Statement of Changes in Beneficial Ownership (4)

September 11 2020 - 6:03PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Gilbert Jennifer L. |

2. Issuer Name and Ticker or Trading Symbol

Rocket Companies, Inc.

[

RKT

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O ROCKET COMPANIES, INC., 1050 WOODWARD AVENUE |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/9/2020 |

|

(Street)

DETROIT, MI 48226

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class D common stock (1)(2)(3)(6) | 9/9/2020 | | D | | 15000000 | D | (4) | 1867177661 | I | By spouse, see footnote (6) |

| Class D common stock (1)(2)(3)(6) | | | | | | | | 800000 | I | By spouse, see footnote (8) |

| Class D common stock (1)(2)(3)(5) | | | | | | | | 1101822 | I | By spouse, see footnote (5) |

| Class A common stock | | | | | | | | 28334 | I | By spouse, see footnote (5) |

| Class A common stock | | | | | | | | 344231 | I | By spouse, see footnote (7) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Non-voting common interest units of RKT Holdings, LLC (2)(3) | (2)(3) | 9/9/2020 | | D | | | 15000000 | (2)(3) | (2)(3) | Class B common stock and Class A common stock | 15000000 | (4) | 1867177661 | I | By spouse, see footnote (6) |

| Non-voting common interest units of RKT HoldingsLLC (2)(3)(6) | (2)(3) | | | | | | | (2)(3) | (2)(3) | Class B common stock and Class A common stock | 800000 | | 800000 | I | By spouse, see footnote (8) |

| Non-voting common interest units of RKT Holdings, LLC (2)(3) | (2)(3) | | | | | | | (2)(3) | (2)(3) | Class B common stock and Class A common stock | 1101822 | | 1101822 | I | By spouse, see footnote (5) |

| Explanation of Responses: |

| (1) | Shares of Class D common stock of the Issuer have 10 votes per share but no economic rights (including rights to dividends and distributions upon liquidation) and are issued in an equal amount to the number of non-voting common interest units of RKT Holdings, LLC ("Holdings Units") held. |

| (2) | Pursuant to the terms of the Exchange Agreement, dated as of August 5, 2020, by and among the Issuer, RKT Holdings, LLC, Rock Holdings Inc. ("RHI"), Daniel Gilbert and the holders of Holding Units and shares of Class C common stock or Class D common stock from time to time party thereto (the "Exchange Agreement"), Holdings Units, together with a corresponding number of shares of Class D common stock or Class C common stock, may be exchanged for, at the option of the Issuer, (i) shares of Class B common stock or Class A common stock of the Issuer, as applicable, on a one-for-one basis, or (ii) cash from a substantially concurrent public offering or private sale (based on the price of the Class A common stock in such public offering or private sale), subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications. The exchange rights under the Exchange Agreement do not expire. |

| (3) | Pursuant to the terms of the Issuer's Certificate of Incorporation, each share of the Issuer's Class B common stock will automatically convert into one share of Class A common stock, and each share of the Issuer's Class D common stock will automatically convert into one share of our Class C common stock, (i) at the option of the holder, (ii) immediately prior to any transfer of such share except for certain transfers described in the Issuer's Certificate of Incorporation and (iii) if the reporting person and its permitted transferees own less than 10% of the Issuer's issued and outstanding common stock. |

| (4) | The Issuer sold an additional 15,000,000 shares of Class A common stock of the Issuer, pursuant to the underwriters' exercise in full of the over-allotment option the Issuer granted to the underwriters in connection with its recently closed initial public offering of 100,000,000 shares of Class A common stock. The Issuer used the net proceeds from the offering of the additional 15,000,000 shares of Class A common stock to purchase an equal number of Holdings Units and corresponding shares of Class D common stock from RHI in a transaction exempt under Rule 16b-3. The purchase price per Holdings Unit and share of Class D common stock was $17.59 (the offering price per share to the public of $18.00 per share minus the underwriting discount and commissions). |

| (5) | Directly owned by Daniel Gilbert, the spouse of the reporting person. |

| (6) | Directly owned by RHI. Daniel Gilbert, the spouse of the reporting person, is the majority shareholder of RHI and has voting and dispositive control and beneficial ownership with respect to the shares of the Issuer's common stock held of record by RHI. |

| (7) | Directly owned by entities affiliated with Daniel Gilbert. |

| (8) | Directly owned by a wholly-owned subsidiary of RHI. Daniel Gilbert, the spouse of the reporting person, is the majority shareholder of RHI and has voting and dispositive control and beneficial ownership with respect to these shares. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Gilbert Jennifer L.

C/O ROCKET COMPANIES, INC.

1050 WOODWARD AVENUE

DETROIT, MI 48226 | X |

|

|

|

Signatures

|

| /s/ Jeffrey B. Morganroth, attorney in fact | | 9/11/2020 |

| **Signature of Reporting Person | Date |

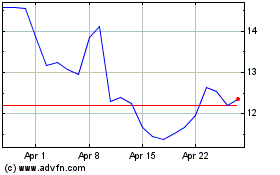

Rocket Companies (NYSE:RKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

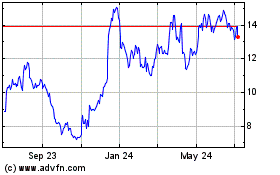

Rocket Companies (NYSE:RKT)

Historical Stock Chart

From Apr 2023 to Apr 2024