UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3/A

(Amendment

No.2)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF

1933

UNITED STATES ANTIMONY CORPORATION

(Exact

name of registrant as specified in its charter)

Montana

(State

or other jurisdiction of incorporation or

organization)

81-0305822

(I.R.S.

Employer Identification Number)

P.O.

Box 643, Thompson Falls, Montana 59873 Phone: (406)

827-3523

(Address,

including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

John

Gustavsen, 49 Steamboat Way, Thompson Falls, Montana 59873 Phone:

(406) 827-3523

(Name,

address, including zip code, and telephone number, including area

code, of agent for service)

(Approximate

date of commencement of proposed sale to the public)

If the

only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If any

of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in

connection with dividend or interest reinvestment plans, check the

following box: ☒

If this

Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. ☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same

offering. ☐

If this

Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e)

under the Securities Act, check the following

box. ☐

If this

Form is a post-effective amendment filed pursuant to General

Instruction I.D. filed to register additional securities or

additional classes of securities pursuant to Rule 413(b) under the

Securities Act, check the following

box. ☐

Indicate by check

mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act.

|

Large accelerated

filer ☐

|

Accelerated filer ☐

|

|

|

Smaller reporting company

☒

|

|

Non-accelerated filer

☐

|

Emerging growth

company ☐

|

SEC 870

(05-19)

Persons who are to

respond to the collection of information contained in this form are

not required to respond unless the form displays a currently valid

OMB control number.

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of Securities

Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

Amount to be registered (1)

|

Proposed maximum offering price per unit (2)

|

Proposed maximum aggregate offering price

|

Amount of registration fee

|

|

Common

Stock, par value $0.01 per share

|

11,485,716

|

$0.45

|

$5,168,572.20

|

$670.88

|

(1) The

shares will be offered for resale by selling

stockholders. Pursuant to Rule 416 under the Securities Act of

1933, as amended, there is also being registered hereby such

indeterminate number of additional shares of common stock, par

value $0.01 per share, of the registrant as may be issued or

issuable because of stock splits, stock dividends, stock

distributions, and similar transactions.

(2) Estimated solely for the purpose of computing the amount of the

registration fee for the shares of common stock being registered in

accordance with Rule 457(c) under the Securities Act of 1933, as

amended, based upon the average of the high and low prices for a

share of the registrant’s common stock as reported on NYSE

American, where the Company’s stock is listed, on August 24,

2020.

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically

states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the Registration Statement shall become

effective on such date as the Commission, acting pursuant to said

Section 8(a), may determine.

The information in this preliminary prospectus is not complete and

may be changed. The selling stockholders may not sell these

securities until the registration statement filed with the

Securities and Exchange Commission is effective. This preliminary

prospectus is not an offer to sell these securities

and the selling stockholders named in this prospectus are not

soliciting offers to buy these securities in any jurisdiction

where the offer or sale is not permitted.

Subject to Completion, Dated September 8, 2020.

11,485,716 Shares

UNITED STATES

ANTIMONY CORPORATION

Common Stock

This

prospectus relates to the resale, from time to time, of up to

11,485,716 shares of our common stock by the selling stockholders,

including 5,742,858 shares of our common stock that are issuable

upon the exercise of outstanding warrants to purchase our common

stock held by the selling stockholders. The selling stockholders

acquired 5,742,858 of the shares of common stock and the warrants

to purchase 5,742,858 shares of our common stock pursuant to the

securities purchase agreement dated July 23, 2020.

We

are not selling any securities under this prospectus and we will

not receive any proceeds from the sale of the shares. We will

receive proceeds from any cash exercise of the warrants, which, if

exercised in cash with respect to all of the 5,742,858 shares of

common stock offered hereby, would result in gross proceeds to us

of $2.64 million; however, we cannot predict when and in what

amounts or if the warrants will be exercised and there can be no

assurance the warrants will be exercised for cash, in which case we

would not receive any cash proceeds.

We

have agreed to bear all of the expenses incurred in connection with

the registration of these shares. The selling stockholders will pay

or assume discounts, commissions, fees of underwriters, selling

brokers or dealer managers, if any, incurred for the sale of shares

of our common stock.

The

selling stockholders identified in this prospectus may offer the

shares from time to time through public or private transactions at

prevailing market prices, at prices related to prevailing market

prices or at privately negotiated prices. For additional

information on the methods of sale that may be used by the selling

stockholders, see the section entitled “Plan of

Distribution” on page 12. For a list of the selling

stockholders, see the section entitled “Selling

Stockholders” on page 9.

We

may amend or supplement this prospectus from time to time by filing

amendments or supplements as required. You should read the entire

prospectus and any amendments or supplements carefully before you

make your investment decision.

Our

common stock is listed on the NYSE American under the symbol

“UAMY”. The last reported sales price of our common

stock on the NYSE American on September 8, 2020 was $0.50 per

share.

An investment in our common stock involves significant risks. You

should carefully consider the risk factors discussed in the

prospectus before you make your decision to invest in our common

stock.

Neither the Securities and Exchange Commission nor any other

regulatory body has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus. Any

representation to the contrary is a criminal offense.

The date of this prospectus is September 8, 2020

TABLE OF CONTENTS

|

ABOUT THIS PROSPECTUS

|

5

|

|

|

|

|

PROSPECTUS SUMMARY

|

6

|

|

|

|

|

RISK FACTORS

|

7

|

|

|

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

8

|

|

|

|

|

DESCRIPTION OF PRIVATE PLACEMENT

|

8

|

|

|

|

|

USE OF PROCEEDS

|

8

|

|

|

|

|

SELLING STOCKHOLDERS

|

9

|

|

|

|

|

PLAN OF DISTRIBUTION

|

12

|

|

|

|

|

DESCRIPTION OF CAPITAL STOCK

|

13

|

|

|

|

|

LEGAL MATTERS

|

15

|

|

|

|

|

EXPERTS

|

16

|

|

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

16

|

|

|

|

|

INCORPORATION OF DOCUMENTS BY REFERENCE

|

16

|

No

dealer, salesperson or other person is authorized to give any

information or to represent anything not contained in this

prospectus. You must not rely on any unauthorized information or

representations. This prospectus is an offer to sell only the

shares offered hereby, but only under circumstances and in

jurisdictions where it is lawful to do so. The information

contained in this prospectus is current only as of its

date.

ABOUT THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with

the Securities and Exchange Commission, or SEC. The selling

stockholders may from time to time sell up to 11,485,716 shares of common stock, as

described in this prospectus, in one or more offerings. We have

agreed to pay the expenses incurred in registering these shares,

including legal and accounting fee.

This

prospectus does not contain all of the information included in the

registration statement. For a more complete understanding of the

offering of the securities, you should refer to the registration

statement, including its exhibits. A prospectus supplement may also

add, update or change information contained or incorporated by

reference in this prospectus. This prospectus, together with any

applicable prospectus supplements and the documents incorporated by

reference into this prospectus, includes all material information

relating to the offering of securities under this prospectus. You

should carefully read this prospectus, any applicable prospectus

supplement, the information and documents incorporated herein by

reference and the additional information under the heading

“Where You Can Find More Information” before making an

investment decision.

You

should rely only on the information we have provided or

incorporated by reference in this prospectus or any prospectus

supplement. We have not authorized anyone to provide you with

information different from that contained or incorporated by

reference in this prospectus. No dealer, salesperson or other

person is authorized to give any information or to represent

anything not contained or incorporated by reference in this

prospectus. You must not rely on any unauthorized information or

representation. This prospectus is an offer to sell only the

securities offered hereby, but only under circumstances and in

jurisdictions where it is lawful to do so. You should assume that

the information in this prospectus or any prospectus supplement is

accurate only as of the date on the front of the document and that

any information we have incorporated herein by reference is

accurate only as of the date of the document incorporated by

reference, regardless of the time of delivery of this prospectus or

any sale of a security.

We

further note that the representations, warranties and covenants

made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference in the accompanying

prospectus were made solely for the benefit of the parties to such

agreement, including, in some cases, for the purpose of allocating

risk among the parties to such agreements, and should not be deemed

to be a representation, warranty or covenant to you. Moreover, such

representations, warranties or covenants were accurate only as of

the date when made. Accordingly, such representations, warranties

and covenants should not be relied on as accurately representing

the current state of our affairs.

Unless

the context otherwise required, “United States Antimony

Corporation,” “UAMY,” “USAC,”

“the Company,” “we,” “us,”

“our” and similar terms refer to United States Antimony

Corporation and its subsidiaries.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this

prospectus. This summary does not contain all of the information

that you should consider before deciding to invest in our common

stock. You should read this entire prospectus

carefully, including the information in our filings with the

Securities and Exchange Commission, or SEC, incorporated by

reference in this prospectus.

Overview

United

States Antimony Corporation, or USAC, was incorporated in Montana

in January 1970 to mine and produce antimony products. In December

1983, we suspended antimony mining operations but continued to

produce antimony products from domestic and foreign sources. In

April 1998, we formed United States Antimony SA de CV or USAMSA, to

mine and smelt antimony in Mexico. Bear River Zeolite Company or

BRZ, was incorporated in 2000, and it is mining and producing

zeolite in southeastern Idaho. On August 19, 2005, USAC formed

Antimonio de Mexico, S. A. de C. V. to explore and develop antimony

and silver deposits in Mexico. Our principal business is the

production and sale of antimony, silver, gold, and zeolite

products. On May 16, 2012, we started trading on the NYSE MKT (now

NYSE AMERICAN) under the symbol UAMY.

Corporate Information

Our corporate offices are located at 47 Cox Gulch,

P.O. Box 643, Thompson Falls, Montana 59873. Our telephone number

is (406) 827-3523. Our Internet address is www.usantimony.com.

On this web site, we post the following filings as soon as

reasonably practicable after they are electronically filed with or

furnished to the U.S. Securities and Exchange Commission

(“SEC”): our Annual Reports on Form 10-K; our

Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K;

our proxy statements related to our annual stockholders’

meetings; and any amendments to those reports or statements. All

such filings are available on our web site free of charge. The

charters of our audit, nominating and governance and compensation

committees and our Code of Ethics Policy are also available on our

web site and in print to any stockholder who requests them. The

content on our web site, or that can be accessed through our web

site, is not part of this prospectus.

Additional Information

For

additional information related to our business and operations,

please refer to the reports incorporated herein by reference,

including our Quarterly Reports on Form 10-Q for the quarters ended

March 31, 2020 and June 30, 2020 and Annual Report on Form 10-K for

the year ended December 31, 2019, as described under the caption

“Incorporation of Documents by Reference” on page 16 of

this prospectus.

We

are a “smaller reporting company” as defined in Rule

12b-2 of the Exchange Act and have elected to take advantage of

certain of the scaled disclosure available to smaller reporting

companies.

The Offering

|

|

Common

stock offered by the selling stockholders

|

|

|

11,485,716 shares, which includes 5,742,858 shares issuable

upon the exercise of warrants

|

|

|

|

Common

stock outstanding immediately before this offering

|

|

|

75,740,259 shares

|

|

|

|

Use of

proceeds

|

|

|

All

proceeds from the sale of shares of common stock offered hereby

will be for the account of the selling stockholders. We will not

receive any proceeds from the sale of common stock offered pursuant

to this prospectus. We will receive proceeds upon cash exercises of

the warrants to purchase the shares of common stock offered hereby,

if any. See the caption “Use of Proceeds” in this

prospectus.

|

|

|

|

Risk

Factors

|

|

|

See

“Risk Factors” and other information appearing

elsewhere in this prospectus for a discussion of factors you should

carefully consider before deciding whether to invest in our common

stock.

|

|

|

|

Terms

of this offering

|

|

|

The

selling stockholders, including their transferees, donees,

pledgees, assignees and successors-in-interest, may sell, transfer

or otherwise dispose of any or all of the shares of common stock

offered by this prospectus from time to time on the NYSE American

or any other stock exchange, market or trading facility on which

the shares are traded or in private transactions. The shares of

common stock may be sold at fixed prices, at market prices

prevailing at the time of sale, at prices related to prevailing

market price or at negotiated prices.

|

|

|

|

NYSE

American symbol

|

|

|

“UAMY”

|

|

The

number of shares of common stock outstanding is based on 75,740,259

shares outstanding as of September 8, 2020, and does not give

effect to:

|

|

●

|

452,041

issued and outstanding warrants to purchase Common Stock at a price

of $0.65 purchased pursuant to the December 2019 securities

purchase agreement;

|

|

|

●

|

750,000

issued and outstanding (non-convertible) shares of Series B

preferred stock;

|

|

|

●

|

177,904

issued and outstanding (non-convertible) shares of Series C

preferred stock;

|

|

|

●

|

1,751,005

issued and outstanding (convertible to common stock on a 1:1 basis)

shares of Series D preferred stock; and

|

|

|

●

|

5,742,858

shares of common stock underlying the warrants held by the selling

stockholders at an exercise price of $0.46 per share that were

purchased pursuant to the securities purchase agreement dated July

23, 2020.

|

RISK FACTORS

Investing

in our common stock involves a high degree of risk. Before

investing in our common stock, you should consider carefully the

risks and uncertainties discussed under “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31,

2019 and in our Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2020 and June 30, 2020, which are incorporated by

reference herein in their entirety. If any of the risks

incorporated by reference herein occur, our business, financial

condition, results of operations and future growth prospects could

be materially and adversely affected. In these circumstances, the

market price of our common stock could decline, and you may lose

all or part of your investment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference in this

prospectus include forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 (the “Securities Act”) and

Section 21E of the Exchange Act that relate to future events or our

future financial performance and involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to differ

materially from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking

statements. The sections in our periodic reports, including our

Annual Reports on Form 10-K, entitled “Business,”

“Risk Factors,” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations,” as well as other sections in this prospectus and

the documents or reports incorporated by reference in this

prospectus, discuss some of the risks and uncertainties that could

contribute to these differences. Words such as

“believe,” “expect,”

“anticipate,” “estimate,”

“intend,” “may,” “plan,”

“potential,” “predict,”

“project,” “targets,” “likely,”

“will,” “would,” “could,”

“should,” “continue,” and similar

expressions or phrases, or the negative of those expressions or

phrases, are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. You should carefully review and consider our

forward-looking statements in light of those risks and

uncertainties as you read this prospectus and documents

incorporated by reference into this prospectus. We undertake no

obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise.

DESCRIPTION OF PRIVATE PLACEMENT

On July 23, 2020, we entered into a securities

purchase agreement with the selling stockholders for the issuance

and sale of an aggregate of 5,742,858 units, each unit consisting

of (i) one share of our common stock, and (ii) one warrant to

purchase one share of our common stock. The offering price of the

units was $0.35 per unit. This price reflects a modest discount to

the price of the common stock on July 23, 2020 because of the

temporary illiquidity of the units. The warrants included in the

units will become exercisable six months after the Issuance Date at

a price of $0.46 per share and expire five years from the Issuance

Date. The closing of the issuance and sale of these securities was

consummated on July 27, 2020 (“Issuance

Date”).

We

received gross proceeds of $2.0 million from the sale of these

securities, before deducting placement agent fees and offering

expenses, and excluding the exercise of any warrants.

We

filed the registration statement on Form S-3, of which this

prospectus forms a part, to fulfill our contractual obligations

under the registration rights agreement entered into concurrently

with the securities purchase agreement with the selling

stockholders to provide for the resale by the selling stockholders

of the shares of common stock offered hereby.

USE OF PROCEEDS

All

shares of our common stock offered by this prospectus are being

registered for the account of the selling stockholders identified

herein. We will not receive any of the proceeds from the sale of

these shares.

We

will receive proceeds from any cash exercise of the warrants,

which, if exercised in cash with respect to all of the 5,742,858

shares of common stock offered hereby, would result in gross

proceeds to us of $2.64 million.

We

intend to use any proceeds received by us from the cash exercise of

the warrants for working capital and general corporate purposes.

The proceeds shall not be used for the satisfaction of any portion

of the Company’s debt (other than payment of trade payables

in the ordinary course of the Company’s business and prior

practices), for the redemption of any common stock or common stock

equivalents, for the settlement of any outstanding litigation, or

in violation of FCPA or OFAC regulations. Other than these

statements, as of the date of this prospectus, we cannot specify

with certainty all of the particular uses for the net proceeds to

us from the cash exercise of the warrants. Accordingly, our

management will have broad discretion in the timing and application

of these proceeds. The holders of the warrants may exercise the

warrants at their own discretion and at any time until their

expiration in accordance with the terms of the warrants. As a

result, we cannot predict when or if the warrants will be

exercised, and it is possible that the warrants may expire and

never be exercised. In addition, the warrants are exercisable on a

cashless basis if at the time of exercise there is no effective

registration statement registering, or the prospectus contained

therein is not available for, the issuance of shares of common

stock for which the warrants are exercisable. As a result, we may

never receive meaningful, or any, cash proceeds from the exercise

of the warrants.

SELLING STOCKHOLDERS

The

common stock being offered by the selling stockholders are those

previously issued to the selling stockholders, and those issuable

to the selling stockholders, upon exercise of the warrants. For

additional information regarding the issuances of those shares of

common stock and warrants, see “Description of Private

Placement” above. We are registering the shares of common

stock in order to permit the selling stockholders to offer the

shares for resale from time to time. Except for the ownership of

the shares of common stock and the warrants, the selling

stockholders have not had any material relationship with us within

the past three years other than participating in prior securities

offerings.

The

table below lists the selling stockholders and other information

regarding the beneficial ownership of the shares of common stock by

each of the selling stockholders. The second column lists the

number of shares of common stock beneficially owned by each selling

stockholder, based on its ownership of the shares of common stock

and warrants, as of July 27, 2020, assuming exercise of the

warrants held by the selling stockholders on that date, without

regard to any limitations on exercises.

The

third column lists the shares of common stock being offered by this

prospectus by the selling stockholders.

In

accordance with the terms of a registration rights agreement with

the selling stockholders, this prospectus generally covers the

resale of the sum of (i) the number of shares of common stock

issued to the selling stockholders in the “Description of

Private Placement” described above and (ii) the maximum

number of shares of common stock issuable upon exercise of the

related warrants, determined as if the outstanding warrants were

exercised in full as of the trading day immediately preceding the

date this registration statement was initially filed with the SEC,

each as of the trading day immediately preceding the applicable

date of determination and all subject to adjustment as provided in

the registration right agreement, without regard to any limitations

on the exercise of the warrants. The fourth column assumes the sale

of all of the shares offered by the selling stockholders pursuant

to this prospectus.

Under

the terms of the warrants issued to Anson, EAM, ETE, ETE III, CVI,

Intracoastal, Ionic, L1, and Lind Global as a group, and to Hudson

(as defined in the following table), a selling stockholder may

not exercise the warrants to the extent such exercise would cause

such selling stockholder, together with its affiliates and

attribution parties, to beneficially own a number of shares of

common stock which would exceed 4.99%, or 9.99% for Hudson, of our

then outstanding common stock following such exercise, excluding

for purposes of such determination shares of common stock issuable

upon exercise of the warrants which have not been exercised. The

number of shares in the second column does not reflect this

limitation. The selling stockholders may sell all, some or none of

their shares in this offering. See “Plan of

Distribution.”

|

Name of Selling Stockholder (1)

|

Number of Shares of Common Stock Beneficially Owned Prior to

Offering (2)

|

Maximum Number of shares of Common Stock to be Sold Pursuant to

this Prospectus (3)

|

Number of Shares of Common Stock Owned After Offering

(4)

|

|

Number

|

Percentage

|

|

Anson

Investments Master Fund LP (“Anson”)(5)

|

1,428,572

|

1,428,572

|

-

|

-

|

|

Empery

Asset Master, Ltd (“EAM”)(6)

|

926,616

|

926,616

|

-

|

-

|

|

Empery

Tax Efficient, LP (“ETE”)(7)

|

266,580

|

266,580

|

-

|

-

|

|

Empery

Tax Efficient III, LP (“ETE III”)(8)

|

521,090

|

521,090

|

-

|

-

|

|

CVI

Investments, Inc. (“CVI”)(9)

|

1,200,000

|

1,200,000

|

-

|

-

|

|

Hudson

Bay Master Fund Ltd. (“Hudson”)(10)

|

1,714,286

|

1,714,286

|

-

|

-

|

|

Intracoastal

Capital, LLC (“Intracoastal”)(11)

|

1,714,284

|

1,714,284

|

-

|

-

|

|

Ionic

Ventures LLC (“Ionic”)(12)

|

1,428,571

|

1,428,571

|

-

|

-

|

|

L1

Capital Global Opportunities Master Fund

(“L1”)(13)

|

1,142,858

|

1,142,858

|

-

|

-

|

|

Lind

Global Partners, LLC (“Lind Global”)(14)

|

1,142,858

|

1,142,858

|

-

|

-

|

(1) The information in this

table and the related footnotes is based upon information supplied

by the selling stockholders.

(2) Represents the total number

of shares of our common stock issued or issuable to each selling

stockholder as of the date of this prospectus, without regard to

ownership limitations described in footnotes (3) and (6) below,

including (i) all of the shares offered hereby, and (ii) to our

knowledge, all other securities held by each of the selling

stockholders as of the date hereof.

(3) Consists of the shares

of common stock, including the shares of common stock underlying

the warrants, issued in the July 2020 offering, see

“Description of Private Placement” above. Assumes that

none of the securities have been sold or otherwise transferred

prior to the date of this prospectus in transactions exempt from

the registration requirements of the Securities Act. All warrants,

except the warrant issued to Hudson, contain beneficial ownership

limitations, which provide that a holder of the warrants will not

have the right to exercise any portion of its warrants if the

holder, together with its affiliates, would beneficially own in

excess of 4.99% (9.99% for Hudson) of the number of shares of our

common stock outstanding immediately after giving effect to such

exercise, provided that upon at least 61 days prior notice to us, a

holder may increase or decrease such limitation up to a maximum of

9.99% of the number of shares of common stock

outstanding.

(4) Assumes that, after the date

of this prospectus and prior to completion of this offering, none

of the selling stockholders (i) acquires additional shares of our

common stock or other securities or (ii) sells or otherwise

disposes of shares of our common stock or other securities held by

such selling Stockholder other than as offered

hereby.

(5) The securities set forth in

the table above consist of 714,286 shares of common stock and a

warrant to purchase 714,286 shares of common stock. Anson is the

record and beneficial owner of the securities set forth in the

table, and shares voting and dispositive power over such securities

with Anson Advisors Inc and Anson Funds Management LP, the

Co-Investment Advisors of Anson. Bruce Winson is the managing

member of Anson Management GP LLC, which is the general partner of

Anson Funds Management LP. Moez Kassam and Amin Nathoo are

directors of Anson Advisors Inc. Mr. Winson, Mr. Kassam, and Mr.

Nathoo each disclaim beneficial ownership of the reported

securities except to the extent of their pecuniary interest

therein.

(6) The securities set forth in

the table above consist of 463,308 shares of common stock and a

warrant to purchase 463,308 shares of common stock. EAM is the

record and beneficial owner of the securities set forth in the

table. Empery Asset Management LP, the authorized agent of EAM, has

discretionary authority to vote and dispose of the shares held by

EAM and may be deemed to be the beneficial owner of these shares.

Martin Hoe and Ryan Lane, in their capacity as investment managers

of Empery Asset Management LP, may also be deemed to have

investment discretion and voting power over the shares held by EAM.

EAM, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of

these shares.

(7) The securities set forth in

the table above consist of 133,290 shares of common stock and a

warrant to purchase 133,290 shares of common stock. ETE is the

record and beneficial owner of the securities set forth in the

table. Empery Asset Management LP, the authorized agent of ETE, has

discretionary authority to vote and dispose of the shares held by

ETE and may be deemed to be the beneficial owner of these shares.

Martin Hoe and Ryan Lane, in their capacity as investment managers

of Empery Asset Management LP, may also be deemed to have

investment discretion and voting power over the shares held by ETE.

ETE, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of

these shares.

(8) The securities set forth in

the table above consist of 260,545 shares of common stock and a

warrant to purchase 260,545 shares of common stock. ETE III is the

record and beneficial owner of the securities set forth in the

table. Empery Asset Management LP, the authorized agent of ETE III,

has discretionary authority to vote and dispose of the shares held

by ETE III and may be deemed to be the beneficial owner of these

shares. Martin Hoe and Ryan Lane, in their capacity as investment

managers of Empery Asset Management LP, may also be deemed to have

investment discretion and voting power over the shares held by ETE

III. ETE III, Mr. Hoe and Mr. Lane each disclaim any beneficial

ownership of these shares.

(9) The securities set forth in

the table above consist of 600,000 shares of common stock and a

warrant to purchase 600,000 shares of common stock. CVI is the

record and beneficial owner of the securities set forth in the

table. Heights Capital Management, Inc., the authorized agent of

CVI, has discretionary authority to vote and dispose of the shares

held by CVI and may be deemed to be the beneficial owner of these

shares. Martin Kobinger, in his capacity as Investment Manager of

Heights Capital Management, Inc., may also be deemed to have

investment discretion and voting power over the shares held by CVI.

Mr. Kobinger disclaims any such beneficial ownership of the shares.

CVI Investments, Inc.is affiliated with one or more FINRA member,

none of whom are currently expected to participate in the sale

pursuant to the prospectus contained in the Registration Statement

of Shares purchased by the Investor in this Offering.

(10) The securities set forth in the

table above consist of 857,143 shares of common stock and a warrant

to purchase 857,143 shares of common stock. Hudson is the record

and beneficial owner of the securities set forth in the

table. Hudson

Bay Capital Management LP, the investment manager of Hudson Bay

Master Fund Ltd., has voting and investment power over these

securities. Sander Gerber is the managing member of Hudson Bay

Capital GP LLC, which is the general partner of Hudson Bay Capital

Management LP. Each of Hudson Bay Master Fund Ltd. and Sander

Gerber disclaims beneficial ownership over these

securities.

(11) The securities set forth in

the table above consist of 857,142 shares of common stock and a

warrant to purchase 857,142 shares of common stock. Intracoastal is

the record and beneficial owner of the securities set forth in the

table. Mitchell Kopin and Daniel Asher are the managers of

Intracoastal. Mitchell P. Kopin (“Mr.

Kopin”) and Daniel B.

Asher (“Mr.

Asher”), each of whom are

managers of Intracoastal, have shared voting control and investment

discretion over the securities reported herein that are held by

Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be

deemed to have beneficial ownership (as determined under Section

13(d) of the Securities Exchange Act of 1934, as amended (the

“Exchange

Act”)) of the securities

reported herein that are held by Intracoastal.

(12) The securities set forth in

the table above consist of 714,286 shares of common stock and a

warrant to purchase 714,286 shares of common stock. Ionic is the

record and beneficial owner of the securities set forth in the

table. Brendan O’Neil and Keith Coulston are the managers of

Ionic. Mr. O’Neil and Mr. Coulston each disclaim beneficial

ownership of the reported securities except to the extent of their

pecuniary interest therein.

(13) The securities set forth in

the table above consist of 571,429 shares of common stock and a

warrant to purchase 571,429 shares of common stock. L1 is the

record and beneficial owner of the securities set forth in the

table. David Feldman is the portfolio manager of L1. Mr. Feldman

disclaims beneficial ownership of the reported securities except to

the extent of his pecuniary interest therein.

(14) The securities set forth in

the table above consist of 571,429 shares of common stock and a

warrant to purchase 571,429 shares of common stock. Lind Global is

the record and beneficial owner of the securities set forth in the

table. Jeff Easton is the managing member of Lind Global. Mr.

Easton disclaims beneficial ownership of the reported securities

except to the extent of his pecuniary interest

therein.

PLAN OF DISTRIBUTION

Each Selling Stockholder (the

“Selling

Stockholders”) of the

securities and any of their pledgees, assignees and

successors-in-interest may, from time to time, sell any or all of

their securities covered hereby on the principal Trading Market or

any other stock exchange, market or trading facility on which the

securities are traded or in private transactions. These sales may

be at fixed or negotiated prices. A Selling Stockholder may use any

one or more of the following methods when selling

securities:

●

ordinary

brokerage transactions and transactions in which the broker-dealer

solicits purchasers;

●

block

trades in which the broker-dealer will attempt to sell the

securities as agent but may position and resell a portion of the

block as principal to facilitate the transaction;

●

purchases

by a broker-dealer as principal and resale by the broker-dealer for

its account;

●

an

exchange distribution in accordance with the rules of the

applicable exchange;

●

privately

negotiated transactions;

●

settlement

of short sales;

●

in

transactions through broker-dealers that agree with the Selling

Stockholders to sell a specified number of such securities at a

stipulated price per security;

●

through

the writing or settlement of options or other hedging transactions,

whether through an options exchange or otherwise;

●

a

combination of any such methods of sale; or

●

any

other method permitted pursuant to applicable law.

The

Selling Stockholders may also sell securities under Rule 144 or any

other exemption from registration under the Securities Act, if

available, rather than under this prospectus.

Broker-dealers

engaged by the Selling Stockholders may arrange for other

brokers-dealers to participate in sales. Broker-dealers may receive

commissions or discounts from the Selling Stockholders (or, if any

broker-dealer acts as agent for the purchaser of securities, from

the purchaser) in amounts to be negotiated, but, except as set

forth in a supplement to this Prospectus, in the case of an agency

transaction not in excess of a customary brokerage commission in

compliance with FINRA Rule 2121; and in the case of a principal

transaction a markup or markdown in compliance with FINRA Rule

2121.

In

connection with the sale of the securities or interests therein,

the Selling Stockholders may enter into hedging transactions with

broker-dealers or other financial institutions, which may in turn

engage in short sales of the securities in the course of hedging

the positions they assume. The Selling Stockholders may also sell

securities short and deliver these securities to close out their

short positions, or loan or pledge the securities to broker-dealers

that in turn may sell these securities. The Selling Stockholders

may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or

more derivative securities which require the delivery to such

broker-dealer or other financial institution of securities offered

by this prospectus, which securities such broker-dealer or other

financial institution may resell pursuant to this prospectus (as

supplemented or amended to reflect such transaction).

The

Selling Stockholders and any broker-dealers or agents that are

involved in selling the securities may be deemed to be

“underwriters” within the meaning of the Securities Act

in connection with such sales. In such event, any commissions

received by such broker-dealers or agents and any profit on the

resale of the securities purchased by them may be deemed to be

underwriting commissions or discounts under the Securities Act.

Each Selling Stockholder has informed the Company that it does not

have any written or oral agreement or understanding, directly or

indirectly, with any person to distribute the

securities.

The

Company is required to pay certain fees and expenses incurred by

the Company incident to the registration of the securities. The

Company has agreed to indemnify the Selling Stockholders against

certain losses, claims, damages and liabilities, including

liabilities under the Securities Act.

We

agreed to keep this prospectus effective until the earlier of (i)

the date on which the securities may be resold by the Selling

Stockholders without registration and without regard to any volume

or manner-of-sale limitations by reason of Rule 144, without the

requirement for the Company to be in compliance with the current

public information under Rule 144 under the Securities Act or any

other rule of similar effect or (ii) all of the securities have

been sold pursuant to this prospectus or Rule 144 under the

Securities Act or any other rule of similar effect. The resale

securities will be sold only through registered or licensed brokers

or dealers if required under applicable state securities laws. In

addition, in certain states, the resale securities covered hereby

may not be sold unless they have been registered or qualified for

sale in the applicable state or an exemption from the registration

or qualification requirement is available and is complied

with.

Under

applicable rules and regulations under the Exchange Act, any person

engaged in the distribution of the resale securities may not

simultaneously engage in market making activities with respect to

the common stock for the applicable restricted period, as defined

in Regulation M, prior to the commencement of the distribution. In

addition, the Selling Stockholders will be subject to applicable

provisions of the Exchange Act and the rules and regulations

thereunder, including Regulation M, which may limit the timing of

purchases and sales of the common stock by the Selling Stockholders

or any other person. We will make copies of this prospectus

available to the Selling Stockholders and have informed them of the

need to deliver a copy of this prospectus to each purchaser at or

prior to the time of the sale (including by compliance with Rule

172 under the Securities Act).

DESCRIPTION OF CAPITAL STOCK

The following summary is a description of the material terms of our

capital stock and is not complete. You should also refer to the

United States Antimony Corporation restated articles of

incorporation as amended and amended and restated bylaws, which are

included as exhibits to the registration statement of which this

prospectus forms a part, and the applicable provisions of the

Montana Business Corporation Act.

Our restated articles of incorporation as amended

authorize us to issue up to 90,000,000 shares of common stock, par

value $0.01 per share. On September 8, 2020, we had

75,740,259 shares of common stock outstanding, 750,000 shares

of Series B preferred stock outstanding (non-convertible), 177,904

shares of Series C preferred stock outstanding (non-convertible),

1,751,005 shares of Series D preferred stock outstanding

(convertible to common stock on a 1:1 basis), and 6,194,899

warrants outstanding to purchase common stock. On September 8, 2020

we had approximately 2,988 stockholders of

record.

Common and Preferred Stock

Shares

of our common stock have the following rights, preferences and

privileges:

Voting

Each

holder of common stock is entitled to one vote for each share of

common stock held on all matters submitted to a vote of

stockholders. Any action at a meeting at which a quorum is present

will be decided by a majority of the voting power present in person

or represented by proxy, except in the case of any election of

directors, which will be decided by a plurality of votes cast.

Cumulative voting is allowed.

Dividends

Holders

of our common stock are entitled to receive dividends when, as and

if declared by our board of directors out of funds legally

available for payment, subject to the rights of holders, if any, of

any class of stock having preference over the common stock. Any

decision to pay dividends on our common stock will be at the

discretion of our board of directors. Our board of directors may or

may not determine to declare dividends in the future. The

board’s determination to issue dividends will depend upon our

profitability and financial condition any contractual restrictions,

restrictions imposed by applicable law and the SEC, and other

factors that our board of directors deems relevant.

Liquidation Rights

In

the event of a voluntary or involuntary liquidation, dissolution or

winding up of the company, the holders of our common stock will be

entitled to share ratably on the basis of the number of shares held

in any of the assets available for distribution after we have paid

in full, or provided for payment of, all of our debts and after the

holders of all outstanding series of any class of stock have

preference over the common stock, if any, have received their

liquidation preferences in full.

Other

Our

issued and outstanding shares of common stock are fully paid and

non-assessable. Holders of shares of our common stock are not

entitled to preemptive rights. Shares of our common stock are not

convertible into shares of any other class of capital stock, nor

are they subject to any redemption or sinking fund

provisions.

Preferred Stock

Shares

of our Series B, Series C, and Series D preferred stock have the

following rights, preferences and privileges:

Voting

Series

B preferred stock is non-voting, except if and when dividends

payable on any of the Series B preferred stock is in default.

Holders of Series C preferred stock have the right to that number

of votes equal to the number of shares of common stock issuable

upon conversion of such Series C shares, and holders of Series D

preferred stock may vote equally with the shares of the common

stock of the Company and not as a separate class, and each holder

of shares of Series D preferred stock is entitled to such number of

votes as shall be equal to the whole number of shares of common

stock into which such holder’s aggregate number of shares of

Series D preferred stock are convertible immediately after the

close of business on the record date fixed for such meeting or the

effective date of such written consent.

Dividends and Liquidation Rights

Holders of Series B preferred stock are entitled

to receive out of the net profits of the Company, when and if

declared by the Board of Directors, cumulative dividends at the

annual rate of one cent ($0.01) per share, payable on the

31st

day of December. In the event of

liquidation of the Company, holders of Series B preferred stock

shall be entitled to receive, subject to the preference of the

holders of the Series A preferred stock, $1.00 per share plus all

accumulated dividends before any amounts shall be distributed among

the holders of the common stock.

Holders

of Series C preferred stock have no dividend rights. In the event

of any liquidation or winding up of the Company, the holders of

Series C shares shall be entitled to receive in preference to the

holders of common stock an amount per share equal to $0.55, subject

to the preferences of the holders of the Company’s

outstanding Series B preferred stock.

Holders

of Series D preferred stock have no dividend rights. In the event

of (i) any merger, sale, liquidation, or winding up of the Company,

or (ii) any sale of all or substantially all of the assets of the

Company (including subsidiaries, joint ventures, or partnerships),

or (iii) any other corporate change as defined in the Articles, the

holders of Series D preferred stock are entitled to be paid out of

the assets of the Company in preferences to the holders of common

stock but after payment and satisfaction of the liquidation

preferences of the holders of the Company’s outstanding

Series B and Series C preferred stock, an amount per share equal to

the greater of $2.50 or the equivalent market value of the number

of shares of common stock into which each share of Series D

preferred is convertible. Additional rights for holders of Series D

preferred stock are outlined in the Articles.

Other

Additional

rights of holders of preferred stock are outlined in the Restated

Articles of Incorporation as amended and attached hereto as an

exhibit.

Warrants

As

of July 27, 2020, we had outstanding (i) five-year warrants to

purchase 5,742,858 shares of common stock underlying warrants at an

exercise price of $0.46 per share issued in the July 2020 private

placement, and (ii) warrants to purchase 452,041 shares of common

stock underlying warrants at an exercise price of $0.65 per share

issued in the December 2019 private placement.

Registration Rights

In

connection with the July 2020 private placement, we entered into a

registration rights agreement with the selling stockholders under

which we have agreed to file the registration statement of which

this prospectus is a part with the SEC, covering the resale of the

5,742,858 shares of common stock issued in the July 2020 private

placement and the 5,742,858 shares of common stock issuable upon

exercise of the warrants issued in the July 2020 private

placement.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Direct

Transfer, LLC, Issuer Direct Corporation, One Glenwood Avenue,

Suite 1001, Raleigh, North Carolina 27603.

Stock

Exchange Listing

Our

common stock is listed for trading on NYSE American under the

symbol “UAMY.”

Limitation

of Liability and Indemnification

Our Amended and Restated Bylaws

(“Bylaws”)

limit the liability of our officers and directors and provide that

we will indemnify our officers and directors, in each case, to the

fullest extent permitted by the Montana Business Corporation Act.

We have also obtained directors’ and officers’

liability insurance coverage in the amount of

$5,000,000.

The

foregoing discussion of our Bylaws and directors’ and

officers’ liability insurance is not intended to be

exhaustive and is qualified in its entirety by such Bylaws and

insurance policy, and applicable law, including the Montana

Business Corporation Act.

LEGAL MATTERS

Certain legal matters in connection with this

offering will be passed upon for us by Stoel Rives LLP, Boise,

Idaho.

EXPERTS

The

consolidated financial statements as of December 31, 2019 and

2018, and for each of the two years in the period ended

December 31, 2019 incorporated by reference in this Prospectus

and the registration statement have been so incorporated in

reliance on the report of DeCoria, Maichel & Teague, P.S, an

independent registered public accounting firm, incorporated by

reference, given on the authority of said firm as experts in

auditing and accounting. The audit report covering the

December 31, 2019 consolidated financial statements contains an

emphasis of matter paragraph regarding the Company’s ability

to continue as a going concern.

An

opinion of counsel as to the legality of the securities being

registered pursuant to the registration statement has been provided

by Stoel Rives LLP, a law firm, which opinion is incorporated by

reference herein and in the registration statement and is attached

as an exhibit hereto.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration

statement on Form S-3 under the Securities Act for the shares of

common stock being offered by this prospectus. This prospectus,

which is part of the registration statement, does not contain all

of the information included in the registration statement and the

exhibits. For further information about us and the common stock

offered by this prospectus, you should refer to the registration

statement and its exhibits. References in this prospectus to any of

our contracts or other documents are not necessarily complete, and

you should refer to the exhibits attached to the registration

statement for copies of the actual contract or document. You may

read and copy any document that we file at the SEC’s public

reference room located at 100 F Street, NE,

Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330

for further information on the public reference rooms. SEC filings

are also available to the public at the SEC’s website

at www.sec.gov.

We

are subject to the reporting and information requirements of the

Exchange Act and, as a result, we file periodic and current

reports, proxy statements and other information with the SEC. We

make our periodic reports and other information filed with or

furnished to the SEC, available, free of charge, through our

website as soon as reasonably practicable after those reports and

other information are filed with or furnished to the

SEC.

The

information contained in, or that can be accessed through, our

website is not part of, and is not incorporated into, this

prospectus.

Additionally,

these periodic reports, proxy statements and other information

are available for inspection and copying at the public

reference room and website of the SEC referred to

above.

INCORPORATION OF DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” information

from other documents that we file with it, which means that we can

disclose important information to you by referring you to those

documents. The information incorporated by reference is considered

to be part of this prospectus. Information in this prospectus

supersedes information incorporated by reference that we filed with

the SEC prior to the date of this prospectus. We incorporate by

reference into this prospectus and the registration

statement of which this prospectus is a part the information

or documents listed below that we have filed with the

SEC:

● our

Annual Report on Form 10-K for the fiscal year ended December 31,

2019, filed with the SEC on April 14, 2020;

● all

other reports filed pursuant to Section 13(a) or 15(d) of the

Exchange Act since the end of the 2019 fiscal year, including a

Form 8-K filed with the SEC on June 19, 2020 and July 27, 2020 and

our Quarterly Reports on Form 10-Q for the three-month period ended

March 31, 2020, filed with the SEC on May 15, 2020 and for the

three- and six-month period ended June 30, 2020, filed with the SEC

on August 19, 2020; and

● the

description of our common stock contained in our Registration

Statement filed on Form 8-A filed on May 16, 2012, including any

amendment or report filed for the purpose of updating such

description.

Additionally,

all documents filed by us with the SEC under Sections 13(a), 13(c),

14 or 15(d) of the Exchange Act after (i) the date of the initial

registration statement and prior to effectiveness of the

registration statement, and (ii) the date of this prospectus and

before the termination or completion of any offering hereunder,

shall be deemed to be incorporated by reference into this

prospectus from the respective dates of filing of such documents,

except that we do not incorporate any document or portion of a

document that is “furnished” to the SEC, but not deemed

“filed.”

We

will furnish without charge to you, on written or oral request, a

copy of any or all of the documents incorporated by reference in

this prospectus, including exhibits to these documents. You should

direct any requests for documents to United States Antimony

Corporation, Attn: Corporate Secretary, 47 Cox Gulch, P.O. Box 643,

Thompson Falls, Montana 59873.

The SEC maintains an Internet site that contains

reports, proxy and information statements, and other information

regarding issuers that file electronically with the SEC, which may

be accessed at http://www.sec.gov. You also may access these

filings on our website at www.usantimony.com.

We do not incorporate the information on our website into this

prospectus or any supplement to this prospectus and you should not

consider any information on, or that can be accessed through, our

website as part of this prospectus or any supplement to this

prospectus (other than those filings with the SEC that we

specifically incorporate by reference into this prospectus or any

supplement to this prospectus).

Any

statement contained in a document incorporated or deemed to be

incorporated by reference in this prospectus will be deemed

modified, superseded or replaced for purposes of this prospectus to

the extent that a statement contained in this prospectus modifies,

supersedes or replaces such statement.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item

13.

Other

Expenses of Issuance and Distribution

The

following table sets forth the various expenses incurred or to be

incurred in connection with the sale and distribution of the

securities being registered hereby, all of which will be borne by

us (except any underwriting discounts and commissions and expenses

incurred by the selling stockholders for brokerage, accounting, tax

or legal services or any other expenses incurred by the selling

stockholders in disposing of the shares). All amounts shown are

estimates and are given subject to future

contingencies.

|

SEC Registration

and Filing Fees

|

$671

|

|

Accounting Fees and

Expenses

|

-

|

|

Legal Fees and

Expenses

|

$31,000

|

|

Federal

Taxes

|

-

|

|

State

Taxes

|

-

|

|

Trustees’ and

Transfer Agents’ Fees

|

-

|

|

Printing,

Messenger, Telephone and Delivery Expenses

|

-

|

|

Miscellaneous

|

$10,000

|

|

Total

$

|

41,671

|

Item

14.

Indemnification

of Directors and Officers

Montana Business Corporation Act. As a

Montana corporation, the Company is subject to the Montana Business

Corporation Act (MCA 35-14-101 et seq., the “MBCA”), which provides

mandatory indemnification by the Company for a director who was

wholly successful in the defense of any proceeding to which the

director was a party because the director was a director of the

corporation. The MBCA also provides for (i) permissible

indemnification in certain circumstances as provided under Section

35-14-851, (ii) an advance for expenses under Section 35-14-853,

and (ii) court-ordered indemnification in certain circumstances as

provided under Section 35-14-854. All other provisions of the MBCA

governing indemnification applies to the Company except when the

MBCA allows the Company’s Restated Articles of Incorporation

as amended and/or Bylaws to govern.

Amended and Restated Bylaws. Our Bylaws

provide for the indemnification of our directors and officers and

provides a right of reimbursement or advancement of expenses as

detailed further in our Bylaws.

Insurance Policies. The Company has

directors’ and officers’ liability insurance in an

amount of $5,000,000. We intend to maintain insurance on behalf of

any person who is or was a director or officer against any loss

arising from any claim asserted against him or her and incurred by

him or her in any such capacity, subject to certain

exclusions.

The

foregoing discussion of our Bylaws, insurance policies, and the Act

is not intended to be exhaustive and is qualified in its entirety

by such Bylaws, insurance policies, the Act or any other applicable

law.

Insofar

as indemnification for liabilities arising under the Securities Act

may be permitted to our directors, officers and controlling persons

pursuant to the foregoing provisions, or otherwise, we have been

advised that in the opinion of the SEC such indemnification is

against public policy as expressed in the Securities Act and is,

therefore, unenforceable.

(a)

Exhibits. The

exhibits to this registration statement are listed in the Exhibit

Index attached hereto and incorporated by reference

herein.

(a)

The undersigned hereby undertakes:

(1)

To file, during any period in which offers or sales are being made,

a post-effective amendment to this registration

statement:

(i)

To include any prospectus required by Section 10(a)(3) of the

Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the

effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the

aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing,

any increase or decrease in volume of securities offered (if the

total dollar value of securities offered would not exceed that

which was registered) and any deviation from the low or high end of

the estimated maximum offering range may be reflected in the form

of prospectus filed with the Commission pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more

than a 20% change in the maximum aggregate offering price set forth

in the “Calculation of Registration Fee” table in the

effective registration statement.

(iii)

To include any material information with respect to the plan of

distribution not previously disclosed in the registration statement

or any material change to such information in the registration

statement;

provided,

however, that Paragraphs

(a)(1)(i), (ii), and (iii) of this section do not apply if the

registration statement is on Form S–1 (§ 239.11 of this

chapter), Form S–3 (§ 239.13 of this chapter), Form

SF–3 (§ 239.45 of this chapter) or Form F–3

(§ 239.33 of this chapter) and the information required to be

included in a post-effective amendment by those paragraphs is

contained in reports filed with or furnished to the Commission by

the registrant pursuant to section 13 or section 15(d) of the

Securities Exchange Act of 1934 (15 U.S.C. 78m or

78o(d))

that are incorporated by reference in the registration statement,

or, as to a registration statement on Form S–3, Form

SF–3 or Form F–3, is contained in a form of prospectus

filed pursuant to § 230.424(b) of this chapter that is part of

the registration statement.

(2)

That, for the purpose of determining any liability under the

Securities Act of 1933, each such post-effective amendment shall be

deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering

thereof.

(3)

To remove from registration by means of a post-effective amendment

any of the securities being registered which remain unsold at the

termination of the offering.

(4) That, for the purpose of determining liability

under the Securities Act to any purchaser, each prospectus filed

pursuant to Rule 424(b) as part of a registration statement

relating to an offering, other than registration statements relying

on Rule 430B or other than prospectuses filed in reliance on Rule

430A, shall be deemed to be part of and included in the

registration statement as of the date it is first used after

effectiveness. Provided,

however, that no statement made

in a registration statement or prospectus that is part of the

registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or

prospectus that is part of the registration statement will, as to a

purchaser with a time of contract of sale prior to such first use,

supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such date of

first use.

(b)

The undersigned registrant hereby undertakes that, for purposes of

determining any liability under the Securities Act of 1933, each

filing of the registrant's annual report pursuant to section 13(a)

or section 15(d) of the Securities Exchange Act of 1934 (and, where

applicable, each filing of an employee benefit plan's annual report

pursuant to section 15(d) of the Securities Exchange Act of 1934)

that is incorporated by reference in the registration statement

shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering

thereof.

(c)

Insofar as indemnification for liabilities arising under the

Securities Act of 1933 may be permitted to directors, officers and

controlling persons of the registrant pursuant to the foregoing

provisions, or otherwise, the Registrant has been advised that in

the opinion of the Securities and Exchange Commission such

indemnification is against public policy as expressed in the Act

and is, therefore, unenforceable. In the event that a claim for

indemnification against such liabilities (other than the payment by

the registrant of expenses incurred or paid by a director, officer,

or controlling person of the registrant in the successful defense

of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities

being registered hereunder, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the

question of whether such indemnification by it is against public

policy as expressed in the Act and will be governed by the final

adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant

certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-3 and has duly caused

this registration statement to be signed on its behalf by the

undersigned, thereunto duly authorized, in the City of Thompson

Falls, State of Montana, on September 8, 2020.

UNITED

STATES ANTIMONY CORPORATION

By_____/s/ John C.

Gustavsen________________________

John C.

Gustavsen, Chief Executive Officer

Pursuant

to the requirements of the Securities Act of 1933, this

registration statement has been signed by the following persons in

the capacities and on the dates indicated.

|

|

Daniel

Parks, Chief Financial Officer

Alicia

Hill, Controller

Jeffrey

Wright, Director

Craig

W. Thomas, Director

By: /s/ Russell C.

Lawrence

Russell

C. Lawrence, Director

|

EXHIBIT INDEX

|

ExhibitNumber

|

|

Description

|

|

|

|

Restated

Articles of Incorporation, as amended as of July 23, 2020, filed

herewith.

|

|

|

|

Amended

and Restated Bylaws (Incorporated by reference to Form 8-K filed on

December 15, 2012).

|

|

|

|

Form of

Securities Purchase Agreement (Incorporated by reference to Form

8-K filed on July 27, 2020).

|

|

|

|

Form of

Registration Rights Agreement (Incorporated by reference to Form

8-K filed on July 27, 2020).

|

|

|

|

Form of

Common Stock Purchase Warrant (Incorporated by reference to Form

8-K filed on July 27, 2020).

|

|

|

|

Opinion

of Stoel Rives LLP with respect to the legality of the securities

being registered, filed herewith.

|

|

|

|

Consent

of DeCoria, Maichel, and Teague, P.C.,

as auditor, filed herewith.

|

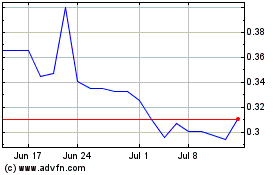

United States Antimony (AMEX:UAMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

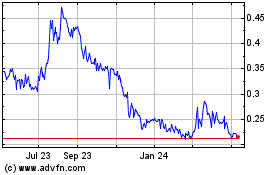

United States Antimony (AMEX:UAMY)

Historical Stock Chart

From Apr 2023 to Apr 2024