UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

TRACON Pharmaceuticals, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑

|

|

No fee required

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

4)

|

|

Date Filed:

|

TRACON Pharmaceuticals, Inc.

4350 La Jolla Village Drive, Suite 800

San Diego, CA 92122

(858) 550-0780

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held December 7, 2020

You are invited to attend a special meeting of stockholders (the “Special Meeting”) of TRACON Pharmaceuticals, Inc. (the “Company” or “TRACON”) to be held on December 7, 2020, at 8:00 AM Pacific time at the Company’s corporate headquarters located at 4350 La Jolla Village Drive, Suite 800, San Diego, California 92122 for the following purposes, as more fully described in the accompanying Proxy Statement:

|

|

1.

|

To approve an amendment to the Company’s certificate of incorporation to increase its authorized shares of common stock from 20,000,000 to 40,000,000; and

|

|

|

2.

|

To transact any other business that may be properly brought before the meeting or any continuation, adjournment or postponement thereof.

|

Only stockholders of record at the close of business on October 26, 2020 will be entitled to attend and vote at the Special Meeting and at any adjournments or postponements thereof. Such stockholders are cordially invited to attend the Special Meeting.

Our board of directors recommends that you vote FOR the Authorized Share Increase Proposal as provided in Proposal 1.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to Be Held on December 7, 2020 at 8:00 a.m. Pacific time at the Company’s corporate headquarters located at 4350 La Jolla Village Drive, Suite 800, San Diego, California 92122.

The proxy statement is available at www.proxyvote.com

In light of the COVID-19 pandemic, it could become necessary to change the date, time, location and/or means of holding the Special Meeting (including by means of remote communication). If such a change is made, we will announce the change in advance, and details on how to participate will be issued by press release, posted on our website and filed as additional proxy materials.

|

|

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

Dr. Charles P. Theuer, M.D., Ph.D.

|

|

President and Chief Executive Officer

|

San Diego, California

October 30, 2020

YOUR VOTE IS IMPORTANT!

ALL STOCKHOLDERS ARE INVITED TO ATTEND THE TRACON PHARMACEUTICALS, INC. SPECIAL MEETING OF STOCKHOLDERS IN PERSON. WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING, WE ENCOURAGE YOU TO READ THIS PROXY STATEMENT AND SUBMIT YOUR PROXY AS SOON AS POSSIBLE. IF YOU ATTEND THE SPECIAL MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY SUBMITTED YOUR PROXY. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE SPECIAL MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THAT RECORD HOLDER.

TRACON Pharmaceuticals, Inc.

4350 La Jolla Village Drive, Suite 800

San Diego, CA 92122

(858) 550-0780

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 7, 2020

Your proxy is being solicited by the Board of Directors (the “Board”) of TRACON Pharmaceuticals, Inc. (the “Company”, “TRACON”, “we”, “our” or “us”) and this Proxy Statement contains information related to the Company’s Special Meeting of Stockholders (the “Special Meeting”). The Special Meeting will be held at 8:00 AM local time at the Company’s corporate headquarters located at 4350 La Jolla Village Drive, Suite 800, San Diego, California 92122, or any adjournments or postponements thereof, for the purposes described herein.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND THE SPECIAL MEETING

Why did I receive these proxy materials?

We have sent you this proxy statement and the enclosed proxy card because the Board is soliciting your proxy to vote at the Special Meeting, including any adjournments or postponements of the Special Meeting. Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we are also providing access to our proxy materials over the internet, which can be accessed at www.proxyvote.com.

We intend to mail these proxy materials on or about October 30, 2020 to all stockholders of record entitled to vote at the Special Meeting.

Who is entitled to vote?

Only stockholders of record at the close of business on October 26, 2020 (the “Record Date”) are entitled to vote at the Special Meeting. At the close of business on the Record Date, there were 13,684,753 shares of our common stock outstanding. Each share of common stock is entitled to one vote.

In accordance with Delaware law, a list of stockholders entitled to vote at the Special Meeting will be available both (i) at the Special Meeting and for 10 days prior to the Special Meeting, Monday through Friday between the hours of 9:00 AM and 4:00 PM local time at our corporate headquarters located at 4350 La Jolla Village Drive, Suite 800, San Diego, California 92122. If, on the Record Date, your shares were registered directly in your name with the Company’s transfer agent, American Stock Transfer N.A., then you are a “stockholder of record.” As a stockholder of record, you may vote in person at the Special Meeting (subject to satisfying the admission criteria) or vote by proxy. Whether or not you plan to attend the Special Meeting, we urge you to vote by proxy pursuant to the instructions set forth below to ensure your vote is counted.

What does it mean to beneficially own shares in “street name”?

If on the Record Date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, trust, or other similar organization (we will refer to those organizations collectively as “broker”), then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that broker. The broker holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker on how to vote the shares in your account and you are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Special Meeting unless you request and obtain a valid legal proxy from your broker.

If you hold your shares in “street name” and do not provide voting instructions to your broker, your shares will not be voted on any proposals on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under the rules that govern brokers, brokers have the discretion to vote on routine matters, but not on non-routine matters. The New York Stock Exchange (“NYSE”) has advised us that the proposal to amend our certificate of incorporation to increase our authorized shares of common stock is considered to be a routine matter.

1

What am I voting on?

Management is presenting one proposal for stockholder vote: to amend the Company’s Amended and Restated Certificate of Incorporation to increase its authorized shares from 20,000,000 to 40,000,000 (the “Authorized Share Increase Proposal”).

You may vote “For” the Authorized Share Increase Proposal, vote “Against” the Authorized Share Increase Proposal or “Abstain” from voting on the Authorized Share Increase Proposal.

Our Board unanimously recommends a vote FOR the Authorized Share Increase Proposal.

What if another matter is properly brought before the Special Meeting?

Our Board knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before the Special Meeting, it is the intention of the persons named in the proxy to vote on those matters in accordance with their best judgment.

How do I vote?

If you are a stockholder with shares registered in your name, you may vote for the matter before our stockholders as described in this Proxy Statement by one of the following methods:

|

|

•

|

Vote via the Internet. Go to the web address www.proxyvote.com and follow the instructions for Internet voting. You will be asked to provide the company number and control number from the enclosed proxy card. If you vote via the Internet, you should be aware that there may be incidental costs associated with electronic access, such as your usage charges from your Internet access providers and telephone companies, for which you will be responsible.

|

|

|

•

|

Vote by Telephone. Dial 1-800-690-6903 and follow the instructions for telephone voting. You will be asked to provide the company number and control number from the enclosed proxy card.

|

|

|

•

|

Vote by Proxy Card Mailed to You. Complete, sign and date the enclosed proxy card and return it promptly in the envelope provided.

|

|

|

•

|

Vote In Person. Come to the Special Meeting and we will give you a ballot when you arrive.

|

The Internet and telephone voting procedures are designed to authenticate your identity and to allow you to vote your shares for the matter before our stockholders as described in this Proxy Statement and confirm that your voting instructions have been properly recorded.

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with this proxy statement from that organization rather than from us. Simply complete and mail the proxy card as directed by the voting instructions to ensure that your vote is counted. Alternatively, you may be able to vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the Special Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with our proxy materials, or contact your broker or bank to request a proxy form.

Votes submitted via the Internet, by telephone or by signed proxy card must be received by 11:59 PM Eastern Time on December 6, 2020.

How many votes do I have?

|

|

On each matter to be voted upon, you have one vote for each share of common stock you owned as of the Record Date.

|

What if I return a proxy card or otherwise vote by proxy but do not make specific choices?

If you voted by proxy without marking any voting selections, then the proxy holders will vote your shares as recommended by our Board on the matter presented in this Proxy Statement, and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Special Meeting.

2

Who is soliciting the proxies?

The Board is soliciting the proxies for the Special Meeting.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions with respect to each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Special Meeting. If you are a stockholder of record, you may revoke your proxy at any time before it is voted at the Special Meeting by: (a) delivering a proxy revocation or another duly executed proxy bearing a later date to the Secretary of the Company at 4350 La Jolla Village Drive, Suite 800, San Diego, California 92122, (b) granting another proxy by telephone or through the Internet, (c) submitting another properly completed proxy card with a later date or (d) attending the Special Meeting and voting in person. Attendance at the Special Meeting will not, by itself, revoke your proxy unless you actually vote in person at the Special Meeting.

Your most current proxy, whether submitted by proxy card, telephone or Internet, is the one that is counted.

For shares you beneficially hold in street name, you may change your vote by submitting new voting instructions to your broker or other nominee following the instructions they provided, or, if you have obtained a legal proxy from your broker or other nominee giving you the right to vote your shares, by attending the Special Meeting and voting in person.

How are the votes counted?

The Company’s Amended and Restated Bylaws (the “Bylaws”) provide that a majority of all of our outstanding shares of stock entitled to vote - whether present in person or represented by proxy - constitutes a quorum for the transaction of business at the Special Meeting. Votes for and against, abstentions, and “broker non-votes” will be counted for purposes of determining the presence or absence of a quorum.

You may either vote “FOR” or “AGAINST” or you may abstain from voting for the Authorized Share Increase Proposal.

Votes will be counted by the inspector of election appointed for the Special Meeting, who will separately count “For” votes, “Against” votes, abstentions and broker non-votes.

What vote is needed to approve the Authorized Share Increase Proposal?

To be approved, the Authorized Share Increase Proposal must receive a “For” vote from a majority of the outstanding shares of common stock on the Record Date. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will also have the same effect as “Against” votes.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid Special Meeting. A quorum will be present if a majority of the outstanding shares entitled to vote are represented by stockholders present at the Special Meeting or by proxy. On the Record Date, there were 13,684,753 shares of our common stock outstanding and entitled to vote. Thus, at least 6,842,377 shares must be represented by stockholders present at the Special Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Special Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the Special Meeting or a majority of the votes present at the Special Meeting may adjourn the meeting to another date.

How do I attend the Special Meeting?

The meeting will be held on December 7, 2020 at 8:00 a.m. Pacific time at 4350 La Jolla Village Drive, Suite 800, San Diego, California 92122. Directions to the Special Meeting may be found at www.traconpharma.com.

3

Admission to the Special Meeting is limited to TRACON stockholders and a member of each attending stockholder’s immediate family or their named representatives. For stockholders of record, upon your arrival at the meeting location, you will need to present identification to be admitted to the Special Meeting. If you are a stockholder who is an individual, you will need to present government-issued identification showing your name and photograph (i.e., a driver’s license or passport), or, if you are representing an institutional investor, you will need to present government-issued photo identification and professional evidence showing your representative capacity for such entity. In each case, we will verify such documentation with our Record Date stockholder list. We reserve the right to limit the number of immediate family members or representatives who may attend the Special Meeting. For stockholders holding shares in street name, in addition to providing identification as outlined for record holders above, you will need a valid proxy from your broker or a recent brokerage statement or letter from your broker reflecting your stock ownership as of the Record Date. Cameras and electronic recording devices are not permitted at the Special Meeting.

In light of the COVID-19 pandemic, it could become necessary to change the date, time, location and/or means of holding the Special Meeting (including by means of remote communication). If such a change is made, we will announce the change in advance, and details on how to participate will be issued by press release, posted on our website and filed as additional proxy materials.

How does the Board recommend that I vote?

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE AUTHORIZED SHARE INCREASE PROPOSAL.

Who pays the costs of the proxy solicitation?

We will pay all of the costs of soliciting proxies. In addition to these proxy materials, our officers, directors, employees and other stockholders may solicit proxies personally, by telephone, or by other means of communication without receiving additional compensation. If requested, we will also pay brokers and other fiduciaries that hold shares of common stock for beneficial owners for their reasonable out-of-pocket expenses of forwarding these materials to stockholders.

Where can I find the voting results of the Special Meeting?

We intend to announce the final voting results at the Special Meeting and publish the final results in a Current Report on Form 8-K within four business days of the Special Meeting, unless final results are unavailable in which case we will publish the preliminary results in such Current Report on Form 8-K. If final results are not filed with our Current Report on Form 8-K to be filed within four business days of the Special Meeting, the final results will be published in an amendment to our Current Report on Form 8-K within four business days after the final voting results are known.

When are stockholder proposals due for the next annual meeting?

The Bylaws state the procedures for a stockholder to bring a stockholder proposal or nominate an individual to serve as a director of the Board. The Bylaws provide that advance notice of a stockholder’s proposal or nomination of an individual to serve as a director must be delivered to the Secretary of the Company at our principal executive offices not earlier than the 120th day prior to the anniversary of the previous year’s annual meeting of stockholders (i.e., February 10, 2021), nor later than the close of business on the 90th day prior to the anniversary of the previous year’s annual meeting of stockholders (i.e., March 12, 2021). However, the Bylaws also provide that, in the event that the date of the annual meeting is changed by more than 30 days from the previous year’s annual meeting as specified in our notice of meeting, this advance notice must be given not earlier than the 120th day, nor later than the close of business on the later of the 90th day, prior to the date of such annual meeting, or the 10th day following the day on which we first publicly announce the date of such annual meeting.

In addition to meeting the advance notice provisions mentioned above, the stockholder in its notice must provide the information required by the Bylaws to bring a stockholder proposal or nominate an individual to serve as a director of the Board.

A copy of the full text of the provisions of the Bylaws dealing with stockholder nominations and proposals is available to stockholders from the Secretary of the Company upon written request.

Under SEC rules, stockholders who wish to submit proposals for inclusion in the proxy statement for the annual meeting of stockholders to be held in 2021 must submit such proposals so as to be received by us at 4350 La Jolla Village Drive, Suite 800, San Diego, California 92122, on or before December 25, 2020; provided, however, that in the event that we hold the annual meeting of stockholders to be held in 2021 more than 30 days before or after the one year anniversary date of the 2020 annual meeting of stockholders, we will disclose the new deadline by which stockholders proposals must be received under Item 5 of our earliest possible Quarterly Report on Form 10-Q, or, if impracticable, by any means reasonably calculated to inform stockholders. In addition, stockholder proposals must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934,

4

as amended. Such proposals also must comply with SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials.

Whom should I contact with other questions?

If you have additional questions about this Proxy Statement or the Special Meeting, or if you would like additional copies of this Proxy Statement, please contact: TRACON Pharmaceuticals, Inc., 4350 La Jolla Village Drive, Suite 800, San Diego, California 92122, Attn: Corporate Secretary, or by telephone: (858) 550-0780.

5

FORWARD-LOOKING STATEMENTS

This Proxy Statement contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, relating to future events. Such statements are only predictions and involve risks and uncertainties, resulting in the possibility that the actual events or performance will differ materially from such predictions. For a nonexclusive list of major factors which could cause the actual results to differ materially from the predicted results in the forward looking statements, please refer to the “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2019, and in our subsequent quarterly reports on Form 10-Q and current reports on Form 8-K.

6

PROPOSAL 1

THE AUTHORIZED SHARE INCREASE PROPOSAL

On September 24, 2020, our Board unanimously approved, subject to stockholder approval, an amendment to our certificate of incorporation to increase our authorized shares of common stock from 20,000,000 to 40,000,000 and to make a corresponding change to the number of authorized shares of capital stock. The form of the proposed Certificate of Amendment effecting the amendment is attached to this proxy statement as Appendix A.

We currently have a total of 30,000,000 shares of capital stock authorized under our certificate of incorporation, consisting of 20,000,000 shares of common stock and 10,000,000 shares of preferred stock. Our Board is asking our stockholders to approve an amendment that will increase the number of authorized shares of common stock from 20,000,000 to 40,000,000, and increase the number of authorized shares of all classes of stock from 30,000,000 to 50,000,000. The number of shares of authorized preferred stock would remain unchanged.

The additional common stock to be authorized by adoption of the amendment would have rights identical to our currently outstanding common stock. Adoption of the proposed amendment and issuance of the common stock would not affect the rights of the holders of our currently outstanding common stock, except for effects incidental to increasing the number of shares of our common stock outstanding, such as diluting earnings per share, voting power and common shareholdings of stockholders. It could also have the effect of making it more difficult for a third party to acquire control of our company.

Our Board has determined that it would be in our best interests to increase the number of authorized shares of common stock in order to provide our company with the flexibility to pursue all finance and corporate opportunities involving our common stock, which may include private or public offerings of our equity securities, without the need to obtain additional stockholder approvals. There are currently no formal proposals or agreements that would require an increase in our authorized shares of common stock. Each additional authorized share of common stock would have the same rights and privileges as each share of currently authorized common stock.

As of August 31, 2020, 13,182,653 shares of common stock, $0.001 par value, were outstanding, leaving 6,817,347 shares of common stock available for issuance. As of August 31, 2020, we had reserved, pursuant to various equity award plans, 766,663 shares of common stock, of which 623,941 were reserved for options granted and outstanding and 142,722 were available for future grants and purchases pursuant to various equity award plans. Additionally, as of August 31, 2020, we had warrants outstanding to purchase 4,991,599 shares of common stock. Thus, as of August 31, 2020, we had 1,059,085 shares of common stock that were unissued and unreserved for issuance. We have no shares of preferred stock outstanding.

From our inception, we have financed our operations primarily through the sale of equity securities and debt financings. Until we can generate sufficient product revenues, if ever, we expect to finance our cash needs in whole or in part through equity offerings. If the authorization of an increase in the available common stock is postponed until the foregoing specific needs arise, the delay and expense incident to obtaining approval of the stockholders at that time could impair our ability to meet our objectives.

If this proposal is not approved by our stockholders, our financing alternatives will likely be limited by the lack of sufficient unissued and unreserved authorized shares of common stock, and stockholder value may be harmed by this limitation. In addition, our future success depends upon our ability to attract, retain and motivate highly-skilled scientific, commercial and managerial employees, and if this proposal is not approved by our stockholders, the lack of sufficient unissued and unreserved authorized shares of common stock to provide future equity incentive opportunities could adversely impact our ability to achieve these goals. In short, if our stockholders do not approve this proposal, we may not be able to access the capital markets, complete corporate collaborations, partnerships or other strategic transactions, attract, retain and motivate employees, and pursue other business opportunities integral to our growth and success.

At present, our Board has no immediate plans, arrangements or understandings to issue the additional shares of common stock. However, it desires to have the shares available to provide additional flexibility to use our common stock for business and financial purposes in the future as well to have sufficient shares available to provide appropriate equity incentives for our employees. The shares will be available for issuance by our Board for proper corporate purposes, including but not limited to, acquisitions, financings and equity compensation plans. Our management believes the increase in authorized share capital is in the best interests of our company and our stockholders and recommends that the stockholders approve the increase in authorized share capital.

7

The proposal to approve the amendment to our certificate of incorporation to increase our authorized shares of common stock from 20,000,000 to 40,000,000 requires the affirmative vote of a majority of outstanding shares of stock entitled to vote as of the Record Date. Abstentions and broker non-votes, if any, will have the same effect as a vote “against” this proposal.

If the amendment is approved by the requisite vote of the stockholders, we will file a certificate of amendment to our certificate of incorporation with the Delaware Secretary of State as soon as reasonably practicable after the Special Meeting. The amendment shall become effective upon filing with the Delaware Secretary of State.

Vote Required

The affirmative vote of holders of a majority of our common stock on the Record Date will be required to approve the amendment of our Amended and Restated Certificate of Incorporation to effect an increase in the authorized shares.

|

|

|

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A “FOR”

VOTE FOR THIS PROPOSAL

|

8

STOCKHOLDERS SHARING THE SAME ADDRESS

SEC rules permit companies, brokers, banks or other agents to deliver a single copy of a proxy statement to households at which two or more stockholders reside. This practice, known as “householding”, is designed to reduce duplicate mailings and save significant printing and postage costs as well as natural resources. Stockholders sharing an address who have been previously notified by their broker, bank or other agent and have consented to householding will receive only one copy of our proxy statement.

If you would like to opt out of this practice for future mailings and receive separate proxy statements and, if applicable, annual reports for each stockholder sharing the same address, please contact your broker, bank or other agent. You may also obtain a separate proxy statement without charge by contacting us at TRACON Pharmaceuticals, Inc., Investor Relations, 4350 La Jolla Village Drive, Suite 800, San Diego, California 92122; or by telephone to (858) 550-0780. We will promptly send additional copies of the proxy statement.

Stockholders sharing an address that are receiving multiple copies of the proxy statement can request delivery of a single copy of the proxy statement by contacting their broker, bank or other intermediary or by contacting us as indicated above.

9

TRANSACTION OF OTHER BUSINESS

We do not know of any business other than that described in this Proxy Statement that will be presented for consideration or action by the stockholders at the Special Meeting. If, however, any other business is properly brought before the Special Meeting, shares represented by proxies will be voted in accordance with the best judgment of the persons named in the proxies or their substitutes.

|

By Order of the Board of Directors

|

|

|

|

Dr. Charles P. Theuer, M.D., Ph.D.

|

|

President and Chief Executive Officer

|

San Diego, California

October 30, 2020

10

APPENDIX A

CERTIFICATE OF AMENDMENT OF THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

TRACON PHARMACEUTICALS, INC.

TRACON Pharmaceuticals, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Company”), does hereby certify:

FIRST: The original name of the Company was Lexington Pharmaceuticals, Inc. The date on which the Company’s original Certificate of Incorporation was filed with the Secretary of State of the State of Delaware is October 28, 2004.

SECOND: The Board of Directors of the Company (the “Board”), acting in accordance with the provisions of Sections 141 and 242 of the General Corporation Law of the State of Delaware (the “DGCL”), adopted resolutions approving and deeming advisable an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Restated Certificate”), as follows:

The first paragraph of Paragraph A of Article IV of the Restated Certificate is hereby amended and restated to read in its entirety as follows:

“A. The Company is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares which the Company is authorized to issue is 50,000,000 shares. 40,000,000 shares shall be Common Stock, each having a par value of $0.001. 10,000,000 shares shall be Preferred Stock, each having a par value of $0.001.”

THIRD: The foregoing amendment was submitted to the stockholders of the Company for their approval at a special meeting of stockholders which was duly called and held, upon notice in accordance with Section 222 of the DGCL, at which meeting the necessary number of shares as required by statute were voted in favor of the amendment. Accordingly, said amendment was duly adopted in accordance with the provisions of Section 242 of the DGCL.

FOURTH: This Certificate of Amendment shall become effective on ______________________ at _____ p.m. Eastern Time.

A-1

IN WITNESS WHEREOF, TRACON Pharmaceuticals, Inc. has caused this Certificate of Amendment to be signed by its President and Chief Executive Officer on ______________________.

|

|

|

|

|

TRACON Pharmaceuticals, Inc.

|

|

|

|

|

By:

|

|

|

|

|

|

Charles Theuer, M.D., Ph.D.

|

|

|

|

President and Chief Executive Officer

|

A-2

TRACON PHARMACEUTICALS, INC. 4350 LA JOLLA VILLAGE DRIVE SUITE 800 SAN DIEGO, CA 92122 VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 P.M. ET on 12/06/2020. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 P.M. ET on 12/06/2020. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. The Board of Directors recommends you vote FOR the following proposal: For Against Abstain 1. To approve an amendment to the Company's certificate of incorporation to increase its authorized shares of common stock from 20,000,000 to 40,000,000. NOTE: Such other business as may properly come before the meeting or any adjournment thereof. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. 0000474595_1 R1.0.1.18 Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Proxy Statement is available at www.proxyvote.com TRACON PHARMACEUTICALS, INC. Special Meeting of Stockholders December 7, 2020 8:00 AM PST This proxy is solicited by the Board of Directors The stockholder(s) hereby appoint(s) Charles P. Theuer, M.D., Ph.D. and Mark C. Wiggins, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorize(s) them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common Stock of TRACON PHARMACEUTICALS, INC. that the stockholder(s) is/are entitled to vote at the Special Meeting of Stockholders to be held at 8:00 AM, PST on December 7, 2020, at the Company's headquarters, 4350 La Jolla Village Drive, Suite 800, San Diego, California 92122, and any adjournment or postponement thereof. This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors' recommendations. Continued and to be signed on reverse side 0000474595_2 R1.0.1.18

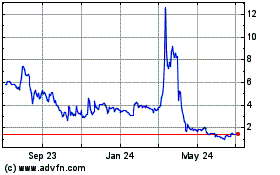

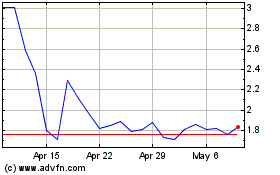

TRACON Pharmaceuticals (NASDAQ:TCON)

Historical Stock Chart

From Mar 2024 to Apr 2024

TRACON Pharmaceuticals (NASDAQ:TCON)

Historical Stock Chart

From Apr 2023 to Apr 2024