Kraft Heinz Draws Customers Back to Familiar Brands -- Update

October 29 2020 - 1:12PM

Dow Jones News

By Annie Gasparro

Kraft Heinz Co. said higher grocery demand during the

coronavirus pandemic is setting the food maker up to exceed sales

expectations for next year.

Chief Executive Miguel Patricio said Thursday that despite

volatile demand and some production capacity constraints, Kraft

Heinz adapted to meet higher demand and invested in advertising to

make it stick.

"We are holding on to new households and consumers at a greater

rate than before," he said on a call with investors.

Kraft Heinz's comparable sales rose 6.3% in its latest quarter,

excluding the effects of currency fluctuations and divestitures.

Its earnings topped analyst expectations, sending shares up 2%.

Kraft Heinz said that grocery sales accelerated in the second

half of September as cases of Covid-19 rose in many parts of the

country.

The company's U.S. President Carlos Abrams-Rivera said Kraft

Heinz is meeting with dozens of retailers to help them prepare for

the unprecedented pandemic holiday season as they rebuild inventory

depleted in the first couple months of the pandemic.

Kraft Heinz said it has added factory capacity and adjusted some

manufacturing lines to increase production of high-demand items by

about 20%. The company also shifted marketing to focus on products

that it has plenty of, Mr. Abrams-Rivera said. For instance, the

company is promoting its boxed Kraft macaroni and cheese versus the

single-serve microwavable cups that are in short supply.

Fellow food maker Kellogg Co., meanwhile, said Thursday that it

has seen demand for its products at grocery stores decelerate in

recent months from the levels of growth over the summer.

"The continuation of the deceleration is what we see, but you

have to be agile just in case that changes," said Kellogg Chief

Executive Steve Cahillane.

He said in an interview that other companies with more

lunch-and-dinner-oriented foods relative to Kellogg's cereal and

snacks saw sales surge a couple of weeks earlier than Kellogg at

the beginning of the pandemic.

Kellogg's sales and profit were also higher than analysts

expected and it raised its outlook for the year. Shares rose

0.7%.

Since the coronavirus pandemic began, big food brands have

benefited from people staying at home more. Kraft Heinz said it has

attracted younger consumers and drawn shoppers of all ages to its

familiar food brands. However, some of its brands such as Oscar

Mayer and Maxwell House lost market share despite strong sales

growth.

Kraft Heinz said Thursday several of those big brands are

regaining ground. Oscar Mayer cold cuts gained market share in the

third quarter for the first time in a year and a half, the company

said.

Mr. Patricio last month outlined for investors a plan to further

cut costs and spend the savings largely on innovation and marketing

for its most promising brands.

Kraft Heinz's namesake cheese wasn't among them. The company has

agreed to sell a major chunk of its cheese business to French

company Lactalis Group for $3.2 billion in a deal expected to close

next year.

Like other big food companies, Kraft Heinz has increased its

advertising spending to capitalize on the sales momentum generated

by the pandemic.

Kellogg, which also makes Pringles chips, MorningStar Farms

plant-based meats and more, is spending more on marketing after

delaying some advertisements earlier in the year because of the

pandemic.

"That will allow us to enter 2021 with lots of good momentum,"

Mr. Cahillane said.

Kellogg's net income rose to $348 million from $247 million the

prior year. Its adjusted profit of 91 cents a share was ahead of

expectations from analysts by 5 cents. Sales rose to $3.43 billion

for the quarter from $3.37 billion for the third-quarter last year

and were ahead of the $3.4 billion consensus estimate for the

latest period.

Kraft Heinz's third-quarter profit fell to $597 million from

$899 million a year earlier, primarily due to divestitures.

Excluding certain one-time charges, its adjusted profit rose 1.4%

to 70 cents a share. Its revenue rose 6% from the prior year to

$6.44 billion. The results topped analysts' projections of $6.32

billion in sales and 62 cents a share in adjusted earnings.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

October 29, 2020 12:57 ET (16:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

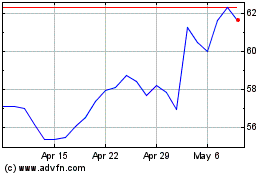

Kellanova (NYSE:K)

Historical Stock Chart

From Mar 2024 to Apr 2024

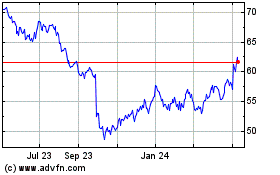

Kellanova (NYSE:K)

Historical Stock Chart

From Apr 2023 to Apr 2024