Automatic Data Processing Sees FY21 EPS Between Flat and Down 4%

October 28 2020 - 7:55AM

Dow Jones News

By Allison Prang

Automatic Data Processing Inc. said it expects earnings per

share to be between flat and down 4% for the fiscal 2021 year.

The company expects adjusted earnings to be down 3% to 7%. In

July, it expected adjusted earnings to fall between 13% and

18%.

It also is expecting revenue to be between down 1% and up 1%,

the company said. ADP in July expected revenue to fall between 1%

and 4%.

ADP is guiding for its adjusted earnings before interest and

taxes margin to fall between 100 basis points and 150 basis points.

It previously expected that margin to fall about 300 basis

points.

The company affirmed it expectation for an adjusted effective

tax rate of 23.1%.

ADP expects to log about $50 million in pretax charges related

to transformation initiatives, it said. That is lower than its old

guidance of about $60 million.

For fiscal year 2020, the company logged $128 million in pretax

charges for transformation initiatives and other items.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

October 28, 2020 07:40 ET (11:40 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

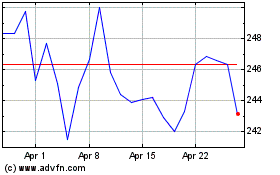

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

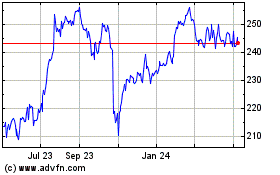

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024