Solid Biosciences Inc. (Nasdaq: SLDB), a life sciences company

focused on advancing meaningful therapies for Duchenne muscular

dystrophy (Duchenne), today reported financial results for the

third quarter ended September 30, 2020 and provided a

business update.

“With the FDA’s lifting of the clinical hold on the IGNITE DMD

trial, we are well underway in completing the activities necessary

to resume dosing, which we expect will occur in the first quarter

of 2021,” said Ilan Ganot, Chief Executive Officer, President

and Co-Founder of Solid Biosciences. “This important event and

establishing a strategic collaboration with Ultragenyx to develop

additional gene therapies for Duchenne mark important progress

toward our goal of improving the lives of patients living with

Duchenne. We are also increasing production of SGT-001 using our

improved manufacturing process in support of dosing additional

patients in 2021. Additionally, we strengthened our balance sheet

with additional capital from the Ultragenyx collaboration and

our recent at-the-market, or ATM, equity financing, both of

which will support our planned clinical advancement of

SGT-001.”

Recent Developments

- In October 2020,

Solid announced that the U.S. Food and Drug Administration (FDA)

lifted the clinical hold placed on the Company’s IGNITE DMD Phase

I/II clinical trial. Solid expects to resume dosing in the clinical

trial in the first quarter of 2021.

- Solid implemented and shared with the FDA manufacturing process

changes that remove the majority of empty viral capsids. The

improved process is averaging approximately 90% full capsids,

allowing target dosing to be achieved with fewer viral

particles.

- Solid submitted data from a new, quantitative, in vitro

microdystrophin expression assay that demonstrates comparability

between SGT-001 manufactured by the two processes.

- Solid is reducing the maximum weight of the next two patients

dosed to 18 kg. This reduction, in conjunction with the delivery of

fewer viral particles as a result of the company’s manufacturing

process improvements, will reduce patients’ total viral load while

continuing dosing at the 2E14 vg/kg dose.

- Solid has amended the IGNITE DMD clinical protocol to include

the prophylactic use of both anti-complement inhibitor eculizumab

and C1 esterase inhibitor, and an increase in prednisone dose in

the first month post dosing.

- Solid also provided the FDA with updated functional efficacy

data (including 6-Minute Walk Test and North Star Ambulatory

Assessment data) for all patients dosed to date in IGNITE DMD.

- In October

2020, Solid and Ultragenyx Pharmaceutical (Ultragenyx) announced a

strategic collaboration to develop and commercialize new gene

therapies for Duchenne. The parties will collaborate to develop

products that combine Solid’s differentiated microdystrophin

construct and Ultragenyx’s HeLa producer cell line (PCL)

manufacturing platform for adeno-associated virus (AAV) vectors

using AAV8 variants. The goal of the collaboration is to expand the

pipeline of potential gene therapies for patients living with

Duchenne.

- Ultragenyx made a $40 million investment in Solid at a 33%

premium.

- Ultragenyx has also agreed to pay up to $255 million in

cumulative milestone payments per product upon achievement of

specified milestone events, and tiered royalties on worldwide net

sales. Upon achievement of proof-of-concept, Solid has the right to

opt-in to co-fund collaboration programs in return for

participation in a profit share or increased royalty payments.

- Solid retains full rights to SGT-001 as well as the opportunity

to establish additional partnerships around SGT-001 or the

Company’s proprietary and differentiated microdystrophin construct

outside of AAV8 variants.

- In October

2020, Solid announced that it sold shares of its common stock

pursuant to a sales agreement dated March 13, 2019, between the

Company and Jefferies LLC that resulted in gross proceeds of $23.9

million (ATM Sale).

Financial Highlights

Research and development expenses for the third quarter of 2020

were $16.0 million, compared to $22.8 million for

the third quarter of 2019. Research and development expenses for

the first nine months of 2020 were $49.2 million,

compared to $67.7 million for the first nine months of 2019.

The decrease was primarily attributable to a reduction in personnel

and facility related expenses as a result of the restructuring that

occurred in January 2020, as well as lower manufacturing costs and

a decrease in costs related to other product candidates as the

Company focuses on advancing SGT-001.

General and administrative expenses for the third quarter of

2020 were $5.2 million, compared to $6.9 million for

the third quarter of 2019. General and administrative expenses for

the first nine months of 2020 were $16.0 million,

compared to $19.3 million for the first nine months of

2019. The decrease was primarily attributable to decreased

personnel costs and corporate expenses partially due to the

restructuring that occurred in January 2020.

Net loss for the third quarter of 2020 was $21.2 million,

compared to $29.3 million for the third quarter of 2019.

Net loss for the first nine months of 2020 was $66.9

million, compared to $85.4 million for the first nine

months of 2019.

Solid had $24.8 million in cash and cash equivalents

as of September 30, 2020. The Company expects that its cash

and cash equivalents, combined with proceeds of $40 million from

the issuance and sale of shares of common stock to Ultragenyx and

the net proceeds of $23.2 million from the ATM Sale will enable

Solid to fund its operating expenses into the second half of

2021.

Conference CallManagement will host a webcast

and conference call to discuss Solid’s third quarter 2020 financial

results and business update today, November 5, 2020, at 8:30 AM

ET.

A live webcast of the call will be available on

the Company's website at www.solidbio.com under the “News &

Events” tab in the Investor Relations section, or by clicking here.

Participants may also access the call, by dialing 866-763-0341 for

domestic callers or 703-871-3818 for international callers.

The archived webcast will be available for in

the “News and Events” section of the Company's website.

About SGT-001Solid’s SGT-001 is a novel

adeno-associated viral (AAV) vector-mediated gene transfer therapy

designed to address the underlying genetic cause of Duchenne.

Duchenne is caused by mutations in the dystrophin gene that result

in the absence or near absence of dystrophin protein. SGT-001 is a

systemically administered candidate that delivers a synthetic

dystrophin gene, called microdystrophin, to the body. This

microdystrophin encodes for a functional protein surrogate that is

expressed in muscles and stabilizes essential associated proteins,

including neuronal nitric oxide synthase nNOS. Data from Solid’s

preclinical program suggests that SGT-001 has the potential to slow

or stop the progression of Duchenne, regardless of genetic mutation

or disease stage.

SGT-001 is based on pioneering research in dystrophin biology by

Dr. Jeffrey Chamberlain of the University of Washington and Dr.

Dongsheng Duan of the University of Missouri. SGT-001 has been

granted Rare Pediatric Disease Designation, or RPDD, and Fast Track

Designation in the United States and Orphan Drug Designations in

both the United States and European Union.

About Solid BiosciencesSolid Biosciences

is a life sciences company focused on advancing transformative

treatments to improve the lives of patients living with Duchenne.

Disease-focused and founded by a family directly impacted by

Duchenne, our mandate is simple yet comprehensive – work to address

the disease at its core by correcting the underlying mutation that

causes Duchenne with our lead gene therapy candidate, SGT-001. For

more information, please visit www.solidbio.com.

Forward-Looking StatementsThis press release

contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements regarding the timing and ability of the Company to

resume dosing and move the IGNITE DMD clinical trial forward, the

safety or potential efficacy of SGT-001, the sufficiency of the

Company’s cash and cash equivalents to fund its operations,

potential milestone payments or royalty payments in connection with

the Ultragenyx collaboration and other statements containing the

words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” “should,” “target,” “would,” “working” and similar

expressions. Any forward-looking statements are based on

management’s current expectations of future events and are subject

to a number of risks and uncertainties that could cause actual

results to differ materially and adversely from those set forth in,

or implied by, such forward-looking statements. These risks and

uncertainties include, but are not limited to, risks associated

with the Company’s ability to resume and/or continue IGNITE DMD on

the timeline expected or at all; obtain and maintain necessary

approvals from the FDA and other regulatory authorities; obtain and

maintain the necessary approvals from investigational review boards

at IGNITE DMD clinical trial sites and the IGNITE DMD independent

data safety monitoring board; enroll patients in IGNITE DMD;

continue to advance SGT-001 in clinical trials; replicate in

clinical trials positive results found in preclinical studies and

earlier stages of clinical development; advance the development of

its product candidates under the timelines it anticipates in

current and future clinical trials; successfully optimize and scale

its manufacturing process; obtain, maintain or protect intellectual

property rights related to its product candidates; compete

successfully with other companies that are seeking to develop

DMD/Duchenne treatments and gene therapies; manage expenses; and

raise the substantial additional capital needed, on the timeline

necessary, to continue development of SGT-001, achieve its other

business objectives and continue as a going concern. For a

discussion of other risks and uncertainties, and other important

factors, any of which could cause the Company’s actual results to

differ from those contained in the forward-looking statements, see

the “Risk Factors” section, as well as discussions of potential

risks, uncertainties and other important factors, in the Company’s

most recent filings with the Securities and Exchange Commission. In

addition, the forward-looking statements included in this press

release represent the Company’s views as of the date hereof and

should not be relied upon as representing the Company’s views as of

any date subsequent to the date hereof. The Company anticipates

that subsequent events and developments will cause the Company's

views to change. However, while the Company may elect to update

these forward-looking statements at some point in the future, the

Company specifically disclaims any obligation to do so.

Investor Contact:David CareyFINN

Partners212-867-1768David.Carey@finnpartners.com

Media Contact:Erich SandovalFINN

Partners917-497-2867Erich.Sandoval@finnpartners.com

|

Solid Biosciences Inc. |

|

Condensed Consolidated Statements of Operations |

|

(unaudited, in thousands, except share and per share data) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

| |

Research and development |

|

|

16,045 |

|

|

|

22,792 |

|

|

|

49,158 |

|

|

|

67,671 |

|

| |

General and administrative |

|

|

5,181 |

|

|

|

6,925 |

|

|

|

15,957 |

|

|

|

19,317 |

|

| |

Restructuring charges |

|

|

- |

|

|

|

- |

|

|

|

1,944 |

|

|

|

- |

|

| |

|

Total operating expenses |

|

|

21,226 |

|

|

|

29,717 |

|

|

|

67,059 |

|

|

|

86,988 |

|

|

Loss from operations |

|

|

(21,226 |

) |

|

|

(29,717 |

) |

|

|

(67,059 |

) |

|

|

(86,988 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

| |

Interest (expense) income |

|

|

(20 |

) |

|

|

406 |

|

|

|

131 |

|

|

|

1,281 |

|

| |

Other income |

|

|

- |

|

|

|

56 |

|

|

|

1 |

|

|

|

345 |

|

| |

|

Total other income (expense), net |

|

|

(20 |

) |

|

|

462 |

|

|

|

132 |

|

|

|

1,626 |

|

|

Net loss |

|

$ |

(21,246 |

) |

|

$ |

(29,255 |

) |

|

$ |

(66,927 |

) |

|

$ |

(85,362 |

) |

|

Net loss per share attributable to common stockholders, basic and

diluted |

|

$ |

(0.44 |

) |

|

$ |

(0.67 |

) |

|

$ |

(1.39 |

) |

|

$ |

(2.26 |

) |

|

Weighted average shares of common stock outstanding, basic and

diluted |

|

|

48,295,468 |

|

|

|

43,467,618 |

|

|

|

48,172,686 |

|

|

|

37,727,640 |

|

| |

|

|

|

|

|

|

|

Solid Biosciences Inc. |

|

Condensed Consolidated Balance Sheets |

|

(unaudited, in thousands, except share and per share data) |

| |

|

|

|

|

|

|

| |

|

|

|

September 30, |

|

December 31, |

|

|

|

|

|

|

2020 |

|

|

|

2019 |

|

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

| |

Cash and cash equivalents |

|

$ |

24,797 |

|

|

$ |

76,043 |

|

| |

Available-for-sale securities |

|

|

- |

|

|

|

7,481 |

|

| |

Prepaid expenses and other current assets |

|

|

2,365 |

|

|

|

2,778 |

|

|

|

|

Total current assets |

|

|

27,162 |

|

|

|

86,302 |

|

|

Property and equipment, net |

|

|

8,869 |

|

|

|

11,645 |

|

|

Operating lease, right-of-use assets |

|

|

3,951 |

|

|

|

4,988 |

|

|

Other non-current assets |

|

|

209 |

|

|

|

209 |

|

|

Restricted cash |

|

|

327 |

|

|

|

327 |

|

| |

|

Total assets |

|

$ |

40,518 |

|

|

$ |

103,471 |

|

| |

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

| |

Accounts payable |

|

$ |

4,083 |

|

|

$ |

7,124 |

|

| |

Accrued expenses |

|

|

8,550 |

|

|

|

9,178 |

|

| |

Operating lease liabilities |

|

|

1,930 |

|

|

|

1,736 |

|

| |

Finance lease liabilities |

|

|

202 |

|

|

|

186 |

|

| |

Other current liabilities |

|

|

- |

|

|

|

52 |

|

| |

|

Total current liabilities |

|

|

14,765 |

|

|

|

18,276 |

|

| |

Operating lease liabilities, excluding current portion |

|

|

2,943 |

|

|

|

4,414 |

|

| |

Finance lease liabilities, excluding current portion |

|

|

579 |

|

|

|

733 |

|

| |

|

Total liabilities |

|

|

18,287 |

|

|

|

23,423 |

|

|

Common Stock |

|

|

48 |

|

|

|

48 |

|

| |

Additional paid-in capital |

|

|

405,389 |

|

|

|

396,278 |

|

| |

Accumulated other comprehensive income |

|

|

- |

|

|

|

1 |

|

| |

Accumulated deficit |

|

|

(383,206 |

) |

|

|

(316,279 |

) |

| |

|

Total stockholders' equity |

|

|

22,231 |

|

|

|

80,048 |

|

| |

|

Total liabilities and stockholders' equity |

|

$ |

40,518 |

|

|

$ |

103,471 |

|

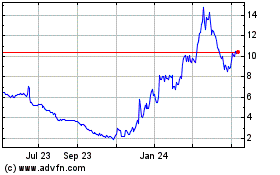

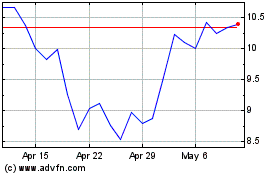

Solid Biosciences (NASDAQ:SLDB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Solid Biosciences (NASDAQ:SLDB)

Historical Stock Chart

From Apr 2023 to Apr 2024