S&P Global Posts Lower 3Q Profit, Higher Sales; Cuts Earnings Outlook

October 27 2020 - 8:20AM

Dow Jones News

By Dave Sebastian

S&P Global Inc. said Tuesday its profit fell for the recent

quarter due to debt tender premium and fees associated with a

recent senior notes tender offer and it cut its full-year earnings

outlook, though the company's ratings business drove gains in sales

due to strong bond issuance amid the Covid-19 pandemic.

The company posted third-quarter profit of $455 million, or

$1.88 a share, compared with $617 million, or $2.50 a share, in the

comparable quarter last year.

Adjusted earnings were $2.85 a share. Analysts polled by FactSet

were expecting $2.57 a share.

Revenue rose 9%, to $1.85 billion. Analysts were looking for

$1.74 billion.

S&P Global Ratings' revenue rose 13%, to $894 million,

offset by lower bank loan rating activity. Transaction revenue rose

22%, to $490 million.

Market-intelligence revenue grew 9%, to $530 million. S&P

Dow Jones Indices LLC revenue grew 1%, to $234 million, on modest

gains in asset-linked fees and data and custom subscriptions.

Platts revenue grew 5%, to $222 million, due to growth in its core

subscription business, offset by lower global trading services

activity.

The company cut its earnings outlook to $10 a share to $10.15 a

share, from $10.25 a share to $10.45 a share, due to the debt

tender premium and fees incurred in the third quarter.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

October 27, 2020 08:05 ET (12:05 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

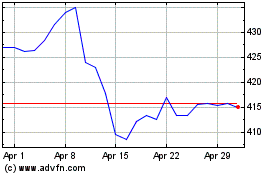

S&P Global (NYSE:SPGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

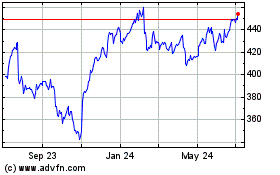

S&P Global (NYSE:SPGI)

Historical Stock Chart

From Apr 2023 to Apr 2024