Ninepoint Partners Announces Closing of Maximum $25M (Upsized from original $20M) Offering of the Ninepoint 2020 Short Durati...

September 21 2020 - 11:45AM

Ninepoint Partners LP (“Ninepoint”) is pleased to announce that the

Ninepoint 2020 Short Duration Flow-Through Limited Partnership (the

“Partnership”) has completed the first and final closing in

connection with its offering of Class A and Class F limited

partnership units (the “Units”) pursuant to a prospectus dated

September 14, 2020. The Partnership issued 1,000,000 units for

gross proceeds of $25,000,000. The Units are being offered at a

price per Unit of $25.00 with a minimum subscription of 100 Units

($2,500). The Partnership intends to provide liquidity to limited

partners through a rollover to the Ninepoint Resource Class in the

period between January 15, 2022 and February 28, 2022.

Ninepoint is Canada’s leading investment firm at

providing Flow-Through Funds in Canada. Since its inception in

2017, Nineopoint has successfully raised more Flow-Through Fund

capital than any other asset manager in Canada. “We are pleased

with another successful Flow-Through Fund raise, and with being

able to hit our maximum capacity for the Partnership in a short

period of time” said James Fox, Managing Partner at Ninepoint.

Investment

Objective

of

the

PartnershipThe

Partnership’s investment objective is to achieve capital

appreciation and significant tax benefits for limited partners by

investing in a diversified portfolio of Flow-Through Shares and

other securities, if any, of Resource Issuers.

Attractive

Tax-Reduction

BenefitsFlow-through

partnerships are one of the most effective tax reduction strategies

available to Canadians. Ninepoint anticipates that investors

participating in the Partnership will be eligible to receive a tax

deduction of approximately 100% of the amount invested.

Resource

ExpertiseThe

Partnership will be sub-advised by Sprott Asset Management LP

(“Sprott”), one of Canada’s leading investment advisors in small

and mid- cap resource companies. Over its long history of investing

in the resource sector, Sprott has developed relationships with

hundreds of companies. Its experienced team of portfolio managers

is supported by a team of technical experts with extensive

backgrounds in mining and geology.

Portfolio manager Jason Mayer will manage the

portfolio of the Partnership and will be supported by Sprott’s

broader team of experienced resource investment professionals.

AgentsThe

offering is being made through a syndicate of agents led by RBC

Dominion Securities Inc, which includes CIBC World Markets Inc., TD

Securities Inc., National Bank Financial Inc., Scotia Capital Inc.,

BMO Nesbitt Burns Inc., Richardson GMP Limited, Industrial Alliance

Securities Inc., Manulife Securities Incorporated, Raymond James

Ltd., Canaccord Genuity Corp. and Desjardins Securities Inc.

About

Ninepoint Partners

LPBased in Toronto, Ninepoint

Partners LP is one of Canada’s leading alternative investment

management firms overseeing approximately $7 billion in assets

under management and institutional contracts. Committed to helping

investors explore innovative investment solutions that have the

potential to enhance returns and manage portfolio risk, Ninepoint

offers a diverse set of alternative strategies including North

American Equity, Global Equity, Real Assets & Alternative

Income.

Ninepoint is an operating company that has been

created to assume portfolio management of the Canadian diversified

assets of Sprott, including actively managed hedge and mutual

funds.

For more information on Ninepoint Partners LP,

please visit www.ninepoint.com or inquiries regarding the offering,

please contact us at (416) 943-6707 or (866) 299-9906 or

invest@ninepoint.com.

About Sprott

Asset Management LPSprott is a wholly-owned

subsidiary of Sprott Inc., an alternative asset manager and a

global leader in precious metal and real asset investments. Through

its subsidiaries in Canada, the US and Asia, Sprott Inc. is

dedicated to providing investors with best-in-class investment

strategies that include Exchange Listed Products, Managed Equities,

Lending and Brokerage. Sprott Inc.’s common shares are listed on

the New York Stock Exchange under the symbol (NYSE: SII) and on the

Toronto Stock Exchange under the symbol (TSX:SII). For more

information, please visit www.sprott.com.

Certain statements included in this news release

constitute forward-looking statements, including, but not limited

to, those identified by the expressions “expects”, “intends”,

“anticipates”, “will” and similar expressions to the extent that

they relate to the Partnership. The forward-looking statements are

not historical facts but reflect the Partnership’s, Ninepoint’s and

Sprott’s current expectations regarding future results or events.

These forward-looking statements are subject to a number of risks

and uncertainties that could cause actual results or events to

differ materially from current expectations. Although the

Partnership, Ninepoint and Sprott believe the assumptions inherent

in the forward-looking statements are reasonable, forward-looking

statements are not guarantees of future performance and,

accordingly, readers are cautioned not to place undue reliance on

such statements due to the inherent uncertainty therein. Neither

the Partnership, nor Ninepoint or Sprott undertake any obligation

to update publicly or otherwise revise any forward-looking

statement or information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law.

This offering is only made by

prospectus. The Partnership’s prospectus contains important

detailed information about the securities being offered. Copies of

the prospectus may be obtained from your IIROC registered financial

advisor. Investors should read the prospectus before making an

investment decision.

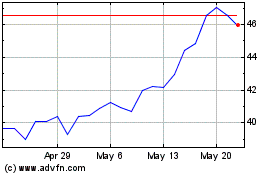

Sprott (NYSE:SII)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sprott (NYSE:SII)

Historical Stock Chart

From Apr 2023 to Apr 2024