Ericsson Reports Swing to Net Profit, Higher Revenue in 3Q; Backs Guidance -- Earnings Review

October 21 2020 - 8:12AM

Dow Jones News

By Dominic Chopping

STOCKHOLM--Sweden's Ericsson AB reported third-quarter earnings

Wednesday. Here's what we watched:

NET PROFIT: The telecom-equipment maker posted a net profit

attributable to shareholders of 5.35 billion Swedish kronor ($608.7

million), compared with a loss of SEK6.23 billion in the

year-earlier period. Analysts had expected SEK4.15 billion,

according to a consensus provided by FactSet. The company booked a

SEK11.5 billion provision to settle a U.S. corruption probe in the

corresponding quarter last year.

REVENUE: Sales ticked 0.6% higher to SEK57.47 billion, against

SEK57.16 billion expected.

WHAT WE WATCHED:

5G PROGRESS: Ericsson noted high activity levels in North East

Asia and North America with increased demand for 5G. Ericsson said

5G contracts in mainland China have developed according to plan,

contributing positively to profits in 3Q and are expected to

improve further.

DEVELOPED VS EMERGING MARKETS: Underlying business fundamentals

remain strong in North America, driven by consolidation in the U.S.

operator market, pending spectrum auctions, and increased demand

for 5G, the company said. Its business in Europe grew based on

several footprint gains, and while the pandemic has hurt revenues

for several of its customers, and in some cases this has led to a

reduction of capex, Ericsson said it has not seen any negative

impact on its business, largely due to footprint gains. However,

the pandemic negatively impacted sales in Latin America and

Africa.

MARGINS: Reported gross margin was 43.1% in the quarter from

37.7% last year, driven by strong margin improvements in all

segments. Increased software sales contributed to the higher margin

in networks and digital services. Managed services gross margin

improved mainly as an effect of efficiency gains. Reported gross

margin also increased to from 37.6% in the second quarter of this

year, primarily driven by the increased gross margin in networks as

a result of the business mix and higher software sales.

GUIDANCE: The global radio access network equipment market is

estimated to grow by 8%, from a previous expectation of 4% for

full-year 2020. In China this is expected to grow by 33%, while the

global RAN market without China is expected to be flat. Ericsson

said year-to-date results strengthen its confidence in hitting the

2020 group target of sales between SEK230 billion and SEK240

billion, with an operating margin excluding restructuring charges

at more than 10% of sales. The company also maintains its 2022

margin target of 12%-14%, excluding restructuring charges.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

October 21, 2020 07:57 ET (11:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

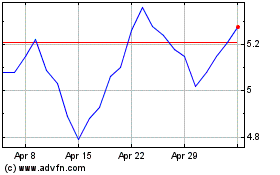

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

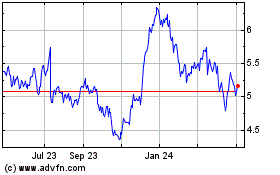

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024