By Renata Geraldo

Oscar de la Renta took the plunge. The fashion house this fall

began selling a $2,000 black lace cocktail dress in an unlikely

place: Amazon.com Inc. Few others have followed.

Amazon is off to a slow start in its latest effort to woo luxury

goods onto its platform. Since creating a special section on its

mobile app to house high-end fashions in September, the e-commerce

giant has amassed just a handful of big brands.

It isn't the first time Amazon has tried to add designer wares

to its sprawling and fast-growing marketplace. Luxury brands such

as Louis Vuitton and Gucci have steered clear of Amazon in the past

for insufficiently policing unauthorized sellers and counterfeit

goods, or for not giving brands more control over what is sold and

at what price.

Amazon's newest offering, called Luxury Stores, addresses some

of those concerns. It is an invitation-only service for select

members of Amazon Prime, which has 150 million global subscribers.

The designers get to pick which products to sell and can control

the pricing. There are no product reviews or links to third-party

sellers. Items are displayed with 360-degree views and motion

graphics.

Both customers and partners have responded positively to Luxury

Stores, an Amazon spokeswoman said, adding that brands have started

to replenish inventory and expand selection. Other fashion houses

have contacted the company to express interest since Luxury Stores

launched, she said, but declined to name them.

One fashion house still not satisfied was LVMH Moët Hennessy

Louis Vuitton SE, the French luxury conglomerate also behind Dior,

Bulgari and Givenchy. The company rejected Amazon's proposal to

join Luxury Stores, according to an LVMH executive, because it has

its own e-commerce operations and doesn't want its brands to be

associated with Amazon.

Big luxury brands are moving to take back control of their

e-commerce business, cutting back the inventory retailed by

third-party sellers such as Mr. Porter, Farfetch or

department-store websites rather than their own e-commerce

platforms.

Oscar de la Renta sold fragrances on Amazon before Luxury Stores

launched. Online wholesale and direct-to-consumer sales account for

about 5% of the business, said Chief Executive Alex Bolen, making

it reliant on luxury department stores like Neiman Marcus and

boutiques that were temporarily closed by the coronavirus

pandemic.

Oscar de la Renta's sales fell 85% in the second quarter, Mr.

Bolen said. The family-owned company tapped the Paycheck Protection

Program, a federal rescue initiative designed to assist small

employers, in April for a loan worth $2 million to $5 million to

save 42 jobs, federal records show.

Opening up a shop on Luxury Stores is a way to increase digital

sales and introduce the brand to more customers, Mr. Bolen said.

"The ability to discover the Oscar de la Renta brand is one of the

most important things about our partnership with Amazon," he

said.

Although it dominates the U.S. e-commerce market, Amazon has had

a mixed record with fashion and apparel brands. It sells Kate Spade

handbags and Levi's jeans, but a roughly two-year partnership with

Nike Inc. unraveled in late 2019. The sportswear maker was

disappointed Amazon didn't eliminate counterfeits and give the

brand more control over listings, The Wall Street Journal

reported.

Amazon says it cracks down on counterfeits, has used its

technology to block 2.5 million suspect accounts and has stopped

more than 6 billion suspected bad listings before they appeared on

its platform.

The initial slate of brands in Luxury Stores is small and the

service can be accessed only through the main Amazon app, which is

a disadvantage, said KeyBanc Capital Markets analyst Ed Yruma. "You

don't want to be next to a bunch of brands that aren't relevant,"

Mr. Yruma said. "The point of luxury isn't to just drive maximum

traffic, it's how do you drive the best quality traffic."

In addition to Oscar de la Renta, the new Luxury Stores features

$1,500 handbags from Joseph Altuzarra, Roland Mouret ready-to-wear

dresses and La Perla lingerie. On Oct. 15, it added Clé de Peau

Beauté, a skin-care brand owned by Shiseido Co., followed by Prada

SpA's footwear brand Car Shoe on Oct. 22.

"The time is right" to join Luxury Stores as Amazon becomes "the

next frontier for the future of luxury fashion online," Roland

Mouret said in a statement. The British brand also said Luxury

Stores gives it an opportunity to reach new customers in the

U.S.

Before the pandemic, the online luxury market was growing as

more people shifted their spending. And while many fashion houses

were slow to embrace e-commerce, they haven't ignored it.

Brands such as Prada and Gucci sell to online shoppers through

luxury marketplaces run by Farfetch Ltd. and Yoox Net-a-Porter SpA,

which collect commissions on transactions. Many designers are also

available on the Luxury Pavilion section of Chinese e-commerce

giant Alibaba Group Holding Ltd.'s Tmall website.

José Neves, CEO of Farfetch, says most fashion brands already

sell online through U.S. retailers such as Neiman Marcus and

Nordstrom. "They really don't need, and are actually trying to

avoid, extra exposure," he said.

The Amazon spokeswoman said Luxury Stores gives consumers more

choice and brands a new way to connect with them. "It's very much a

test-and-learn relationship with Amazon," said Mr. Bolen, the Oscar

de la Renta chief, noting that it has been available for just a

month.

--Matthew Dalton contributed to this article.

(END) Dow Jones Newswires

October 31, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

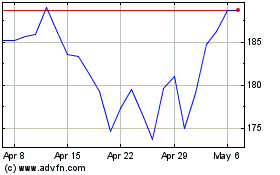

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

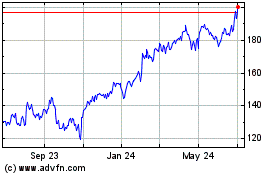

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024