Oracle, Snowflake, SoftBank: Stocks That Defined the Week -- WSJ

September 19 2020 - 3:02AM

Dow Jones News

By Francesca Fontana andDerek Hall

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 19, 2020).

Oracle Corp.

Oracle won the bidding for TikTok's U.S. operations, beating out

Microsoft Corp., but more hurdles are ahead. President Trump said

on Wednesday that he wasn't prepared to sign off on a deal that

could also award a stake to Walmart Inc. Administration officials

still want American investors to hold a majority of the

Chinese-owned app. Starting Sunday, the White House will also start

banning use of TikTok due to national-security concerns. Oracle

shares rose 4.3% Monday.

FedEx Corp.

Christmas came early for FedEx. Residential shipments surged as

consumers keep shopping from home, reaching levels the delivery

giant normally sees during the holiday season. Thanks to the extra

cargo, FedEx on Tuesday posted the highest quarterly revenue in its

history. The increasing shift to online shopping has been a boon to

the FedEx Ground business, which handles shipments for store chains

such as Target Corp. and Dick's Sporting Goods Inc. Now, FedEx and

rival United Parcel Service Inc. are bracing for an additional

torrent of packages during the holiday season, testing networks

that are already strained. FedEx shares added 5.8% Wednesday.

Kraft Heinz Co.

Kraft Heinz is shredding its ties with a large chunk of its

cheese business. The food maker said Tuesday that it had reached a

deal to sell a portion of its cheese brands to France's Groupe

Lactalis SA for $3.2 billion. The deal comes as some food companies

struggle to keep up with unprecedented demand for groceries during

the pandemic. The sale will include Kraft shredded and blocks of

cheese and the Cracker Barrel brand in the U.S. Kraft Heinz will

keep Philadelphia cream cheese, Velveeta, Cheez Whiz and Kraft

Singles in the U.S, along with its macaroni-and-cheese business

world-wide. Kraft Heinz shares added 0.3% Tuesday.

Hershey Co.

Hershey wants to save Halloween from the real-life scare of

Covid-19. The candy maker is offering tips on trick-or-treating

safety to protect sales during its biggest holiday. The site,

Halloween2020.org, maps Covid-19 risk level by county and offers

suggestions, like masked trick-or-treating in low-risk areas and

at-home Halloween candy hunts in high-risk areas. The coronavirus

pandemic didn't bolster demand for sweets like it did for staples

like cereal and soup, making the upcoming holidays even more

important. Hershey also introduced its Halloween offerings earlier

than usual in the hopes of selling more, and produced less themed

candy to avoid having tons of discounted leftovers. Hershey shares

fell 0.7% Monday.

Snowflake Inc.

Snowflake didn't melt on its opening day. Shares of the

data-warehousing company more than doubled in value on Wednesday,

further stoking enthusiasm for initial public offerings in 2020.

The IPO market is on pace for a banner year as investors search for

higher returns with interest rates at historically low levels and

the Federal Reserve pumping trillions of dollars into the economy.

Snowflake's stock, the biggest tech issue of the year so far, took

longer than any traditional IPO in modern history to pair up orders

and begin trading. Its shares closed up 111% from its IPO price on

Wednesday.

Facebook Inc.

Facebook isn't generating any "likes" from antitrust

authorities. The Wall Street Journal reported Tuesday that the

Federal Trade Commission is gearing up to file a possible antitrust

lawsuit against the company by the end of the year, following more

than a year investigating concerns that Facebook has been using its

powerful market position to stifle competition. The inquiry is part

of a broader effort to examine the conduct of a handful of dominant

tech companies. No final decision had been made as of Tuesday

whether to sue Facebook, and the commission doesn't always bring

cases even when it is making preparations to do so. Facebook shares

fell 3.3% Wednesday.

SoftBank Group Corp.

SoftBank is on a selling spree. The Japanese tech-investment

conglomerate said on Friday that it was selling U.S.-based

wireless-services unitBrightstar Corp. to a private-equity firm

founded by a former Brightstar executive. This deal came on the

heels of its sale of semiconductor company Arm Holdings to

graphics-chip giant Nvidia Corp. for $40 billion. SoftBank's string

of divestitures began in March, after a series of stumbles in its

$100 billion venture-capital pool, the Vision Fund. The losses,

coupled with the overall rout in markets, drove Chief Executive

Masayoshi Son to announce $42 billion in asset sales to fund share

buybacks and debt redemptions. American depositary shares of

SoftBank lost 2.2% Friday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

September 19, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

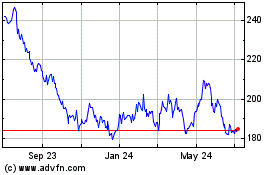

Hershey (NYSE:HSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

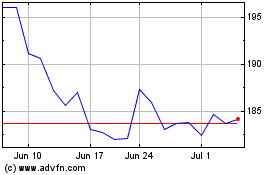

Hershey (NYSE:HSY)

Historical Stock Chart

From Apr 2023 to Apr 2024