Sony Looks Well Placed to Benefit From Next Console War -- Heard on the Street

October 28 2020 - 8:13AM

Dow Jones News

By Jacky Wong

The next videogame console war is looming. Dragons may or may

not be involved, but electronics and gaming conglomerate Sony looks

well placed after another solid quarter.

The Japanese entertainment company's results for the quarter

ended in September were impressive: its operating profit rose 14%

from a year earlier, much better than the 31% decline expected by

analysts polled by S&P Global Market Intelligence.

Sony has been cautious about coming quarters. The company's

operating profit at its gaming division rose 65% from a year

earlier for the six months ended in September, but growth will

likely slow without the boost from stay-at-home gamers.

Initial costs for the launch of Sony's next-generation videogame

console PlayStation 5, slated for next month, would eat into its

margins. Its image-sensor business will also likely hurt by the ban

restricting China's Huawei from buying semiconductor chips using

U.S. technology. Citi estimates that Sony's sales to Huawei

amounted to 290 billion yen, equivalent to $2.8 billion, last

fiscal year, around 27% of the company's image-sensor revenue. Sony

expected the division's operating profit will drop 66% this fiscal

year compared with the last one.

Yet Sony's August guidance still looks too pessimistic after

another great quarter: the company raised by 13% its operating

profit forecast for the fiscal year ending next March. That sounds

like a lot but may still be too cautious. PS5s will likely sell

like hot cakes, which could also push game sales higher. More

people are also buying games digitally, which means higher margins

for Sony. PlayStation Plus, the company's subscription-based

service offering gamers discounts and other perks, also saw

growth.

Sony will also get a boost from Aniplex, its anime and music

production company in Japan. The company's mobile game "Fate/Grand

Order" has been doing well. "Demon Slayer," an anime movie it

helped distribute, had a record opening in Japan this month.

All this bodes well for Sony in the next stage of the console

war. Both Microsoft and Sony will launch their next-generation

consoles next month, for the first time in seven years. Other

technology giants are also joining the fray: Google, Amazon.com and

Facebook have all launched cloud-gaming services, hoping that users

will play their games on any device.

That means having exclusive content could become even more

important. That is why Microsoft agreed last month to pay $7.5

billion to buy ZeniMax Media, the parent of Bethesda Softworks,

which owns popular games such as "Fallout" and "Doom." Sony

likewise acquired a stake in Epic Games, the creator of "Fortnite,"

earlier this year, but it has to keep beefing up its content

library.

Sony has played its game well so far. Whatever plot twists lie

ahead, the company appears to be in a solid position to capitalize

on them.

Write to Jacky Wong at JACKY.WONG@wsj.com

(END) Dow Jones Newswires

October 28, 2020 07:58 ET (11:58 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

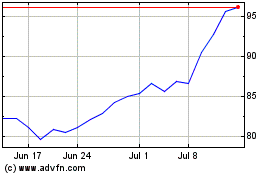

Sony (NYSE:SONY)

Historical Stock Chart

From Mar 2024 to Apr 2024

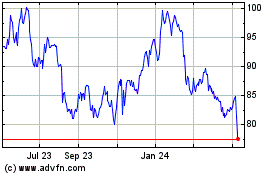

Sony (NYSE:SONY)

Historical Stock Chart

From Apr 2023 to Apr 2024