Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-229323

PROSPECTUS

SUPPLEMENT

(To Prospectus dated February 11, 2019)

222,222

Ordinary Shares

Pursuant

to this prospectus supplement and the accompanying prospectus, we are offering up to 222,222 ordinary shares, no par value (the

“Ordinary Shares”) of Taoping Inc. (the “Company”) at a price of $2.70 per share directly to an individual

investor. In a concurrent private placement, for a purchase price of $1,400,000, we are selling to the same investor a Convertible

Promissory Note (the “Note”), with a principal amount of $1,480,000 and a warrant to purchase up to 53,333 Ordinary

Shares at $9.00 per share within three years following the issue date (the “Warrants”). The Note carries an original

issue discount of $80,000 (the “OID”) matures in 12 months from the issue date, bearing interest at a rate of 5.0%

per annum. The Note, the Warrant and the Ordinary Shares issuable upon the conversion of Note and the exercise of the Warrant

are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), and are not being offered

pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to an exemption from the

registration requirements of the Securities Act provided in Section 4(a)(2) of the Securities Act and/or Rule 506(b) promulgated

thereunder.

Our

Ordinary Shares trade on the NASDAQ Capital Market under the symbol “TAOP.” The last reported sale price of our Ordinary

Shares on the NASDAQ Capital Market on September 10, 2020 was $2.80 per share. As of the date of this prospectus supplement, the

aggregate market value of our outstanding Ordinary Shares held by non-affiliates is approximately $39.13 million, based on 7,432,983

Ordinary Shares issued and outstanding, of which approximately 4,446,989 Ordinary Shares are held by non-affiliates, and a per

share price of $8.80 based on the closing price of our Ordinary Shares on July 30, 2020, which is the highest closing sale price

of our Ordinary Shares on The Nasdaq Capital Market within the prior 60 days.

During

the 12 calendar months prior to and including the date of this Prospectus Supplement, we have sold $600,000 of our Ordinary Shares

pursuant to General Instruction I.B.5 of Form F-3. Pursuant to General Instruction I.B.5 of Form F-3, in no event will we sell

securities registered in a public primary offering with a value exceeding more than one-third of our public float in any 12 calendar

month period that ends on, and includes, the date of this prospectus supplement, so long as our public float remains below $75.0

million.

We

have not retained an underwriter or placement agent with respect to this offering and therefore are not paying any underwriting

discounts or commissions. We estimate the total expenses of this offering will be approximately $0.08 million.

Please

read “Risk Factors” beginning on page S-5 of this prospectus supplement and on page 2 of the accompanying

prospectus.

Neither

the Securities and Exchange Commission nor any states securities commission has approved or disapproved of these securities or

determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary

is a criminal offense.

We

expect that delivery of the Ordinary Shares offered pursuant to this prospectus supplement and the accompanying prospectus will

be made on or about September 14, 2020, subject to customary closing conditions.

The

date of this prospectus supplement is September 10, 2020

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not authorized

anyone else to provide you with additional or different information. We are offering to sell, and seeking offers to buy Ordinary

Shares only in jurisdictions where offers and sales are permitted. You should not assume that the information in this prospectus

supplement or the accompanying prospectus is accurate as of any date other than the date on the front of those documents or that

any document incorporated by reference is accurate as of any date other than its filing date.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the Ordinary Shares or possession

or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession

of this prospectus supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform

themselves about and to observe any restrictions as to this offering and the distribution of this prospectus supplement and the

accompanying prospectus applicable to that jurisdiction.

ABOUT

THIS PROSPECTUS SUPPLEMENT

On

January 22, 2019, we filed with the Securities and Exchange Commission, or the SEC, a registration statement on Form F-3 (File

No. 333-229323) utilizing a shelf registration process relating to the securities described in this prospectus supplement. The

registration statement was declared effective on February 11, 2019. Under this shelf registration process, we have registered,

among others, to sell, from time to time, up to $80,000,000 in the aggregate of Ordinary Shares, debt securities, warrants and

units.

This

document is in two parts. The first part is the prospectus supplement, which describes the specific terms of this offering and

adds, updates and changes information contained in the accompanying prospectus. The second part is the accompanying prospectus,

which gives more general information, some of which may not apply to this offering. To the extent there is a conflict between

the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus

or any document incorporated by reference in this prospectus supplement or the accompanying prospectus, on the other hand, you

should rely on the information in this prospectus supplement. However, if any statement in one of these documents is inconsistent

with a statement in another document having a later date — for example, a document incorporated by reference

in this prospectus supplement or the accompanying prospectus — the statement in the document having the later

date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may

have changed since the earlier dates.

This

prospectus supplement and the accompanying prospectus include important information about us, our Ordinary Shares and other information

you should know before investing. You should carefully read this prospectus supplement, the accompanying prospectus, all information

incorporated by reference herein and therein, as well as the additional information described under the heading “Where You

Can Find More Information.”

This

prospectus supplement and the accompanying prospectus and any free writing prospectus may contain and incorporate by reference,

market data and industry statistics and forecasts that are based on independent industry publications and other publicly available

information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information,

and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included

or incorporated by reference in this prospectus supplement and the accompanying prospectus or any applicable free writing prospectus

may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including

those discussed under the heading “Risk Factors” contained in this prospectus supplement and the accompanying prospectus

and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into

this prospectus supplement. Accordingly, investors should not place undue reliance on this information.

FORWARD-LOOKING

INFORMATION

This

prospectus supplement contains “forward-looking statements” that involve substantial risks and uncertainties. All

statements other than statements of historical facts contained in this prospectus supplement, including statements regarding our

future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended, or the Exchange Act. We have attempted to identify forward-looking statements by terminology including “anticipates,”

“believes,” “can,” “continue,” “could,” “estimates,” “expects,”

“intends,” “may,” “plans,” “potential,” “predicts,” “should,”

or “will” or the negative of these terms or other comparable terminology. Our actual results may differ materially

or perhaps significantly from those discussed herein, or implied by, these forward-looking statements. Forward-looking statements

included or incorporated by reference in this prospectus supplement or our other filings with the SEC, include, but are not necessarily

limited to, those relating to:

|

|

●

|

our

limited operating history of selling cloud-based products and services;

|

|

|

●

|

our

independent registered auditors’ substantial doubt about our ability to continue as a going concern

|

|

|

●

|

lack

of insurance coverage for our product-related liabilities and other business liability;

|

|

|

●

|

outbreak

of coronavirus;

|

|

|

●

|

uncertainties

related to China’s legal system and economic, political and social events in China;

|

|

|

●

|

a

general economic downturn; and

|

|

|

●

|

our

potential failure to maintain compliance with NASDAQ continued listing requirements.

|

The

foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein

or risk factors with which we are faced that may cause our actual results to differ from those anticipated in our forward-looking

statements. Please see “Risk Factors” in our reports filed or furnished with the SEC or in this prospectus supplement

and the accompanying prospectus for additional risks which could adversely impact our business and financial performance.

Moreover,

new risks regularly emerge and it is not possible for our management to predict or articulate all risks we face, nor can we assess

the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to

differ from those contained in any forward-looking statements. All forward-looking statements included in this prospectus supplement

and the accompanying prospectus are based on information available to us on the date of this prospectus supplement or the accompanying

prospectus, as applicable. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update

or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

PROSPECTUS

SUMMARY

This

summary highlights information about us and the offering contained elsewhere in, or incorporated by reference into, this prospectus

supplement and the accompanying prospectus. It is not complete and may not contain all the information that may be important to

you. You should carefully read the entire prospectus supplement and the accompanying prospectus, as well as the information incorporated

by reference, before making an investment decision, especially the information presented under the heading “Risk Factors”

beginning on page S-5 of this prospectus supplement, and our financial statements and the notes to those financial statements,

which are incorporated by reference, and the other financial information appearing elsewhere in or incorporated by reference into

this prospectus supplement. See “Incorporation of Certain Information by Reference.” In this prospectus supplement,

except as otherwise indicated or as the context otherwise requires, “Taoping,” “the Company,” “we,”

“our” and “us” refer to Taoping Inc. and its subsidiaries and other consolidated entities.

Unless

otherwise indicated, all share amounts and per share amounts in this prospectus supplement have been presented on a retroactive

basis to reflect a share combination of our outstanding ordinary shares at a ratio of one for six (1 for 6) which was implemented

on July 30, 2020.

About

Taoping Inc.

Company

Overview

We

are a leading provider of cloud-app technologies for Smart City IoT platforms, digital advertising delivery, and other internet-based

information distribution systems in China. Our Internet ecosystem enables all participants of the new media community to efficiently

promote branding, disseminate information, and exchange resources. In addition, we provide a broad portfolio of software and hardware

with fully integrated solutions, including Information Technology infrastructure, Internet-enabled display technologies, and IoT

platforms to customers in government, education, residential community management, media, transportation, and other private sectors.

We

were founded in 1993 and are headquartered in Shenzhen, China. As of December 31, 2019, we had approximately 78 full-time employees.

Prior

to 2014, we generated the majority of our revenues through selling our products and services mostly to the public service entities

to help them improve their operational efficiency and service quality. Our representative customers included the China Ministry

of Public Security, provincial bureaus of public security, fire departments, traffic bureaus, police stations, human resource

departments, urban planning boards, civic administrations, land resource administrations, mapping and surveying bureaus, and the

Shenzhen General Station of Immigration Frontier Inspection.

Since

2014, we have expanded and diversified our customer base into the private sector as well. Our customers in the private sector

include, among others, elevator maintenance companies, residential community management, advertising agencies, auto dealerships,

and educational institutes. Our new corporate mission is to make publicity accessible and affordable for businesses of all sizes.

We

generated revenues from sales of hardware products, software products, system integration services, and related maintenance and

support services. In 2015, with the introduction of our cloud-based software as a service (SaaS) offering, we expected to generate

additional recurring monthly revenues from SaaS fees. In 2018 and 2019, only a very small portion of our revenue was generated

from SaaS, which is expected to increase in the coming years with the nationwide roll-out of our cloud-based ad display terminal

network.

In

May 2017, we completed our transformation to a provider of CAT and IoT technology based digital advertising distribution network

and new media resource sharing platform, and offered an end-to-end digital advertising solution enabling customers to efficiently

and cost-effectively direct advertisements to specific interactive ad display terminals in the out-of-home advertising market

across China. In 2017, we became profitable as a result of a successful transition of our business model. We continued to improve

our financial position in 2018. However, due to the unfavorable macro-economic environment and the slowdown of the out-of-home

advertising market in China, we had net loss of approximately $3.6 million in 2019. For years going forward, we will continue

to execute our business plan and build a nationwide cloud-based ad terminal network by penetrating into more cities throughout

China, which is expected to generate recurring service revenue for the Company, in addition to equipment sales.

Starting

from January 2020, the coronavirus outbreak, also known as COVID-19, has caused the Chinese government to take quarantine measures,

such as nationwide lockdowns, transportation restrictions, public gathering prohibitions and temporary closures of non-essential

businesses, which had put economic activities in a suspension mode until late March, in addition to the regular Chinese New Year

Holiday. Although the COVID-19 epidemic has largely been contained in China since then and businesses have gradually resumed to

operations, China’s economic recovery still faces great challenges. Facing this challenge, we believe China’s out-of-home

advertising market and our revenue in 2020 so far have been negatively affected.

Our

customers are located across different provinces of China, including certain areas severely affected by the epidemic, the coronavirus

outbreak may have a negative impact on revenue in the short run. We had a year-over-year decrease of approximately 26% in revenue

in the first quarter of 2020, according to unaudited financial information, and a potential slowdown in collection of accounts

receivable in 2020. However, we have seen sales starting to increase in the second quarter compared with the first quarter in

2020, and yet a year-over-year decrease compared with the same period of 2019. Nevertheless, the Company does not expect a significant

impact on the Company’s operations and financial results in the long run unless the COVID-19 epidemic is not contained in

the year of 2020. The epidemic in China is currently under control. Businesses around China have largely returned to normal since

April 2020. The operations of our customers and our supply chain have been back to normal since most cities in China have lifted

the lockdown restrictions.

We

report financial and operational information in the following two segments:

(1)

Cloud-based Technology (CBT) segment — The CBT segment is our current and future focus of corporate development. It includes

our cloud-based products and services offered to customers in the private sector including new media, healthcare, education, and

residential community management. In this segment, we generate revenues from the sales of hardware, and the provision of total

solutions of interactive advertisement display terminals integrated with proprietary software, out-of-home digital advertising

distribution, and advertising time slot programmed trading transactions. We also generate revenue from monthly software subscription

and Software-as-a Service (SaaS) fees.

(2)

Traditional Information Technology (TIT) segment — The TIT segment includes our project-based technology products and services

offered to the public sector, including Digital Public Security Technology (DPST) and Multi-screen Digital Display Systems (MDDS).

In this segment, we generate revenues from the sales of software and systems integration services.

Corporate

Information

We

were incorporated in the British Virgin Islands on June 18, 2012. Our principal executive office is located at 21st Floor, Everbright

Bank Building, Zhuzilin, Futian District, Shenzhen, Guangdong Province 518040, People’s Republic of China. Our telephone

number is (+86) 755-8831-9888.

The

following chart reflects our organizational structure as of the date of this prospectus supplement.

THE

OFFERING

|

Ordinary

Shares Offered by Us

|

|

222,222

shares

|

|

|

|

|

|

Offering

Price Per Share

|

|

$2.70

|

|

|

|

|

|

Ordinary

Shares Outstanding Immediately Before the Offering*

|

|

7,432,983

shares

|

|

|

|

|

|

Ordinary

Shares to be Outstanding Immediately After the Offering (assumes all Ordinary Shares offered in this offering are sold and

excludes the shares underlying the Note and the Warrant)*

|

|

7,655,205

shares

|

|

|

|

|

|

Market

for the Ordinary Shares

|

|

Our

Ordinary Shares are traded on the Nasdaq Capital Market under the symbol “TAOP.”

|

|

|

|

|

|

Use

of Proceeds

|

|

We

intend to use the net proceeds from this offering for working capital and other general corporate purposes. See “Use

of Proceeds” on page S-8 of this prospectus supplement.

|

|

|

|

|

|

Risk

Factors

|

|

Investing

in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding

to invest in our Ordinary Shares. See “Risk Factors” beginning on page S-5 of this prospectus supplement and on

page 2 of the accompanying prospectus and other information included or incorporated by reference in this prospectus supplement

and the accompanying prospectus.

|

|

|

|

|

|

Concurrent

Private Placement

|

|

In

a concurrent private placement, for a purchase price of $1,400,000, we are selling to the same investor a Note with a principal

amount of $1,480,000 and a Warrant to purchase up to 53,333 Ordinary Shares at $9.00 per share within three years following

the issue date. The Note, the Warrant and the Ordinary Shares issuable upon the conversion of the Note and the exercise

of the Warrant are not being offered pursuant to this prospectus supplement and the accompanying prospectus. See “Private

Placement Transaction.”

|

|

|

|

|

|

Transfer

Agent and Registrar

|

|

Transhare

Corporation

|

*The

number of our Ordinary Shares to be outstanding after this offering is based on 7,432,983 Ordinary Shares outstanding on September

10, 2020.

The

number of our Ordinary Shares outstanding immediately before and immediately after this offering excludes:

|

|

●

|

up

to 26,667 Ordinary Shares issuable upon exercise of the warrants issued in October 2019;

|

|

|

●

|

up

to 53,334 Ordinary Shares issuable upon exercise of the warrants issued in March 2020;

|

|

|

●

|

up

to 16,667 Ordinary Shares issuable upon exercise of the warrants issued in April 2020;

|

|

|

●

|

up

to 1,000,000 Ordinary Shares issuable upon conversion of the convertible notes issued in March 2020 (the “March 2020

Notes”);

|

|

|

●

|

up

to 470,000 Ordinary Shares issuable upon conversion of the convertible note issued in October 2019 (the “2019 Note”);

|

|

|

●

|

up

to 53,333 Ordinary Shares issuable upon exercise of the Warrant issued in the concurrent private placement;

|

|

|

●

|

up

to 1,000,000 Ordinary Shares issuable upon conversion of the Note issued in the concurrent private placement; and

|

|

|

●

|

up

to 390,714 Ordinary Shares issuable upon the exercise of outstanding options, which were granted to our officers, employees

and consultants in July 2020 under our equity incentive plans.

|

RISK

FACTORS

Any

investment in our securities involves a high degree of risk. You should consider carefully the risks described below as well as

the risks described in the section captioned “Risk Factors” in our annual report on Form 20-F for the year ended December

31, 2019, and as updated by any document that we subsequently file with the SEC that is incorporated by reference in this prospectus

supplement or the accompanying prospectus, together with other information in this prospectus supplement, the accompanying prospectus

and the information and documents incorporated by reference in this prospectus supplement and the accompanying prospectus before

you make a decision to invest in our securities. If any of such risks actually occur, our business, operating results, prospects

or financial condition could be materially and adversely affected. This could cause the trading price of our Ordinary Shares to

decline and you may lose all or part of your investment. The risks described below are not the only ones that we face. Additional

risks not presently known to us or that we currently deem immaterial may also affect our business operations. The risks discussed

below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking

statements. See “Forward-Looking Information.”

RISKS

RELATED TO THIS OFFERING

Our

business operations have been and may continue to be materially and adversely affected by the outbreak of the coronavirus (COVID-19).

An

outbreak of respiratory illness caused by COVID-19 emerged in late 2019 and has spread within the PRC and globally. The coronavirus

is considered to be highly contagious and poses a serious public health threat. The World Health Organization labeled the coronavirus

a pandemic on March 11, 2020, given its threat beyond a public health emergency of international concern the organization had

declared on January 30, 2020.

Any

outbreak of health epidemics in the PRC or elsewhere in the world may materially and adversely affect the global economy, our

markets and business. For most of the first quarter of 2020, we scaled back operations, as our employees worked remotely or at

premises in shifts for limited periods of time in response to nationwide lockdowns and quarantines. We only resumed full operations

since late March. The pandemic has also depressed customers’ demand for our products and services, since businesses across

China largely suspended or reduced operations in the past few months. In addition, it now takes longer time to collect accounts

receivable. As a provider of digital advertising distribution networks, we are sensitive to the overall business environment and

vulnerable to any market downturns.

With

the coronavirus epidemic expanding globally, the world economy is suffering a noticeable slowdown. Commercial activities throughout

the world have been curtailed with decreased consumer spending, business operation disruptions, interrupted supply chain, difficulties

in travel, and reduced workforces. The duration and intensity of disruptions resulting from the coronavirus outbreak is uncertain.

It is unclear as to when the outbreak will be contained, and we also cannot predict if the impact will be short-lived or long-lasting.

The extent to which the coronavirus impacts our financial results will depend on its future developments. If the outbreak of the

coronavirus persists, our business operation and financial condition may be materially and adversely affected as a result of slowdown

in economic growth, operation disruptions or other factors that we cannot predict.

We

will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Subject

to certain limited exceptions set forth in the offering documents, we have agreed to use the net proceeds from this offering solely

for working capital and general corporate purposes; provided, however, that none of such proceeds will be used, directly or indirectly,

for (i) the satisfaction of any of our indebtedness, other than payment of trade payables incurred in the ordinary course of business

and consistent with prior practices; (ii) the redemption or repurchase of any of our securities; or (iii) the settlement of any

outstanding litigation. We have considerable discretion in the application of the net proceeds of this offering. You will not

have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used in a manner agreeable

to you. You must rely on our judgment regarding the application of the net proceeds of this offering. The net proceeds may be

used for corporate purposes that do not improve our profitability or increase the price of our shares. The net proceeds may also

be placed in investments that do not produce income or that lose value. The failure to use such funds by us effectively could

have a material adverse effect on our business, financial condition, operating results and cash flow.

A

large number of shares may be sold in the market following this offering, which may significantly depress the market price of

our Ordinary Shares.

The

Ordinary Shares sold in the offering will be freely tradable without restriction or further registration under the Securities

Act. As a result, a substantial number of our Ordinary Shares may be sold in the public market following this offering. If there

are significantly more Ordinary Shares offered for sale than buyers are willing to purchase, then the market price of our Ordinary

Shares may decline to a market price at which buyers are willing to purchase the offered Ordinary Shares and sellers remain willing

to sell the Ordinary Shares.

If

we fail to maintain compliance with the continued listing requirements of NASDAQ, we would face possible delisting, which would

result in a limited public market for trading our shares and make obtaining future debt or equity financing more difficult for

us.

Our

Ordinary Shares are traded and listed on the Nasdaq Capital Market under the symbol of “TAOP.” Our shares may be delisted,

if we fail to regain compliance with certain continued listing requirements of the Nasdaq Stock Market, or NASDAQ, in a timely

manner.

On

June 18, 2019, we received a notification letter from the Listing Qualifications Staff of NASDAQ notifying us that the minimum

bid price per share for our Ordinary Shares has been below $1.00 for a period of 30 consecutive business days and we therefore

no longer meet the minimum bid price requirements set forth in Nasdaq Listing Rule 5550(a)(2). We regained the compliance with

the minimum bid price rule on August 20, 2020 by implementing a 1-for-6 share combination of our outstanding Ordinary Shares effective

on July 30, 2020.

If

we fail to maintain compliance with the NASDAQ continued listing requirements, our Ordinary Shares may lose their status on Nasdaq

Capital Market and they would likely be traded on the over-the-counter market. As a result, selling our Ordinary Shares could

be more difficult because smaller quantities of shares would likely be bought and sold, transactions could be delayed, and security

analysts’ coverage of us may be reduced. In addition, in the event our Ordinary Shares are delisted, broker dealers would

have bear certain regulatory burdens which may discourage broker dealers from effecting transactions in our Ordinary Shares and

further limiting the liquidity of our shares. These factors could result in lower prices and larger spreads in the bid and ask

prices for our Ordinary Shares. Such delisting from NASDAQ and continued or further declines in our share price could also greatly

impair our ability to raise additional necessary capital through equity or debt financing, and could significantly increase the

ownership dilution to shareholders caused by our issuing equity in financing or other transactions.

If

our Ordinary Shares were delisted from NASDAQ, we may become subject to the trading complications experienced by “Penny

Stocks” in the over-the-counter market.

Delisting

from NASDAQ may cause our Ordinary Shares to become subject to the SEC’s “penny stock” rules. The SEC generally

defines a penny stock as an equity security that has a market price of less than $5.00 per share or an exercise price of less

than $5.00 per share, subject to specific exemptions. One such exemption is to be listed on NASDAQ. The market price of our Ordinary

Shares is currently below $5.00 per share. Therefore, were we to be delisted from NASDAQ, our Ordinary Shares will become subject

to the SEC’s “penny stock” rules. These rules require, among other things, that any broker engaging in a purchase

or sale of our securities provide its customers with: (i) a risk disclosure document, (ii) disclosure of market quotations, if

any, (iii) disclosure of the compensation of the broker and its salespersons in the transaction, and (iv) monthly account statements

showing the market values of our securities held in the customer’s accounts. A broker would be required to provide the bid

and offer quotations and compensation information before effecting the transaction. This information must be contained on the

customer’s confirmation. Generally, brokers are less willing to effect transactions in penny stocks due to these additional

delivery requirements. These requirements may make it more difficult for shareholders to purchase or sell our Ordinary Shares.

Because the broker, not us, prepares this information, we would not be able to assure that such information is accurate, complete

or current.

The

market price of our Ordinary Shares has been volatile, leading to the possibility that their value may be depressed at a time

when you want to sell your holdings.

The

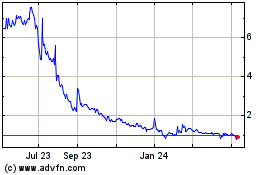

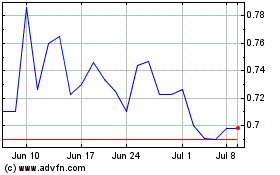

market price of our Ordinary Shares has been volatile, and this volatility may continue. From January 2, 2020 through September

10, 2020 the closing price of our Ordinary Shares on the NASDAQ Capital Market has ranged from a high of $8.80 to a low

of $1.92. Numerous factors, many of which are beyond our control, may cause the market price of our Ordinary Shares to

fluctuate significantly. These factors include, among others:

|

|

●

|

actual

or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial

market analysts and investors;

|

|

|

●

|

changes

in financial estimates by us or by any securities analysts who might cover our share;

|

|

|

●

|

speculation

about our business in the press or the investment community;

|

|

|

●

|

significant

developments relating to our relationships with our customers or suppliers;

|

|

|

●

|

stock

market price and volume fluctuations of other publicly traded companies and, in particular, those that are in our industry;

|

|

|

●

|

customer

demand for our services and products;

|

|

|

●

|

investor

perceptions of our industry in general and our company in particular;

|

|

|

●

|

the

operating and share performance of comparable companies;

|

|

|

●

|

general

economic conditions and trends;

|

|

|

●

|

major

catastrophic events;

|

|

|

●

|

announcements

by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures;

|

|

|

●

|

changes

in accounting standards, policies, guidance, interpretation or principles;

|

|

|

●

|

loss

of external funding sources;

|

|

|

●

|

sales

of our Ordinary Shares, including sales by our directors, officers or significant shareholders;

|

|

|

●

|

additions

or departures of key personnel; and

|

|

|

●

|

investor

perception of litigation, investigation or other legal proceedings involving us or certain of our individual shareholders

or their family members.

|

Any

of these factors may result in large and sudden changes in the volume and price at which our Ordinary Shares will trade. We cannot

give any assurance that these factors will not occur in the future again. In addition, the securities market has from time to

time experienced significant price and volume fluctuations that are not related to the operating performance of particular companies.

These market fluctuations may also have a material adverse effect on the market price of our Ordinary Shares. In the past, following

periods of volatility in the market price of their stock, many companies have been the subject of securities class action litigation.

If we become involved in similar securities class action litigation in the future, it could result in substantial costs and diversion

of our management’s attention and resources and could harm our stock price, business, prospects, financial condition and

results of operations.

There

is no public market for the Note or the Warrant.

There

is no established public trading market for the Note or the Warrant being offered in the concurrent private placement and we do

not expect a market to develop. In addition, we do not intend to apply for listing of the Note or the Warrant on any securities

exchange or automated quotation system. Without an active market, investors in this offering may be unable to readily sell the

Note or the Warrant.

Conversion

of the Note or exercise of the Warrant being offered concurrently may dilute the ownership interest of existing shareholders.

The

conversion or exercise of the Note and the Warrant, respectively, will dilute the ownership interests of existing shareholders.

Any sales in the public market of the Ordinary Shares issuable upon such conversion or exercise could adversely affect prevailing

market prices of our Ordinary Shares. In addition, the existence of the Note or Warrant may encourage short selling by market

participants because the conversion of the Note or the exercise of Warrant could depress the price of our Ordinary Shares.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering will be approximately $1.92 million, after deducting the estimated expenses

of this registered direct offering and the concurrent private placement payable by us.

We

intend to use the net proceeds from this offering for working capital and general corporate purposes; provided, however, that

none of such proceeds will be used, directly or indirectly, for (i) the satisfaction of any of our indebtedness, other than payment

of trade payables incurred in the ordinary course of business and consistent with prior practices; (ii) the redemption or repurchase

of any of our securities; or (iii) the settlement of any outstanding litigation.

The

amounts and timing of our use of proceeds will vary depending on a number of factors, including the amount of cash generated or

used by our operations, and the rate of growth, if any, of our business. As a result, we will retain broad discretion in the allocation

of the net proceeds of this offering. In addition, while we have not entered into any agreements, commitments or understandings

relating to any significant transaction as of the date of this prospectus supplement, we may use a portion of the net proceeds

to pursue acquisitions, joint ventures and other strategic transactions. Depending on future events and others changes in the

business climate, we may determine at a later time to use the net proceeds for different purposes.

CAPITALIZATION

AND INDEBTEDNESS

The

table below sets forth our capitalization and indebtedness as of December 31, 2019:

|

|

●

|

on

an actual basis;

|

|

|

|

|

|

|

●

|

on

a pro forma basis, given the effect of (i) the issuance and sale of 285,714 Ordinary Shares in the registered direct offering

in March 2020 at the offering price of $2.10 per share; and (ii) the issuance and sale of $1.48 million principal amount of

the March 2020 Notes and warrants to purchase up to 53,334 Ordinary Shares of the Company resulting in net proceeds of approximately

$1.92 million after deducting estimated offering expenses payable by us; (iii) the issuance of 30,000 Ordinary Shares to a

consultant as compensation for investor relations service in the first half of 2020; (iv) the issuance of 16,667 Ordinary

Shares and warrants to purchase up to 16,667 Ordinary Shares as compensation for a consultant’s service in April 2020;

(v) the issuance of 5,000 Ordinary Shares to certain employees in July 2020 as equity awards; (vi) the issuance of 6,250 Ordinary

Shares to certain consultant in July 2020 as a result of non-cash exercise of the warrants issued in March 2019; (vii) the

issuance of 72,414 Ordinary Shares to certain employees as a result of non-cash exercise of share options granted in 2016

and 2017; (viii) the issuance of 14,000 Ordinary Shares to a consultant as compensation for its investor relations service

for July and August of 2020; and (ix) the issuance of stock options to certain consultants to purchase up 57,366 Ordinary

Shares in July, 2020

|

|

|

|

|

|

|

●

|

on

a pro forma as adjusted basis to give effect to (i) the issuance and sale of 222,222 Ordinary Shares in the registered direct

offering pursuant to this prospectus supplement at the offering price of $2.70 per share; and (ii) the issuance and sale of

$1.48 million principal amount of the Note and warrant to purchase up to 53,333 Ordinary Shares in the concurrent private

placement, resulting in net proceeds of approximately $1.92 million after deducting estimated offering expenses payable by

us.

|

|

|

|

As of December 31, 2019

|

|

|

|

|

Actual**

|

|

|

Pro Forma(1)

|

|

|

Pro Forma

As Adjusted(1)

|

|

|

Total Current Liabilities

|

|

$

|

26,007,161

|

|

|

$

|

27,174,001

|

|

|

$

|

28,124,168

|

|

|

Short-term bank loans

|

|

|

6,584,664

|

|

|

|

6,584,664

|

|

|

|

6,584,664

|

|

|

Convertible note payable

|

|

|

916,511

|

|

|

|

2,083,351

|

|

|

|

3,033,518

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares,

|

|

|

126,257,156

|

|

|

|

129,087,069

|

|

|

|

129,663,069

|

|

|

Additional paid-in capital*

|

|

|

16,461,333

|

|

|

|

14,732,766

|

|

|

|

15,126,599

|

|

|

Reserve

|

|

|

14,044,269

|

|

|

|

14,044,269

|

|

|

|

14,044,269

|

|

|

Accumulated deficit

|

|

|

(174,517,769

|

)

|

|

|

(174,654,077

|

)

|

|

|

(174,654,077

|

)

|

|

Accumulated other comprehensive income

|

|

|

23,022,845

|

|

|

|

23,022,845

|

|

|

|

23,022,845

|

|

|

Total equity of the Company

|

|

$

|

5,267,834

|

|

|

$

|

6,232,872

|

|

|

$

|

7,202,705

|

|

|

Non-controlling interest

|

|

|

9,340,551

|

|

|

|

9,340,551

|

|

|

|

9,340,551

|

|

|

Total Equity

|

|

|

14,608,385

|

|

|

|

15,573,423

|

|

|

|

16,543,256

|

|

|

Total capitalization

|

|

$

|

22,109,560

|

|

|

$

|

24,241,438

|

|

|

$

|

26,161,438

|

|

|

*

|

Does

not include any potential proceeds from the exercise of Warrant issued in the concurrent private placement at an exercise

price of $9.00 per share.

|

|

**

|

Based

on 7,000,027 Ordinary Shares issued and outstanding as of December 31, 2019

|

(1) The pro forma information is illustrative only. You should read the above table together with our financial statements and the related notes and the information included in our annual report on Form 20-F, dated June 12, 2020, which is incorporated by reference herein.

DESCRIPTION

OF ORDINARY SHARES WE ARE OFFERING

In

this offering, we are offering 222,222 Ordinary Shares pursuant to this prospectus supplement and the accompanying prospectus.

A description of the Ordinary Shares that we are offering pursuant to this Prospect Supplement is set forth under the heading

“Description of Share Capital” starting on page 4 of the accompanying prospectus.

PRIVATE

PLACEMENT TRANSACTION

The

material terms and provisions of the Note and Warrant being offered in the concurrent private placement are summarized below.

This summary is subject to, and qualified in its entirety by, the terms of the Note and Warrant as set forth in the form of Note

and the form of Warrant to be furnished as exhibits to our report on Form 6-K filed with the SEC on or about September 11, 2020.

In

a concurrent private placement, we will issue and sell to the investor a Note with a principal amount of $1,480,000, and a Warrant

to purchase up to 53,333 Ordinary Shares at an exercise price equal to $9.00 per share.

The

Notes, Warrants and the Ordinary Shares issuable upon the conversion of such notes and the exercise of such warrants are not being

registered under the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus

and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and/or Rule 506(b) promulgated

thereunder. Accordingly, the investors may only sell Ordinary Shares issued upon the conversion of Notes or the exercise of Warrants

pursuant to an effective registration statement under the Securities Act covering the resale of those shares, an exemption under

Rule 144 under the Securities Act or another applicable exemption under the Securities Act.

Note

The

Note carries an OID of $80,000 and matures in 12 months from the issue date, bearing interest at a rate of 5.0% per annum. The

Note is convertible into Ordinary Shares in the following situations:

Fixed

Price Conversion. At any time prior to the maturity, the Note, at the investor’s option, may be convertible into fully

paid Ordinary Shares of the Company at a conversion price of $9.00 per share.

Alternate

Conversion. At any time after the occurrence of an event of default (as defined in the Note), the investor may convert all

of the outstanding balance of the Note into Ordinary Shares at the lowest of: (i) $9.00 per share; (ii) 90% of the volume-weighted

average closing price of Ordinary Shares during the 20 consecutive trading day period ending on the trading day immediately prior

to the applicable conversion date; (iii) 90% of the volume-weighted average closing price of Ordinary Shares during the 175 consecutive

trading day period ending on the trading day immediately prior to the applicable conversion date; (iv) 95% of the per share purchase

price of Ordinary Shares offered in a subsequent private placement transaction of the Company consummated during the term of the

Note; and (v) the purchase price of Ordinary Shares offered in a subsequent underwritten public offering of the Company that takes

place during the term of the Note. However in no event will the number of Ordinary Shares issuable upon such conversion of the

Notes exceed 1,000,000 shares in aggregate.

Quarterly

Conversion. In the event the Notes are outstanding in each of the months of March and June 2021, the investor has a one-time

option during the first three weeks in each of March and June 2021 to convert no more than one half of the then outstanding balance

of the Note into Ordinary Shares at the lowest of: (i) $9.00 per share; (ii) 90% of the volume-weighted average closing price

of Ordinary Shares during the 20 consecutive trading day period ending on the trading day immediately prior to the applicable

conversion date; (iii) 90% of the volume-weighted average closing price of Ordinary Shares during the 175 consecutive trading

day period ending on the trading day immediately prior to the applicable conversion date; (iv) 95% of the per share purchase price

of Ordinary Shares offered in a subsequent private placement transaction of the Company consummated during the term of the Note;

(v) the purchase price of Ordinary Shares offered in a subsequent underwritten public offering of the Company that takes place

during the term of the Note; and (vi) volume-weighted average trade price of Ordinary Shares on the trading day immediately prior

to the applicable conversion date. However, in no event will the conversion price be less than $2.40 per share.

Conversion

upon Maturity Date. In the event the Notes remain outstanding on the maturity date, the investors may convert all but not

less than all of the outstanding balance of the Notes into Ordinary Shares at the lowest of the prices as set forth thereunder.

Same as Quarterly Conversion, in no event will the conversion price be less than $2.4 per share.

Warrant

Exercisability.

The Warrant issued in the concurrent private placement is exercisable for a period of three years, at the initial exercise

price of $9.00 per share, in whole or in part by delivering to us a duly executed exercise notice and by payment in full in immediately

available funds for the number of Ordinary Shares purchased upon such exercise. In addition, the holder may, in its sole discretion,

elect to exercise the Warrant through a cashless exercise, in which case the holder would receive upon such exercise the net number

of Ordinary Shares determined according to the formula set forth in the Warrant.

Exercise

Price Adjustment. The exercise price of the Warrant is subject to appropriate adjustment in the event of certain share dividends

and distributions, share splits, share combinations, reclassifications or similar events affecting our Ordinary Shares and also

upon any distributions of assets, including cash, stock or other property to our shareholders.

Rights

as a Shareholder. Prior to exercise of this Warrant, the Holder hereof shall not, by reason of by being a Holder, be entitled

to any rights of a shareholder with respect to the shares underlying the Warrant.

PLAN

OF DISTRIBUTION

We

are selling 222,222 Ordinary Shares in a registered direct offering to one individual investor in a privately negotiated transaction

pursuant to this prospectus supplement and accompanying prospectus at a price of $2.70 per share. The Ordinary Shares were offered

directly to the investor without a placement agent, underwriter, broker or dealer.

Transfer

Agent and Registrar

The

transfer agent and registrar for our Ordinary Shares is Transhare Corporation, 2849 Executive Dr., Suite 200, Clearwater FL 33762

and its telephone number is (303) 662-1112.

Listing

Our

Ordinary Shares are traded on the Nasdaq Capital Market under the symbol “TAOP.”

LEGAL

MATTERS

The

validity of the issuance of the Ordinary Shares offered hereby will be passed upon for us by Maples and Calder, British Virgin

Islands counsel.

EXPERTS

The

consolidated financial statements of Taoping Inc. as of December 31, 2019 and 2018 and for the years ended December 31, 2019,

2018 and 2017 have been incorporated by reference herein in reliance upon the reports of UHY LLP, independent registered public

accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we file with them. This means that we can disclose important

information to you by referring you to those documents. Each document incorporated by reference is current only as of the date

of such document, and the incorporation by reference of such documents shall not create any implication that there has been no

change in our affairs since the date thereof or that the information contained therein is current as of any time subsequent to

its date. The information incorporated by reference is considered to be a part of this prospectus supplement and should be read

with the same care. When we update the information contained in documents that have been incorporated by reference by making future

filings with the SEC, the information incorporated by reference in this prospectus supplement is considered to be automatically

updated and superseded. In other words, in the case of a conflict or inconsistency between information contained in this prospectus

supplement and information incorporated by reference in this prospectus supplement, you should rely on the information contained

in the document that was filed later.

The

documents we are incorporating by reference as of their respective dates of filing are:

|

|

●

|

Our

Annual Report on Form 20-F for the fiscal year ended December 31, 2019, filed with the SEC on June 12, 2020.

|

|

|

|

|

|

|

●

|

Our

Report of Foreign Private Issuer on Form 6-K furnished on July 29, 2020; and

|

|

|

|

|

|

|

●

|

The

description of the Company’s Ordinary Shares contained in the Form 8-K12B, filed with the SEC on October 31, 2012, and

any further amendment or report filed hereafter for the purpose of updating such description.

|

All

subsequent annual reports on Form 20-F and all subsequent reports on Form 6-K submitted by us to the SEC, that are identified

by us as being incorporated by reference, shall be deemed to be incorporated by reference into this prospectus supplement and

deemed to be a part hereof after the date of this prospectus supplement but before the termination of the offering under this

prospectus supplement. Unless expressly incorporated by reference, nothing in this prospectus supplement and the accompanying

prospectus shall be deemed to incorporate by reference information furnished to, but not filed with, the SEC.

Any

statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will

be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in

this prospectus supplement or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus

supplement modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified

or superseded, to constitute a part of this prospectus supplement.

Copies

of all documents incorporated by reference in this prospectus supplement, including exhibits to these documents, will be provided

at no cost to each person, including any beneficial owner, who receives a copy of this prospectus supplement on the written or

oral request of that person made to:

Taoping

Inc.

21st

Floor, Everbright Bank Building, Zhuzilin

Futian

District, Shenzhen, Guangdong 518040

People’s

Republic of China

Telephone

number (+86)755-8370-8333.

You

may also obtain information about us by visiting our website at www.taop.com. Information contained in our website is not

part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form F-3 (File No. 333-229323) under the Securities Act with respect to the

securities offered by this prospectus supplement. This prospectus supplement and the accompanying prospectus, which constitute

a part of our registration statement on Form F-3, omit some information contained in the registration statement in accordance

with SEC rules and regulations. You should review the information and exhibits in the registration statement for further information

on us and the securities we are offering. Statements in this prospectus supplement and the accompanying prospectus concerning

any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to

be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements.

We

are subject to the reporting requirements of the Exchange Act that are applicable to a foreign private issuer. In accordance with

the Exchange Act, we file reports, including annual reports on Form 20-F containing financial statements audited by an independent

accounting firm. We also furnish to the SEC, under cover of Reports of Foreign Private Issuer on Form 6-K, material information

required to be made public by us or filed by us with and made public by any stock exchange or distributed by us to our shareholders.

As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy

statements to shareholders, and our officers, directors and principal shareholders are exempt from the “short-swing profits”

reporting and liability provisions contained in Section 16 of the Exchange Act and related Exchange Act rules. In addition, we

are not required under the Exchange Act to file periodic reports and financial statements as frequently or as promptly as U.S.

companies whose securities are registered under the Exchange Act.

The

SEC maintains an Internet site that contains reports, information statements and other information regarding issuers, such as

us, that file electronically with the SEC (http://www.sec.gov).

Additionally,

we make these filings available, free of charge, on our website at www.taop.com as soon as reasonably practicable after

we electronically file such materials with, or furnish them to, the SEC. The information on our website, other than these filings,

is not, and should not be, considered part of this prospectus supplement and is not incorporated by reference into this document.

PROSPECTUS

TAOPING

INC.

$80,000,000

Ordinary

Shares

Debt

Securities

Warrants

Units

Offered

by Taoping Inc.

And

500,000

Ordinary Shares Offered by the Selling Shareholder Named Herein

This

prospectus relates to a primary offering by us and a secondary offering by the selling shareholder named in this prospectus (the

“Selling Shareholder”).

In

the primary offering, we may offer, issue and sell from time to time our ordinary shares, no par value (“Ordinary Shares”),

debt securities, warrants, or units up to $80,000,000 or its equivalent in any other currency, currency units, or composite currency

or currencies in one or more issuances. We may sell any combination of these securities in one or more offerings.

In

addition, the Selling Shareholder may offer and sell from time to time up to 500,000 Ordinary Shares, covered by this prospectus.

This

prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be

offered. The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described

in a supplement to this prospectus or incorporated into this prospectus by reference. You should read this prospectus and any

supplement carefully before you invest. Each prospectus supplement will indicate if the securities offered thereby will be listed

or quoted on a securities exchange or quotation system.

The

information contained or incorporated in this prospectus or in any prospectus supplement is accurate only as of the date of this

prospectus, or such prospectus supplement, as applicable, regardless of the time of delivery of this prospectus or any sale of

our securities.

Our

Ordinary Shares are listed on the NASDAQ Capital Market under the symbol “TAOP.” On January 17, 2019, the last reported

per share sale price of our Ordinary Share was $1.15. As of January 17, 2019, the aggregate market value of our outstanding Ordinary

Shares held by non-affiliates was approximately $27.61 million, which was calculated based on approximately 41,760,163 shares

of outstanding ordinary shares, of which approximately 24,011,452 shares were held by non-affiliates. We have not offered and

sold any securities pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on,

and includes, the date of this prospectus.

We

may offer securities through underwriting syndicates managed or co-managed by one or more underwriters, through agents, or directly

to purchasers. The prospectus supplement for each offering of securities will describe the plan of distribution for that offering.

For general information about the distribution of securities offered, please see “Plan of Distribution” in this prospectus.

Investing

in our securities involves risks. You should carefully consider the risk factors beginning on page 2 of this prospectus, in any

accompanying prospectus supplement and in any related free writing prospectus, and in the documents incorporated by reference

into this prospectus, any accompanying prospectus supplement and any related free writing prospectus before making any decision

to invest in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is February 11, 2019

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a

“shelf” registration process. Under this shelf registration process, we may sell our securities described in this

prospectus in one or more offerings up to a total dollar amount of $80,000,000 (or its equivalent in foreign or composite currencies).

In addition, this prospectus relates to the resale, from time to time, by the Selling Shareholder identified in this prospectus

under the caption “Selling Shareholder,” of up to 500,000 Ordinary Shares.

This

prospectus provides you with a general description of the securities that may be offered. Each time we offer our securities, we

will provide you with a supplement to this prospectus that will describe the specific amounts, prices and terms of the securities

we offer. The prospectus supplement may also add, update or change information contained in this prospectus. This prospectus,

together with applicable prospectus supplements and the documents incorporated by reference in this prospectus and any prospectus

supplements, includes all material information relating to this offering. Please read carefully both this prospectus and any prospectus

supplement together with additional information described below under “Where You Can Find More Information.”

You

should rely only on the information contained in or incorporated by reference in this prospectus and any applicable prospectus

supplement. Neither we nor the Selling Shareholder have authorized anyone to provide you with different or additional information.

If anyone provides you with different or inconsistent information, you should not rely on it. We nor the Selling Shareholder take

no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery

of this prospectus or any sale of securities described in this prospectus. This prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

You

should not assume that the information contained in this prospectus and the accompanying prospectus supplement is accurate on

any date subsequent to the date set forth on the front of the document or that any information that we have incorporated by reference

is correct on any date subsequent to the date of the document incorporated by reference. Our business, financial condition, results

of operations and prospects may have changed since those dates.

TAOPING

INC.

We

are a leading provider of cloud-app technologies for Smart City IoT (Internet of Things) platforms, digital advertising delivery,

and other internet-based information distribution systems in China. Our Internet ecosystem enables all participants of the new

media community to efficiently promote branding, disseminate information, and exchange resources. In addition, we provide a broad

portfolio of software, hardware with fully integrated solutions, including Information Technology infrastructure, Internet-enabled

display technologies, and IoT platforms to customers in government, education, residential community management, media, transportation,

and other private sectors.

We

were founded in 1993 and are headquartered in Shenzhen, China. As of September 30, 2018, we had approximately 110 employees.

Prior

to 2014, we generated the majority of our revenues through selling our products and services mostly to the public service entities

to help them improve their operational efficiency and service quality. Since 2014, we have expanded and diversified our customer

base to the private sector as well. Our customers in the private sector include, among others, elevator maintenance companies,

residential community management, advertising agencies, auto dealerships, and educational institutes. Our new corporate mission

is to make publicity accessible and affordable for businesses of all sizes.

We

generated revenues from sales of hardware products, software products, system integration services, and related maintenance and

support services. Starting in 2015, with the introduction of our cloud-based software as a service (SaaS) offering, we expect

to generate additional recurring monthly revenues from SaaS fees. In 2016 and 2017, a small portion of our revenue was generated

from SaaS, which is expected to increase in the coming years with the roll-out of our cloud-based elevator IoT and ad display

terminals.

In

May 2017, we completed our transformation to a provider of Cloud-App-Terminal (CAT) and IoT technology based digital advertising

distribution network and new media resource sharing platform, and offered an end-to-end digital advertising solution enabling

customers to efficiently and cost-effectively direct advertisements to specific interactive ad display terminals in the Out-of-Home

advertising market across China. In 2017, we became profitable as a result of a successful transition of our business model. During

the nine months of 2018, we continued to expand the market and our revenue increased by 34.8% to $16.5 million from $12.2 million

and net income attributable to the Company increased 67.4% to $1.9 million from $1.1 million, compared to the same period of last

year.

We

report financial and operational information in the following two segments:

|

|

(1)

|

Cloud-based Technology (CBT) segment —

The CBT segment is our current and future focus of corporate development. It includes our cloud-based products and services

offered to customers in the private sector including new media, healthcare, education, and residential community management.

In this segment, we generate revenues from the sales of hardware, and total solutions of interactive advertisement display

terminals integrated with proprietary software, Out-of-Home digital advertising distribution and advertising time slot programmed

trading transactions. We also generate revenue from monthly software subscription and Software-as-a Service (SaaS) fees.

|

|

|

|

|

|

|

(2)

|

Traditional Information Technology (TIT) segment

— The TIT segment includes our project-based technology products and services offered to the public sector, including

Digital Public Security Technology (DPST) and Multi-screen Digital Display Systems (MDDS). In this segment, we generate revenues

from the sales of software and systems integration services.

|

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Some of these risks include:

|

|

●

|

We have

a limited operating history of selling our cloud-based products and services and may be unable to achieve or sustain profitability

or reasonably predict our future results.

|

|

|

|

|

|

|

●

|

Our independent

registered auditors have expressed substantial doubt about our ability to continue as a going concern.

|

|

|

|

|

|

|

●

|

Our periodic operating

results are difficult to predict and could fall below investors’ expectations or estimates by securities research analysts,

which may cause the trading price of our ordinary shares to decline.

|

|

|

|

|

|

|

●

|

PRC laws and regulations

governing our businesses and the validity of certain of our contractual relationships with iASPEC are uncertain. If we are

found to be in violation of such PRC laws and regulations, our business may be negatively affected and we may be forced to

relinquish our interests in those operations.

|

|

|

|

|

|

|

●

|

If we fail to comply

with the continued listing requirements of NASDAQ, we would face possible delisting, which would result in a limited public

market for trading our shares and make obtaining future debt or equity financing more difficult for us.

|

|

|

|

|

|

|

●

|

Because we are incorporated

under the laws of the British Virgins Islands, or BVI, it may be more difficult for our shareholders to protect their rights

than it would be for a shareholder of a corporation incorporated in another jurisdiction.

|

We

operate in a highly competitive environment in which there are numerous factors which can influence our business, financial position

or results of operations and which can also cause the market value of our ordinary shares to decline. Many of these factors are

beyond our control and therefore, are difficult to predict. Prior to making a decision about investing in our securities, you

should carefully consider the risk factors noted above, the risk factors discussed in the sections entitled “Risk Factors”

contained in our most recent Annual Report on Form 20-F filed with the SEC, and in any applicable prospectus supplement and our

other filings with the SEC and incorporated by reference in this prospectus or any applicable prospectus supplement, together

with all of the other information contained in this prospectus or any applicable prospectus supplement. If any of the risks or

uncertainties described in our SEC filings or any prospectus supplement or any additional risks and uncertainties actually occur,

our business, financial condition and results of operations could be materially and adversely affected. In that case, the trading

price of our securities could decline and you might lose all or part of your investment.

FORWARD-LOOKING

STATEMENTS

This

prospectus contains or incorporates forward-looking statements within the meaning of section 27A of the Securities Act and section

21E of the Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking statements are management’s beliefs

and assumptions. In addition, other written or oral statements that constitute forward-looking statements are based on current

expectations, estimates and projections about the industry and markets in which we operate and statements may be made by or on

our behalf. Words such as “should,” “could,” “may,” “expect,” “anticipate,”

“intend,” “plan,” “believe,” “seek,” “estimate,” variations of such

words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of

future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. There are a number

of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements.

We

describe material risks, uncertainties and assumptions that could affect our business, including our financial condition and results

of operations, under “Risk Factors” and may update our descriptions of such risks, uncertainties and assumptions in

any prospectus supplement. We base our forward-looking statements on our management’s beliefs and assumptions based on information

available to our management at the time the statements are made. We caution you that actual outcomes and results may differ materially

from what is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying

on any forward-looking statements. Reference is made in particular to forward-looking statements regarding growth strategies,

financial results, product and service development, competitive strengths, intellectual property rights, litigation, mergers and

acquisitions, market acceptance or continued acceptance of our products, accounting estimates, financing activities, ongoing contractual

obligations and sales efforts. Except as required under the federal securities laws, the rules and regulations of the SEC, stock

exchange rules, and other applicable laws, regulations and rules, we do not have any intention or obligation to update publicly

any forward-looking statements after the distribution of this prospectus, whether as a result of new information, future events,

changes in assumptions, or otherwise.

USE

OF PROCEEDS

Except

as described in any prospectus supplement and any free writing prospectus in connection with a specific offering, we currently

intend to use the net proceeds from the sale of the securities offered by us under this prospectus to fund the growth of our business,