Travelport Owners, Lenders Settle $1 Billion Debt Dispute -- Update

September 17 2020 - 4:55PM

Dow Jones News

By Andrew Scurria

Elliott Management Corp.'s Travelport Worldwide Ltd. reached a

restructuring agreement that unwinds a disputed $1 billion

shareholder rescue package and ends a standoff with some of Wall

Street's biggest debt buyers, people familiar with the matter

said.

The settlement cools tensions between Travelport's top lenders

and its private-equity backers Elliott and Siris Capital Group LLC,

resolving one of the highest-profile fights to break out between

investors in companies hit hard by the Covid-19 pandemic. Elliott

declined to comment.

U.K.-based Travelport tried to weather the coronavirus with a

financing package supplied by its owners, which had taken it

private in 2018 and were eager to protect their stakes. One of

Elliott's biggest private-equity bets, Travelport competes with

Amadeus IT Group SA and Sabre Corp. to link airlines with booking

websites and travel agents, a business that has slowed amid

government-imposed travel restrictions and passengers' fear of

contagion.

To secure the rescue loan, the company shifted

intellectual-property assets out of the lenders' grasp to serve as

collateral for Elliott and Siris. Although Travelport got

much-needed cash to help survive the pandemic, lenders including

Blackstone Group Inc., Bain Capital LP and Mudrick Capital

Management LP were upset about losing access to valuable corporate

assets.

These asset-shifting maneuvers have been increasingly popular

among struggling private-equity-backed companies since J.Crew Group

Inc. pioneered the strategy in 2016. Taking advantage of flexible

credit agreements, portfolio companies have moved brands,

trademarks and other intellectual property out of the reach of

lenders and used the assets to secure financial lifelines elsewhere

and avoid bankruptcy.

The groundwork for these disputes was laid in recent years as

debt buyers, hoping to squeeze out meager returns from picked-over

debt markets, accepted fewer and fewer protections when investing.

Credit investors sometimes have fought back, with varying degrees

of success.

Lenders said Travelport had tripped a debt default by stripping

away property that should have stayed available to satisfy their

claims. When they threatened to take action against Travelport, the

company sued them, arguing it had complied with its debt agreements

and struck a prudent deal to get through the downturn in air

travel.

Kirkland & Ellis LLP, one of the most powerful law firms in

finance, soon resigned from representing the company in a sign of

how acrimonious the dispute had become. Travelport warned it could

be forced into a defensive bankruptcy. It later reached an interim

deal to keep lenders at bay and lay the groundwork for

negotiations.

Under the settlement, lenders agreed to backstop $500 million in

fresh loans, backed by the intellectual property that had been

pledged to Elliott and Siris, people familiar with the matter

said.

First-lien lenders are accepting a discount of 10 cents on the

dollar on some of their debt claims, while second-lien lenders are

taking a 25-cent discount, reducing Travelport's roughly $3 billion

debt load, these people said. The rescue loan supplied by Elliott

and Siris is being repaid, the people said.

Write to Andrew Scurria at Andrew.Scurria@wsj.com

(END) Dow Jones Newswires

September 17, 2020 16:40 ET (20:40 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

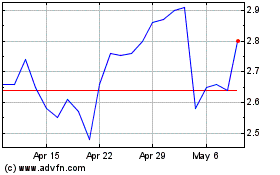

Sabre (NASDAQ:SABR)

Historical Stock Chart

From Mar 2024 to Apr 2024

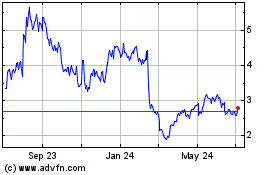

Sabre (NASDAQ:SABR)

Historical Stock Chart

From Apr 2023 to Apr 2024