P&G Cleans Up on Pandemic-Driven Hygiene

October 20 2020 - 7:29AM

Dow Jones News

By Sharon Terlep and Saabira Chaudhuri

Procter & Gamble Co. reported its biggest global sales

increase in 15 years as the world's consumers spent more to keep

their homes and themselves clean during the coronavirus

pandemic.

Even as the economic picture grew bleaker around the world, the

maker of Tide detergent and Gillette razors said demand grew for

pricier products. It logged the strongest growth in the unit that

sells Swiffer mops and Dawn dish soaps.

Earlier Tuesday, Lysol maker Reckitt Benckiser Group PLC

reported its sharpest quarterly sales growth on record, driven by

its hygiene unit.

Where sales gains early in the coronavirus pandemic were driven

by consumers stocking up amid lockdowns and shortages of products

such as paper towel and toilet paper, P&G said demand in recent

months appears driven by an increased focus on home cleaning and

personal hygiene as people remain home more.

"The dynamics associated with this period of economic difficulty

are different than in the past," P&G finance chief Jon Moeller

said in an interview. "Large portions of peoples' budgets are not

being spent on travel, leisure and hospitality, which leaves them

more money in the budget."

Reckitt Chief Executive Laxman Narasimhan said he thinks renewed

interest in hygiene will outlast the pandemic: "Consumers are

adopting better hygiene practices," he said in a call with

journalists.

Lysol maker Reckitt Benckiser Group PLC and Clorox Co. have

reported booming demand for their cleaning products, straining

their abilities to keep stores stocked with their disinfectant

sprays or wipes.

Reckitt said it had doubled capacity for Lysol and other major

disinfectant products from a year ago -- through capital investment

and by adding contract packers and raw material suppliers. It said

it was "well positioned" to meet future demand.

P&G and its peers have cut back on deals and discounts as

demand is so high that consumers buy whatever they can find.

P&G said organic sales, a measure that excludes currency

moves, acquisitions and divestitures, rose 9% for the quarter ended

Sept. 30 compared with a year earlier. Increased consumption drove

most of that growth, but consumers also paid higher prices and

shifted toward more premium products, such as Tide laundry pods and

scented laundry beads, the company said.

Sales of private-label household and personal-care products fell

1% overall in the U.S. for the four-week period ended Oct. 3,

according to Nielsen, a signal that consumers are leaning toward

higher priced, name-brand products.

The biggest growth was in P&G's home-care unit, where sales

jumped 30%. The unit's products include Swiffer, Febreze air

freshener and Mr. Clean. An antibacterial surface cleaner, Microban

24, launched in February and initially planned as a niche product,

is on track to reach $200 million in annual sales.

Overall, P&G said net sales for the quarter were $19.3

billion, up 9% versus the prior year. Net income was $4.31 billion,

or $1.63 per diluted share, an increase of 20% from the prior

year.

The results were ahead of Wall Street's expectations. Analysts

polled by FactSet predicted sales of $18.35 billion and earnings of

$1.41 per diluted share.

The company raised its guidance for sales and profit gains for

the fiscal year ending in June 2021. It now expects organic sales

to rise between 4% and 5% for the year, compared with its prior

forecast of 2% to 4% growth.

Reckitt, which in addition to Lysol and Finish dishwasher

tablets, sells big international brands like Dettol disinfectant

and Harpic toilet cleaner, said its third-quarter comparable sales

rose 13.3% compared with the year before, beating analysts'

estimates.

Revenue rose to GBP3.51 billion ($4.55 billion) from GBP3.29

billion. Reckitt didn't report net income for the quarter.

Its hygiene unit logged a jump of 19.5% in sales, driven by

sales of Lysol, Finish and Air Wick. Reckitt recently launched a

new business selling its cleaning expertise to hotel operators,

airlines and other companies and on Tuesday the company said it had

added Amtrak and Airbnb Inc. to its list of clients.

Write to Sharon Terlep at sharon.terlep@wsj.com and Saabira

Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 20, 2020 07:14 ET (11:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

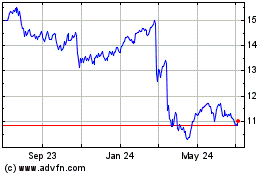

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

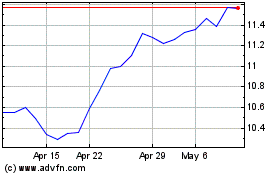

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Apr 2023 to Apr 2024