Filed Pursuant to Rule

424(b)(3)

Registration No. 333-225049

Prospectus Supplement

(to Prospectus dated July 23, 2018)

Jones Soda Co.

Up to 11,315,000 Shares

of Common Stock

This prospectus supplement

supplements the prospectus, dated July 23, 2018 (the “Prospectus”), which forms a part of our Amendment No. 1 to our

Registration Statement on Form S-3 on Form S-1 (Registration No. 333-225049). This prospectus supplement is being filed to update,

amend and supplement the information included or incorporated by reference in the Prospectus with the information contained in

our current report on Form 8-K, filed with the Securities and Exchange Commission (the “Commission”) on September 8,

2020 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus

and this prospectus supplement relates to the sale of up to 11,315,000 shares of our common stock which may be resold from time

to time by the selling shareholders identified in the Prospectus. The shares of common stock covered by the Prospectus and this

prospectus supplement are issuable upon the conversion of a portion or all of the

convertible subordinated promissory notes (the “Convertible Notes”) issued pursuant to that certain Note Purchase Agreement

dated as of March 23, 2018 among the Company and the purchasers of the Convertible Notes.

We are not selling any common stock under the Prospectus and this prospectus supplement and will not receive any of the proceeds

from the sale or other disposition of shares by the selling shareholders.

This prospectus supplement

should be read in conjunction with the Prospectus. This prospectus supplement updates, amends and supplements the information included

or incorporated by reference in the Prospectus. If there is any inconsistency between the information in the Prospectus and this

prospectus supplement, you should rely on the information in this prospectus supplement.

Our common stock is listed

for quotation on the OTCQB quotation system under the symbol “JSDA.” The last bid price of our common stock on September

4, 2020 was $0.16 per share.

Investing

in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “Risk Factors” of the Prospectus, and under similar headings in any amendment or

supplements to the Prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus

supplement is September 8, 2020.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): September 1, 2020

Jones Soda Co.

(Exact Name of Registrant as Specified in Charter)

|

Washington

|

0-28820

|

52-2336602

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

|

66 South Hanford Street, Suite 150, Seattle, Washington 98134

|

|

(Address of Principal Executive Offices) (Zip Code)

|

(206) 624-3357

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(c) Appointment of Mark Murray as President.

On September 1, 2020, the board of directors (the “Board”) of Jones Soda Co. (the “Company”) appointed Mark Murray to serve as the Company’s President, effective immediately. Mr. Murray was previously providing consulting services to the Company since May 2020, for which he has been paid an aggregate amount of $75,000 in consulting fees by the Company.

Mr. Murray was most recently the President of JGC Food Company (“JGC”), a position he held from 2017 to May 2019, and was previously the VP of Sales and Marketing of JGC from 2013 to 2017. He was the VP of Sales of Harry’s Fresh Foods from 2011 and 2013 and VP of National Accounts of Solo Cup Company from 2008 to 2011. Previous to 2008, Mr. Murray held numerous other roles in Sales and Marketing, including a 22-year career with Kraft Foods. Mr. Murray received a Bachelor of Arts, Marketing, from Michigan State University.

In connection with his appointment, the Company and Mr. Murray entered into the Company’s standard employment letter agreement pursuant to which Mr. Murray will serve as President on an at-will basis at an annual salary of $250,000 (with bonus and incentive equity to be determined at a later date).

There are no arrangements or understandings between Mr. Murray and any other persons pursuant to which Mr. Murray was selected as the Company’s President. Mr. Murray does not have any family relationship with any director or executive officer of the Company, or any person nominated or chosen to become a director or executive officer of the Company, and except as described above, there are no applicable transactions that would require disclosure under Item 404(a) of Regulation S-K.

Pursuant to a previously disclosed Consulting Agreement, Jamie Colbourne is providing certain consulting services to the Company, including serving as the Company’s Interim Chief Executive Officer and Acting Principal Financial Officer (the “Consulting Agreement”). Mr. Colbourne shall continue to serve as the Company’s Interim Chief Executive Officer and Acting Principal Financial Officer pursuant to the Consulting Agreement; provided that effective as of September 1, 2020, Mr. Colbourne’s monthly payments shall be reduced from $25,000 per month to $10,000 per month and Mr. Colbourne shall thereafter provide such services on a part-time basis.

(d) Appointment of Jamie Colbourne as Director

In addition, on September 1, 2020, upon the recommendation of the Nominating Committee of the Board, Mr. Colbourne was appointed as a member of the Board to fill a current vacancy on the Board. Mr. Colbourne will serve until the next annual shareholder meeting at which directors are elected and until his successor is duly qualified and elected. In addition, until such time as Mr. Colbourne is no longer providing consulting or employment services to the Company, Colbourne shall not be entitled to participate in the Company’s existing compensation plan for non-employee directors. It is currently anticipated that Mr. Colbourne will not serve on any committees of the Board at this time.

There are no arrangements or understandings between Mr. Colbourne and any other persons pursuant to which Mr. Colbourne was selected to serve on the Board. Mr. Colbourne does not have any family relationship with any director or executive officer of the Company, or any person nominated or chosen to become a director or executive officer of the Company, and except as described above, there are no applicable transactions that would require disclosure under Item 404(a) of Regulation S-K.

In connection with the appointments described above, each of Mr. Colbourne and Mr. Murray will enter into the Company’s standard form of indemnification agreement, a copy of which has been filed as Exhibit 10.6 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on July 12, 2019.

On September 8, 2020, the Company issued a press release announcing Mr. Murray’s appointment as President and Mr. Colbourne’s appointment to the Board. A copy of the press release is attached as Exhibit 99.1 and incorporated herein by reference.

The information in the press release attached as Exhibit 99.1 hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Jones Soda Co.

|

|

|

|

|

|

|

|

|

|

Date: September 8, 2020

|

By:

|

/s/ Jamie Colbourne

|

|

|

|

Jamie Colbourne

|

|

|

|

Interim Chief Executive Officer and Acting Principal Financial Officer

|

|

|

|

|

EXHIBIT 99.1

Jones Soda Appoints Mark Murray as President

Proven Executive Brings Track Record of Driving Sales Growth and Operational Efficiencies for Notable CPG and Food Service Companies

SEATTLE, Sept. 08, 2020 (GLOBE NEWSWIRE) -- Jones Soda Co. (OTCQB: JSDA), the original craft soda known for its unconventional flavors and user-designed label artwork, has appointed 38-year CPG and foodservice industry veteran Mark Murray as President, effective September 1, 2020.

Murray most recently served as the president of JGC Foods, a 600-employee North American food manufacturer specializing in fresh soups, sauces, sides, and entrées. In his six years with JGC, including four as vice president of sales and marketing, Murray created and implemented a broad range of strategic initiatives that nearly tripled company sales, developed new channels, achieved significant cost savings, and led to the acquisition of JGC by a capital fund.

Earlier in his career, Murray held various senior sales and marketing positions for well-known CPG and food service brands, including Harry’s Fresh Foods, SOLO Cup Company, Campbell’s Food Company and Kraft Heinz Food Service. At each of these companies, he substantially grew sales and operational efficiencies through strategic visioning, new business and key account development, change management and other executive leadership.

“Bringing in a proven executive with nearly four decades of experience in implementing sales strategies and driving revenue growth is a pivotal step forward for Jones Soda,” said Jamie Colbourne, Interim CEO. “Mark has a proven track record with exceptional leadership traits and ability to implement the necessary tactics to increase sales. We look forward to having Mark’s expertise as we remain committed to resetting our go-to-market approach and evaluating strategies to drive profitability and sustain growth going forward.”

Commenting on his appointment, Murray stated: “Having worked with Jones closely over the past several months, it is clear the company has made progress resetting the business and identifying its unique areas of strength. It is a pivotal time for the company as we look to capitalize on the notable marketing campaigns implemented a few months ago, and I firmly believe there is ample room for growth. Although we are still in the early innings of revitalizing the business, I look forward to leveraging my background, along with the company’s exceptional brand image and leadership team, to further expand its customer base and significantly increase sales.”

In addition, interim CEO Jamie Colbourne has been appointed as a director to fill a current vacancy on Jones Soda’s board of directors.

About Jones Soda Co.

Headquartered in Seattle, Washington, Jones Soda Co.® (OTCQB: JSDA) markets and distributes premium beverages under the Jones® Soda and Lemoncocco® brands. A leader in the premium soda category, Jones Soda is made with pure cane sugar and other high-quality ingredients, and is known for packaging that incorporates ever-changing photos sent in from its consumers. Jones’ diverse product line offers something for everyone – pure cane sugar soda, zero-calorie soda and Lemoncocco non-carbonated premium refreshment. Jones is sold across North America in glass bottles, cans and on fountain through traditional beverage outlets, restaurants and alternative accounts. For more information, visit www.jonessoda.com or www.myjones.com or www.drinklemoncocco.com.

Investor Relations Contact

Cody Slach

Gateway Investor Relations

1-949-574-3860

JSDA@gatewayir.com

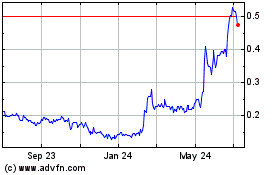

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

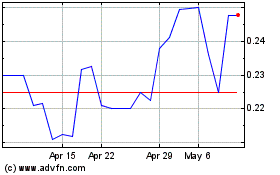

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Apr 2023 to Apr 2024