Revenues Totaled $1.0 Billion; Diluted

Earnings Per Share Grew to $.83 Gross Margin Expanded to

19.9%, Up 140 Basis Points Net Order Value Rose 29%; Backlog

Value Increased 12% to $2.6 Billion

KB Home (NYSE: KBH) today reported results for its third quarter

ended August 31, 2020.

“We produced solid results in our third quarter, moving beyond

the disruption associated with the early stages of the COVID-19

pandemic that we experienced in the spring. While our deliveries

were lower compared to a year ago, our profitability rose

meaningfully, led by a housing gross profit margin of 20.6%,

excluding inventory-related charges, driving a 14% increase in our

diluted earnings per share,” said Jeffrey Mezger, Chairman,

President and Chief Executive Officer.

“Housing market conditions strengthened during the third

quarter, fueled by the combination of historically low mortgage

interest rates, a limited supply of resale inventory and consumers’

desire to own a single-family home,” continued Mezger. “Reflecting

this strength, our net orders expanded 27% year over year, with

growth in each of our four regions. We achieved a monthly

absorption pace that accelerated to 5.9 orders per community, an

increase of 36%, while we also increased prices in most of our

communities. We believe that our Built-to-Order model is a key

factor driving our sales pace, with this quarter’s results

underscoring the robust demand for the choice and personalization

we offer to our homebuyers."

“As we look ahead to 2021, assuming market conditions remain

favorable, we believe we are well positioned to expand our scale,

and, with a leaner and more efficient operation, we anticipate

accelerating our profitable growth next year, as we remain focused

on generating higher returns,” concluded Mezger.

Three Months Ended August 31, 2020

(comparisons on a year-over-year basis)

- Revenues totaled $999.0 million, down 14% from $1.16 billion,

reflecting the impact from the COVID-19 pandemic during the

Company’s 2020 second quarter.

- Homes delivered were 2,545, compared to 3,022.

- Average selling price was $384,700, up from $381,400.

- Homebuilding operating income increased to $88.9 million from

$85.5 million. The homebuilding operating income margin expanded

150 basis points to 8.9%. Excluding inventory-related charges of

$6.9 million in the current quarter and $5.3 million in the

year-earlier quarter, this metric improved 180 basis points to

9.6%.

- The housing gross profit margin expanded 140 basis points to

19.9%. Excluding inventory-related charges, the housing gross

profit margin increased 170 basis points to 20.6%.

- The housing gross profit margin improvement primarily reflected

a mix shift of homes delivered, lower amortization of previously

capitalized interest, workforce realignment and reductions in the

second quarter in response to the significant negative impact from

the pandemic on the Company’s business, and a favorable pricing

environment during the period.

- Adjusted housing gross profit margin, a metric that excludes

inventory-related charges and the amortization of previously

capitalized interest, increased to 23.7% from 22.3%.

- Selling, general and administrative expenses as a percentage of

housing revenues improved slightly to 11.0%, mainly due to the

Company’s targeted actions, including the above-mentioned workforce

reductions, to reduce overhead costs, partly offset by decreased

operating leverage from lower housing revenues.

- The Company’s financial services operations generated pretax

income of $9.7 million, up from $6.6 million, mainly reflecting

higher income from its mortgage banking joint venture, KBHS Home

Loans, LLC (“KBHS”).

- KBHS originated 79% of the residential mortgage loans the

Company’s homebuyers obtained to finance their home purchase,

compared to 72%.

- Total pretax income grew 10% to $101.3 million. As a percentage

of revenues, pretax income increased 220 basis points to 10.1% from

7.9%.

- The Company‘s income tax expense and effective tax rate were

$22.9 million and approximately 23%, respectively. In the

year-earlier quarter, income tax expense was $23.8 million and the

effective tax rate was approximately 26%. The lower effective tax

rate in the current quarter primarily reflected the favorable

impact of federal energy tax credits.

- Net income grew 15% to $78.4 million, and diluted earnings per

share increased 14% to $.83.

Nine Months Ended August 31, 2020

(comparisons on a year-over-year basis)

- Total revenues of $2.99 billion were flat.

- Homes delivered decreased 2% to 7,796.

- Average selling price increased to $379,800.

- Pretax income grew 30% to $238.0 million.

- Net income increased 31% to $190.2 million and diluted earnings

per share rose 30% to $2.02.

Backlog and Net Orders (comparisons on

a year-over-year basis)

- Net orders for the quarter grew 27% to 4,214, the Company’s

highest third-quarter level since 2005, with net order value

increasing by $367.5 million, or 29%, to $1.64 billion. Both net

orders and net order value increased in all of the Company’s four

regions.

- The Company’s net order growth accelerated during the quarter,

with monthly net orders up 11% in June, 23% in July and 50% in

August. The Company’s cancellation rate as a percentage of gross

orders for the quarter improved to 17% from 20%.

- Company-wide, net orders per community averaged 5.9 per month,

compared to 4.3.

- The Company’s ending backlog increased 8% to 6,749 homes.

Ending backlog value grew 12% to $2.57 billion. This marked the

Company’s highest third-quarter backlog, in terms of both homes and

value, since 2007.

- Average community count for the quarter decreased 7% to 238.

Ending community count of 232 was down 9%.

Balance Sheet as of August 31, 2020

(comparisons to November 30, 2019)

- Cash and cash equivalents increased to $722.0 million, compared

to $453.8 million.

- The Company had total liquidity of $1.51 billion, including

cash and cash equivalents and $787.6 million of available capacity

under its unsecured revolving credit facility. There were no cash

borrowings outstanding under the facility. The Company has not

borrowed under the facility in 2020.

- Inventories decreased slightly to $3.67 billion.

- The Company had 60,278 lots owned or under contract, of which

approximately 63% were owned and 37% were under contract.

- The Company’s 38,110 owned lots represented a supply of

approximately 3.3 years, based on homes delivered in the trailing

12 months.

- Notes payable of $1.75 billion were essentially unchanged.

- The Company’s debt to capital ratio of 40.5% improved 180 basis

points. The Company’s net debt to capital ratio improved 660 basis

points to 28.6%.

- The Company’s next scheduled debt maturity is on December 15,

2021, when $450.0 million in aggregate principal amount of its

7.00% senior notes become due.

Company Outlook — COVID-19

Impact

Although housing market conditions in the 2020 third quarter

improved significantly from the prior quarter, the Company’s

deliveries and revenues for the period were tempered primarily by

the negative impact that restrictive public health measures to

combat the outbreak and spread of COVID-19 had on its second

quarter. Since the easing of public health restrictions in its

served markets beginning in May 2020, all of Company’s communities

have been open to walk-in traffic, following appropriate safety

protocols and applicable public health guidelines. The Company also

continues to engage with customers using its robust virtual selling

capability, including enhanced online tools such as virtual home

tours, interactive floor plans, live chats with sales counselors

and online consultations with its design studios. Reflecting the

shift in operating conditions, the Company’s net orders began to

rebound significantly in May following a low point in April, and

the upward trajectory continued into the third quarter and

accelerated as the quarter progressed.

The Company is encouraged by the resilience of the housing

market and the significant increase in demand over the past several

months. Subsequent to the end of the third quarter, demand remains

strong, with the Company’s net orders for the first three weeks of

September 2020 up 32% from the corresponding period of 2019, and

the cancellation rate for the period improving to 12% from 17%.

While the Company limited its land investments during the second

quarter and most of the third quarter to preserve cash and

liquidity due to the uncertainty surrounding the COVID-19 pandemic,

given the sustained strong housing demand, it has resumed land

acquisition and development activities to bolster its lot pipeline

and support community growth in the future. Although the trajectory

and strength of the current recovery remains uncertain, and it

could be slowed or reversed by a number of factors, including a

possible widespread resurgence in COVID-19 infections combined with

the seasonal flu, the Company believes it is well positioned to

operate effectively through the present environment.

Conference Call

The conference call to discuss the Company’s 2020 third quarter

earnings will be broadcast live TODAY at 2:00 p.m. Pacific Time,

5:00 p.m. Eastern Time. To listen, please go to the Investor

Relations section of the Company’s website at kbhome.com.

About KB Home

KB Home (NYSE: KBH) is one of the largest and most recognized

homebuilders in the United States and has been building quality

homes for over 60 years. Today, KB Home operates in 42 markets

across eight states, serving a wide array of buyer groups. What

sets us apart is how we give our customers the ability to

personalize their homes from homesites and floor plans to cabinets

and countertops, at a price that fits their budget. We are the

first builder to make every home we build ENERGY STAR® certified.

In fact, we go beyond the EPA requirements by ensuring every ENERGY

STAR certified KB home has been tested and verified by a

third-party inspector to meet the EPA’s strict certification

standards, which helps lower the cost of ownership and to make our

new homes healthier and more comfortable than new ones without

certification. We also work with our customers every step of the

way, building strong personal relationships so they have a real

partner in the homebuying process, and the experience is as simple

and easy as possible. Learn more about how we build homes built on

relationships by visiting kbhome.com.

Forward-Looking and Cautionary

Statements

Certain matters discussed in this press release, including any

statements that are predictive in nature or concern future market

and economic conditions, business and prospects, our future

financial and operational performance, or our future actions and

their expected results are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on current expectations and

projections about future events and are not guarantees of future

performance. We do not have a specific policy or intent of updating

or revising forward-looking statements. Actual events and results

may differ materially from those expressed or forecasted in

forward-looking statements due to a number of factors. The most

important risk factors that could cause our actual performance and

future events and actions to differ materially from such

forward-looking statements include, but are not limited to the

following: general economic, employment and business conditions,

generally and during the current recession; population growth,

household formations and demographic trends; conditions in the

capital, credit and financial markets; our ability to access

external financing sources and raise capital through the issuance

of common stock, debt or other securities, and/or project

financing, on favorable terms; the execution of any share

repurchases pursuant to our board of directors’ authorization;

material and trade costs and availability, particularly lumber;

changes in interest rates; our debt level, including our ratio of

debt to capital, and our ability to adjust our debt level and

maturity schedule; our compliance with the terms of our revolving

credit facility; volatility in the market price of our common

stock; weak or declining consumer confidence, either generally or

specifically with respect to purchasing homes; competition from

other sellers of new and resale homes; weather events, significant

natural disasters and other climate and environmental factors; any

failure of lawmakers to agree on a budget or appropriation

legislation to fund the federal government’s operations, and

financial markets’ and businesses’ reactions to that failure;

government actions, policies, programs and regulations directed at

or affecting the housing market (including the Coronavirus Aid,

Relief, and Economic Security Act relief provisions for outstanding

mortgage loans, tax benefits associated with purchasing and owning

a home, and the standards, fees and size limits applicable to the

purchase or insuring of mortgage loans by government-sponsored

enterprises and government agencies), the homebuilding industry, or

construction activities; changes in existing tax laws or enacted

corporate income tax rates, including those resulting from

regulatory guidance and interpretations issued with respect

thereto; changes in U.S. trade policies, including the imposition

of tariffs and duties on homebuilding materials and products, and

related trade disputes with and retaliatory measures taken by other

countries; the adoption of new or amended financial accounting

standards and the guidance and/or interpretations with respect

thereto; the availability and cost of land in desirable areas and

our ability to timely develop acquired land parcels and open new

home communities; our warranty claims experience with respect to

homes previously delivered and actual warranty costs incurred;

costs and/or charges arising from regulatory compliance

requirements or from legal, arbitral or regulatory proceedings,

investigations, claims or settlements, including unfavorable

outcomes in any such matters resulting in actual or potential

monetary damage awards, penalties, fines or other direct or

indirect payments, or injunctions, consent decrees or other

voluntary or involuntary restrictions or adjustments to our

business operations or practices that are beyond our current

expectations and/or accruals; our ability to use/realize the net

deferred tax assets we have generated; our ability to successfully

implement our current and planned strategies and initiatives

related to our product, geographic and market positioning, gaining

share and scale in our served markets and in entering into new

markets; our operational and investment concentration in markets in

California; consumer interest in our new home communities and

products, particularly from first-time homebuyers and higher-income

consumers; our ability to generate orders and convert our backlog

of orders to home deliveries and revenues, particularly in key

markets in California; our ability to successfully implement our

business strategies and achieve any associated financial and

operational targets and objectives; income tax expense volatility

associated with stock-based compensation; the ability of our

homebuyers to obtain residential mortgage loans and mortgage

banking services; the performance of mortgage lenders to our

homebuyers; the performance of KBHS, our mortgage banking joint

venture with Stearns Ventures, LLC; information technology failures

and data security breaches; an epidemic or pandemic (such as the

outbreak and worldwide spread of COVID-19), and the control

response measures that international, federal, state and local

governments, agencies, law enforcement and/or health authorities

implement to address it, which may (as with COVID-19) precipitate

or exacerbate one or more of the above-mentioned and/or other

risks, and significantly disrupt or prevent us from operating our

business in the ordinary course for an extended period; a

continuation of widespread protests and civil unrest related to

efforts to institute law enforcement and other social and political

reforms, and the impacts of implementing or failing to implement

any such reforms; and other events outside of our control. Please

see our periodic reports and other filings with the Securities and

Exchange Commission for a further discussion of these and other

risks and uncertainties applicable to our business.

KB HOME

CONSOLIDATED STATEMENTS OF

OPERATIONS

For the Three Months and Nine

Months Ended August 31, 2020 and 2019

(In Thousands, Except Per Share

Amounts - Unaudited)

Three Months Ended August 31,

Nine Months Ended August 31,

2020

2019

2020

2019

Total revenues

$

999,013

$

1,160,786

$

2,988,918

$

2,994,072

Homebuilding:

Revenues

$

995,148

$

1,156,855

$

2,977,810

$

2,984,314

Costs and expenses

(906,205)

(1,071,380)

(2,777,083)

(2,815,401)

Operating income

88,943

85,475

200,727

168,913

Interest income

786

201

2,163

1,745

Equity in income (loss) of unconsolidated

joint ventures

1,922

(384)

11,981

(1,159)

Homebuilding pretax income

91,651

85,292

214,871

169,499

Financial services:

Revenues

3,865

3,931

11,108

9,758

Expenses

(1,056)

(1,003)

(2,901)

(3,067)

Equity in income of unconsolidated joint

ventures

6,855

3,716

14,874

7,018

Financial services pretax income

9,664

6,644

23,081

13,709

Total pretax income

101,315

91,936

237,952

183,208

Income tax expense

(22,900)

(23,800)

(47,800)

(37,600)

Net income

$

78,415

$

68,136

$

190,152

$

145,608

Earnings per share:

Basic

$

.86

$

.77

$

2.09

$

1.65

Diluted

$

.83

$

.73

$

2.02

$

1.55

Weighted average shares

outstanding:

Basic

90,535

88,262

90,292

87,630

Diluted

94,105

92,842

93,788

94,032

KB HOME

CONSOLIDATED BALANCE

SHEETS

(In Thousands - Unaudited)

August 31, 2020

November 30, 2019

Assets

Homebuilding:

Cash and cash equivalents

$

722,033

$

453,814

Receivables

269,651

249,055

Inventories

3,671,129

3,704,602

Investments in unconsolidated joint

ventures

48,821

57,038

Property and equipment, net

64,619

65,043

Deferred tax assets, net

241,171

364,493

Other assets

125,242

83,041

5,142,666

4,977,086

Financial services

34,761

38,396

Total assets

$

5,177,427

$

5,015,482

Liabilities and stockholders’

equity

Homebuilding:

Accounts payable

$

231,821

$

262,772

Accrued expenses and other liabilities

630,529

618,783

Notes payable

1,747,704

1,748,747

2,610,054

2,630,302

Financial services

2,065

2,058

Stockholders’ equity

2,565,308

2,383,122

Total liabilities and stockholders’

equity

$

5,177,427

$

5,015,482

KB HOME

SUPPLEMENTAL

INFORMATION

For the Three Months and Nine

Months Ended August 31, 2020 and 2019

(In Thousands, Except Average

Selling Price - Unaudited)

Three Months Ended August 31,

Nine Months Ended August 31,

2020

2019

2020

2019

Homebuilding revenues:

Housing

$

979,113

$

1,152,618

$

2,960,901

$

2,968,588

Land

16,035

4,237

16,909

15,726

Total

$

995,148

$

1,156,855

$

2,977,810

$

2,984,314

Homebuilding costs and

expenses:

Construction and land costs

Housing

$

784,427

$

939,538

$

2,414,059

$

2,443,937

Land

14,068

4,216

14,942

14,416

Subtotal

798,495

943,754

2,429,001

2,458,353

Selling, general and administrative

expenses

107,710

127,626

348,082

357,048

Total

$

906,205

$

1,071,380

$

2,777,083

$

2,815,401

Interest expense:

Interest incurred

$

31,054

$

36,024

$

93,071

$

107,356

Interest capitalized

(31,054)

(36,024)

(93,071)

(107,356)

Total

$

—

$

—

$

—

$

—

Other information:

Amortization of previously capitalized

interest

$

30,628

$

38,558

$

93,949

$

106,859

Depreciation and amortization

7,701

7,948

23,445

23,325

Average selling price:

West Coast

$

605,400

$

588,800

$

596,200

$

588,700

Southwest

330,700

318,400

321,700

323,700

Central

310,000

297,000

300,100

290,200

Southeast

286,500

294,000

290,500

296,400

Total

$

384,700

$

381,400

$

379,800

$

373,800

KB HOME

SUPPLEMENTAL

INFORMATION

For the Three Months and Nine

Months Ended August 31, 2020 and 2019

(Dollars in Thousands -

Unaudited)

Three Months Ended August 31,

Nine Months Ended August 31,

2020

2019

2020

2019

Homes delivered:

West Coast

626

838

2,005

2,015

Southwest

628

566

1,783

1,615

Central

958

1,098

2,881

2,989

Southeast

333

520

1,127

1,323

Total

2,545

3,022

7,796

7,942

Net orders:

West Coast

1,329

957

2,863

2,797

Southwest

857

706

1,927

2,007

Central

1,469

1,132

3,405

3,556

Southeast

559

530

1,272

1,704

Total

4,214

3,325

9,467

10,064

Net order value:

West Coast

$

761,742

$

570,531

$

1,685,094

$

1,655,423

Southwest

285,917

219,930

642,601

632,498

Central

438,697

331,635

1,024,623

1,054,203

Southeast

157,404

154,146

362,540

488,893

Total

$

1,643,760

$

1,276,242

$

3,714,858

$

3,831,017

August 31, 2020

August 31, 2019

Homes

Value

Homes

Value

Backlog data:

West Coast

1,901

$

1,088,096

1,497

$

883,765

Southwest

1,382

458,681

1,318

412,391

Central

2,512

750,831

2,281

674,614

Southeast

954

270,056

1,134

326,027

Total

6,749

$

2,567,664

6,230

$

2,296,797

KB HOME RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (In Thousands, Except Percentages -

Unaudited)

This press release contains, and Company management’s discussion

of the results presented in this press release may include,

information about the Company’s adjusted housing gross profit

margin and ratio of net debt to capital, neither of which is

calculated in accordance with generally accepted accounting

principles (“GAAP”). The Company believes these non-GAAP financial

measures are relevant and useful to investors in understanding its

operations and the leverage employed in its operations, and may be

helpful in comparing the Company with other companies in the

homebuilding industry to the extent they provide similar

information. However, because they are not calculated in accordance

with GAAP, these non-GAAP financial measures may not be completely

comparable to other companies in the homebuilding industry and,

thus, should not be considered in isolation or as an alternative to

operating performance and/or financial measures prescribed by GAAP.

Rather, these non-GAAP financial measures should be used to

supplement their respective most directly comparable GAAP financial

measures in order to provide a greater understanding of the factors

and trends affecting the Company’s operations.

Adjusted Housing Gross Profit

Margin

The following table reconciles the Company’s housing gross

profit margin calculated in accordance with GAAP to the non-GAAP

financial measure of the Company’s adjusted housing gross profit

margin:

Three Months Ended August 31,

Nine Months Ended August 31,

2020

2019

2020

2019

Housing revenues

$

979,113

$

1,152,618

$

2,960,901

$

2,968,588

Housing construction and land costs

(784,427)

(939,538)

(2,414,059)

(2,443,937)

Housing gross profits

194,686

213,080

546,842

524,651

Add: Inventory-related charges (a)

6,888

5,251

16,939

13,143

Housing gross profits excluding

inventory-related charges

201,574

218,331

563,781

537,794

Add: Amortization of previously

capitalized interest (b)

30,186

38,558

93,507

106,260

Adjusted housing gross profits

$

231,760

$

256,889

$

657,288

$

644,054

Housing gross profit margin

19.9

%

18.5

%

18.5

%

17.7

%

Housing gross profit margin excluding

inventory-related charges

20.6

%

18.9

%

19.0

%

18.1

%

Adjusted housing gross profit margin

23.7

%

22.3

%

22.2

%

21.7

%

(a) Represents inventory impairment and

land option contract abandonment charges associated with housing

operations.

(b) Represents the amortization of

previously capitalized interest associated with housing

operations.

Adjusted housing gross profit margin is a non-GAAP financial

measure, which the Company calculates by dividing housing revenues

less housing construction and land costs excluding (1) housing

inventory impairment and land option contract abandonment charges

(as applicable) recorded during a given period and (2) amortization

of previously capitalized interest associated with housing

operations, by housing revenues. The most directly comparable GAAP

financial measure is housing gross profit margin. The Company

believes adjusted housing gross profit margin is a relevant and

useful financial measure to investors in evaluating the Company’s

performance as it measures the gross profits the Company generated

specifically on the homes delivered during a given period. This

non-GAAP financial measure isolates the impact that housing

inventory impairment and land option contract abandonment charges,

and the amortization of previously capitalized interest associated

with housing operations, have on housing gross profit margins, and

allows investors to make comparisons with the Company’s competitors

that adjust housing gross profit margins in a similar manner. The

Company also believes investors will find adjusted housing gross

profit margin relevant and useful because it represents a

profitability measure that may be compared to a prior period

without regard to variability of housing inventory impairment and

land option contract abandonment charges, and amortization of

previously capitalized interest associated with housing operations.

This financial measure assists management in making strategic

decisions regarding community location and product mix, product

pricing and construction pace.

Ratio of Net Debt to

Capital

The following table reconciles the Company’s ratio of debt to

capital calculated in accordance with GAAP to the non-GAAP

financial measure of the Company’s ratio of net debt to

capital:

August 31, 2020

November 30, 2019

Notes payable

$

1,747,704

$

1,748,747

Stockholders’ equity

2,565,308

2,383,122

Total capital

$

4,313,012

$

4,131,869

Ratio of debt to capital

40.5

%

42.3

%

Notes payable

$

1,747,704

$

1,748,747

Less: Cash and cash equivalents

(722,033)

(453,814)

Net debt

1,025,671

1,294,933

Stockholders’ equity

2,565,308

2,383,122

Total capital

$

3,590,979

$

3,678,055

Ratio of net debt to capital

28.6

%

35.2

%

The ratio of net debt to capital is a non-GAAP financial

measure, which the Company calculates by dividing notes payable,

net of homebuilding cash and cash equivalents, by capital (notes

payable, net of homebuilding cash and cash equivalents, plus

stockholders’ equity). The most directly comparable GAAP financial

measure is the ratio of debt to capital. The Company believes the

ratio of net debt to capital is a relevant and useful financial

measure to investors in understanding the leverage employed in the

Company’s operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200922005311/en/

Jill Peters, Investor Relations Contact (310) 893-7456 or

jpeters@kbhome.com

Cara Kane, Media Contact (321) 299-6844 or ckane@kbhome.com

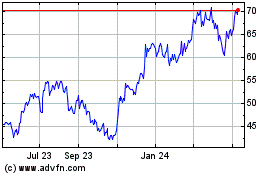

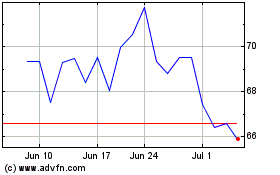

KB Home (NYSE:KBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

KB Home (NYSE:KBH)

Historical Stock Chart

From Apr 2023 to Apr 2024