Oil Giant Total Pledges Renewable Power Push

September 30 2020 - 3:44PM

Dow Jones News

By Sarah McFarlane

Total SA pledged to ramp up its spending on renewable energy and

reduce its dependence on petroleum, the latest move by a major oil

company toward cleaner power.

The French company said Wednesday that it plans to spend $3

billion a year on renewables by 2030, about 20% of its annual

investment budget and up from $2 billion this year. Over the same

period, it said it also plans to reduce its sales of oil products

such as gasoline and diesel by 30%, while increasing its sales of

natural gas, electricity and biofuels.

Overall, Total said its energy production was set to grow by a

third in the coming decade. Of that, roughly half would come from

liquefied natural gas and the other half from electricity -- mostly

from growth in solar and wind power.

"We are also convinced that this is the right direction," Chief

Executive Patrick Poyanne told investors at an event detailing the

company's plans.

However, he also said Total would remain committed to its core

oil and gas business. "We consider that maintaining an oil and gas

business is a foundation of the transformation, because it will

provide to us the cash flow that we need."

The move comes as Total expects oil demand to peak by 2030 as

demand for electricity and LNG rises.

Total's green investment plans are similar to those outlined by

rival BP PLC earlier this year, although on a slower time

frame.

BP intends to increase its low-carbon investments to 20% of its

budget by 2025 and cut its oil-and-gas output by 40% in the coming

decade. The British company has also said it plans to increase

renewable-power output.

Major oil companies have said that the coronavirus pandemic

could speed up the transition from fossil fuels toward low-carbon

energy, which has been under way for several years amid concern

about global warming. The pandemic has sapped demand for oil,

hitting prices and corporate profits.

In response, these companies have cut their workforces, written

down the value of their assets and, in the case of Royal Dutch

Shell PLC and BP, cut dividends.

Total has resisted taking some of these measures. On Wednesday,

Mr. Pouyanne said the company intended to maintain its dividend and

didn't plan to lay off staff.

Mr. Poyanne said he hoped the shift into renewables would boost

the company's valuation, and that its dividend would help

differentiate Total from other majors making the move. Oil stocks

have fallen out of favor in recent years, while renewable energy

companies have fared better.

However, some investors say they're concerned that oil companies

might damage profits by moving into areas like wind and solar

because they lack experience, competition is rising and returns are

typically lower. Total said it expects its renewable-energy

projects to generate returns of 10%, below its target of 15% given

last year. The industry benchmark for returns on oil and gas

projects is around 15%.

Oil companies have struggled to attract investors amid

uncertainty over the speed and timing of the transition to

low-carbon energy. The pandemic has exacerbated that slump, with

shares in the world's oil majors taking a beating this year.

However, Total's stock price has fared better than its peers,

down about 14% over the past three months, compared with drops of

over 20% for other majors.

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

September 30, 2020 15:29 ET (19:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

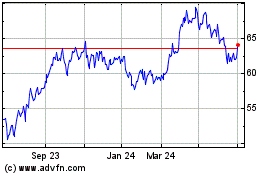

TotalEnergies (EU:TTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

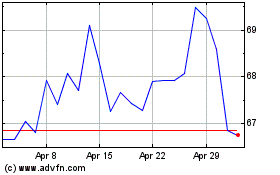

TotalEnergies (EU:TTE)

Historical Stock Chart

From Apr 2023 to Apr 2024