Tiffany, LVMH Near Agreement on New Deal Terms -- Update

October 28 2020 - 12:28PM

Dow Jones News

By Cara Lombardo and Dana Cimilluca

Tiffany & Co. is nearing an agreement to accept a lower

price in its takeover by LVMH Moët Hennessy Louis Vuitton SE that

would end a bitter dispute between the luxury-goods companies.

The companies have come to a preliminary agreement on new deal

terms that would call for LVMH to pay $131.50 for the iconic U.S.

jewelry maker, according to people familiar with the matter. That

is down from a prior agreement of $135 a share.

Tiffany's board plans to consider the revised terms at a meeting

later Wednesday, and there is no guarantee they will accept them,

the people said. Should they accept the revised terms, litigation

that erupted over the deal would go away and conditions required

for it to close would be reduced, some of the people said. That

would pave the way for a new shareholder vote and a closing of the

deal possibly by January.

Tiffany agreed to sell itself to LVMH late last year in a

roughly $16.2 billion deal. The acquisition represented the biggest

bet yet by LVMH under Bernard Arnault, the French billionaire who

has been its chief executive and controlling shareholder for three

decades. But LVMH said in September it was backing out of the deal,

blaming trade disputes between France and the Trump administration.

Many saw the move as a bid to lower the price.

Write to Cara Lombardo at cara.lombardo@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

October 28, 2020 12:13 ET (16:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

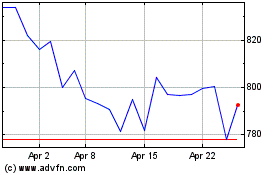

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

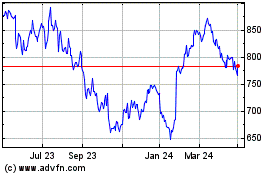

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024