business segments. Those are spectacular results that have been

delivered in difficult circumstances. I applaud the efforts of all

our teams in their considerable accomplishment. Every business

segment delivered impressive results.

“Our mortgage segment has taken great advantage

of the circumstances presented this year. The pandemic-created

interest rate decline spurred refinance volumes, made purchase

transactions more affordable, and provided generally higher margins

on the sale of loans for those institutions having the sales,

operational, and financial wherewithal to take advantage. Our

hardworking staff met the challenge of the more than doubled

volumes by increasing efficiency in a very difficult workplace

environment, such that costs only increased about 60% - an enviable

accomplishment.

“Our insurance segment’s operational income

reflects similar accomplishment. Our Kilpatrick Life Insurance

Company acquisition, which closed last December, has been

integrated. Much of that work was accomplished in difficult

COVID-related circumstances. While Kilpatrick experienced losses

during the first four months of 2020, as was anticipated, it is now

profitable and contributing beyond expectations. COVID-related

death claims have become more pronounced with death claims

increasing about 20% YTD, and for September increasing

approximately 65% over September 2019. I don’t know if the 65%

number is a fair predictor of the future, but obviously COVID-19

claims are having, and will continue to have, an impact. Lastly,

obtaining necessary investment yields within acceptable risk

tolerances is becoming more difficult in this low interest rate

environment. We do not anticipate those economic circumstances

changing over the near term.

“Our Memorial segment similarly delivered very

solid Q3 and YTD result with revenues increasing 54% for the

quarter and operational income increasing 100% YTD. Substantially

contributing to those results is increased preneed cemetery sales,

but mortuary and cemetery operations were also significant

contributors. This excellent performance is not an isolated

instance. It is instructive to note that our Memorial segment has

achieved an average 24% compound annual growth rate in operational

income over the last six years. In my view, such excellent

financial results are the natural consequence of continuously

providing superb customer care and consumer experience during very

difficult times.”

SNFC has three business segments. The following

table shows the revenues and earnings before taxes for the three

months ended September 30, 2020, as compared to 2019, for each of

the three business segments:

| |

Revenues |

|

Earnings before Taxes |

| |

|

2020 |

|

|

2019 |

|

|

|

|

2020 |

|

|

2019 |

|

|

|

Life Insurance |

$ |

39,261,000 |

|

$ |

29,825,000 |

|

31.6 |

% |

|

$ |

4,807,000 |

|

$ |

1,264,000 |

|

280.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cemeteries/Mortuaries |

$ |

5,496,000 |

|

$ |

3,570,000 |

|

53.9 |

% |

|

$ |

1,322,000 |

|

$ |

213,000 |

|

520.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgages |

$ |

101,448,000 |

|

$ |

41,985,000 |

|

141.6 |

% |

|

$ |

32,455,000 |

|

$ |

3,283,000 |

|

888.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

$ |

146,205,000 |

|

$ |

75,380,000 |

|

94.0 |

% |

|

$ |

38,584,000 |

|

$ |

4,760,000 |

|

710.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended September 30, 2020: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues |

|

Earnings before Taxes |

| |

|

2020 |

|

|

2019 |

|

|

|

|

2020 |

|

|

2019 |

|

|

| Life

Insurance |

$ |

110,255,000 |

|

$ |

88,937,000 |

|

24.0 |

% |

|

$ |

5,408,000 |

|

$ |

4,568,000 |

|

18.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cemeteries/Mortuaries |

$ |

14,816,000 |

|

$ |

12,473,000 |

|

18.8 |

% |

|

$ |

2,976,000 |

|

$ |

2,422,000 |

|

22.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgages |

$ |

219,404,000 |

|

$ |

103,909,000 |

|

111.2 |

% |

|

$ |

58,868,000 |

|

$ |

4,826,000 |

|

1,119.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

$ |

344,475,000 |

|

$ |

205,319,000 |

|

67.8 |

% |

|

$ |

67,252,000 |

|

$ |

11,816,000 |

|

469.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Net earnings per common share was $1.51 for the

three months ended September 30, 2020, compared to net earnings of

$0.19 per share for the prior year, as adjusted for the effect of

annual stock dividends. Book value per common share was $13.53 as

of September 30, 2020, compared to $10.86 as of December 31,

2019.

The Company has two classes of common stock

outstanding, Class A and Class C. There were 18,919,980 Class A

equivalent shares outstanding as of September 30, 2020.

If there are any questions, please contact Mr.

Garrett S. Sill, Mr. Brian Nelsen or Mr. Scott Quist at:

Security National Financial Corporation P.O. Box

57250 Salt Lake City, Utah 84157 Phone (801) 264-1060 Fax (801)

265-9882

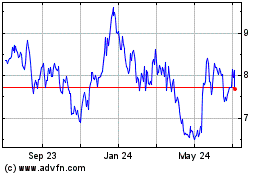

Security National Financ... (NASDAQ:SNFCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

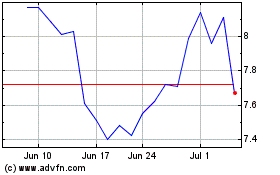

Security National Financ... (NASDAQ:SNFCA)

Historical Stock Chart

From Apr 2023 to Apr 2024