As filed with the Securities and

Exchange Commission on October 23, 2020

Registration No. 333-__________

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

THE LGL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

38-1799862

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

2525 Shader Road

Orlando, Florida 32804

(407) 298-2000

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Joan Atkinson Nano

Chief Accounting Officer

2525 Shader Road

Orlando, Florida 32804

(407) 298-2000

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Elizabeth Gonzalez-Sussman, Esq.

Kenneth A. Schlesinger, Esq.

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box. ý

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer

|

¨

|

Accelerated filer box

|

¨

|

|

Non-accelerated filer

|

ý

|

Smaller reporting company

|

ý

|

|

|

|

Emerging growth company

|

¨

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

____________________________

CALCULATION OF REGISTRATION FEE

Title of Each Class of

Securities to be Registered

|

Amount to

be Registered

|

Proposed Maximum Offering Price per Warrant

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration Fee

|

|

Warrants to Purchase Shares of Common Stock

|

5,258,320

|

-

|

-

|

-(1)

|

|

Shares of Common Stock, $0.01 par value per share(2)

|

1,051,664(3)

|

$12.50

|

$13,145,800

|

$1,434.21(4)

|

|

|

(1)

|

No registration fee payable in accordance with Rule 457(g) under the Securities Act of 1933, as

amended (the “Securities Act”).

|

|

|

(2)

|

Pursuant to Rule 416, there are also deemed covered hereby such additional securities as may be

issued to prevent dilution resulting from stock splits, stock dividends or similar transactions.

|

|

|

(3)

|

Represents the issuance of up to 1,051,664 shares of our common stock upon exercise of the warrants.

|

|

|

(4)

|

The initial exercise price of the warrants of $12.50 is being used to calculate the registration

fee in accordance with Rule 457(g) of the Securities Act of 1933.

|

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to Section 8(a), may determine.

The information

in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED OCTOBER 23, 2020

PRELIMINARY PROSPECTUS

THE LGL GROUP, INC.

5,258,320 Warrants to Purchase Shares of Common

Stock

1,051,664 Shares of Common Stock, $0.01 par

value per share

We are

distributing at no cost to you, as a holder of our common stock, par value $0.01 per share, transferable warrants to purchase

shares of our common stock. If you own shares of our common stock on [•], 2020, the record date, you will be entitled to

receive one (1) warrant for each share of common stock you own. When exercisable, five (5) warrants will entitle their

holder to purchase one (1) share of our common stock at an exercise price of $12.50 per share. The warrants are

“European style warrants” and will only become exercisable on the earlier of (i) the expiration date, [•],

2025, and (ii) such date that the 30-day volume weighted average price per share, or VWAP, of our common stock is greater

than or equal to $17.50. Once the warrants become exercisable, they may be exercised in accordance with the terms of the

warrant agreement until their expiration at 5:00 p.m., Eastern Time, on the expiration date.

Our board of directors

is not making a recommendation regarding your exercise of the warrants. You should carefully consider whether to exercise them.

We have applied

for listing the warrants on the NYSE American and expect trading to commence on or around [•], 2020 under the symbol LGL

WS. Our common stock is traded on the NYSE American under the symbol LGL.The last reported sales price of our common stock on

the NYSE American on October 22, 2020, the last practicable date before the filing of this prospectus, was $9.35. We urge

you to obtain a current market price for the shares of our common stock before making any investment decision with respect to

the warrants.

Investing in our

securities involves risks. See “Risk Factors” beginning on page 3 of this prospectus.

Neither the Securities

and Exchange Commission, any state securities commission, nor any other regulatory body has approved or disapproved of these securities

or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ___________

__, 2020.

TABLE OF CONTENTS

About this Prospectus

This prospectus

is part of a Registration Statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”).

It is important for you to read and consider all information contained in this prospectus in making your investment decision. You

should also read and consider the information contained in the documents identified under the headings “Incorporation by

Reference” and “Where You Can Find More Information.”

You should rely

only on the information provided in this prospectus, including the information incorporated by reference. We have not authorized

anyone to provide you with different information. You should not assume that the information contained or incorporated by reference

in this prospectus is accurate as of any date other than as of the date of this prospectus, as the case may be, or in the case

of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus or

any sale of our securities.

This prospectus

does not constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction where, or to any person

to whom, it is unlawful to make such offer or solicitation.

Unless the context

otherwise requires, references to “we,” “our,” “us,” or the “Company” in this

prospectus refer to The LGL Group, Inc.

PROSPECTUS SUMMARY

This summary

highlights selected information contained elsewhere or incorporated by reference in this prospectus. This summary may not contain

all the information that you should consider before determining whether to invest in our securities. You should read the entire

prospectus carefully, including the information included in the “Risk Factors” section, as well as our consolidated

financial statements, notes to the consolidated financial statements and the other information incorporated by reference into this

prospectus, as well as the exhibits to the registration statement of which this prospectus is a part, before making an investment

decision.

The Company

Overview

We are a globally-positioned

producer of industrial and commercial products and services. We operate in two identified segments. Our electronic components segment

is currently focused on the design and manufacture of highly-engineered, high reliability frequency and spectrum control products.

These electronic components ensure reliability and security in aerospace and defense communications, low noise and base accuracy

for laboratory instruments, and synchronous data transfers throughout the wireless and Internet infrastructure. Our electronic

instruments segment is focused on the design and manufacture of high-performance Frequency and Time reference standards that form

the basis for timing and synchronization in various applications. The Company was incorporated in 1928 under the laws of the State

of Indiana, and in 2007, the Company was reincorporated under the laws of the State of Delaware as The LGL Group, Inc. We maintain

our executive offices at 2525 Shader Road, Orlando, Florida, 32804. Our telephone number is (407) 298-2000. Our Internet address

is www.lglgroup.com. The information contained on our website is not part of this prospectus. Our common stock is traded on the

NYSE American under the symbol LGL. We have applied for listing the warrants on the NYSE American and expect trading to commence

on or around [•], 2020 under the symbol LGL WS.

We operate through our

two principal subsidiaries, M-tron Industries, Inc. (together with its subsidiaries, “MtronPTI”), which has design

and manufacturing facilities in Orlando, Florida; Yankton, South Dakota; and Noida, India, and Precise Time and Frequency, LLC

(“PTF”), which has a design and manufacturing facility in Wakefield, Massachusetts. We also have local sales and customer

support offices in Sacramento, California; Austin, Texas; and Hong Kong.

Our primary objective

is to create long-term growth with a market-based approach of designing and offering new products to our customers through both

organic research and development, and through strategic partnerships, joint ventures, acquisitions or mergers. We seek to leverage

our core strength as an engineering leader to expand client access, add new capabilities and continue to diversify our product

offerings. Our focus is on investments that will differentiate us, broaden our portfolio and lead toward higher levels of integration

organically and through joint venture, merger and acquisition opportunities. We believe that successful execution of this strategy

will lead to a transformation of our product portfolio towards longer product life cycles, better margins and improved competitive

position.

Recent Developments

ATM Program.

On January 22, 2020, the Company entered into an Open Market Sale Agreement (the “Sales Agreement”) with Jefferies

LLC, as sales agent (“Jefferies”), pursuant to which the Company may offer and sell, from time to time, in what is

deemed to be an “at the market offering” (“ATM Offering”) through Jefferies, shares of the Company’s

common stock, par value $0.01 per share, having an aggregate offering price of up to $15,000,000 (the “Shares”). Shares

sold under the Sales Agreement are issued pursuant to the shelf registration statement on Form S-3 (File No. 333-235767), filed

by the Company with the SEC on December 31, 2019, which was declared effective on January 8, 2020. The Company filed a prospectus

supplement with the SEC on January 23, 2020 in connection with the offer and sale of the Shares pursuant to the Sales Agreement.

During February and March of 2020, there were 263,725 shares sold under the Sales Agreement, at an average price per share of

$13.65 and generating net proceeds of approximately $3,492,000 after brokerage charges of $108,000 were deducted and paid to Jefferies.

As required under the Sales Agreement, the Company obtained the prior consent of Jefferies in order to consummate this offering.

The Sales Agreement and ATM Offering remain in effect in accordance with their terms.

COVID-19. The

global outbreak of coronavirus (“COVID-19”) was declared a pandemic by the World Health Organization and a national

emergency by the U.S. government in March 2020 and has negatively impacted the U.S. and global economy, disrupted global supply

chains, resulted in significant travel and transport restrictions, including mandated closures and orders to “shelter-in-place,”

and created significant disruption of the financial markets.

As a result of the

COVID-19 pandemic, the Company’s operations in India were closed from March 23, 2020 and resumed limited operations on May

7, 2020 with a reduced level of staffing. By the end of June 2020, the Company’s India facilities were fully staffed and

operating at normal capacity. Despite the second quarter revenue decrease associated with the foregoing suspension of operations

in India, the impact of the COVID-19 outbreak has not had a significant impact on the Company to date. Our updated 2020 annual

projection shows some decline, although also not significant. However, the ultimate effect on our future results could be significant

and will largely depend on future developments, which are highly uncertain and cannot be predicted, including new information which

may emerge concerning the severity of COVID-19, the success of actions taken to contain or treat COVID-19, and reactions by consumers,

companies, governmental entities and capital markets.

In accordance with

the Department of Defense guidance issued in March 2020 designating the Defense Industrial Base as a critical infrastructure workforce,

our U.S. production facilities have continued to operate in support of essential products and services required to meet national

security commitments to the U.S. government and the U.S. military, however, facility closures or work slowdowns or temporary stoppages

have occurred and could occur in the future. In addition, other countries have different practices and policies that can affect

our international operations and the operations of our suppliers and customers. In some cases, our facilities are not operating

under full staffing as a result of COVID-19, which could have a longer-term impact. Customer visits and representative training

are being impacted by travel restrictions as a result of COVID-19, which could delay new design wins and future business with

our customers.

The Company has

taken measures to protect the health and safety of our employees, work with our customers to minimize potential disruptions and

support our community in addressing the challenges posed by this global pandemic. The extent of the impact of the COVID-19 pandemic

on our operational and financial performance, including our ability to execute our contracts in the expected timeframe, will depend

on future developments, including the duration and spread of the pandemic and related actions taken by the U.S. government, state

and local government officials, and international governments to prevent disease spread, all of which are uncertain and cannot

be predicted.

An extended period

of global supply chain disruption caused by the response to COVID-19 could impact our ability to perform on our contracts. To date,

we have identified a number of suppliers that have potential delivery impacts due to COVID-19 and, if we are not able to implement

alternatives or other mitigations, contract deliveries could be adversely impacted.

Delays in inspection,

acceptance and payment by our customers, many of whom are teleworking, could also affect our sales and cash flows. This is particularly

an issue with respect to classified work that is unable to be done remotely. Limitations on government operations can also impact

regulatory approvals such as export licenses that are needed for international sales and deliveries. In addition, we could experience

delays in new contract starts or awards of future work as well as the uncertain impact of contract modifications to respond to

the national emergency. Current limitations on travel to customers could impact both domestic and international orders. Government

funding priorities may change as a result of the costs of COVID-19. If significant portions of our workforce are unable to work

effectively, including because of illness, quarantines, absenteeism, government actions, facility closures, travel restrictions

or other restrictions in connection with the COVID-19 pandemic, our operations will be impacted. We may be unable to perform fully

on our contracts and our costs may increase as a result of the COVID-19 outbreak. These cost increases, including costs for employees

whose jobs cannot be performed remotely, may not be fully recoverable under our contracts, or adequately covered by insurance.

The impact of COVID-19 could worsen if there is an extended duration of any COVID-19 outbreak or a resurgence of COVID-19 infection

in affected regions after they have begun to experience improvement.

The continued spread of COVID-19 has also led to disruption and volatility in the global capital markets,

which depending on future developments could impact our capital resources and liquidity in the future. COVID-19 has also caused

volatility in the equity capital markets. We are monitoring the impacts of COVID-19 on the fair value of our assets. While we

do not currently anticipate any material impairments on our assets as a result of COVID-19, future changes in expectations for

sales, earnings and cash flows related to intangible assets, goodwill and other long-lived assets below our current projections

could cause these assets to be impaired. While these are our current assumptions, this is an emerging situation and these could

change, which could affect our outlook.

The Offering

|

Securities Distributed

|

We are

distributing to the holders of our common stock on the record date, at no charge, one (1) warrant for each share of common

stock owned. When exercisable, five (5) warrants will entitle their holder to purchase one (1) share of

our common stock at the exercise price.

|

|

Record Date

|

[•], 2020.

|

|

Exercise Price

|

$12.50.

|

|

Exercise Period

|

The warrants are “European style warrants” and will only become exercisable on the earlier of (i) the expiration date and (ii) such date that the 30-day volume weighted average price per share, or VWAP, of our common stock is greater than or equal to $17.50. Once the warrants become exercisable, they may be exercised in accordance with the terms of the warrant agreement until their expiration at 5:00 p.m., Eastern Time, on the expiration date.

|

|

Expiration Date

|

[•], 2025.

|

|

Transferability of Warrants; Listing

|

The warrants may be sold, transferred or assigned, in whole or in

part. We have applied for listing the Warrants on the NYSE American and expect trading to commence on or around [•], 2020

under the symbol LGLWS. Our common stock is listed on the NYSE American under the symbol LGL.

|

|

Shares Outstanding After Exercise of Warrants

|

5,213,320 shares of our common stock were outstanding as of October 15, 2020. If all of the warrants are exercised in full, there would be 6,264,984 shares of common stock outstanding.

|

|

Use of Proceeds

|

The purpose of this distribution of warrants

is to return a portion of the Company’s future value to our stockholders in a cost-effective manner that gives all of our

stockholders the opportunity to participate in the Company’s growth.

Assuming that all warrants are exercised, the net proceeds from

the exercise of the warrants will be approximately $12.989 million, after deducting our estimated expenses related to this offering.

We intend to use the net proceeds of warrant exercises for general corporate purposes.

|

|

Warrant Agent

|

Computershare Inc. and Computershare Trust Company, N.A.

|

RISK FACTORS

You should carefully

consider the specific risks described below, the risk factors described in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2019, the risk factors described under the caption “Risk Factors” in any applicable prospectus supplement

and any risk factors set forth in our other filings with the SEC made pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange

Act, which are incorporated by reference herein, before making an investment decision. Each of the risks described below and in

these documents could materially and adversely affect our business, financial condition, results of operations and prospects, and

could result in a partial or complete loss of your investment. See “Where You Can Find More Information.”

Risks Related to the Warrants and

Our Common Stock

The warrants may not have any

value.

The warrants are “European style warrants” and will only become exercisable on the earlier of (i) the expiration date, [•], 2025,

and (ii) such date that the 30-day volume weighted average price per share, or VWAP, of our common stock is greater than or equal

to $17.50. Once the warrants become exercisable, they may be exercised in accordance with the terms of the warrant agreement until

their expiration at 5:00 p.m., Eastern Time, on the expiration date.

The warrants have

an exercise price of $12.50 per share. This exercise price does not necessarily bear any relationship to established criteria for

valuation of our common stock, such as book value per share, cash flows, or earnings, and you should not consider this exercise

price as an indication of the current or future market price of our common stock. There can be no assurance that the market price

of our common stock will exceed $12.50 per share at any time on the expiration date of the warrants, [•], 2025, or at any

other time the warrants may be exercised. If the warrants only become exercisable on the expiration date and the market price of

our common stock on such date does not exceed $12.50 per share, your warrants will be of no value.

There can be no

assurance that the 30-day VWAP of our common stock will be greater than or equal to $17.50 at any time prior to the expiration

date of the warrants, [•], 2025. As a result, the warrants may become exercisable only on the expiration date. If the warrants

may be exercised only on the expiration date and you do not exercise your warrants on that date, your warrants will expire and

be of no value.

No warrants will

be exercisable unless at the time of exercise a prospectus relating to our common stock issuable upon exercise of the warrants

is current and the common stock has been registered or qualified or deemed to be exempt under the securities laws of the state

of residence of the holder of the warrants. Under the terms of the warrant agreement, we have agreed to meet these conditions

and use our best efforts to maintain a current prospectus relating to common stock issuable upon exercise of the warrants until

the expiration of the warrants. However, we cannot assure you that we will be able to do so, and if we do not maintain a current

prospectus related to the common stock issuable upon exercise of the warrants, holders will be unable to exercise their warrants

and we will not be required to settle any such warrant exercise. If the prospectus relating to the common stock issuable upon

the exercise of the warrants is not current or if the common stock is not qualified or exempt from qualification in the jurisdictions

in which the holders of the warrants reside, we will not be required to net cash settle or cash settle the warrant exercise, the

warrants may have no value, the market for the warrants may be limited and the warrants may expire worthless.

An active trading market for our

warrants may not develop.

Prior to this offering, there has been no public market for our

warrants. We have applied for listing the warrants on the NYSE American and expect trading to commence on or around [•], 2020

under the symbol LGL WS. Even if the warrants are approved for listing on the NYSE American, an active trading market for our warrants

may not develop or be sustained. If an active market for our warrants does not develop, it may be difficult for you to sell the

warrants without depressing the market price for such securities.

Holders of our warrants will have

no rights as a common stockholder until such holders exercise their warrants and acquire shares of our common stock.

Until warrant holders

acquire shares of our common stock upon exercise of the warrants, warrant holders will have no rights with respect to the shares

of our common stock underlying such warrants. Upon the acquisition of shares of our common stock upon exercise of the warrants,

the holders thereof will be entitled to exercise the rights of a common stockholder only as to matters for which the record date

for the matter occurs after the exercise date of the warrants.

Adjustments to the exercise price

of the warrants, or the number of shares of common stock for which the warrants are exercisable, following certain corporate events

may not fully compensate warrant holders for the value they would have received if they held the common stock underlying the warrants

at the time of such events.

The warrants provide

for adjustments to the exercise price of the warrants following a number of corporate events, including (i) our issuance of a

stock dividend or the subdivision or combination of our common stock, (ii) our issuance of rights, options or warrants to purchase

our common stock at a price below the 10-day VWAP of our common stock, (iii) a distribution of capital stock of the Company or

any subsidiary other than our common stock, rights to acquire such capital stock, evidences of indebtedness or assets, (iv) our

issuance of a cash dividend on our common stock, and (v) certain tender offers for our common stock by the Company or one or more

of our wholly-owned subsidiaries. The warrants also provide for adjustments to the number of shares of common stock for which

the warrants are exercisable following our issuance of a stock dividend or the subdivision or combination of our common stock.

Any adjustment made to the exercise price of the warrants or the number of shares of common stock for which the warrants are exercisable

following a corporate event in accordance with these provisions may not fully compensate warrant holders for the value they would

have received if they held the common stock underlying the warrants at the time of the event.

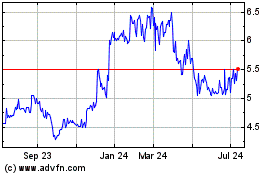

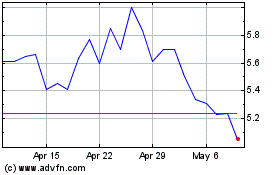

The prices of our common stock

have fluctuated considerably and are likely to remain volatile, in part due to the limited market for our securities.

From January 1,

2020, through October 1, 2020, the high and low sales price for our common stock was $16.55 and $7.36, respectively.

There is a limited public market for our common stock, and we cannot provide assurances that a more active trading market will

develop or be sustained. As a result of low trading volume in our common stock, the purchase or sale of a relatively small number

of securities could result in significant price fluctuations and it may be difficult for holders to sell their securities without

depressing the market price for such securities.

Additionally, the

market prices of our common stock may continue to fluctuate significantly in response to a number of factors, some of which are

beyond our control, including the following:

|

|

·

|

General economic conditions affecting the availability of long-term or short-term credit facilities,

the purchasing and payment patterns of our customers, or the requirements imposed by our suppliers;

|

|

|

·

|

Economic conditions in our industry and in the industries of our

customers and suppliers (including the impact of COVID-19);

|

|

|

·

|

Changes in financial estimates or investment recommendations by securities analysts relating to

our common stock;

|

|

|

·

|

Market reaction to our reported financial results;

|

|

|

·

|

Loss of a major customer;

|

|

|

·

|

Announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships,

joint ventures or capital commitments; and

|

|

|

·

|

Changes in key personnel.

|

Our officers, directors and 10%

or greater stockholders have significant voting power and may vote their shares in a manner that is not in the best interest of

other stockholders.

Our officers, directors

and 10% or greater stockholders control approximately 36.5% of the voting power represented by our outstanding shares of common

stock as of June 30, 2020. If these stockholders act together, they may be able to exert significant control over our

management and affairs requiring stockholder approval, including approval of significant corporate transactions. This concentration

of ownership may have the effect of delaying or preventing a change in control and might adversely affect the market price of our

common stock. This concentration of ownership may not be in the best interests of all of our stockholders.

Provisions in our corporate charter

documents and under Delaware law could make an acquisition of the Company more difficult, which acquisition may be beneficial to

stockholders.

Provisions in our

certificate of incorporation and by-laws, as well as provisions of the General Provisions in our certificate of incorporation and

by-laws, as well as provisions of the General Corporation Law of the State of Delaware (“DGCL”), may discourage, delay

or prevent a merger, acquisition or other change in control of the Company, even if such a change in control would be beneficial

to our stockholders. These provisions include prohibiting our stockholders from fixing the number of directors, and establishing

advance notice requirements for stockholder proposals that can be acted on at stockholder meetings and nominations to our board

of directors (the “Board”).

Additionally, Section

203 of the DGCL prohibits a person who owns in excess of 15% of our outstanding voting stock from merging or combining with us

for a period of three years after the date of the transaction in which the person acquired in excess of 15% of our outstanding

voting stock, unless the merger or combination is approved in a prescribed manner. We have not opted out of the restrictions under

Section 203, as permitted under DGCL.

Risks Related to Our Business and

Industry

We are dependent on a single line

of business.

Prior to our September

2016 acquisition of PTF, we were engaged only in the design, manufacture and marketing of standard and custom-engineered electronic

components that are used primarily to control the frequency or timing of signals in electronic circuits. Although our acquisition

of PTF added an additional product line of electronic instruments that includes highly engineered products for the generation of

time and frequency references for synchronization and control, until we see significant growth from the PTF electronic instruments

product line or develop or acquire additional product lines we will remain dependent on our electronic components line of business.

Virtually all of our 2019 and 2018 revenues came from sales of electronic components, which consist of packaged quartz crystals,

oscillator modules, electronic filters and integrated modules. We expect that this product line will continue to account for substantially

all of our revenues in 2020.

Given our reliance

on this single line of business, any decline in demand for this product line or failure to achieve continued market acceptance

of existing and new versions of this product line may harm our business and our financial condition. Additionally, unfavorable

market conditions affecting this line of business would likely have a disproportionate impact on us in comparison with certain

competitors, who have more diversified operations and multiple lines of business. Should this line of business fail to generate

sufficient sales to support ongoing operations, there can be no assurance that we will be able to develop alternate business lines.

Our operating results vary significantly

from period to period.

We experience fluctuations

in our operating results. Some of the principal factors that contribute to these fluctuations include: changes in demand for our

products; our effectiveness in managing manufacturing processes, costs and inventory; our effectiveness in engineering and qualifying

new product designs with our OEM customers and in managing the risks associated with offering those new products into production;

changes in the cost and availability of raw materials, which often occur in the electronics manufacturing industry and which affect

our margins and our ability to meet delivery schedules; macroeconomic and served industry conditions; and events that may affect

our production capabilities, such as labor conditions and political instability. In addition, due to the prevailing economic climate

and competitive differences between the various market segments which we serve, the mix of sales between our communications, networking,

aerospace, defense, industrial and instrumentation market segments may affect our operating results from period to period.

For the years ended

December 31, 2019 and 2018 and the six month period ended June 30, 2020, we had net income of approximately $ 7,016,000 (including

a $3,107,000 tax benefit), $1,405,000, and $438,000, respectively. Our revenues are derived primarily from MtronPTI, whose future

rate of growth and profitability are highly dependent on the development and growth of demand for our products in the communications,

networking, aerospace, defense, instrumentation and industrial markets, which are cyclical. We cannot be certain whether we will

generate sufficient revenues or sufficiently manage expenses to sustain profitability.

We have a large customer that

accounts for a significant portion of our revenues, and the loss of this customer, or decrease in its demand for our products,

could have a material adverse effect on our results.

In 2019, our largest

customer, an electronics contract manufacturing company, accounted for $5,522,000, or 17.3%, of the Company’s total revenues

compared to $4,436,000, or 17.8%, in 2018. In 2019, the Company’s second largest customer, a defense contract manufacturer,

accounted for $3,187,000, or 10.0%, of the Company’s total revenues compared to $1,617,000, or 7.2%, in 2018. During the

six months ended June 30, 2020, our largest customer and second largest customer represented $2,750,000, or 17.5%, and $2,639,000,

or 16.8%, of the Company’s total revenues, respectively. The loss of either of these customers, or a decrease in their demand

for our products, could have a material adverse effect on our results.

A relatively small number of customers

account for a significant portion of our accounts receivable, and the insolvency of any of these customers could have a material

adverse impact on our liquidity.

As of June 30, 2020,

four of our largest customers accounted for approximately $1,708,000, or 37%, of accounts receivable. As of December 31, 2019,

four of our largest customers accounted for approximately $1,841,000, or 40%, of accounts receivable. As of December 31, 2018,

four of our largest customers accounted for approximately $1,043,000, or 30%, of accounts receivable. The insolvency of any of

these customers could have a material adverse impact on our liquidity.

Our order backlog may not be

indicative of future revenues.

Our order backlog

is comprised of orders that are subject to specific production release, orders under written contracts, oral and written orders

from customers with which we have had long-standing relationships and written purchase orders from sales representatives. Our customers

may order products from multiple sources to ensure timely delivery when backlog is particularly long and may cancel or defer orders

without significant penalty. They also may cancel orders when business is weak and inventories are excessive. As a result, we cannot

provide assurances as to the portion of backlog orders to be filled in a given year, and our order backlog as of any particular

date may not be representative of actual revenues for any subsequent period.

We are a holding company and,

therefore, are dependent upon the operations of our subsidiaries to meet our obligations.

We are a holding

company that transacts business through our operating subsidiaries. Our primary assets are cash and cash equivalents, marketable

securities, the shares of our operating subsidiaries and intercompany loans. Should our cash and cash equivalents be depleted,

our ability to meet our operating requirements and to make other payments will depend on the surplus and earnings of our subsidiaries

and their ability to pay dividends or to advance or repay funds.

Our future rate of growth and

profitability are highly dependent on the development and growth of the communications, networking, aerospace, defense, instrumentation

and industrial markets, which are cyclical.

In 2019 and 2018,

the majority of our revenues were derived from sales to manufacturers of equipment for the defense, aerospace, instrumentation

and industrial markets for frequency and spectrum control devices, including indirect sales through distributors and contract manufacturers.

During 2020, we expect a significant portion of our revenues to continue to be derived from sales to these manufacturers. Often

OEMs and other service providers within these markets have experienced periods of capacity shortage and periods of excess capacity,

as well as periods of either high or low demand for their products. In periods of excess capacity or low demand, purchases of capital

equipment may be curtailed, including equipment that incorporates our products. A reduction in demand for the manufacture and purchase

of equipment for these markets, whether due to cyclical, macroeconomic or other factors, or due to our reduced ability to compete

based on cost or technical factors, could substantially reduce our net sales and operating results and adversely affect our financial

condition. Moreover, if these markets fail to grow as expected, we may be unable to maintain or grow our revenues. The multiple

variables which affect the communications, networking, aerospace, defense, instrumentation and industrial markets for our products,

as well as the number of parties involved in the supply chain and manufacturing process, can impact inventory levels and lead to

supply chain inefficiencies. As a result of these complexities, we have limited visibility to forecast revenue projections accurately

for the near and medium-term timeframes.

The market share of our customers

in the communications, networking, aerospace, defense, instrumentation and industrial markets may change over time, reducing the

potential value of our relationships with our existing customer base.

We have developed

long-term relationships with our existing customers, including pricing contracts, custom designs and approved vendor status. If

these customers lose market share to other equipment manufacturers in the communications, networking, aerospace, defense, instrumentation

and industrial markets with whom we do not have similar relationships, our ability to maintain revenue, margin or operating performance

may be adversely affected.

We may make acquisitions that

are not successful, or we may fail to integrate acquired businesses into our operations properly.

We intend to continue

exploring opportunities to buy other businesses or technologies that could complement, enhance, or expand our current business

or product lines, or that might otherwise offer us growth opportunities. We may have difficulty finding such opportunities

or, if such opportunities are identified, we may not be able to complete such transactions for reasons including a failure to secure

necessary financing.

Any transactions

that we are able to identify and complete may involve a number of risks, including:

|

|

·

|

The diversion of our management’s attention from the management of our existing business

to the integration of the operations and personnel of the acquired or combined business or joint venture;

|

|

|

·

|

Material business risks not identified in due diligence;

|

|

|

·

|

Possible adverse effects on our operating results during the integration process;

|

|

|

·

|

Substantial acquisition-related expenses, which would reduce our net income, if any, in future

years;

|

|

|

·

|

The loss of key employees and customers as a result of changes in management; and

|

|

|

·

|

Our possible inability to achieve the intended objectives of the transaction.

|

In addition, we

may not be able to integrate, operate, maintain or manage, successfully or profitably, our newly acquired operations or employees.

We may not be able to maintain uniform standards, controls, policies and procedures, and this may lead to operational inefficiencies.

Any of these difficulties

could have a material adverse effect on our business, financial condition, results of operations and cash flows.

If we are unable to introduce

innovative products, demand for our products may decrease.

Our future operating

results are dependent on our ability to develop, introduce and market innovative products continually, to modify existing products,

to respond to technological change and to customize some of our products to meet customer requirements. There are numerous risks

inherent in this process, including the risks that we will be unable to anticipate the direction of technological change or that

we will be unable to develop and market new products and applications in a timely or cost-effective manner to satisfy customer

demand.

Our markets are highly competitive,

and we may lose business to larger and better-financed competitors.

Our markets are

highly competitive worldwide, with low transportation costs and few import barriers. We compete principally on the basis of product

quality and reliability, availability, customer service, technological innovation, timely delivery and price. Within the industries

in which we compete, competition has become increasingly concentrated and global in recent years.

Many of our major

competitors, some of which are larger than us, and potential competitors have substantially greater financial resources and more

extensive engineering, manufacturing, marketing and customer support capabilities. If we are unable to successfully compete against

current and future competitors, our operating results will be adversely affected.

Our success depends on our ability

to retain key management and technical personnel and attracting, retaining and training new technical personnel.

Our future growth

and success will depend in large part upon our ability to recruit highly-skilled technical personnel, including engineers, and

to retain our existing management and technical personnel. The labor markets in which we operate are highly competitive and some

of our operations are not located in highly populated areas. As a result, we may not be able to recruit and retain key personnel.

Our failure to hire, retain or adequately train key personnel could have a negative impact on our performance.

We purchase certain key components

and raw materials from single or limited sources and could lose sales if these sources fail to fulfill our needs for

any reason, including the inability to obtain these key components or raw materials due to the recent novel coronavirus (COVID-19)

outbreak.

If single-source

components or key raw materials were to become unavailable on satisfactory terms, and we could not obtain comparable replacement

components or raw materials from other sources in a timely manner, our business, results of operations and financial condition

could be harmed. On occasion, one or more of the components used in our products have become unavailable, resulting in unanticipated

redesign and related delays in shipments. Recently, the coronavirus outbreak has caused a global pandemic that has disrupted supply

chains and the ability to obtain components and raw materials around the world for all companies, including us. We cannot give

assurance that we will be able to obtain the necessary components and raw materials necessary to conduct our business during the

coronavirus pandemic, and we also cannot give assurance that similar delays will not occur in the future. In addition, our suppliers

may be impacted by compliance with environmental regulations including RoHS and Waste Electrical and Electronic Equipment (“WEEE”),

which could disrupt the supply of components or raw materials or cause additional costs for us to implement new components or raw

materials into our manufacturing processes.

As a supplier to U.S. Government

defense contractors, we are subject to a number of procurement regulations and other requirements and could be adversely affected

by changes in regulations or any negative findings from a U.S. Government audit or investigation.

A number of our

customers are U.S. Government contractors. As one of their suppliers, we must comply with significant procurement regulations and

other requirements. We also maintain registration under the International Traffic in Arms Regulations for all of our production

facilities. One of those production facilities must comply with additional requirements and regulations for its production processes

and for selected personnel in order to maintain the security of classified information. These requirements, although customary

within these markets, increase our performance and compliance costs. If any of these various requirements change, our costs of

complying with them could increase and reduce our operating margins.

We operate in a

highly regulated environment and are routinely audited and reviewed by the U.S. Government and its agencies such as the Defense

Contract Audit Agency and Defense Contract Management Agency. These agencies review our performance under our contracts, our cost

structure and our compliance with applicable laws, regulations, and standards, as well as the adequacy of, and our compliance with,

our internal control systems and policies. Systems that are subject to review include our purchasing systems, billing systems,

property management and control systems, cost estimating systems, compensation systems and management information systems.

Any costs found

to be improperly allocated to a specific contract will not be reimbursed or must be refunded if already reimbursed. If an audit

uncovers improper or illegal activities, we may be subject to civil and criminal penalties and administrative sanctions, which

may include termination of contracts, forfeiture of profits, suspension of payments, fines and suspension, or prohibition from

doing business as a supplier to contractors who sell products and services to the U.S. Government. In addition, our reputation

could be adversely affected if allegations of impropriety were made against us.

From time to time,

we may also be subject to U.S. Government investigations relating to our or our customers’ operations and products,

and are expected to perform in compliance with a vast array of federal laws, including the Truth in Negotiations Act, the False

Claims Act, the International Traffic in Arms Regulations promulgated under the Arms Export Control Act, and the Foreign Corrupt

Practices Act. We or our customers may be subject to reductions of the value of contracts, contract modifications or termination,

and the assessment of penalties and fines, which could negatively impact our results of operations and financial condition, or

result in a diminution in revenue from our customers, if we or our customers are found to have violated the law or are indicted

or convicted for violations of federal laws related to government security regulations, employment practices or protection of the

environment, or are found not to have acted responsibly as defined by the law. Such convictions could also result in suspension

or debarment from serving as a supplier to government contractors for some period of time. Such convictions or actions could have

a material adverse effect on us and our operating results. The costs of cooperating or complying with such audits or investigations

may also adversely impact our financial results.

Our products are complex and may

contain errors or design flaws, which could be costly to correct.

When we release

new products, or new versions of existing products, they may contain undetected or unresolved errors or defects. The vast majority

of our products are custom-designed for requirements of specific OEM systems. The expected business life of these products ranges

from less than one year to more than 10 years depending on the application. Some of the customizations are modest changes to existing

product designs while others are major product redesigns or new product platforms.

Despite testing,

errors or defects may be found in new products or upgrades after the commencement of commercial shipments. Undetected errors

and design flaws have occurred in the past and could occur in the future. These errors could result in delays, loss of market

acceptance and sales, diversion of development resources, damage to the Company’s reputation, product liability claims and

legal action by its customers and third parties, failure to attract new customers and increased service costs.

Communications and network infrastructure

equipment manufacturers increasingly rely upon contract manufacturers, thereby diminishing our ability to sell our products directly

to those equipment manufacturers.

There is a continuing

trend among communications and network infrastructure equipment manufacturers to outsource the manufacturing of their equipment

or components. As a result, our ability to persuade these OEMs to utilize our products in customer designs could be reduced and,

in the absence of a manufacturer’s specification of our products, the prices that we can charge for them may be subject to

greater competition.

Future changes in our environmental

liability and compliance obligations may increase costs and decrease profitability.

Our present and

past manufacturing operations, products, and/or product packaging are subject to environmental laws and regulations governing air

emissions, wastewater discharges, and the handling, disposal and remediation of hazardous substances, wastes and other chemicals.

In addition, more stringent environmental regulations may be enacted in the future, and we cannot presently determine the modifications,

if any, in our operations that any future regulations might require, or the cost of compliance that would be associated with these

regulations.

Environmental laws

and regulations may cause us to change our manufacturing processes, redesign some of our products, and change components to eliminate

some substances in our products in order to be able to continue to offer them for sale.

We have significant international

operations and sales to customers outside of the United States that subject us to certain business, economic and political risks.

We have office and

manufacturing space in Noida, India, and a sales office in Hong Kong. Additionally, foreign revenues (primarily to Malaysia) for

the years ended December 31, 2019 and December 31, 2018 and the six month period ended June 30, 2020 accounted for 26.6%, 24.9%,

and 26.1% of our consolidated revenues for the respective periods. We anticipate that sales to customers located outside of the

United States will continue to be a significant part of our revenues for the foreseeable future. Our international operations and

sales to customers outside of the United States subject our operating results and financial condition to certain business, economic,

political, health, regulatory and other risks, including but not limited to:

|

|

·

|

Political and economic instability in countries in which our products are manufactured and sold;

|

|

|

·

|

Expropriation or the imposition of government controls;

|

|

|

·

|

Responsibility to comply with anti-bribery laws such as the U.S. Foreign Corrupt Practices Act

and similar anti-bribery laws in other jurisdictions;

|

|

|

·

|

Sanctions or restrictions on trade imposed by the United States government;

|

|

|

·

|

Export license requirements;

|

|

|

·

|

Currency controls or fluctuations in exchange rates;

|

|

|

·

|

High levels of inflation or deflation;

|

|

|

·

|

Difficulty in staffing and managing non-U.S. operations;

|

|

|

·

|

Greater difficulty in collecting accounts receivable and longer payment cycles;

|

|

|

·

|

Changes in labor conditions and difficulties in staffing and managing international operations;

|

|

|

·

|

The impact of the current coronavirus outbreak; and

|

|

|

·

|

Limitations on insurance coverage against geopolitical risks, natural disasters and business operations.

|

Additionally, to

date, very few of our international revenue and cost obligations have been denominated in foreign currencies. As a result, changes

in the value of the United States dollar relative to foreign currencies may affect our competitiveness in foreign markets. We do

not currently engage in foreign currency hedging activities but may do so in the future to the extent that we incur a significant

amount of foreign-currency denominated liabilities.

We rely on information technology

systems to conduct our business, and disruption, failure or security breaches of these systems could adversely affect our business

and results of operations.

We rely on information technology

(“IT”) systems in order to achieve our business objectives. We also rely upon industry accepted security measures and

technology to securely maintain confidential information maintained on our IT systems. However, our portfolio of hardware and software

products, solutions and services and our enterprise IT systems may be vulnerable to damage or disruption caused by circumstances

beyond our control such as catastrophic events, power outages, natural disasters, computer system or network failures, computer

viruses, cyber-attacks or other malicious software programs. The failure or disruption of our IT systems to perform as anticipated

for any reason could disrupt our business and result in decreased performance, significant remediation costs, transaction errors,

loss of data, processing inefficiencies, downtime, litigation and the loss of suppliers or customers. A significant disruption

or failure could have a material adverse effect on our business operations, financial performance and financial condition.

Cybersecurity risks and cyber

incidents may adversely affect our business by causing a disruption to our operations, a compromise or corruption of our confidential

information, and/or damage to our business relationships, all of which could negatively impact our financial results.

A cyber incident

is considered to be any adverse event that threatens the confidentiality, integrity or availability of our information resources.

These incidents may be an intentional attack or an unintentional event and could involve gaining unauthorized access to our information

systems for purposes of misappropriating assets, stealing confidential information, corrupting data or causing operational disruption.

The result of these incidents may include disrupted operations, misstated or unreliable financial data, liability for stolen assets

or information, increased cybersecurity protection and insurance costs, litigation and damage to our tenant and investor relationships.

As our reliance on technology increases, so will the risks posed to our information systems, both internal and those we outsource.

There is no guarantee that any processes, procedures and internal controls we have implemented or will implement will prevent

cyber intrusions, which could have a negative impact on our financial results, operations, business relationships or confidential

information.

If we fail to correct any material

weakness that we identify in our internal control over financial reporting or otherwise fail to maintain effective internal control

over financial reporting, we may not be able to report our financial results accurately and timely, in which case our business

may be harmed, investors may lose confidence in the accuracy and completeness of our financial reports and the price of our common

stock may decline.

Our management

is responsible for establishing and maintaining adequate internal control over financial reporting and for evaluating and reporting

on our system of internal control. Our internal control over financial reporting is a process designed to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with GAAP. We are required to comply with the Sarbanes-Oxley Act and other rules that govern public companies.

If we identify

material weaknesses in our internal control over financial reporting in the future, if we cannot comply with the requirements

of the Sarbanes-Oxley Act in a timely manner or attest that our internal control over financial reporting is effective, or if

our independent registered public accounting firm cannot express an opinion as to the effectiveness of our internal control over

financial reporting when required, we may not be able to report our financial results accurately and timely. As a result, investors,

counterparties and consumers may lose confidence in the accuracy and completeness of our financial reports. Accordingly, access

to capital markets and perceptions of our creditworthiness could be adversely affected, and the market price of our common stock

could decline. In addition, we could become subject to investigations by the stock exchange on which our securities are listed,

the SEC or other regulatory authorities, which could require additional financial and management resources. These events could

have a material and adverse effect on our business, operating results, financial condition and prospects.

The Company has made a material

investment in a special purpose acquisition company that may not be successful.

The Company has

invested $3.35 million in LGL Systems Acquisition Holding Company, LLC, who serves as the sponsor (the “Sponsor”) of

LGL Systems Acquisition Corp., a special purpose acquisition company, commonly referred to as a “SPAC,” or blank check

company, formed for the purpose of effecting a business combination in the aerospace, defense and communications industries (the “SPAC”).

The Sponsor holds

20% of the shares in the SPAC along with 5,200,000 warrants at a strike price of $11.50. On November 7, 2019, the SPAC raised $172.5

million through the sale of 17.25 million shares and was listed as a publicly traded company on the NASDAQ Capital Market under

the ticker symbol “DFNS.” The initial public offering (the “IPO”) closed on November 12, 2019. Prior to

and immediately following the IPO, the Sponsor held 4,312,500 shares of the SPAC, which are restricted and non-tradable.

If the SPAC is able

to complete a business combination it could be material to the Company. If the SPAC does not complete a business combination within

24 months from the closing of the SPAC’s initial public offering, the proceeds from the sale of the private warrants will

be used to fund the redemption of the shares sold in the SPAC’s initial public offering (subject to the requirements of applicable

law), and the private warrants will expire worthless. There is no assurance that the SPAC will be successful in completing a business

combination or that any business combination will be successful. The Company can lose its entire investment in the SPAC if a business

combination is not completed within 24 months or if the business combination is not successful, which may adversely impact the

Company’s stockholder value.

The ongoing effects of the COVID-19

pandemic and associated global economic disruption and uncertainty have affected, and may further affect, our business, results

of operations and financial condition.

As previously indicated

in our Annual Report on Form 10-K for the year ended December 31, 2019, our results of operations are affected by certain economic

factors, including the closure of our facilities located in Noida, India on March 23, 2020. This facility resumed limited

operations on May 7, 2020 and was in full operation at the end of June 2020. The broader implications of the COVID-19 pandemic

on our results of operations and overall financial performance remain uncertain as well as the extent to which it will affect

our revenues and earnings. Although we believe we have sufficient liquidity and capital resources to effectively continue operations

for the foreseeable future, continued deterioration of worldwide credit and financial markets may limit our ability to raise capital

and financing may not be available to us in sufficient amounts, on acceptable terms, or at all. If we are unable to access sufficient

capital on acceptable terms, our business could be adversely impacted.

In an effort to protect

the health and safety of our employees, we implemented various measures to reduce the impact of COVID-19 across our organization,

while also working to maintain business continuity. Consistent with government guidelines and mandates, these initiatives included

the adoption of social distancing policies, work-at-home arrangements, and suspending employee travel. Currently, while a few of

our administrative employees are working remotely from home in an effort to reduce the spread of the virus, most of our employees

are unable to work from home as we are primarily a manufacturer of products for the defense and aerospace industries and our employees

work must be performed within a controlled environment. A decline in the health and safety of our employees, including key employees,

or material disruptions to their ability to work either remotely or at one of our manufacturing facilities, could negatively affect

our ability to operate our business normally and have a material adverse impact on our results of operations or financial condition.

To the extent that

the COVID-19 virus continues to spread and affect the employee base or operations of our materials providers, disruptions in or

the inability to provide materials to us could negatively impact our business operations.

FORWARD-LOOKING STATEMENTS

Information included

or incorporated by reference in this prospectus may contain forward-looking statements. Forward-looking statements, which involve

assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or the negative of these words or other variations on these words or comparable terminology, as they relate to future periods.

Examples of forward-looking

statements include, but are not limited to, statements we make regarding the Company’s efforts to grow revenue, the Company’s

expectations regarding fulfillment of backlog, the results of introduction of a new product line, future benefits to operating

margins and the adequacy of the Company’s cash resources.

Forward-looking

statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions.

As forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances

that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements.

They are neither statements of historical fact nor guarantees of assurances of future performance. Important factors that could

cause actual results to differ materially from those in the forward-looking statements include national and global economic, business,

competitive, market and regulatory conditions and the factors described under “Risk Factors” in this prospectus, in

our Annual Report on Form 10-K for the year ended December 31, 2019 and our Quarterly Reports on Form 10-Q for the quarters ended

March 31, 2020 and June 30, 2020.

Further, we do not

undertake any obligation to publicly update any forward-looking statements. As a result, you should not place undue reliance on

these forward-looking statements.

Use

of Proceeds

We will not receive

any proceeds from the distribution of the warrants. Assuming that all warrants are exercised, the net proceeds from the exercise

of the warrants will be approximately $12.989 million, after deducting our estimated expenses related to this offering including

legal, accounting, listing, and exercise fees.

We intend to use

the net proceeds from this offering for general corporate purposes, which may include working capital, general and administrative

expenses, capital expenditures and implementation of our strategic priorities. Pending the application of the net proceeds, we

may invest the proceeds in short-term, interest bearing, investment-grade marketable securities or money market obligations.

PLAN OF DISTRIBUTION

As soon as practicable

after the record date for the dividend, we will distribute the warrants to individuals who owned shares of our common stock on

the record date. If the warrants become exercisable as outlined in the section “Description of Warrants – Exercisability,” the warrant agent will notify The Depository Trust Company, New York, New York, known as DTC, and mail to each warrant holder exercise

forms detailing the terms and procedure for exercise of the warrants. As warrants are exercised, the warrant agent will deliver

the shares of our common stock issued upon exercise of the warrants to stockholders and forward the proceeds from the warrant exercises

to us.

To the extent that

our directors and officers held shares of our common stock as of the record date, they will receive the warrants. Our directors

and officers may also sell some or all of their warrants or their shares upon exercise of such warrants. This prospectus covers

any such sales.

We have agreed

to pay the warrant agent and transfer agent customary fees plus certain expenses in connection with the warrants. We have not

employed any brokers, dealers or underwriters in connection with the distribution of the warrants or any exercise or resale of

the warrants.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market for Common Equity

Our common stock

is traded on the NYSE American under the symbol LGL. We have applied for listing the warrants on the NYSE American and expect trading

to commence on or around [•], 2020 under the symbol LGL WS. The last reported sales price of our common stock on the NYSE

American on October 22, 2020, the last practicable date before the filing of this prospectus, was $9.35.

Based upon information

furnished by our transfer agent, at [•], 2020, we had [•] holders of record of our common stock.

5,213,320

shares of our common stock were outstanding as of October 15, 2020. If all of the warrants are exercised in full, there would

be 6,264,984 shares of common stock outstanding.

Stock Repurchase Program

On August 29, 2011,

our Board authorized the Company to repurchase up to 100,000 shares of its common stock in accordance with applicable securities

laws. This authorization increased the total number of shares authorized and available for repurchase under the Company’s

existing share repurchase program to 540,000 shares, at such times, amounts and prices as the Company shall deem appropriate. Subject

to certain safe harbor rules, the timing, amounts, and manner in which the Company can repurchase shares is tied to prevailing

trading volumes and other limitations, which includes a general limitation to 25% of the average daily trading volume based on

the most recent prior four weeks. As of June 30, 2020, the Company had repurchased a total of 81,584 shares of common stock under

this program at a cost of $580,000, which shares are currently held in treasury.

ATM Program

On January 22,

2020, the Company entered into the Sales Agreement with Jefferies, as sales agent, pursuant to which the Company may offer and

sell, from time to time, through Jefferies, the Shares having an aggregate offering price of up to $15,000,000. Shares sold under

the Sales Agreement are issued pursuant to the shelf registration statement on Form S-3 (File No. 333-235767), filed by the Company

with the SEC on December 31, 2019, which was declared effective on January 8, 2020. The Company filed a prospectus supplement

with the SEC on January 23, 2020 in connection with the offer and sale of the Shares pursuant to the Sales Agreement. During February

and March of 2020, there were 263,725 shares sold under the Sales Agreement, at an average price per share of $13.65 and generating

net proceeds of approximately $3,492,000 after brokerage charges of $108,000 were deducted and paid to Jefferies. As required

under the Sales Agreement, the Company obtained the prior consent of Jefferies in order to consummate this offering. The Sales

Agreement and ATM Offering remain in effect in accordance with their terms.

Dividend Policy

Our Board has adhered

to a practice of not paying cash dividends. This policy takes into account our long-term growth objectives, including our anticipated

investments for organic growth, potential technology acquisitions or other strategic ventures, and stockholders’ desire for

capital appreciation of their holdings. In addition, the covenants under MtronPTI’s credit facility effectively place certain

limitations on its ability to make certain payments to its parent, including but not limited to payments of dividends and other

distributions, which effectively could limit the Company’s ability to pay cash dividends to stockholders. No cash dividends

have been paid to the Company’s stockholders since January 30, 1989, and none are expected to be paid for the foreseeable

future.

DESCRIPTION OF CAPITAL STOCK

General

This prospectus

describes the general terms of our common stock and other securities we may issue. For a more detailed description of these securities,

you should read the applicable provisions of Delaware law and our Certificate of Incorporation and by-laws, as amended (the “By-laws”).

When we offer to sell a particular series of these securities, we will describe the specific terms of the series in an applicable

prospectus or prospectus supplement. Accordingly, for a description of the terms of any series of securities, you must refer to

both the prospectus supplement relating to that series and the description of the securities contained in this prospectus. To the

extent the information contained in a prospectus supplement differs from this summary description, you should rely on the information

in the prospectus supplement.

Under our Certificate

of Incorporation, the total number of shares of all classes of stock that we have authority to issue is 10,000,000, consisting

entirely of shares of our common stock. As of October 15, 2020, there were 5,213,320 shares of common stock outstanding.

The description

of our capital stock is qualified by reference to our Certificate of Incorporation and our By-laws, which are incorporated by reference

as exhibits into the Registration Statement of which this prospectus is part.

Common Stock

Subject to the prior

rights of holders of all classes of stock at the time outstanding having prior rights as to dividends, the holders of common stock

are entitled to receive such dividends, if any, as may from time to time be declared by our Board of Directors out of funds legally

available therefor. Under our Certificate of Incorporation, holders of common stock are entitled to one vote per share, and are

entitled to vote upon such matters and in such manner as may be provided by law. Holders of common stock have no preemptive, conversion,

redemption or sinking fund rights. Subject to the prior rights of holders of all classes of stock at the time outstanding having

prior rights as to liquidation, holders of common stock, upon the liquidation, dissolution or winding up of the Company, are entitled

to share equally and ratably in the assets of the Company. The outstanding shares of common stock are, and the shares of common

stock to be offered hereby when issued will be, fully paid and non-assessable. The rights, preferences and privileges of holders

of common stock are subject to any series of preferred stock that the Company may authorize and issue in the future.

Anti-Takeover Effects of Certain