By Anne Steele

Spotify Technology SA moved past a slump that hit early in the

pandemic, as customers collectively spent more time listening to

the service than before Covid-19 shutdowns.

The music-streaming company added more users than expected in

the most recent quarter and said consumption habits have

normalized, with in-car listening hours -- which had fallen with

time spent commuting -- exceeding their prepandemic peak. Listening

on home devices, which exploded during lockdowns, also remained

high.

At the close of the quarter ended Sept. 30, Spotify had 320

million monthly active users, higher than its guidance. Paying

subscribers, its most lucrative type of customer, grew to 144

million, at the high end of the company's forecast.

"We know that when we reach more listeners, we're able to

attract more creators to our platform. So with more reach comes

more content and with more content, especially content unique to

Spotify, there comes more opportunities to monetize," said Chief

Executive Daniel Ek. "Bottom line, as I look at the increase

specifically in reach that we are seeing this quarter, it gives me

confidence in our ability to monetize that growth."

During the quarter, average revenue per user for the

subscription business slipped 10% to 4.19 euros, equivalent to

$4.92, as Spotify brought in new subscribers via discounted plans

and charged lower prices in new markets such as India and Russia.

The company said it had raised the price of its family plan in

seven markets this month.

"Initial results indicate that in markets where we've tested

increased prices, our users believe that Spotify remains an

exceptional value and they have shown a willingness to pay more for

our service," said Mr. Ek. "You will see us further expand price

increases," he said, adding that the company will be cautious about

price increases during the pandemic.

Revenue from subscriptions was up 15% from a year earlier in the

quarter, to EUR1.79 billion, equivalent to $2.1 billion.

Advertising revenue returned to growth after sliding in the first

half of the year, rising 9% to EUR185 million. Though advertising

accounts for 10% or less of Spotify's overall revenue, it has

become a growth area -- on a double-digit rise before the pandemic

-- as the company has expanded its podcast business, which led the

rebound in the recent quarter.

The company said it now has 1.9 million podcasts available on

its service, and during the period 22% of its monthly active users

listened to one, up from 21% in the previous quarter. Spotify's own

original and exclusive podcasts -- the shows from which it can draw

ad revenue -- now account for 19% of all podcast listening on the

service. "The Michelle Obama Podcast," a Spotify exclusive launched

in July, was the most-listened to podcast through August. "The Joe

Rogan Experience," which arrived on Spotify in September, is now

the No. 1 show in all of the service's English-language markets,

the company said.

With Mr. Rogan's podcast becoming exclusive to the service this

fall, and strong growth from Bill Simmons's podcasts on the

platform, "the ability to monetize those things going into 2021

will increase," said Spotify finance chief Paul Vogel.

Mr. Rogan drew criticism this week -- both from listeners and

Spotify employees -- for releasing a podcast featuring right-wing

provocateur Alex Jones, whose own content has been removed from

other platforms for violating hate speech policies. On Instagram,

Mr. Rogan defended his controversial guest.

"He said a lot of crazy but accurate things, and that's what

I've been saying about him for years," said Mr. Rogan.

"The most important thing for us is to have very clear policies

in place. We have millions of creators on Spotify, and we

consistently evaluate all that content we have on Spotify and

evaluate that against same policies and principles," said Mr. Ek.

"It doesn't matter if you're Joe Rogan or anyone else, we do apply

those policies and they need to be evenly applied."

In music, still the main draw to the service, new releases were

up 13% over the previous quarter.

Revenue climbed 14% to EUR1.98 billion, in line with

guidance.

Spotify swung to a loss of EUR101 million, or 58 European cents

a share, in the third quarter, from a profit of EUR241 million, or

36 European cents a share, a year earlier. While the company has

periodically reported a quarterly profit, executives have said it

would continue to give priority to growth -- attracting new

subscribers and investing in podcasts.

Free cash flow, a measure of the cash a company generates from

operations -- viewed by many investors as a proxy for performance

-- was EUR103 million, more than double the EUR48 million a year

earlier.

For the fourth quarter, the company forecast growth in monthly

active users to between 340 million and 345 million, and in premium

subscribers to between 150 million and 154 million. It guided for

revenue of EUR2 billion to EUR2.2 billion.

News Corp's Dow Jones & Co., publisher of The Wall Street

Journal, has a content partnership with Spotify's Gimlet Media

unit.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

October 29, 2020 10:37 ET (14:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

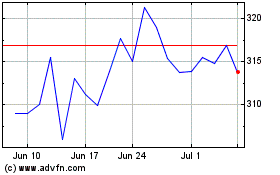

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

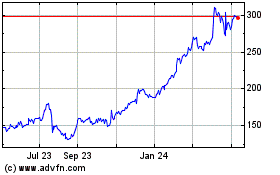

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Apr 2023 to Apr 2024