UPS Posts Strong Gains as Package Volumes Swell--2nd Update

October 28 2020 - 11:35AM

Dow Jones News

By Paul Ziobro

United Parcel Service Inc. is delivering more packages, but it

is paying a much bigger price to do so.

The delivery giant said revenue rose nearly 16% in the third

quarter and profit rose 11.8% amid an influx of packages moving

domestically and internationally during the pandemic. Despite the

boost, UPS's large domestic business posted a sharp decline in

profits due to the need to hire tens of thousands of new workers,

lower margins from delivering packages to homes and $179 million in

spending to speed up delivery times.

The decline in U.S. profits and continued higher costs heading

into the holiday season weighed on shares, which fell more than 5%

in early trading amid a broader market selloff. They are still up

nearly 40% for the year.

The results put added pressure on new Chief Executive Carol Tomé

to operate UPS as "better, not bigger" by solving the problem of

how to handle the shift to e-commerce, which was accelerated by the

pandemic, more profitably.

"Continued compression in domestic margins means that the debate

over whether UPS has 'fixed' e-commerce remains open," Bernstein

transportation analyst David Vernon said in a research note.

Ms. Tomé, a former Home Depot Inc. finance chief and longtime

UPS board member, is focusing on cutting costs and reining in

spending while raising shipping rates and getting more business

from higher-margin customers like smaller businesses and the

health-care industry.

She is trying to do it at a larger scale than the company had

done in the past, including speeding up decisions by cutting the

number of committees running the business to six from 21.

"In the past, we did it by increments," she said on Wednesday's

earnings call. "We're now doing it in a meaningful way."

The decline in U.S. profits was offset by big gains in UPS's

other segments. Its international business posted a 12% increase in

shipping volumes and a 45% jump in profits, as a reduction in

passenger flights that normally handle cargo has given shippers

fewer options.

The smaller supply chain and freight division posted a 22%

profit increase due to strong shipping demand out of Asia.

Both FedEx and UPS have benefited from the global shipping

environment, which has tightened international freight capacity and

provided more packages to deliver as more people shop online. The

boom in the number of packages has overwhelmed their delivery

networks and stretched delivery times, but the demand has given the

carriers leeway to impose fees and negotiate higher rates from

shippers.

The shipping volume is expected to remain robust during the

holiday season. Both FedEx and UPS have warned their largest

customers that there is no extra capacity available during the busy

shipping period, while other smaller carriers have stopped taking

new customers until next year.

Ms. Tomé said that the shipping industry is facing "capacity

constraints" for the holiday season and that UPS is working closely

with retailers on the timing of their promotions and using tools

like more automated capacity, faster shipping times and weekend

services to manage through.

"We are projecting a pretty peaky peak," Ms. Tomé said. "While

we expect this holiday season to have its challenges, we are ready

to deliver a successful peak."

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

October 28, 2020 11:20 ET (15:20 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

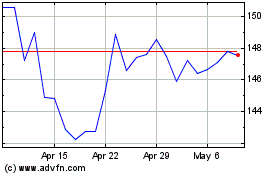

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

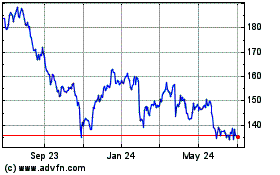

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024