NextEra Energy Made Takeover Approach to Duke Energy -- Update

September 29 2020 - 8:07PM

Dow Jones News

By Cara Lombardo, Maureen Farrell and Dana Cimilluca

NextEra Energy Inc. recently made a takeover approach to Duke

Energy Corp., according to people familiar with the matter, testing

the waters for what would be a $60 billion-plus combination of two

southern utilities.

Duke rebuffed the approach but NextEra is still interested in

pursuing a deal, some of the people said. There is no guarantee

NextEra will do so and if it does, that a deal would result.

Should there be one, it would be big. Duke, based in Charlotte,

N.C., has a market value of roughly $61 billion following a 14%

decline in its share price this year, and an acquisition of the

company could be the largest utility deal ever and the biggest

merger so far this year.

With a market value of about $139 billion after its stock rose

22% so far this year, Juno Beach, Fla.-based NextEra is the largest

public utility company in the U.S.

It owns Florida Power & Light Co., which has more than 5

million customers in Florida and is the biggest rate-regulated

electric utility in the U.S. by retail electricity produced,

according to the company's website. It also owns Gulf Power Co.,

which serves more than 470,000 customers in eight counties in

northwest Florida.

Utility investors see Florida as a particularly desirable market

given the constant need for air conditioning and growing

population.

NextEra also owns a clean-energy business that, along with

affiliates, is the world's largest generator of renewable wind and

solar energy. It also operates emissions-free electricity from

plants in Florida, New Hampshire, Iowa and Wisconsin.

Duke provides electricity to roughly 7.7 million retail

customers in six states, including the Carolinas, some Midwestern

states and Florida, according to its website, and distributes

natural gas to more than 1.6 million customers in Ohio, Kentucky,

Tennessee and the Carolinas. It has a commercial business with

power-generation assets in North America including a renewables

portfolio.

NextEra has been an active acquirer of smaller assets in recent

years and has also eyed larger deals, benefiting from its bulk and

a stock price that has outperformed those of its peers. It

announced a deal Tuesday to buy an independent transmission company

for $660 million, including debt.

The biggest deal announced so far this year is Nvidia Corp.'s

$40 billion acquisition of SoftBank Group Corp.-owned chip designer

Arm Ltd. Merger and acquisition volumes are down 22% globally and

43% in the U.S. compared with last year, in large part because

executives shifted focus from deal-making to respond to the impact

of the coronavirus pandemic. Recently, however, the M&A market

has begun to show signs of life as companies begin to regain their

footing and look to establish strategic plans for the post-pandemic

era.

Write to Cara Lombardo at cara.lombardo@wsj.com, Maureen Farrell

at maureen.farrell@wsj.com and Dana Cimilluca at

dana.cimilluca@wsj.com

(END) Dow Jones Newswires

September 29, 2020 19:52 ET (23:52 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

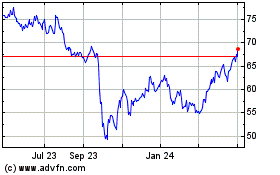

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

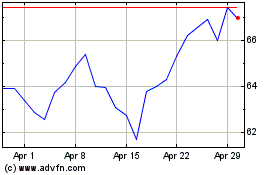

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Apr 2023 to Apr 2024