NatWest Surprises With Swing to 3Q Operating Pretax Profit Despite Impairments

October 30 2020 - 3:56AM

Dow Jones News

By Sabela Ojea

NatWest Group PLC on Friday reported an unexpected swing to

operating pretax profit for the third quarter of 2020 despite

booking a considerable amount of impairments, and said that its

retail banking customer activity levels improved significantly

compared with the second quarter of the year.

The U.K. bank posted an operating pretax profit of 355 million

pounds ($459 million) after booking GBP254 million in impairment

losses. This compares with an operating pretax loss of GBP8 million

for the same period a year earlier and a loss of GBP1.29 billion in

the second quarter of the year.

NatWest was expected to report an operating pretax loss of GBP75

million for the third quarter of the year, and impairment losses of

GBP628 million, according to the bank's own compilation of

forecasts.

The FTSE-100 listed bank's total income declined to GBP2.42

billion from GBP2.90 billion in the year-earlier period. The lender

said total income decreased due to lower fee income on overdrafts,

lower deposit returns, mortgage margin dilution and lower

international spend-related fee income, which was partially offset

by strong balance growth in mortgages and customer deposits.

Nat West's common equity Tier 1 capital ratio--a measure of a

bank's financial strength--stood at 18.2%, up from 17.2% as at June

30. It was anticipated at 16.7%, according to the lender's

compilation of forecasts.

The bank added that it maintains its outlook guidance for the

whole year, but noted that impairment charges are now likely to be

at the lower end of the GBP3.5 billion-GBP4.5 billion range.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

October 30, 2020 03:41 ET (07:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

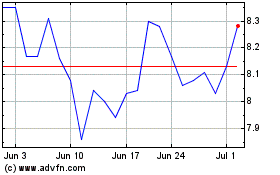

NatWest (NYSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

NatWest (NYSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024