Current Report Filing (8-k)

October 27 2020 - 4:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (date of earlies event reported): October 27, 2020

AIXIN

LIFE INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

|

Colorado

|

|

0-17284

|

|

84-1085935

|

|

State

of

|

|

Commission

|

|

IRS

Employer

|

|

Incorporation

|

|

File

Number

|

|

Identification

No.

|

Hongxing

International Business Building 2, 14th FL, No. 69 Qingyun South Ave., Jinjiang District

Chengdu

City, Sichuan Province, China

(Address

of principal executive offices)

86-313-6732526

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities

registered pursuant to Section 12(b) of the Act: None

Item

3.03 Material Modification to Rights of Security Holders

AIXIN

Life International, Inc. announced today that the Amendment to its Articles of Incorporation to effect a reverse stock split of

its issued and outstanding common stock, at a ratio of 1-for- 4 will become effective at 5:01 PM today. The Company’s common

stock will begin trading on a split-adjusted basis commencing upon market open tomorrow, October 28, 2020.

As

a result of the reverse split, every 4 shares of Aixin’s issued and outstanding common stock will be automatically combined

and converted into one issued and outstanding share of common stock, par value $0.0001 per share. Aixin’s will continue

to trade on the OTCQB Venture Exchange under the symbol “AIXN” but will be assigned a new CUSIP number, 009603

20 0. Effective upon the completion of the reverse stock split, Aixin will have approximately

50 million shares of outstanding common stock.

No

fractional shares of common stock will be issued as a result of the reverse stock split. Stockholders of record who would otherwise

be entitled to receive a fractional share will receive a cash payment in lieu thereof. The reverse stock split impacts all holders

of Aixin’s common stock proportionally and will not impact any stockholder’s percentage ownership of common stock

(except to the extent the reverse stock split results in any stockholder owing only a fractional share).

AIXIN

has chosen its transfer agent, Securities Transfer Corporation (“SCT”), to act as exchange agent for the reverse stock

split. Stockholders owning shares via a bank, broker or other nominee will have their positions automatically adjusted to reflect

the reverse stock split and will not be required to take further action in connection with the reverse stock split, subject to

brokers’ particular processes. SCT can be reached at (469) 633-0101.

In

connection with the reverse stock split, Aixin’s Articles of Incorporation will be amended to reduce the number of authorized

shares of common stock from 950 million shares of common stock to 500 million shares of common stock. Accordingly, on October

28, 2020, the number of authorized shares of Aixin’s common stock will be 500 million shares. Since the ratio of the decrease

in the number of shares of common stock outstanding as a result of the 1 for 4 reverse stock split is greater than the ratio of

the decrease in the number of authorized shares of common stock, the number of authorized shares of common stock now represents

an increase, on a percentage basis, compared to the number of shares of common stock outstanding as a result of the reverse stock

split.

Item

9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

AiXin

Life International, Inc.

|

|

|

|

|

|

Date:

October 27, 2020

|

By:

|

/s/

Quanzhong Lin

|

|

|

|

Quanzhong

Lin

Chief

Executive Officer

|

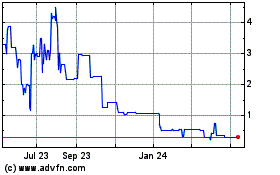

AiXin Life (QB) (USOTC:AIXN)

Historical Stock Chart

From Mar 2024 to Apr 2024

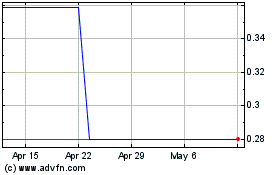

AiXin Life (QB) (USOTC:AIXN)

Historical Stock Chart

From Apr 2023 to Apr 2024