SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2020

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

|

Third Quarter 2020 Results

October 29, 2020

Page | 1

|

AMBEV REPORTS

2020 THIRD QUARTER RESULTS UNDER IFRS

São Paulo,

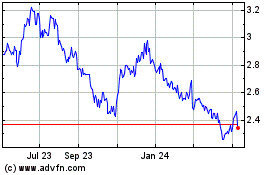

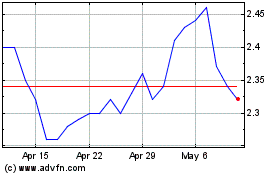

October 29, 2020 – Ambev S.A. [B3: ABEV3; NYSE: ABEV] announces its results for the third quarter of 2020. The following

operating and financial information, unless otherwise indicated, is presented in nominal Reais and prepared according to

the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”)

and to the accounting practices issued by the Brazilian Accounting Standards Committee ("CPC”) and approved by the Brazilian

Securities and Exchange Commission (“CVM”). The information herein should be read together with our financial information

for the nine-month period ended September 30, 2020 filed with the CVM and submitted to the U.S. Securities and Exchange Commission

(“SEC”).

OPERATING

AND FINANCIAL HIGHLIGHTS

Net revenue: Net revenue was

up 15.1% in 3Q20, with volume growing by 12.0% and net revenue per hectoliter (NR/hl) up 2.8%. Net revenue grew in Brazil

(21.2%), Central America and the Caribbean (CAC) (1.9%), Latin America South (LAS)[1] (15.1%) and in Canada (6.4%).

In Brazil, volume was up 19.8% and NR/hl was up 1.2%. In CAC, volume declined by 9.9% and NR/hl grew by 13.0%. In LAS, volume was

down 0.4% and NR/hl rose by 15.6%. In Canada, volume increased by 7.1% while NR/hl decreased by 0.7%. In 9M20, on a consolidated

basis, net revenue was up 0.5%, with volume decreasing 1.1% and NR/hl growing by 1.6%.

Cost of goods sold (COGS): In 3Q20,

COGS and cash COGS (excluding depreciation and amortization) were up 26.6% and 30.3%, respectively. On a per hectoliter basis,

COGS grew by 13.0% while cash COGS was up 16.4%, mainly due to inflationary pressures in Argentina, transactional currency headwinds

and package mix impacts. In 9M20, COGS and cash COGS increased by 14.8% and 16.3%, respectively. On a per hectoliter basis, COGS

rose by 16.0% and cash COGS by 17.6%.

Selling, general & administrative

(SG&A) expenses: SG&A and cash SG&A (excluding depreciation and amortization) were up 8.9% and 13.0%, supporting

top line recovery in the markets where we operate. In 9M20, SG&A grew by 3.7% while cash SG&A grew by 3.3%.

EBITDA, gross

margin and EBITDA margin: In 3Q20, EBITDA reached R$ 5,073.5 million, which corresponds to an organic growth of 1.4%, with

a gross margin of 52.4% (-440bps) and EBITDA margin of 32.5% (-440bps). In 9M20, EBITDA was R$ 12,654.2 (-17.4%) with gross margin

and EBITDA margin reaching 52.6% (-600bps) and 31.8% (-690bps), respectively.

Normalized

profit and EPS: Normalized profit was R$ 2,495.9 million, 2.2% higher than in 3Q19, due

to higher EBITDA partially offset by higher financial expenses. Normalized EPS was R$ 0.15 (3.2%). In 9M20, normalized profit

decreased by 35.6%, reaching R$ 5,096.3 million, with normalized EPS of R$ 0.31 (-36.5%).

Cash generation and CAPEX: Cash

flow from operating activities was R$ 7,079.4 million (+99.3%) and CAPEX reached R$ 1,144.8 million (-29.5%). In 9M20, cash flow

from operating activities totaled R$ 10,462.2 million (19.6%) and CAPEX increased by 7.6% to R$ 3,298.3 million.

[1] The impacts resulting from applying

Hyperinflation Accounting for our Argentinean subsidiaries, in accordance to IAS 29, are detailed in the section Financial Reporting

in Hyperinflationary Economies - Argentina (page 19).

|

Third Quarter 2020 Results

October 29, 2020

Page | 2

|

|

Financial highlights - Ambev consolidated

|

3Q19

|

3Q20

|

% As Reported

|

% Organic

|

YTD19

|

YTD20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

37,785.7

|

42,378.8

|

12.2%

|

12.0%

|

115,947.3

|

114,855.9

|

-0.9%

|

-1.1%

|

|

Net revenue

|

11,957.7

|

15,604.5

|

30.5%

|

15.1%

|

36,742.9

|

39,822.4

|

8.4%

|

0.5%

|

|

Gross profit

|

6,727.9

|

8,181.3

|

21.6%

|

6.2%

|

21,444.2

|

20,954.2

|

-2.3%

|

-9.8%

|

|

% Gross margin

|

56.3%

|

52.4%

|

-390 bps

|

-440 bps

|

58.4%

|

52.6%

|

-580 bps

|

-600 bps

|

|

Normalized EBITDA

|

4,410.5

|

5,073.5

|

15.0%

|

1.4%

|

14,222.4

|

12,654.2

|

-11.0%

|

-17.4%

|

|

% Normalized EBITDA margin

|

36.9%

|

32.5%

|

-440 bps

|

-440 bps

|

38.7%

|

31.8%

|

-690 bps

|

-690 bps

|

|

|

|

|

|

|

|

|

|

|

|

Profit

|

2,604.4

|

2,359.0

|

-9.4%

|

|

7,969.4

|

4,841.5

|

-39.2%

|

|

|

Normalized profit

|

2,441.8

|

2,495.9

|

2.2%

|

|

7,916.4

|

5,096.3

|

-35.6%

|

|

|

EPS (R$/shares)

|

0.16

|

0.14

|

-8.9%

|

|

0.49

|

0.29

|

-40.2%

|

|

|

Normalized EPS (R$/shares)

|

0.15

|

0.15

|

3.2%

|

|

0.48

|

0.31

|

-36.5%

|

|

Note: Earnings per share calculation is based on outstanding

shares (total existing shares excluding shares held in treasury).

MANAGEMENT

COMMENTS

Ambev’s third quarter was marked

by the continued V-shaped recovery driven by the company’s commercial strategy coming together as innovation, flexibility

and operational excellence gained momentum.

All countries showed sustained volume

improvements from second quarter as restrictions were gradually lifted in the markets where we operate, with limited exceptions.

Moreover, seven of our top ten markets delivered volume growth year over year.

In the charts below, we separated our

countries as per the weight of the off-trade channel in each beer market and the household consumer expenditure[2] to

illustrate the status of channel dynamics in our main markets. We also ranked the countries based on beer volumes performance during

the third quarter:

Source: Canback, Euromonitor, Nielsen,

Internal Sources

On a consolidated basis, our organic volumes

grew 12% in the quarter, driven by the strong performance of Brazil Beer:

|

|

·

|

In Brazil Beer, we considerably

outperformed the industry, driven by the successful implementation of our commercial strategy, the adaptability of our pricing

calendar and the net positive effect of government subsidies helping to support consumer disposable income, more than offsetting

the closing impact of the on-trade, which is still in the process of reopening. Meanwhile,

in Brazil NAB, volumes grew in the quarter as we saw a return of consumption occasions.

|

[2]

Household consumer expenditure for each country is indexed

at the USA household consumer expenditure, which was set at 100.

|

Third Quarter 2020 Results

October 29, 2020

Page | 3

|

|

|

·

|

In LAS, flattish volumes

were driven by Bolivia and Argentina, with the former being impacted by ongoing severe restrictions imposed by local governments

on people circulation, while the latter was more affected by the impacts of COVID-19 in the economy. On the other hand, market

share gains in both Paraguay and Chile led to solid volume recovery.

|

|

|

·

|

In CAC, volumes were

still impacted by COVID-related restrictions especially in Dominican Republic and Panama, partially holding back the pace of volume

recovery in the region. Guatemala, however, showed very strong volume performance thanks to market share gains.

|

|

|

·

|

In Canada, volumes were

driven by a compound effect of a positive industry helped by warmer and dryer weather, increased frequency of in-home occasions

and the strong performance of our premium and beyond beer portfolio.

|

The full impact of the COVID-19 pandemic

on our future results remains uncertain, but our actions will be targeted at maintaining momentum toward our V-shape recovery in

the top line. The scenario continues to be challenging, but we are confident that we are making the right decisions in the market

and that we have a strong position and the right strategy in place to navigate through the challenges that lie ahead.

Status of Operations

Status of Operations

As COVID-19 cases

reduced, restrictions started to be gradually lifted in most of the countries where we operate. To further support our volume recovery,

we have also focused our efforts to continue serving our clients and consumers in the best possible way, leveraging on our digital

platforms, which allow us to have multiple touchpoints with our clients.

|

|

·

|

In Brazil: through the

quarter there was a gradual relaxation of restrictions across the country and the total number of active buyers for both beer and

NAB already reached pre-COVID levels. All our production facilities and distribution centers in Brazil are operating.

|

|

|

·

|

In LAS: countries continued

to gradually reopen; however, Bolivia is still largely affected by the restrictions on people circulation imposed by the local

government. All our production facilities and distribution centers in LAS are operating.

|

|

|

·

|

In CAC: Dominican Republic

had a curfew between 9pm and 5am for most of the quarter and in Panama, some municipalities reestablished a ban on all alcohol

sales that lasted the whole quarter. All our production facilities and distribution centers in CAC are operating.

|

|

|

·

|

In Canada:

through the quarter, bars and restaurants gradually reopened across the country, however the increasing number of cases

makes us cautious as we head into 4Q20. Multiple provinces and municipalities in the country have announced new on-premise shutdowns

and restrictions for 4Q20. All our breweries in Canada are operating.

|

Ambev as an Ecosystem

Ambev as an Ecosystem

We

have continued to contribute to our ecosystem by leveraging our capabilities and competencies

to positively impact our stakeholders and the communities in which we operate. Consumers are changing their perception towards

our company given the way we approached the pandemic and we see

our portfolio in a better shape:

|

Third Quarter 2020 Results

October 29, 2020

Page | 4

|

|

|

·

|

In Brazil, we announced

the donation of 30 million reais for two vaccine plant projects. Bohemia is leading the “Voltadeira” campaign to support

bars as they reopen, inviting consumers back by subsidizing 300,000 bottles in partnership with the Iti app. We partnered with

Get-in, a startup that developed an app that offers remote reservations and waiting list services, digital menus and digital payments

to bars and restaurants. We have also established a partnership with another start up Lemon Energia, aimed at providing cheaper

clean energy to more than 50,000 small businesses by 2023. Finally, to raise awareness of the Amazon Rainforest preservation, we

launched Colorado Amazônica, a beer made with local ingredients with a price that varies according to the current level of

deforestation in the region. The beer has its revenues reverted to Amazonian communities to help preserve the rain forest.

|

|

|

·

|

In LAS, Quilmes - our

subsidiary in Argentina - continued to be recognized by both the public and opinion leaders as the company that has made the greatest

efforts to face solidarity actions in the areas where our production is located. In the country, we launched Comunal Gin, the first

gin made with alcohol from beer, co-created with craft breweries from Bariloche to support the local industry.

|

|

|

·

|

In CAC, with Colmados

Seguros in the Dominican Republic and Paisano Seguro in Panama, we have helped POCs guarantee secure spaces for consumers during

reopening and also partnered with the on-trade to reinvent socializing by creating new safe alternatives to bring people together.

|

|

|

·

|

In Canada, we continued

to support our communities and clients partners through our Stella Artois Rally for Restaurants campaign, aimed at providing financial

relief to bars and restaurants.

|

Innovation and Business Transformation

Innovation and Business Transformation

Innovation is one of the pillars of our

business and front and center to our commercial strategy. The COVID-19 pandemic has continued to accelerate consumer trends in

which we have been investing behind, primarily reinforcing the need for an innovative, consumer-centric mindset. We have a framework

of five growth pathways/avenues that drive the way we approach innovation:

New flavors

& enhanced value proposition

|

|

·

|

In Brazil Beer, Brahma

Duplo Malte continues to be the best example of this part of our innovation strategy, resulting from actively listening to consumer

demands. We continued to accelerate the brand with the launch of a proprietary long neck bottle with a pull-off bottle cap. By

closely monitoring the market, we still see room for the introduction of another Core Plus brand into our portfolio, and we are

piloting other brands in different cities to understand consumers’ preferences and determine which brand to launch. We have

recently launched Berrió in the state of Piauí, our fourth regional brand, that is produced with cashew fruit grown

by local communities. Nossa, Magnífica and Legítima, continued to deliver strong results with volumes up high double-digits

in the quarter.

|

|

|

·

|

In Brazil NAB we have

re-launched Fusion as an e-sports energy drink. The product was developed in collaboration with 15 professional gamers and carries

functional attributes with three different flavors.

|

|

|

·

|

In LAS, in Bolivia,

we have launched Chicha Taquiña, a beer produced with local crops, and introduced the 235ml returnable bottles. In Paraguay,

the 1 liter returnable glass bottles led to sustained

volume recovery and market share gains. In Argentina, we continued to expand our 340ml returnable bottles across our portfolio.

Also in Argentina, we launched Stella Artois Noire, a Dark American Lager, to focus on meal occasions.

|

|

Third Quarter 2020 Results

October 29, 2020

Page | 5

|

|

|

·

|

In CAC, in Dominican

Republic, we launched Presidente Golden Light, a more refreshing liquid with lower alcohol content.

|

|

|

·

|

In Canada, Bud Light

Strawberry Lemonade continues to expand as the fastest growing beer innovation in the country.

|

Convenience

for consumers

|

|

·

|

In Brazil, our direct-to-consumer

platform Zé Delivery saw a continued significant acceleration in number of orders in 3Q20, being now present in all 27 Brazilian

states.

|

|

|

·

|

In LAS, in Argentina,

Appbar continues to grow exponentially, growing almost 5x year to date versus 2019 full year.

|

|

|

·

|

In CAC, in Dominican

Republic, Colmapp continued to expand after the merger with the Tucerveza.do website and the Colmapp delivery into a single platform.

|

Innovation

in service to our customers

|

|

·

|

In Brazil, we began

to roll-out the BEES B2B platform in order to increase service level to our customers through a 24/7 availability for orders and

services. The platform also helps customers to improve sales performance by providing suggestions based on their profile and product

relevance.

|

|

|

·

|

In CAC, Dominican Republic

continues to expand the BEES platform. The country also serves as our laboratory for the marketplace service. We continue to learn

from the early experience about how to manage the different categories within the platform and improve ways of working in order

to export know-how as we start rollout BEES to other operations. In the country, more than 75% of net revenues already come from

the platform.

|

Health and

wellness

|

|

·

|

In Brazil Beer, we continued

to rollout our recently-launched Stella Gluten Free.

|

|

|

·

|

In Brazil NAB, we launched

For Me wellness shots, a functional beverage, in a record-breaking sixty days to enter a new category. Do Bem continued to roll-out

its portfolio of infused drinks and launched 269ml cans for juice to be sold in premium bars and restaurants. In the quarter, we

started the national expansion of Natu, our new version of Guaraná made with 100% natural ingredients. We continue to invest

in the reduction of sugar content in our portfolio.

|

|

|

·

|

In LAS, we have launched

Quilmes 0,0%, the first alcohol-free beer in Argentina and Patagonia launched Sendero SUR, our first certified organic beer in

the country.

|

|

|

·

|

In CAC and Canada, Michelob

Ultra has continued to deliver strong results, growing double-digits by leveraging its connection with outdoor sports.

|

|

Third Quarter 2020 Results

October 29, 2020

Page | 6

|

Beyond Beer

|

|

·

|

In LAS, in Argentina,

Dante Robino has grown consistently ahead of our business plan with sales volumes doubling in the quarter versus last year. The

company has continued to explore new opportunities within the wine segment, accelerating its canned wine brand Blasfemia.

|

|

|

·

|

In Canada, G&W continues

to grow its Nutrl ready-to-drink beverages portfolio and expand the category in the country. The company has also introduced a

brand of Whiskey and the wine brand #4LetterWordWine! to its Canadian portfolio.

|

Commercial Highlights

Commercial Highlights

Premium

Our premium brands

performance has shown strong signs of recovery in the quarter with global brands overperforming in most markets, leading to Ambev’s

total premium portfolio growing double-digits this quarter:

|

|

·

|

In Brazil, our premium

volume grew double-digits driven by our Global Brands. Domestic brands, which are predominantly sold in the on-trade channel, started

to show signs of recovery, but continued to be affected by the restrictions still in place.

|

|

|

·

|

In LAS, in Argentina,

Corona grew double-digits contributing to the premium portfolio reach the all-time high mix in July and gaining share in the quarter.

|

|

|

·

|

In CAC, the premium

segment grew double-digits, with a positive contribution to the whole portfolio mix. Corona grew double-digits in Guatemala and

in Dominican Republic while in Puerto Rico, Michelob Ultra was the highlight, growing double-digits and gaining market share.

|

|

|

·

|

In Canada, our strategy

of premiumization delivered another quarter of solid growth, mainly driven by Corona growing double-digits and resuming as the

highest brand power in the country.

|

Core &

Core Plus

The Core Plus

segment continues to emerge as a relevant growth opportunity, growing triple digits in the quarter:

|

|

·

|

In Brazil, Brahma Duplo

Malte continues to lead the growth of the Core Plus segment. Bohemia grew triple digits for another quarter, keeping the strong

momentum. The quarter was also marked by the resilience of core brands with Skol gaining share in the North, Northeast and Midwest

due to our operational excellence and service level.

|

|

|

·

|

In LAS, in Argentina,

Budweiser showed a strong recovery growing double-digits supported by a campaign with Lionel Messi. Andes Origen has overperformed

the industry in Argentina for another consecutive quarter, growing double-digits. In Chile, Cusqueña and Budweiser continue

to deliver strong results, growing high double-digits and contributing to the above core mix. In Paraguay, we have launched Skol

to develop the Core Plus segment.

|

|

Third Quarter 2020 Results

October 29, 2020

Page | 7

|

|

|

·

|

In Canada, our above

core portfolio outperformed the industry once again with Michelob Ultra growing high-double digits.

|

AMBEV

CONSOLIDATED INCOME STATEMENT

|

Consolidated income statement

|

3Q19

|

Scope

|

Currency Translation

|

IAS 29

HY Impact

|

Organic Growth

|

3Q20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Net revenue

|

11,957.7

|

64.1

|

1,937.8

|

(191.1)

|

1,836.1

|

15,604.5

|

30.5%

|

15.1%

|

|

Cost of goods sold (COGS)

|

(5,229.7)

|

(33.5)

|

(875.7)

|

124.9

|

(1,409.1)

|

(7,423.1)

|

41.9%

|

26.6%

|

|

Gross profit

|

6,727.9

|

30.6

|

1,062.1

|

(66.3)

|

427.1

|

8,181.3

|

21.6%

|

6.2%

|

|

Selling, general and administrative (SG&A)

|

(3,710.6)

|

(13.7)

|

(600.1)

|

57.9

|

(336.2)

|

(4,602.8)

|

24.0%

|

8.9%

|

|

Other operating income/(expenses)

|

137.7

|

|

(14.5)

|

2.5

|

42.4

|

168.0

|

22.0%

|

31.5%

|

Normalized operating income

(normalized EBIT)

|

3,155.0

|

16.9

|

447.5

|

(6.0)

|

133.2

|

3,746.6

|

18.8%

|

4.1%

|

|

Exceptional items above EBIT

|

(14.6)

|

|

(20.4)

|

2.8

|

(127.6)

|

(159.8)

|

nm

|

nm

|

|

Net finance results

|

(305.8)

|

|

|

|

|

(1,144.8)

|

274.4%

|

|

|

Share of results of joint ventures

|

(8.2)

|

|

|

|

|

(11.0)

|

33.4%

|

|

|

Income tax expense

|

(222.0)

|

|

|

|

|

(72.1)

|

-67.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit

|

2,604.4

|

|

|

|

|

2,359.0

|

-9.4%

|

|

|

Attributable to Ambev holders

|

2,497.7

|

|

|

|

|

2,274.8

|

-8.9%

|

|

|

Attributable to non-controlling interests

|

106.7

|

|

|

|

|

84.2

|

-21.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized profit

|

2,441.8

|

|

|

|

|

2,495.9

|

2.2%

|

|

|

Attributable to Ambev holders

|

2,334.6

|

|

|

|

|

2,409.3

|

3.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized EBITDA

|

4,410.5

|

17.1

|

608.6

|

(24.7)

|

62.1

|

5,073.5

|

15.0%

|

1.4%

|

|

Consolidated income statement

|

YTD19

|

Scope

|

Currency Translation

|

IAS 29

HY Impact

|

Organic Growth

|

YTD20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Net revenue

|

36,742.9

|

143.8

|

2,766.0

|

|

169.7

|

39,822.4

|

8.4%

|

0.5%

|

|

Cost of goods sold (COGS)

|

(15,298.7)

|

(72.0)

|

(1,234.4)

|

|

(2,263.1)

|

(18,868.2)

|

23.3%

|

14.8%

|

|

Gross profit

|

21,444.2

|

71.8

|

1,531.7

|

|

(2,093.4)

|

20,954.2

|

-2.3%

|

-9.8%

|

|

Selling, general and administrative (SG&A)

|

(11,192.7)

|

(44.6)

|

(854.7)

|

|

(415.2)

|

(12,507.2)

|

11.7%

|

3.7%

|

|

Other operating income

|

559.7

|

|

(13.3)

|

|

(142.2)

|

404.2

|

-27.8%

|

-25.4%

|

Normalized operating income

(normalized EBIT)

|

10,811.3

|

27.1

|

663.6

|

|

(2,650.8)

|

8,851.2

|

-18.1%

|

-24.5%

|

|

Exceptional items above EBIT

|

(66.9)

|

|

(26.8)

|

|

(218.1)

|

(311.8)

|

nm

|

nm

|

|

Net finance results

|

(1,545.3)

|

|

|

|

|

(3,475.4)

|

124.9%

|

|

|

Share of results of joint ventures

|

(11.1)

|

|

|

|

|

(33.9)

|

nm

|

|

|

Income tax expense

|

(1,218.6)

|

|

|

|

|

(188.6)

|

-84.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit

|

7,969.4

|

|

|

|

|

4,841.5

|

-39.2%

|

|

|

Attributable to Ambev holders

|

7,680.3

|

|

|

|

|

4,593.4

|

-40.2%

|

|

|

Attributable to non-controlling interests

|

289.1

|

|

|

|

|

248.2

|

-14.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized profit

|

7,916.4

|

|

|

|

|

5,096.3

|

-35.6%

|

|

|

Attributable to Ambev holders

|

7,626.2

|

|

|

|

|

4,844.1

|

-36.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized EBITDA

|

14,222.4

|

27.9

|

876.0

|

|

(2,472.1)

|

12,654.2

|

-11.0%

|

-17.4%

|

|

Third Quarter 2020 Results

October 29, 2020

Page | 8

|

AMBEV

CONSOLIDATED RESULTS

The combination of Ambev’s operations

in Brazil, Central America and the Caribbean (CAC), Latin America South (LAS) and Canada’s business units, eliminating intercompany

transactions, comprises our consolidated financial statements. The figures shown below are on an as-reported basis.

|

Volume (million hectoliters)

|

|

|

Net revenue per hectoliter (R$)

|

COGS per hectoliter (R$)

|

|

|

|

Normalized EBITDA (R$ million)

|

Normalized EBITDA Margin (%)

|

|

|

|

Third Quarter 2020 Results

October 29, 2020

Page | 9

|

AMBEV

CONSOLIDATED

|

Ambev

|

3Q19

|

Scope

|

Currency Translation

|

IAS 29

HY Impact

|

Organic Growth

|

3Q20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

37,785.7

|

70.0

|

|

|

4,523.2

|

42,378.8

|

12.2%

|

12.0%

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

11,957.7

|

64.1

|

1,937.8

|

(191.1)

|

1,836.1

|

15,604.5

|

30.5%

|

15.1%

|

|

Net revenue/hl (R$)

|

316.5

|

1.1

|

45.7

|

(3.8)

|

8.7

|

368.2

|

16.4%

|

2.8%

|

|

COGS

|

(5,229.7)

|

(33.5)

|

(875.7)

|

124.9

|

(1,409.1)

|

(7,423.1)

|

41.9%

|

26.6%

|

|

COGS/hl (R$)

|

(138.4)

|

(0.6)

|

(20.7)

|

2.6

|

(18.0)

|

(175.2)

|

26.6%

|

13.0%

|

|

COGS excl. deprec. & amort.

|

(4,574.8)

|

(33.5)

|

(774.1)

|

112.0

|

(1,402.3)

|

(6,672.7)

|

45.9%

|

30.3%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(121.1)

|

(0.7)

|

(18.3)

|

2.3

|

(19.8)

|

(157.5)

|

30.0%

|

16.4%

|

|

Gross profit

|

6,727.9

|

30.6

|

1,062.1

|

(66.3)

|

427.1

|

8,181.3

|

21.6%

|

6.2%

|

|

% Gross margin

|

56.3%

|

|

|

|

|

52.4%

|

-390 bps

|

-440 bps

|

|

SG&A excl. deprec. & amort.

|

(3,110.1)

|

(13.5)

|

(540.6)

|

51.9

|

(414.1)

|

(4,026.3)

|

29.5%

|

13.0%

|

|

SG&A deprec. & amort.

|

(600.5)

|

(0.2)

|

(59.5)

|

5.9

|

77.9

|

(576.4)

|

-4.0%

|

-12.8%

|

|

SG&A total

|

(3,710.6)

|

(13.7)

|

(600.1)

|

57.9

|

(336.2)

|

(4,602.8)

|

24.0%

|

8.9%

|

|

Other operating income/(expenses)

|

137.7

|

|

(14.5)

|

2.5

|

42.4

|

168.0

|

22.0%

|

31.5%

|

|

Normalized EBIT

|

3,155.0

|

16.9

|

447.5

|

(6.0)

|

133.2

|

3,746.6

|

18.8%

|

4.1%

|

|

% Normalized EBIT margin

|

26.4%

|

|

|

|

|

24.0%

|

-240 bps

|

-260 bps

|

|

Normalized EBITDA

|

4,410.5

|

17.1

|

608.6

|

(24.7)

|

62.1

|

5,073.5

|

15.0%

|

1.4%

|

|

% Normalized EBITDA margin

|

36.9%

|

|

|

|

|

32.5%

|

-440 bps

|

-440 bps

|

|

Ambev

|

YTD19

|

Scope

|

Currency Translation

|

IAS 29

HY Impact

|

Organic Growth

|

YTD20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

115,947.3

|

164.6

|

|

|

(1,256.0)

|

114,855.9

|

-0.9%

|

-1.1%

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

36,742.9

|

143.8

|

2,766.0

|

|

169.7

|

39,822.4

|

8.4%

|

0.5%

|

|

Net revenue/hl (R$)

|

316.9

|

0.8

|

24.1

|

|

5.0

|

346.7

|

9.4%

|

1.6%

|

|

COGS

|

(15,298.7)

|

(72.0)

|

(1,234.4)

|

|

(2,263.1)

|

(18,868.2)

|

23.3%

|

14.8%

|

|

COGS/hl (R$)

|

(131.9)

|

(0.4)

|

(10.7)

|

|

(21.2)

|

(164.3)

|

24.5%

|

16.0%

|

|

COGS excl. deprec. & amort.

|

(13,330.7)

|

(72.0)

|

(1,101.1)

|

|

(2,178.8)

|

(16,682.5)

|

25.1%

|

16.3%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(115.0)

|

(0.5)

|

(9.6)

|

|

(20.2)

|

(145.2)

|

26.3%

|

17.6%

|

|

Gross profit

|

21,444.2

|

71.8

|

1,531.7

|

|

(2,093.4)

|

20,954.2

|

-2.3%

|

-9.8%

|

|

% Gross margin

|

58.4%

|

|

|

|

|

52.6%

|

-580 bps

|

-600 bps

|

|

SG&A excl. deprec. & amort.

|

(9,749.6)

|

(43.9)

|

(775.6)

|

|

(320.8)

|

(10,889.9)

|

11.7%

|

3.3%

|

|

SG&A deprec. & amort.

|

(1,443.1)

|

(0.7)

|

(79.1)

|

|

(94.4)

|

(1,617.3)

|

12.1%

|

6.5%

|

|

SG&A total

|

(11,192.7)

|

(44.6)

|

(854.7)

|

|

(415.2)

|

(12,507.2)

|

11.7%

|

3.7%

|

|

Other operating income/(expenses)

|

559.7

|

|

(13.3)

|

|

(142.2)

|

404.2

|

-27.8%

|

-25.4%

|

|

Normalized EBIT

|

10,811.3

|

27.1

|

663.6

|

|

(2,650.8)

|

8,851.2

|

-18.1%

|

-24.5%

|

|

% Normalized EBIT margin

|

29.4%

|

|

|

|

|

22.2%

|

-720 bps

|

-730 bps

|

|

Normalized EBITDA

|

14,222.4

|

27.9

|

876.0

|

|

(2,472.1)

|

12,654.2

|

-11.0%

|

-17.4%

|

|

% Normalized EBITDA margin

|

38.7%

|

|

|

|

|

31.8%

|

-690 bps

|

-690 bps

|

|

Third Quarter 2020 Results

October 29, 2020

Page | 10

|

BRAZIL

|

Brazil

|

3Q19

|

Scope

|

Currency Translation

|

Organic Growth

|

3Q20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

23,746.2

|

|

|

4,703.4

|

28,449.6

|

19.8%

|

19.8%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

6,340.6

|

|

|

1,344.0

|

7,684.5

|

21.2%

|

21.2%

|

|

Net revenue/hl (R$)

|

267.0

|

|

|

3.1

|

270.1

|

1.2%

|

1.2%

|

|

COGS

|

(2,824.0)

|

|

|

(998.7)

|

(3,822.7)

|

35.4%

|

35.4%

|

|

COGS/hl (R$)

|

(118.9)

|

|

|

(15.4)

|

(134.4)

|

13.0%

|

13.0%

|

|

COGS excl. deprec. & amort.

|

(2,451.9)

|

|

|

(993.3)

|

(3,445.2)

|

40.5%

|

40.5%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(103.3)

|

|

|

(17.8)

|

(121.1)

|

17.3%

|

17.3%

|

|

Gross profit

|

3,516.5

|

|

|

345.2

|

3,861.8

|

9.8%

|

9.8%

|

|

% Gross margin

|

55.5%

|

|

|

|

50.3%

|

-520 bps

|

-520 bps

|

|

SG&A excl. deprec. & amort.

|

(1,636.2)

|

|

|

(304.3)

|

(1,940.5)

|

18.6%

|

18.6%

|

|

SG&A deprec. & amort.

|

(456.7)

|

|

|

117.9

|

(338.8)

|

-25.8%

|

-25.8%

|

|

SG&A total

|

(2,092.9)

|

|

|

(186.4)

|

(2,279.3)

|

8.9%

|

8.9%

|

|

Other operating income/(expenses)

|

152.1

|

|

|

76.3

|

228.4

|

50.2%

|

50.2%

|

|

Normalized EBIT

|

1,575.8

|

|

|

235.2

|

1,810.9

|

14.9%

|

14.9%

|

|

% Normalized EBIT margin

|

24.9%

|

|

|

0.0%

|

23.6%

|

-130 bps

|

-130 bps

|

|

Normalized EBITDA

|

2,404.6

|

|

|

122.7

|

2,527.3

|

5.1%

|

5.1%

|

|

% Normalized EBITDA margin

|

37.9%

|

|

|

0.0%

|

32.9%

|

-500 bps

|

-500 bps

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil

|

YTD19

|

Scope

|

Currency Translation

|

Organic Growth

|

YTD20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

75,414.9

|

|

|

1,149.3

|

76,564.2

|

1.5%

|

1.5%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

19,831.1

|

|

|

233.2

|

20,064.3

|

1.2%

|

1.2%

|

|

Net revenue/hl (R$)

|

263.0

|

|

|

(0.9)

|

262.1

|

-0.3%

|

-0.3%

|

|

COGS

|

(8,491.0)

|

|

|

(1,263.1)

|

(9,754.1)

|

14.9%

|

14.9%

|

|

COGS/hl (R$)

|

(112.6)

|

|

|

(14.8)

|

(127.4)

|

13.2%

|

13.2%

|

|

COGS excl. deprec. & amort.

|

(7,378.2)

|

|

|

(1,253.8)

|

(8,632.0)

|

17.0%

|

17.0%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(97.8)

|

|

|

(14.9)

|

(112.7)

|

15.2%

|

15.2%

|

|

Gross profit

|

11,340.1

|

|

|

(1,029.8)

|

10,310.3

|

-9.1%

|

-9.1%

|

|

% Gross margin

|

57.2%

|

|

|

|

51.4%

|

-580 bps

|

-580 bps

|

|

SG&A excl. deprec. & amort.

|

(5,278.9)

|

|

|

(252.5)

|

(5,531.4)

|

4.8%

|

4.8%

|

|

SG&A deprec. & amort.

|

(1,002.8)

|

|

|

(23.4)

|

(1,026.2)

|

2.3%

|

2.3%

|

|

SG&A total

|

(6,281.7)

|

|

|

(275.9)

|

(6,557.6)

|

4.4%

|

4.4%

|

|

Other operating income/(expenses)

|

565.6

|

|

|

(33.8)

|

531.8

|

-6.0%

|

-6.0%

|

|

Normalized EBIT

|

5,624.0

|

|

|

(1,339.5)

|

4,284.5

|

-23.8%

|

-23.8%

|

|

% Normalized EBIT margin

|

28.4%

|

|

|

|

21.4%

|

-700 bps

|

-700 bps

|

|

Normalized EBITDA

|

7,739.6

|

|

|

(1,306.9)

|

6,432.7

|

-16.9%

|

-16.9%

|

|

% Normalized EBITDA margin

|

39.0%

|

|

|

|

32.1%

|

-690 bps

|

-690 bps

|

|

Third Quarter 2020 Results

October 29, 2020

Page | 11

|

BEER

BRAZIL

The volume performance in this quarter

was driven by consistent results from the implementation of our commercial strategy, our ability to adapt to changes in the market

and by a growing industry, positively impacted by the government financial aid, which more than offset the partial shutdown of

the on-trade. According to our estimates, we considerably outperformed the industry.

Our NR/hl was in line with last year’s

despite COVID-19 impact. Positive brand mix and revenue management initiatives were more than offset by channel and geographic

mix.

The increase in cash COGS/hl is mostly

explained by transactional FX and unfavorable packaging mix, as the weight of aluminum cans in the portfolio continued to grow

year over year. On top of that, the unexpected growth of can volumes resulted in additional expenses related to underhedged costs,

mainly FX and aluminum.

The cash SG&A increased following

the strong volume recovery in the quarter.

|

Beer Brazil

|

3Q19

|

Scope

|

Currency Translation

|

Organic Growth

|

3Q20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

17,417.3

|

|

|

4,429.6

|

21,846.9

|

25.4%

|

25.4%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

5,313.9

|

|

|

1,336.7

|

6,650.5

|

25.2%

|

25.2%

|

|

Net revenue/hl (R$)

|

305.1

|

|

|

(0.7)

|

304.4

|

-0.2%

|

-0.2%

|

|

COGS

|

(2,285.6)

|

|

|

(1,009.9)

|

(3,295.6)

|

44.2%

|

44.2%

|

|

COGS/hl (R$)

|

(131.2)

|

|

|

(19.6)

|

(150.8)

|

15.0%

|

15.0%

|

|

COGS excl. deprec. & amort.

|

(1,967.0)

|

|

|

(996.7)

|

(2,963.7)

|

50.7%

|

50.7%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(112.9)

|

|

|

(22.7)

|

(135.7)

|

20.1%

|

20.1%

|

|

Gross profit

|

3,028.3

|

|

|

326.7

|

3,355.0

|

10.8%

|

10.8%

|

|

% Gross margin

|

57.0%

|

|

|

|

50.4%

|

-660 bps

|

-660 bps

|

|

SG&A excl. deprec. & amort.

|

(1,331.2)

|

|

|

(307.2)

|

(1,638.4)

|

23.1%

|

23.1%

|

|

SG&A deprec. & amort.

|

(424.4)

|

|

|

123.4

|

(301.0)

|

-29.1%

|

-29.1%

|

|

SG&A total

|

(1,755.6)

|

|

|

(183.9)

|

(1,939.4)

|

10.5%

|

10.5%

|

|

Other operating income/(expenses)

|

127.8

|

|

|

32.0

|

159.8

|

25.0%

|

25.0%

|

|

Normalized EBIT

|

1,400.4

|

|

|

174.8

|

1,575.3

|

12.5%

|

12.5%

|

|

% Normalized EBIT margin

|

26.4%

|

|

|

|

23.7%

|

-270 bps

|

-270 bps

|

|

Normalized EBITDA

|

2,143.5

|

|

|

64.7

|

2,208.2

|

3.0%

|

3.0%

|

|

% Normalized EBITDA margin

|

40.3%

|

|

|

|

33.2%

|

-710 bps

|

-710 bps

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beer Brazil

|

YTD19

|

Scope

|

Currency Translation

|

Organic Growth

|

YTD20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

56,666.0

|

|

|

1,714.0

|

58,380.0

|

3.0%

|

3.0%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

16,743.2

|

|

|

490.5

|

17,233.7

|

2.9%

|

2.9%

|

|

Net revenue/hl (R$)

|

295.5

|

|

|

(0.3)

|

295.2

|

-0.1%

|

-0.1%

|

|

COGS

|

(6,990.2)

|

|

|

(1,280.3)

|

(8,270.6)

|

18.3%

|

18.3%

|

|

COGS/hl (R$)

|

(123.4)

|

|

|

(18.3)

|

(141.7)

|

14.8%

|

14.8%

|

|

COGS excl. deprec. & amort.

|

(6,027.9)

|

|

|

(1,264.0)

|

(7,291.9)

|

21.0%

|

21.0%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(106.4)

|

|

|

(18.5)

|

(124.9)

|

17.4%

|

17.4%

|

|

Gross profit

|

9,753.0

|

|

|

(789.8)

|

8,963.2

|

-8.1%

|

-8.1%

|

|

% Gross margin

|

58.3%

|

|

|

|

52.0%

|

-630 bps

|

-630 bps

|

|

SG&A excl. deprec. & amort.

|

(4,407.9)

|

|

|

(268.8)

|

(4,676.7)

|

6.1%

|

6.1%

|

|

SG&A deprec. & amort.

|

(903.2)

|

|

|

(5.5)

|

(908.7)

|

0.6%

|

0.6%

|

|

SG&A total

|

(5,311.1)

|

|

|

(274.3)

|

(5,585.4)

|

5.2%

|

5.2%

|

|

Other operating income/(expenses)

|

398.0

|

|

|

9.8

|

407.8

|

2.5%

|

2.5%

|

|

Normalized EBIT

|

4,839.9

|

|

|

(1,054.3)

|

3,785.6

|

-21.8%

|

-21.8%

|

|

% Normalized EBIT margin

|

28.9%

|

|

|

|

22.0%

|

-690 bps

|

-690 bps

|

|

Normalized EBITDA

|

6,705.4

|

|

|

(1,032.5)

|

5,673.0

|

-15.4%

|

-15.4%

|

|

% Normalized EBITDA margin

|

40.0%

|

|

|

|

32.9%

|

-710 bps

|

-710 bps

|

|

Third Quarter 2020 Results

October 29, 2020

Page | 12

|

NAB

BRAZIL

Volume performance was impacted by the

recovery of consumption occasions as restrictions were partially lifted throughout the quarter. Our NR/hl continues to be impacted

by unfavorable channel, brand and pack mix, as the restrictions imposed on the on-trade channel led to a shift to the off-trade

channel as well as to an increased weight of multi-serve packaging versus single serve.

Despite the

mix shift, the cash COGS/hl performance was mostly driven by the favorable comparable in the previous year from phasing of tax

credits. The cash SG&A decrease in the quarter resulted from the continuous revision of our discretionary expenses.

|

NAB Brazil

|

3Q19

|

Scope

|

Currency Translation

|

Organic Growth

|

3Q20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

6,328.9

|

|

|

273.8

|

6,602.7

|

4.3%

|

4.3%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

1,026.7

|

|

|

7.3

|

1,034.0

|

0.7%

|

0.7%

|

|

Net revenue/hl (R$)

|

162.2

|

|

|

(5.6)

|

156.6

|

-3.5%

|

-3.5%

|

|

COGS

|

(538.4)

|

|

|

11.2

|

(527.2)

|

-2.1%

|

-2.1%

|

|

COGS/hl (R$)

|

(85.1)

|

|

|

5.2

|

(79.8)

|

-6.1%

|

-6.1%

|

|

COGS excl. deprec. & amort.

|

(484.9)

|

|

|

3.4

|

(481.5)

|

-0.7%

|

-0.7%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(76.6)

|

|

|

3.7

|

(72.9)

|

-4.8%

|

-4.8%

|

|

Gross profit

|

488.3

|

|

|

18.5

|

506.8

|

3.8%

|

3.8%

|

|

% Gross margin

|

47.6%

|

|

|

|

49.0%

|

140 bps

|

140 bps

|

|

SG&A excl. deprec. & amort.

|

(305.0)

|

|

|

2.9

|

(302.1)

|

-1.0%

|

-1.0%

|

|

SG&A deprec. & amort.

|

(32.3)

|

|

|

(5.5)

|

(37.8)

|

16.9%

|

16.9%

|

|

SG&A total

|

(337.3)

|

|

|

(2.5)

|

(339.8)

|

0.7%

|

0.7%

|

|

Other operating income/(expenses)

|

24.3

|

|

|

44.3

|

68.7

|

182.2%

|

182.2%

|

|

Normalized EBIT

|

175.3

|

|

|

60.4

|

235.7

|

34.4%

|

34.4%

|

|

% Normalized EBIT margin

|

17.1%

|

|

|

|

22.8%

|

570 bps

|

570 bps

|

|

Normalized EBITDA

|

261.1

|

|

|

58.0

|

319.1

|

22.2%

|

22.2%

|

|

% Normalized EBITDA margin

|

25.4%

|

|

|

|

30.9%

|

550 bps

|

550 bps

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAB Brazil

|

YTD19

|

Scope

|

Currency Translation

|

Organic Growth

|

YTD20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

18,748.9

|

|

|

(564.7)

|

18,184.2

|

-3.0%

|

-3.0%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

3,087.9

|

|

|

(257.3)

|

2,830.6

|

-8.3%

|

-8.3%

|

|

Net revenue/hl (R$)

|

164.7

|

|

|

(9.0)

|

155.7

|

-5.5%

|

-5.5%

|

|

COGS

|

(1,500.8)

|

|

|

17.3

|

(1,483.5)

|

-1.2%

|

-1.2%

|

|

COGS/hl (R$)

|

(80.0)

|

|

|

(1.5)

|

(81.6)

|

1.9%

|

1.9%

|

|

COGS excl. deprec. & amort.

|

(1,350.3)

|

|

|

10.2

|

(1,340.1)

|

-0.8%

|

-0.8%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(72.0)

|

|

|

(1.7)

|

(73.7)

|

2.3%

|

2.3%

|

|

Gross profit

|

1,587.1

|

|

|

(240.0)

|

1,347.1

|

-15.1%

|

-15.1%

|

|

% Gross margin

|

51.4%

|

|

|

|

47.6%

|

-380 bps

|

-380 bps

|

|

SG&A excl. deprec. & amort.

|

(871.0)

|

|

|

16.3

|

(854.7)

|

-1.9%

|

-1.9%

|

|

SG&A deprec. & amort.

|

(99.5)

|

|

|

(17.9)

|

(117.5)

|

18.0%

|

18.0%

|

|

SG&A total

|

(970.6)

|

|

|

(1.6)

|

(972.2)

|

0.2%

|

0.2%

|

|

Other operating income/(expenses)

|

167.6

|

|

|

(43.5)

|

124.0

|

-26.0%

|

-26.0%

|

|

Normalized EBIT

|

784.1

|

|

|

(285.2)

|

498.9

|

-36.4%

|

-36.4%

|

|

% Normalized EBIT margin

|

25.4%

|

|

|

|

17.6%

|

-780 bps

|

-780 bps

|

|

Normalized EBITDA

|

1,034.2

|

|

|

(274.4)

|

759.8

|

-26.5%

|

-26.5%

|

|

% Normalized EBITDA margin

|

33.5%

|

|

|

|

26.8%

|

-670 bps

|

-670 bps

|

|

Third Quarter 2020 Results

October 29, 2020

Page | 13

|

CENTRAL

AMERICA AND THE CARIBBEAN (CAC)

The volume

performance was driven by restrictions adopted to mitigate the COVID-19 pandemic in the region. Our NR/hl increased due to the

above core mix contribution and the successful implementation of our revenue management initiatives.

Despite the

volume decline, CAC managed to deliver a healthy 43.7% EBITDA margin in the quarter driven by the positive brand mix and the disciplined

execution of our SG&A savings initiatives.

|

CAC

|

3Q19

|

Scope

|

Currency Translation

|

Organic Growth

|

3Q20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

3,445.1

|

|

|

(339.9)

|

3,105.2

|

-9.9%

|

-9.9%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

1,656.9

|

|

376.7

|

31.3

|

2,064.8

|

24.6%

|

1.9%

|

|

Net revenue/hl (R$)

|

480.9

|

|

121.3

|

62.7

|

664.9

|

38.3%

|

13.0%

|

|

COGS

|

(726.2)

|

|

(171.4)

|

(3.9)

|

(901.4)

|

24.1%

|

0.5%

|

|

COGS/hl (R$)

|

(210.8)

|

|

(55.2)

|

(24.3)

|

(290.3)

|

37.7%

|

11.5%

|

|

COGS excl. deprec. & amort.

|

(642.0)

|

|

(150.3)

|

(0.4)

|

(792.7)

|

23.5%

|

0.1%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(186.4)

|

|

(48.4)

|

(20.5)

|

(255.3)

|

37.0%

|

11.0%

|

|

Gross profit

|

930.7

|

|

205.3

|

27.3

|

1,163.3

|

25.0%

|

2.9%

|

|

% Gross margin

|

56.2%

|

|

|

|

56.3%

|

10 bps

|

60 bps

|

|

SG&A excl. deprec. & amort.

|

(323.3)

|

|

(76.7)

|

36.0

|

(364.0)

|

12.6%

|

-11.1%

|

|

SG&A deprec. & amort.

|

(50.7)

|

|

(16.0)

|

(21.4)

|

(88.0)

|

73.7%

|

42.2%

|

|

SG&A total

|

(374.0)

|

|

(92.7)

|

14.7

|

(452.0)

|

20.9%

|

-3.9%

|

|

Other operating income/(expenses)

|

(3.4)

|

|

(1.0)

|

(1.5)

|

(5.8)

|

72.3%

|

43.3%

|

|

Normalized EBIT

|

553.3

|

|

111.6

|

40.6

|

705.5

|

27.5%

|

7.3%

|

|

% Normalized EBIT margin

|

33.4%

|

|

|

|

34.2%

|

80 bps

|

180 bps

|

|

Normalized EBITDA

|

688.1

|

|

148.7

|

65.4

|

902.3

|

31.1%

|

9.5%

|

|

% Normalized EBITDA margin

|

41.5%

|

|

|

|

43.7%

|

220 bps

|

310 bps

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAC

|

YTD19

|

Scope

|

Currency Translation

|

Organic Growth

|

YTD20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

10,069.8

|

|

|

(2,126.8)

|

7,943.0

|

-21.1%

|

-21.1%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

4,804.8

|

|

760.9

|

(689.0)

|

4,876.6

|

1.5%

|

-14.3%

|

|

Net revenue/hl (R$)

|

477.1

|

|

95.8

|

41.0

|

614.0

|

28.7%

|

8.6%

|

|

COGS

|

(2,090.4)

|

|

(357.7)

|

208.4

|

(2,239.7)

|

7.1%

|

-10.0%

|

|

COGS/hl (R$)

|

(207.6)

|

|

(45.0)

|

(29.3)

|

(282.0)

|

35.8%

|

14.1%

|

|

COGS excl. deprec. & amort.

|

(1,840.5)

|

|

(309.3)

|

219.4

|

(1,930.4)

|

4.9%

|

-11.9%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(182.8)

|

|

(38.9)

|

(21.3)

|

(243.0)

|

33.0%

|

11.7%

|

|

Gross profit

|

2,714.4

|

|

403.2

|

(480.6)

|

2,637.0

|

-2.9%

|

-17.7%

|

|

% Gross margin

|

56.5%

|

|

|

|

54.1%

|

-240 bps

|

-220 bps

|

|

SG&A excl. deprec. & amort.

|

(939.7)

|

|

(160.7)

|

151.8

|

(948.6)

|

0.9%

|

-16.2%

|

|

SG&A deprec. & amort.

|

(139.1)

|

|

(29.7)

|

(13.9)

|

(182.6)

|

31.3%

|

10.0%

|

|

SG&A total

|

(1,078.8)

|

|

(190.4)

|

137.9

|

(1,131.3)

|

4.9%

|

-12.8%

|

|

Other operating income/(expenses)

|

52.8

|

|

(2.6)

|

(69.1)

|

(18.9)

|

-135.8%

|

-130.8%

|

|

Normalized EBIT

|

1,688.4

|

|

210.2

|

(411.8)

|

1,486.8

|

-11.9%

|

-24.4%

|

|

% Normalized EBIT margin

|

35.1%

|

|

|

|

30.5%

|

-460 bps

|

-410 bps

|

|

Normalized EBITDA

|

2,077.4

|

|

288.2

|

(386.9)

|

1,978.7

|

-4.7%

|

-18.6%

|

|

% Normalized EBITDA margin

|

43.2%

|

|

|

|

40.6%

|

-260 bps

|

-210 bps

|

|

Third Quarter 2020 Results

October 29, 2020

Page | 14

|

LATIN

AMERICA SOUTH (LAS)[3]

Net revenue

increased in LAS as countries gradually recovered across the region. NR/hl increased as a result of our continued revenue management

initiatives and inflation in Argentina.

The significant increase

in Cash COGS/hl is mainly explained by transactional FX and pack mix, while the cash SG&A growth was mainly driven by the high

inflation in Argentina despite effective management of our expenses in the region.

|

LAS

|

3Q19

|

Scope

|

Currency Translation

|

IAS 29

HY Impact

|

Organic Growth

|

3Q20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

7,891.9

|

|

|

-

|

(33.3)

|

7,858.6

|

-0.4%

|

-0.4%

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

1,971.4

|

|

842.7

|

(191.1)

|

333.6

|

2,956.5

|

50.0%

|

15.1%

|

|

Net revenue/hl (R$)

|

249.8

|

|

107.2

|

(19.7)

|

38.9

|

376.2

|

50.6%

|

15.6%

|

|

COGS

|

(897.7)

|

|

(424.1)

|

124.9

|

(373.0)

|

(1,569.9)

|

74.9%

|

38.3%

|

|

COGS/hl (R$)

|

(113.8)

|

|

(54.0)

|

12.2

|

(44.2)

|

(199.8)

|

75.6%

|

38.9%

|

|

COGS excl. deprec. & amort.

|

(769.2)

|

|

(361.4)

|

112.0

|

(354.2)

|

(1,372.8)

|

78.5%

|

42.9%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(97.5)

|

|

(46.0)

|

11.2

|

(42.4)

|

(174.7)

|

79.2%

|

43.5%

|

|

Gross profit

|

1,073.7

|

|

418.6

|

(66.3)

|

(39.4)

|

1,386.6

|

29.1%

|

-3.2%

|

|

% Gross margin

|

54.5%

|

|

|

|

|

46.9%

|

-760 bps

|

-880 bps

|

|

SG&A excl. deprec. & amort.

|

(444.4)

|

|

(220.2)

|

51.9

|

(127.5)

|

(740.2)

|

66.6%

|

25.1%

|

|

SG&A deprec. & amort.

|

(48.3)

|

|

(28.2)

|

5.9

|

(20.0)

|

(90.5)

|

87.3%

|

34.2%

|

|

SG&A total

|

(492.7)

|

|

(248.4)

|

57.9

|

(147.5)

|

(830.7)

|

68.6%

|

26.0%

|

|

Other operating income/(expenses)

|

(5.3)

|

|

(9.6)

|

2.5

|

(27.6)

|

(40.0)

|

nm

|

nm

|

|

Normalized EBIT

|

575.7

|

|

160.6

|

(6.0)

|

(214.4)

|

515.9

|

-10.4%

|

-32.4%

|

|

% Normalized EBIT margin

|

29.2%

|

|

|

|

|

17.5%

|

-1170 bps

|

-1240 bps

|

|

Normalized EBITDA

|

752.5

|

|

251.5

|

(24.7)

|

(175.7)

|

803.6

|

6.8%

|

-20.2%

|

|

% Normalized EBITDA margin

|

38.2%

|

|

|

|

|

27.2%

|

-1100 bps

|

-1210 bps

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAS

|

YTD19

|

Scope

|

Currency Translation

|

IAS 29

HY Impact

|

Organic Growth

|

YTD20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

23,114.1

|

|

|

|

(538.3)

|

22,575.7

|

-2.3%

|

-2.3%

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

6,781.5

|

|

624.0

|

|

534.8

|

7,940.3

|

17.1%

|

7.9%

|

|

Net revenue/hl (R$)

|

293.4

|

|

27.6

|

|

30.7

|

351.7

|

19.9%

|

10.5%

|

|

COGS

|

(2,737.4)

|

|

(328.4)

|

|

(1,038.4)

|

(4,104.2)

|

49.9%

|

37.9%

|

|

COGS/hl (R$)

|

(118.4)

|

|

(14.5)

|

|

(48.8)

|

(181.8)

|

53.5%

|

41.2%

|

|

COGS excl. deprec. & amort.

|

(2,271.3)

|

|

(280.5)

|

|

(980.3)

|

(3,532.0)

|

55.5%

|

43.2%

|

|

COGS/hl excl. deprec. & amort. (R$)

|

(98.3)

|

|

(12.4)

|

|

(45.8)

|

(156.5)

|

59.2%

|

46.6%

|

|

Gross profit

|

4,044.2

|

|

295.6

|

|

(503.6)

|

3,836.1

|

-5.1%

|

-12.5%

|

|

% Gross margin

|

59.6%

|

|

|

|

|

48.3%

|

-1130 bps

|

-1120 bps

|

|

SG&A excl. deprec. & amort.

|

(1,612.2)

|

|

(153.1)

|

|

(328.1)

|

(2,093.5)

|

29.9%

|

20.4%

|

|

SG&A deprec. & amort.

|

(196.9)

|

|

(18.3)

|

|

(39.5)

|

(254.7)

|

29.4%

|

20.1%

|

|

SG&A total

|

(1,809.1)

|

|

(171.5)

|

|

(367.6)

|

(2,348.2)

|

29.8%

|

20.3%

|

|

Other operating income/(expenses)

|

(32.6)

|

|

(2.0)

|

|

(31.0)

|

(65.5)

|

101.2%

|

95.2%

|

|

Normalized EBIT

|

2,202.5

|

|

122.2

|

|

(902.3)

|

1,422.4

|

-35.4%

|

-41.0%

|

|

% Normalized EBIT margin

|

32.5%

|

|

|

|

|

17.9%

|

-1460 bps

|

-1470 bps

|

|

Normalized EBITDA

|

2,865.5

|

|

188.4

|

|

(804.6)

|

2,249.2

|

-21.5%

|

-28.1%

|

|

% Normalized EBITDA margin

|

42.3%

|

|

|

|

|

28.3%

|

-1400 bps

|

-1410 bps

|

[3]

Reported numbers are presented applying Hyperinflation

Accounting for our Argentinean operations, as detailed on page 19.

|

Third Quarter 2020 Results

October 29, 2020

Page | 15

|

CANADA[4]

Canada volumes

grew driven by a positive industry impacted by warmer and dryer weather, increased frequency of in-home occasions and another quarter

of market share gains from the strong performance of our premium and beyond beer portfolio and short term industry supply chain

disruptions. The NR/hl decrease in Canada was driven by unfavorable channel and pack mix partially offset by brand mix.

Cash COGS/hl

increased, impacted by channel and pack mix coupled with transactional FX.

|

Canada

|

3Q19

|

Scope

|

Currency Translation

|

Organic Growth

|

3Q20

|

% As Reported

|

% Organic

|

|

R$ million

|

|

Volume ('000 hl)

|

2,702.5

|

70.0

|

|

193.0

|

2,965.5

|

9.7%

|

7.1%

|

|

|

|

|

|

|

|

|

|

|

Net revenue

|

1,988.8

|

64.1

|

718.5

|

127.3

|

2,898.7

|

45.8%

|

6.4%

|

|

Net revenue/hl (R$)

|

735.9

|

4.5

|

242.3

|

(5.3)

|

977.5

|

32.8%

|

-0.7%

|

|

COGS

|

(781.8)

|

(33.5)

|

(280.2)

|

(33.5)

|

(1,129.1)

|

44.4%