By Melanie Evans

Hospitals are holding off as long as possible before halting

procedures to make room for fresh waves of Covid-19 patients, a

reversal from earlier this year when facilities postponed care,

leading to steep financial losses and public-health risks.

National hospital chain Tenet Healthcare Corp. pushed ahead with

procedures as states permitted, such as knee and hip replacements,

colonoscopies, and surgery to implant pacemakers, through recent

surges in Alabama, California and elsewhere. In southeast

Wisconsin, where already rising Covid-19 hospitalizations jumped

35% in the first two weeks of the month, Advocate Aurora Health

continues nonessential surgery across a dozen hospitals.

HCA Healthcare Inc., one of the nation's largest hospital

systems, waited until last week to suspend some surgery in El Paso,

Texas, where a coronavirus surge sharply accelerated in recent

weeks. About 80% of the procedures there continue, however.

Nashville-based HCA stops surgery "as a last resort," said Jon

Foster, an HCA president who oversees 90 of the company's 186

hospitals.

Hospitals have grown more circumspect of shutdowns through new

waves of the virus after fallout from voluntary and state-ordered

shutdowns in March and April. And unlike last spring, fewer states

are ordering broad shutdowns, leaving it to hospitals.

Earlier this year, facilities postponed nonessential surgeries,

such as knee and hip replacements and cancer screenings. Hospital

and clinic revenue plummeted. The widespread halt to procedures led

to an average 30% to 40% drop in nonprofit hospital revenue,

Moody's Investors Service reported in May, as hospitals began to

resume surgery. During the second quarter -- the period in which

most of the surgical delays occurred -- the median for-profit

hospital revenue dropped 10%, the ratings agency said.

Health-care job losses followed, as did $175 billion in federal

spending for relief. Patients grew anxious, and some saw their

medical conditions worsen during delays.

Months later, hospitals have learned from previous surges to

better manage capacity, avoid temporarily halts in services and

rebound quickly from disruption, hospital executives said. Halting

surgery is also not as critical to preserve supplies, with

expanding production of protective equipment and testing

capacity.

"We realize and operate every day with the assumption that Covid

spikes will be part of what we face until a vaccine becomes widely

deployed," Tenet Chief Executive Ron Rittenmeyer said on a call

with analysts last week. "There is no perfect equation. But we do

believe our learnings from each spike improves our responsiveness,

our planning and furthers our effectiveness."

Tenet uses public-health data to monitor for an imminent influx

of Covid-19 patients, and its hospitals typically see surges crest

and begin to subside within four to six weeks, Saum Sutaria, the

company's president, told analysts.

The company now moves swiftly to resume typical operations on

that schedule, Dr. Sutaria said. "We have not had, especially in

recent surges, any need to shut down procedures or elective

surgeries, that's a very important point because we want to

maintain access for the community," he said. "And then as those

cases ramp back down, you know, we ramp back up very, very

quickly."

Many scheduled procedures are common and profitable, and the

loss of that business for weeks earlier this year drained

hospitals' cash reserves. The sector received an influx of federal

aid and loans and has rebounded more quickly than first expected,

however.

HCA monitors local coronavirus case trends and hospital data

including occupancy rates, health-care staff levels and stock of

critical supplies. Color-coded warnings on a dashboard used by HCA

management show markets where surge risk is rising, said Mr.

Foster, the HCA executive.

Local hospital officials also weigh in on the need for more

nurses, doctors, ventilators or other critical supplies. They relay

what they see to corporate headquarters, where executives use

experiences from multiple surges across the country to inform

decisions.

"The net effect of that is they are better able to manage

capacity and therefore defer as long as possible these decisions to

delay or to have to reschedule certain scheduled cases," Mr. Foster

said.

Health-care staff are often critical to meet rising Covid-19

demand without shuttering other services, he said. HCA has 70

nurses at or en route to its two hospitals in El Paso, Texas, and

has another 40 nurses waiting to be deployed. A surge that began in

September but rapidly accelerated this month didn't compel local

hospital executives to postpone surgery until last week, when they

scaled back a limited number of the least-urgent cases, Mr. Foster

said.

Hospital discretion over when to postpone surgery is a switch

from earlier this year, when more than 30 states ordered hospitals

to halt nonessential surgeries. Governors began to roll back

restrictions in late April, but some continue to intervene as the

pandemic flares.

Texas Gov. Greg Abbott in late June ordered hospitals in a

handful of hard-hit counties to halt some procedures, expanding the

temporary restrictions as the state's surge continued.

Other states set no requirements, including Wisconsin, where the

latest state data show the seven-day average hospital

intensive-care Covid-19 patients climbing steadily to reach around

86% occupancy. In June, when the state's Covid-19 hospitalizations

were largely stable, ICU occupancy was about 74% to 77%.

Advocate Aurora, which operates 16 Wisconsin hospitals, hasn't

postponed procedures and has no fixed, statewide threshold for when

to do so, said Jeff Bahr, chief Aurora medical group officer. "A

broad, general overarching rule fails to take into account the

necessary variations from community to community," Dr. Bahr

said.

The system is bringing nurses from its Illinois hospitals to

help in Wisconsin, where it can also transfer patients from crowded

hospitals to those without as many patients. "We are able to

coexist in the midst of Covid," he said.

Advocate Aurora saw hospitalizations drop about 9% during the

first six months of the year compared with the same period in 2019.

Last year's $314 million operating profit in the first half of the

year also evaporated, the system's financial statements show.

Advocate Aurora lost $246 million on operations through June of

this year. It has so far received about $362 million in federal

aid.

Hospitals cannot entirely avoid postponing surgeries as the

pandemic repeatedly surges across the U.S.

Waves of hospitalizations across the South and West this summer

prompted HCA to voluntarily halt electives across about 60% of its

markets, including Florida, Georgia, South Carolina, Tennessee and

Texas. Procedures have since resumed. The simultaneous surge across

so many markets left the company with fewer unaffected hospitals

able to redeploy extra staff to hard-hit areas, Mr. Foster

said.

The Billings Clinic in Montana began in late September to

evaluate each surgical case for urgency and is postponing those

that can wait. Operations have dropped about 10% since.

Billings Clinic's flagship hospital, located in Billings, is now

transferring patients daily to more than a dozen smaller hospitals

nearby to make room for urgent and emergency procedures, Chief

Executive Scott Ellner said.

How long that will remain an option is unclear. Open beds are

dwindling, he said. "They are starting to be stretched."

Write to Melanie Evans at Melanie.Evans@wsj.com

(END) Dow Jones Newswires

October 26, 2020 09:07 ET (13:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

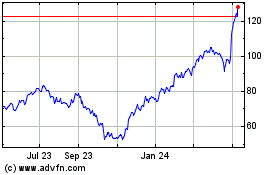

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Mar 2024 to Apr 2024

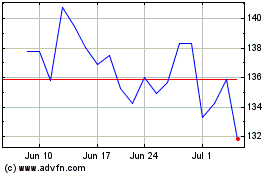

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Apr 2023 to Apr 2024