Current Report Filing (8-k)

September 25 2020 - 5:16PM

Edgar (US Regulatory)

0000010456falseOne Baxter ParkwayDeerfieldIllinois224948-200000000104562020-09-242020-09-240000010456bax:CommonStock1.00PerValueMember2020-09-242020-09-240000010456exch:XNYSbax:CommonStock1.00PerValueMember2020-09-242020-09-240000010456exch:XCHIbax:CommonStock1.00PerValueMember2020-09-242020-09-240000010456bax:GlobalNotes13Due2025Member2020-09-242020-09-240000010456exch:XNYSbax:GlobalNotes13Due2025Member2020-09-242020-09-240000010456bax:GlobalNotes13Due2029Member2020-09-242020-09-240000010456exch:XNYSbax:GlobalNotes13Due2029Member2020-09-242020-09-240000010456bax:GlobalNotes04Due2024Member2020-09-242020-09-240000010456exch:XNYSbax:GlobalNotes04Due2024Member2020-09-242020-09-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 24, 2020

|

|

|

|

|

|

|

|

Baxter International Inc.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware

|

|

|

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

1-4448

|

36-0781620

|

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

One Baxter Parkway, Deerfield, Illinois

|

60015

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

(224)948-2000

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d 2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $1.00 par value

|

|

BAX (NYSE)

|

|

New York Stock Exchange

|

|

|

|

|

|

Chicago Stock Exchange

|

|

1.3% Global Notes due 2025

|

|

BAX 25

|

|

New York Stock Exchange

|

|

1.3% Global Notes due 2029

|

|

BAX 29

|

|

New York Stock Exchange

|

|

0.4% Global Notes due 2024

|

|

BAX 24

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act: ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 24, 2020, Baxter International Inc.’s (the “Company”) Chief Executive Officer, Mr. José Almeida, entered into a new Change-in-Control Agreement with the Company (the “New CIC Agreement”), which replaces Mr. Almeida’s existing severance agreement with the Company, dated as of October 28, 2015 (the “Existing CIC Agreement”) and provides for severance payments and benefits in the event of a qualifying termination of employment, including in connection with a “Change in Control” (as defined in the New CIC Agreement) substantially similar to those provided under the Existing CIC Agreement, except that the New CIC Agreement, among other changes: (i) specifies that amounts payable under the New CIC Agreement or otherwise may be reduced to eliminate any excise tax that may be due under Section 280G of the Internal Revenue Code, but only if such reduction would result in a greater after-tax benefit to the participant under the New CIC Agreement, (ii) aligns the definition of “Change in Control” with the definition provided in the Company’s 2015 Incentive Plan, (iii) provides that the participant will not be deemed to have resigned for “Good Reason” (as defined in the New CIC Agreement) unless (x) the participant provides written notice to the Company of the existence of the Good Reason event within 90 days after its initial occurrence, (y) the Company fails to cure such Good Reason event within 30 days thereafter, and (z) the participant effectively terminates employment within 180 days following the occurrence of the non-cured Good Reason event, and (iv) eliminates the continuation of defined contribution pension plan benefits for the 24-month period following a qualifying termination of employment as was provided in Section 6.1(D) of the Existing CIC Agreement.

On September 24, 2020, each of Messrs. Giuseppe Accogli, Sean Martin and James Saccaro entered into an amendment to his existing severance agreement with the Company (each, an “Amended Grandfathered CIC Agreement”), pursuant to which each such agreement was revised, among other changes, to incorporate the provisions described in items (i) through (iii) of the immediately preceding paragraph. Furthermore, on September 25, 2020, Mr. Cristiano Franzi entered into an amendment to his existing severance agreement with the Company (the “Amended OUS CIC Agreement”), pursuant to which his agreement was revised, among other changes, to incorporate the provisions described in items (ii) and (iii) of the immediately preceding paragraph.

The preceding description of the New CIC Agreement, the Amended Grandfathered CIC Agreement and the Amended OUS CIC Agreement is qualified in its entirety by reference to the New CIC Agreement, the Form of Amended Grandfathered CIC Agreement and the Amended OUS CIC Agreement, filed as Exhibits 10.1, 10.2 and 10.3 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits. The following exhibits are provided as part of this Form 8-K:

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

|

|

|

|

|

|

10.2

|

|

|

|

|

|

|

|

10.3

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 25, 2020

|

|

|

|

|

|

|

|

|

|

|

|

BAXTER INTERNATIONAL INC.

|

|

|

|

|

|

|

|

|

/s/ Ellen K. Bradford

|

|

|

By:

|

Ellen K. Bradford

|

|

|

|

Senior Vice President, Associate General Counsel

|

|

|

|

and Corporate Secretary

|

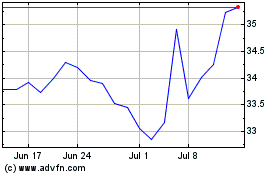

Baxter (NYSE:BAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

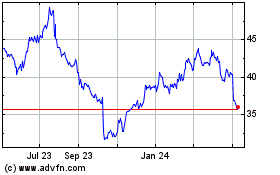

Baxter (NYSE:BAX)

Historical Stock Chart

From Apr 2023 to Apr 2024