Green Plains Partners LP (NASDAQ:GPP) today announced financial and

operating results for the third quarter of 2020. Net income

attributable to the partnership was $10.3 million, or $0.44 per

common unit, for the third quarter of 2020 compared with net income

of $10.1 million, or $0.43 per common unit, for the same period in

2019.

The partnership also reported adjusted EBITDA of $13.9 million

and distributable cash flow of $11.3 million for the third quarter

of 2020, compared with adjusted EBITDA of $13.3 million and

distributable cash flow of $11.1 million for the same period in

2019. Distribution coverage was 3.97x for the three months ended

September 30, 2020 as compared to 0.98x for the same period a year

ago.

“We continue to generate sufficient cash flow from operations to

support our required debt amortization and fund distributions,”

said Todd Becker, president and chief executive officer. “We remain

committed to delivering value to our unitholders by further

deleveraging the balance sheet supported by long-term minimum

volume commitments. The partnership is also well positioned to

benefit from Green Plains’ ongoing transformation, including its

investments to reduce operating costs and the addition of

ultra-high protein production technology, which enables more

consistent and higher throughput over the long-term.”

Third Quarter

Highlights and Recent

Developments

- On October 15, 2020, the board of directors of the

partnership’s general partner declared a quarterly cash

distribution of $0.12 per unit, or approximately $2.8 million, for

the third quarter of 2020. The distribution is payable on November

13, 2020, to unitholders of record at the close of business on

November 6, 2020.

Results of OperationsConsolidated revenues

increased $1.2 million for the three months ended September 30,

2020, compared with the same period for 2019. Storage and

throughput services revenue increased $0.7 million due to an

increase in the rate per gallon charged to Green Plains Trade

beginning on July 1, 2020. Railcar transportation services revenue

increased $0.5 million primarily due to an increase in average

volumetric capacity provided and the average capacity fee

charged.

Operations and maintenance expenses increased $0.4 million for

the three months ended September 30, 2020, compared with the same

period for 2019, primarily due to an increase in railcar lease

expense. This increase was due to the acceleration of operating

lease expense caused by the early termination of leased railcar

assets as well as an increase in the average railcar lease rates.

General and administrative expenses increased $0.2 million for the

three months ended September 30, 2020, compared with the same

period for 2019, primarily due to increased expenses for insurance

and property taxes.

During the third quarter of 2020, our parent’s average

production utilization rate was approximately 66.8% of capacity.

Biofuel throughput was 189.6 million gallons, compared with the

contracted minimum volume commitment of 235.7 million gallons per

quarter. As a result, the partnership charged Green Plains Trade

$2.4 million related to the minimum volume commitment deficiency

for the quarter, resulting in a credit to be applied against excess

volumes in future periods. The cumulative minimum volume deficiency

credits available to Green Plains Trade as of September 30, 2020

totaled $6.7 million. If these credits are unused by Green Plains

Trade, $4.3 million will expire on June 30, 2021 and $2.4 million

will expire on September 30, 2021. These credits have been

recognized in revenue by the partnership, and as such, future

volumes throughput by Green Plains Trade in excess of the quarterly

minimum volume commitment, up to the amount of these credits, will

not be recognized in revenue in future periods prior to

expiration.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

GREEN PLAINS PARTNERS LP |

|

SELECTED OPERATING DATA |

|

(unaudited, in million gallons) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

| |

2020 |

|

2019 |

|

% Var. |

|

2020 |

|

2019 |

|

% Var. |

| Product volumes |

|

|

|

|

|

|

|

|

|

|

|

|

|

Storage and throughput services |

189.6 |

|

238.9 |

|

(20.6 |

)% |

|

581.3 |

|

619.7 |

|

(6.2 |

)% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Terminal services: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Affiliate |

24.5 |

|

31.8 |

|

(23.0 |

) |

|

79.3 |

|

86.4 |

|

(8.2 |

) |

|

|

Non-affiliate |

27.7 |

|

26.3 |

|

5.3 |

|

|

78.3 |

|

79.1 |

|

(1.0 |

) |

|

| |

52.2 |

|

58.1 |

|

(10.2 |

) |

|

157.6 |

|

165.5 |

|

(4.8 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Railcar capacity billed (daily

average) |

81.5 |

|

77.0 |

|

5.8 |

|

|

80.4 |

|

80.5 |

|

(0.1 |

) |

|

Liquidity and Capital

ResourcesTotal liquidity as of September 30, 2020, was

$4.4 million, including $0.1 million in cash and cash equivalents,

and $4.3 million available under the partnership’s revolving credit

facility.

Conference Call InformationOn

November 5, 2020, Green Plains Partners LP and Green Plains Inc.

will host a joint conference call at 11 a.m. Eastern time (10 a.m.

Central time) to discuss third quarter 2020 financial and operating

results for each company. Domestic and international participants

can access the conference call by dialing 877.711.2374 and

281.542.4862, respectively, and referencing conference ID 3682884.

The company advises participants to call at least 10 minutes prior

to the start time. Alternatively, the conference call, transcript

and presentation will be accessible on Green Plains Partners’

website at http://ir.greenplainspartners.com.

Non-GAAP Financial MeasuresAdjusted EBITDA and

distributable cash flow are supplemental financial measures used to

assess the partnership’s financial performance. Management believes

adjusted EBITDA and distributable cash flow provide investors

useful information in assessing the partnership’s financial

condition and results of operations. Adjusted EBITDA is defined as

earnings before interest expense, income tax expense, depreciation

and amortization, plus adjustments for transaction costs related to

acquisitions or financings, unit-based compensation expense, net

gains or losses on asset sales and the partnership’s proportional

share of EBITDA adjustments of equity method investee.

Distributable cash flow is defined as adjusted EBITDA less interest

paid or payable, income taxes paid or payable, maintenance capital

expenditures and the partnership’s proportionate share of

distributable cash flow adjustments of equity method investee.

References to LTM refer to results from the immediately preceding

twelve-month period. Adjusted EBITDA and distributable cash flow

are not presented in accordance with generally accepted accounting

principles (GAAP) and therefore should not be considered in

isolation or as alternatives to net income or any other measure of

financial performance presented in accordance with GAAP to analyze

the partnership’s results.

About Green Plains Partners LPGreen Plains

Partners LP (NASDAQ:GPP) is a fee-based Delaware limited

partnership formed by Green Plains Inc. to provide fuel storage and

transportation services by owning, operating, developing and

acquiring ethanol and fuel storage terminals, transportation assets

and other related assets and businesses. For more information about

Green Plains Partners, visit www.greenplainspartners.com.

About Green Plains Inc.Green Plains Inc.

(NASDAQ:GPRE) is a diversified commodity-processing business with

operations that include corn processing, grain handling and storage

and commodity marketing and logistics services. The company is one

of the leading corn processors in the world and, through its

adjacent businesses, is focused on the production of sustainable

biofuels and sustainable high protein and novel feed ingredients.

Green Plains owns a 48.9% limited partner interest and a 2.0%

general partner interest in Green Plains Partners LP. For more

information about Green Plains, visit www.gpreinc.com.

Forward-Looking StatementsThis news release

includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, as amended.

Forward-looking statements reflect management’s current views,

which are subject to risks and uncertainties including, but not

limited to, anticipated financial and operating results, plans and

objectives that are not historical in nature. These statements may

be identified by words such as “believe,” “expect,” “may,”

“should,” “will” and similar expressions. Factors that could cause

actual results to differ materially from those expressed or implied

are discussed in Green Plains Partners’ reports filed with the

Securities and Exchange Commission. Investors are cautioned not to

place undue reliance on forward-looking statements, which speak

only as of the date of this news release. Green Plains Partners

assumes no obligation to update any such forward-looking

statements, except as required by law.

Consolidated Financial Results

| |

|

|

|

|

|

| |

|

|

|

|

|

|

GREEN PLAINS PARTNERS LP |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands) |

|

|

|

|

|

|

|

| |

September 30, |

|

December 31, |

| |

2020 |

|

2019 |

| ASSETS |

(unaudited) |

|

|

|

| Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

75 |

|

|

$ |

261 |

|

|

Accounts receivable, including from affiliates |

|

16,772 |

|

|

|

16,651 |

|

|

Other current assets |

|

1,098 |

|

|

|

517 |

|

|

Total current assets |

|

17,945 |

|

|

|

17,429 |

|

| Property and equipment,

net |

|

35,186 |

|

|

|

37,355 |

|

| Operating lease right-of-use

assets |

|

36,330 |

|

|

|

35,456 |

|

| Other assets |

|

14,430 |

|

|

|

15,413 |

|

|

Total assets |

$ |

103,891 |

|

|

$ |

105,653 |

|

| |

|

|

|

|

|

| LIABILITIES AND

PARTNERS' DEFICIT |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable, including to affiliates |

$ |

4,895 |

|

|

$ |

5,593 |

|

|

Operating lease current liabilities |

|

11,360 |

|

|

|

13,093 |

|

|

Current maturities of long-term debt |

|

34,035 |

|

|

|

132,100 |

|

|

Other current liabilities |

|

4,691 |

|

|

|

5,026 |

|

|

Total current liabilities |

|

54,981 |

|

|

|

155,812 |

|

| Long-term debt |

|

81,356 |

|

|

|

- |

|

| Operating lease long-term

liabilities |

|

26,384 |

|

|

|

23,088 |

|

| Asset retirement

obligations |

|

2,770 |

|

|

|

2,500 |

|

|

Total liabilities |

|

165,491 |

|

|

|

181,400 |

|

| |

|

|

|

|

|

| Partners' deficit |

|

(61,600 |

) |

|

|

(75,747 |

) |

|

Total liabilities and partners' deficit |

$ |

103,891 |

|

|

$ |

105,653 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GREEN PLAINS PARTNERS LP |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(unaudited, in thousands except per unit amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

| |

September 30, |

|

September 30, |

| |

2020 |

|

2019 |

|

% Var. |

|

2020 |

|

2019 |

|

% Var. |

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Affiliate |

$ |

20,347 |

|

|

$ |

18,836 |

|

|

8.0 |

% |

|

$ |

58,327 |

|

|

$ |

56,751 |

|

|

2.8 |

% |

|

|

Non-affiliate |

|

1,035 |

|

|

|

1,318 |

|

|

(21.5 |

) |

|

|

3,707 |

|

|

|

5,315 |

|

|

(30.3 |

) |

|

|

Total revenues |

|

21,382 |

|

|

|

20,154 |

|

|

6.1 |

|

|

|

62,034 |

|

|

|

62,066 |

|

|

(0.1 |

) |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations and maintenance (excluding depreciation and amortization

reflected below) |

|

6,647 |

|

|

|

6,216 |

|

|

6.9 |

|

|

|

19,410 |

|

|

|

19,314 |

|

|

0.5 |

|

|

|

General and administrative |

|

1,116 |

|

|

|

949 |

|

|

17.6 |

|

|

|

3,038 |

|

|

|

3,054 |

|

|

(0.5 |

) |

|

|

Depreciation and amortization |

|

940 |

|

|

|

991 |

|

|

(5.1 |

) |

|

|

2,867 |

|

|

|

2,747 |

|

|

4.4 |

|

|

|

Total operating expenses |

|

8,703 |

|

|

|

8,156 |

|

|

6.7 |

|

|

|

25,315 |

|

|

|

25,115 |

|

|

0.8 |

|

|

|

Operating income |

|

12,679 |

|

|

|

11,998 |

|

|

5.7 |

|

|

|

36,719 |

|

|

|

36,951 |

|

|

(0.6 |

) |

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

- |

|

|

|

21 |

|

|

* |

|

|

|

- |

|

|

|

61 |

|

|

* |

|

|

|

Interest expense |

|

(2,498 |

) |

|

|

(2,103 |

) |

|

18.8 |

|

|

|

(6,182 |

) |

|

|

(6,324 |

) |

|

(2.2 |

) |

|

|

Other |

|

- |

|

|

|

88 |

|

|

* |

|

|

|

- |

|

|

|

15 |

|

|

* |

|

|

|

Total other expense |

|

(2,498 |

) |

|

|

(1,994 |

) |

|

25.3 |

|

|

|

(6,182 |

) |

|

|

(6,248 |

) |

|

(1.1 |

) |

|

| Income before income taxes and

income from equity method investee |

|

10,181 |

|

|

|

10,004 |

|

|

1.8 |

|

|

|

30,537 |

|

|

|

30,703 |

|

|

(0.5 |

) |

|

| Income tax expense |

|

(30 |

) |

|

|

(45 |

) |

|

(33.3 |

) |

|

|

(166 |

) |

|

|

(144 |

) |

|

15.3 |

|

|

| Income from equity method

investee |

|

155 |

|

|

|

173 |

|

|

(10.4 |

) |

|

|

488 |

|

|

|

530 |

|

|

(7.9 |

) |

|

| Net income |

$ |

10,306 |

|

|

$ |

10,132 |

|

|

1.7 |

% |

|

$ |

30,859 |

|

|

$ |

31,089 |

|

|

(0.7 |

)% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to

partners' ownership interests: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General partner |

$ |

206 |

|

|

$ |

203 |

|

|

1.5 |

% |

|

$ |

617 |

|

|

$ |

621 |

|

|

(0.6 |

)% |

|

|

Limited partners - common unitholders |

|

10,100 |

|

|

|

9,929 |

|

|

1.7 |

|

|

|

30,242 |

|

|

|

30,468 |

|

|

(0.7 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per limited partner

unit (basic and diluted): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common units |

$ |

0.44 |

|

|

$ |

0.43 |

|

|

2.3 |

% |

|

$ |

1.31 |

|

|

$ |

1.32 |

|

|

(0.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average limited

partner units outstanding (basic and diluted): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common units |

|

23,161 |

|

|

|

23,138 |

|

|

|

|

|

23,145 |

|

|

|

23,125 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental Revenues

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Storage and throughput

services |

$ |

12,520 |

|

|

$ |

11,785 |

|

|

6.2 |

% |

|

$ |

36,090 |

|

|

$ |

35,355 |

|

|

2.1 |

% |

|

| Railcar transportation

services |

|

5,538 |

|

|

|

5,005 |

|

|

10.6 |

|

|

|

16,036 |

|

|

|

16,129 |

|

|

(0.6 |

) |

|

| Terminal services |

|

2,162 |

|

|

|

2,193 |

|

|

(1.4 |

) |

|

|

6,488 |

|

|

|

7,394 |

|

|

(12.3 |

) |

|

| Trucking and other |

|

1,162 |

|

|

|

1,171 |

|

|

(0.8 |

) |

|

|

3,420 |

|

|

|

3,188 |

|

|

7.3 |

|

|

|

Total revenues |

$ |

21,382 |

|

|

$ |

20,154 |

|

|

6.1 |

% |

|

$ |

62,034 |

|

|

$ |

62,066 |

|

|

(0.1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * Percentage variance not

considered meaningful. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

GREEN PLAINS PARTNERS LP |

|

CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS |

|

(unaudited, in thousands) |

|

|

|

|

|

|

|

| |

Nine Months Ended |

| |

September 30, |

| |

2020 |

|

2019 |

| Cash flows from operating

activities: |

|

|

|

|

|

|

Net income |

$ |

30,859 |

|

|

$ |

31,089 |

|

|

Noncash operating adjustments: |

|

|

|

|

|

|

Depreciation and amortization |

|

2,867 |

|

|

|

2,747 |

|

|

Distribution from equity method investee |

|

1,000 |

|

|

|

- |

|

|

Other |

|

1,146 |

|

|

|

464 |

|

|

Net change in working capital |

|

(1,595 |

) |

|

|

1,859 |

|

|

Net cash provided by operating activities |

|

34,277 |

|

|

|

36,159 |

|

| |

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

(117 |

) |

|

|

(62 |

) |

|

Proceeds from the disposal of property and equipment |

|

- |

|

|

|

136 |

|

|

Net cash provided by (used in) investing activities |

|

(117 |

) |

|

|

74 |

|

| |

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

|

|

Payments of distributions |

|

(16,958 |

) |

|

|

(33,818 |

) |

|

Net payments on revolving credit facility |

|

(4,400 |

) |

|

|

(2,000 |

) |

|

Net payments on long-term debt |

|

(9,500 |

) |

|

|

- |

|

|

Payments of loan fees |

|

(3,495 |

) |

|

|

- |

|

|

Other |

|

7 |

|

|

|

6 |

|

|

Net cash used in financing activities |

|

(34,346 |

) |

|

|

(35,812 |

) |

| |

|

|

|

|

|

| Net change in cash and cash

equivalents |

|

(186 |

) |

|

|

421 |

|

| Cash and cash equivalents,

beginning of period |

|

261 |

|

|

|

569 |

|

| Cash and cash equivalents, end

of period |

$ |

75 |

|

|

$ |

990 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GREEN PLAINS PARTNERS LP |

|

RECONCILIATIONS TO NON-GAAP FINANCIAL

MEASURES |

|

(unaudited, in thousands except ratios) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

LTM Ended |

|

|

September 30, |

|

September 30, |

|

September 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

2020 |

|

Net income |

$ |

10,306 |

|

|

$ |

10,132 |

|

|

$ |

30,859 |

|

|

$ |

31,089 |

|

|

$ |

41,249 |

|

|

Interest expense |

|

2,498 |

|

|

|

2,103 |

|

|

|

6,182 |

|

|

|

6,324 |

|

|

|

8,168 |

|

|

Income tax expense |

|

30 |

|

|

|

45 |

|

|

|

166 |

|

|

|

144 |

|

|

|

242 |

|

|

Depreciation and amortization |

|

940 |

|

|

|

991 |

|

|

|

2,867 |

|

|

|

2,747 |

|

|

|

3,561 |

|

|

Unit-based compensation expense |

|

81 |

|

|

|

81 |

|

|

|

239 |

|

|

|

239 |

|

|

|

319 |

|

|

Gain on the disposal of assets |

|

- |

|

|

|

(87 |

) |

|

|

- |

|

|

|

(14 |

) |

|

|

- |

|

|

Proportional share of EBITDA adjustments of equity method investee

(1) |

|

43 |

|

|

|

44 |

|

|

|

137 |

|

|

|

153 |

|

|

|

180 |

|

| Adjusted EBITDA |

|

13,898 |

|

|

|

13,309 |

|

|

|

40,450 |

|

|

|

40,682 |

|

|

|

53,719 |

|

|

Interest paid or payable |

|

(2,498 |

) |

|

|

(2,103 |

) |

|

|

(6,182 |

) |

|

|

(6,324 |

) |

|

|

(8,168 |

) |

|

Income taxes paid or payable |

|

(30 |

) |

|

|

(45 |

) |

|

|

(91 |

) |

|

|

(141 |

) |

|

|

(188 |

) |

|

Maintenance capital expenditures |

|

(62 |

) |

|

|

(62 |

) |

|

|

(116 |

) |

|

|

(62 |

) |

|

|

(148 |

) |

| Distributable cash flow

(2) |

$ |

11,308 |

|

|

$ |

11,099 |

|

|

$ |

34,061 |

|

|

$ |

34,155 |

|

|

$ |

45,215 |

|

| Distributions declared

(3) |

$ |

2,848 |

|

|

$ |

11,280 |

|

|

$ |

8,520 |

|

|

$ |

33,829 |

|

|

$ |

19,800 |

|

| Coverage ratio |

|

3.97x |

|

|

0.98x |

|

|

4.00x |

|

|

1.01x |

|

|

2.28x |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Represents

the partnership's proportional share of depreciation and

amortization of its equity method investee. |

| (2) Distributable

cash flow does not include adjustments for the required principal

payments on the term loan of $12.5 million for the three and nine

months ended September 30, 2020. |

| (3) Represents

distributions declared for the applicable period and paid in the

subsequent quarter. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Green Plains Inc.

ContactsInvestors: Phil Boggs | Senior

Vice President, Investor Relations & Treasurer | 402.884.8700 |

phil.boggs@gpreinc.comMedia: Leighton Eusebio |

Manager, Public Relations | 402.952.4971 |

leighton.eusebio@gpreinc.com

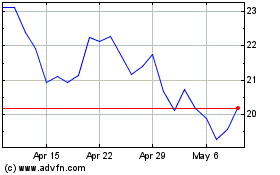

Green Plains (NASDAQ:GPRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

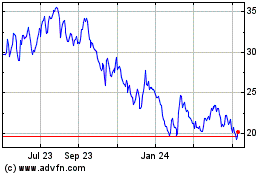

Green Plains (NASDAQ:GPRE)

Historical Stock Chart

From Apr 2023 to Apr 2024