As filed with the Securities and Exchange

Commission on September 8, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

DARIOHEALTH CORP.

(Exact Name of Registrant as Specified in

Its Charter)

|

Delaware

(State or other jurisdiction

of incorporation or organization)

|

45-2973162

(I.R.S. Employer

Identification No.)

|

8 HaTokhen Street

Caesarea Industrial Park

3088900, Israel

Telephone: +(972)-(4) 770 4055

Facsimile: +(972)-(4) 770 4060

(Address, Including Zip Code, and

Telephone Number, Including Area Code, of Registrant’s Principal

Executive Offices)

Mr. Erez Raphael

Chief Executive Officer

DarioHealth Corp.

8 HaTokhen Street

Caesarea Industrial Park

3088900, Israel

Telephone: +(972)-(4) 770 4055

Facsimile: +(972)-(4) 770 4060

(Name, address, including zip code,

and telephone number,

including area code, of agent for service)

Copies to:

Oded Har-Even, Esq.

Ron Ben-Bassat, Esq.

Sullivan & Worcester LLP

1633 Broadway

New York, NY 10019

Telephone: (212) 660-5000

Facsimile: (212) 660-3001

Approximate date of commencement of proposed sale to the

public: From time to time after the effective date of this registration statement, as determined by market and

other conditions.

If the only securities being registered on this Form are

being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being registered on this Form are

to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities

offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant

to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General

Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to

Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging

growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer:

|

¨

|

Accelerated filer:

|

¨

|

|

Non-accelerated filer:

|

x

|

Smaller reporting company:

|

x

|

|

|

Emerging growth company

|

¨

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of Securities Act. ¨

CALCULATION OF REGISTRATION FEE

Title of each class of

securities to be

registered

|

|

Amount To Be

Registered (1)(2)

|

|

|

Proposed Maximum

Offering Price Per

Share

|

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

|

Amount of

Registration Fee

|

|

|

Common Stock, $0.0001 par value

|

|

|

3,825,441

|

|

|

$

|

15.93

|

(3)

|

|

$

|

60,939,275.13

|

|

|

$

|

7,909.92

|

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended, or the Act, this registration statement shall be deemed to cover any additional number of shares of the registrant’s common stock as may be issued from time to time upon exercise of the warrants to prevent dilution as a result of stock splits, stock dividends or similar transactions. No additional consideration will be received for the common stock, and therefore no registration fee is required pursuant to Rule 457(i) under the Act.

|

|

(2)

|

Represents 3,825,441 shares of our common stock, $0.0001 par value per share (the “Common Stock”), which includes 824,689 shares of the registrant’s Common Stock issuable upon the exercise of pre-funded warrants.

|

|

(3)

|

Estimated solely for purposes of calculating the amount of the registration fee pursuant to Rule 457(c) of the

Act, based upon the average of the high and low sales prices of the registrant’s Common Stock as reported on the Nasdaq

Capital Market on September 2, 2020.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT

ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT

WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF

THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION ACTING PURSUANT

TO SAID SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is

not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer

to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated September

8, 2020

PROSPECTUS

3,825,441 SHARES OF COMMON STOCK

The selling stockholders identified in this prospectus may offer

from time to time up to 3,825,441 shares of our common stock, $0.0001 par value per share (the “Common Stock”), which

includes 824,689 shares of the registrant’s Common Stock issuable upon the exercise of pre-funded warrants.

This prospectus describes the general manner in which the shares

may be offered and sold by the selling stockholders. If necessary, the specific manner in which the shares may be offered and sold

will be described in a supplement to this prospectus.

While we will not receive any proceeds from the sale of the

shares by the selling stockholders. We will pay the expenses of registering these shares.

Our Common Stock is traded on the Nasdaq

Capital Market under the symbol “DRIO.”

Investing in our Common Stock involves

risks. See “Risk Factors” beginning on page 4 of this prospectus.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is

, 2020.

TABLE OF CONTENTS

You should rely only on the information contained in this

prospectus, any prospectus supplement and the documents incorporated by reference, or to which we have referred you. Neither we

nor the selling stockholders have authorized anyone to provide you with different information. If anyone provides you with different

or inconsistent information, you should not rely on it. This prospectus and any prospectus supplement do not constitute an offer

to sell, or a solicitation of an offer to purchase, the Common Stock offered by this prospectus and any prospectus supplement in

any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such

jurisdiction. You should not assume that the information contained in this prospectus, any prospectus supplement or any document

incorporated by reference is accurate as of any date other than the date on the front cover of the applicable document.

Neither the delivery of this prospectus nor any distribution

of Common Stock pursuant to this prospectus shall, under any circumstances, create any implication that there has been no change

in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus. Our

business, financial condition, results of operations and prospects may have changed since such date.

When used herein, unless the context requires otherwise, references

to the “Company,” “we,” “our” and “us” refer to DarioHealth Corp., a Delaware corporation,

collectively with its wholly-owned subsidiary, LabStyle Innovation Ltd., an Israeli corporation.

All dollar amounts refer to U.S. dollars unless otherwise indicated.

ABOUT THIS PROSPECTUS

This prospectus describes the general manner in which the selling

stockholders identified in this prospectus may offer from time to time up to 3,825,441 shares of our Common Stock. If necessary,

the specific manner in which the shares may be offered and sold will be described in a supplement to this prospectus, which supplement

may also add, update or change any of the information contained in this prospectus. To the extent there is a conflict between the

information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement,

provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for

example, a document incorporated by reference in this prospectus or any prospectus supplement—the statement in the document

having the later date modifies or supersedes the earlier statement.

OUR COMPANY

This summary highlights information contained in the documents

incorporated herein by reference. Before making an investment decision, you should read the entire prospectus, and our other filings

with the Securities and Exchange Commission, or the SEC, including those filings incorporated herein by reference, carefully, including

the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

We are a leading global Digital Therapeutics, or DTx, company

revolutionizing the way people manage their health across the chronic condition spectrum to live a better and healthier life. By

delivering personalized evidence-based interventions that are driven by data, high quality software, easy-to-use medical devices

and coaching, we empower individuals to make healthy adjustments to their daily lifestyle choices in a personalized way and improve

their overall health. Our cross-functional team operates at the intersection of life sciences, behavioral science and software

technology to deliver highly engaging therapeutic interventions. The DarioTM Blood Sugar Monitor is among the most downloaded

healthcare apps, with 4.9/5.0 stars from 11,000+ reviews on the Apple Store as of July 2020. We are rapidly moving into new

chronic conditions such as hypertension, using a performance-based approach to improve the health of users managing chronic disease.

We attempt to drive behavioral change by creating highly personalized,

closed-loop interactions that support our customers, who become members of our services, via connected FDA cleared monitoring devices,

just-in-time health information and real-time coaching. This highly scalable infrastructure results in members with significant

improvement in their health conditions at a modest price-point. The Dario solution is intended to stretch across various health

conditions and ailments. We currently focus our efforts on diabetes and hypertension, and we plan to expand our focus into additional

chronic conditions during 2020, including hypertension.

Our address is 8 HaTokhen Street, Caesarea Industrial Park,

3088900, Israel and our telephone number is +(972)-(4) 770 4055. Our corporate website is: www.mydario.com. The content

of our website shall not be deemed incorporated by reference in this prospectus.

ABOUT THIS OFFERING

This prospectus relates to the resale by the selling stockholders

identified in this prospectus of up to 3,825,441 shares of our common stock, $0.0001 par value per share (the “Common Stock”)

purchased in our private placement offering, which was closed on July 31, 2020 (the “July 2020 Private Placement”),

consisting of (i) 3,000,752 shares of our Common Stock; and (ii) 824,689 shares of our Common Stock issuable upon the

exercise of pre-funded warrants. All of the shares, when sold, will be sold by these selling stockholders. The selling stockholders

may sell their shares of Common Stock from time to time at prevailing market prices. We will not receive any proceeds from the

sale of the shares of Common Stock by the selling stockholders.

|

Common Stock Offered:

|

|

Up to 3,825,441 shares of common stock.

|

|

|

|

|

|

Common Stock Outstanding at September 2, 2020:

|

|

8,415,564 (assuming the exercise in full of the pre-funded warrants and the issuance in

full of the shares of common stock underlying the pre-funded warrants).

|

|

|

|

|

|

Use of Proceeds:

|

|

We will not receive any proceeds from the sale of the 3,825,441 shares of Common Stock subject to resale by the selling stockholders under this prospectus.

|

|

|

|

|

|

Risk Factors:

|

|

An investment in the Common Stock offered under this prospectus is highly speculative and involves substantial risk. Please carefully consider the “Risk Factors” section and other information in this prospectus for a discussion of risks. Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and operations.

|

|

|

|

|

|

Nasdaq Symbol:

|

|

DRIO

|

RISK FACTORS

An investment in our Common Stock involves significant risks.

You should carefully consider the risk factors contained in any prospectus supplement and in our filings with the SEC, including

our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 as well as all of the information contained

in this prospectus, any prospectus supplement and the documents incorporated by reference herein or therein, before you decide

to invest in our Common Stock. Our business, prospects, financial condition and results of operations may be materially and adversely

affected as a result of any of such risks. The value of our Common Stock could decline as a result of any of these risks. You

could lose all or part of your investment in our Common Stock. Some of our statements in sections entitled “Risk Factors”

are forward-looking statements. The risks and uncertainties we have described are not the only ones we face. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, prospects,

financial condition and results of operations.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, any prospectus supplement and the documents

we incorporate by reference contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act

of 1995 and other federal securities laws, regarding our business, clinical trials, financial condition, expenditures, results

of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,”

“planned expenditures,” “believes,” “seeks,” “estimates” and similar expressions

or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive

means of identifying forward-looking statements as denoted in this prospectus, any prospectus supplement and the documents we incorporate

by reference. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this prospectus, any

prospectus supplement and the documents we incorporate by reference reflect the good faith judgment of our management, such statements

can only be based on facts and factors known by us as of such date. Consequently, forward-looking statements are inherently subject

to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or

anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results

and outcomes include, without limitation, those specifically addressed under the heading “Risk Factors” herein

and in the documents we incorporate by reference, as well as those discussed elsewhere in this prospectus and any prospectus supplement. Readers

are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus,

any prospectus supplement or the respective documents incorporated by reference, as applicable. Except as required by

law, we undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance

that may arise after the date of such forward-looking statements. Readers are urged to carefully review and consider the various

disclosures made throughout the entirety of this prospectus, any prospectus supplement and the documents incorporated by reference,

which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results

of operations and prospects.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the 3,825,441

shares of Common Stock subject to resale by the selling stockholders under this prospectus. We will incur all costs associated

with the preparation and filing of the registration statement of which this prospectus is a part. Brokerage fees, commissions and

similar expenses, if any, attributable to the sale of shares offered hereby will be borne by the applicable selling stockholders.

SELLING STOCKHOLDERS

The shares of Common Stock being offered by the selling stockholders

listed below (or their successors and assigns) were issued, or may be issued, as the case may be, in connection with our July 2020

Private Placement.

On July 28, 2020, we entered into subscription agreements

(each, a “Subscription Agreement”) with accredited investors relating to an offering with respect to the sale of an

aggregate of (i) 2,969,266 shares of Common Stock at a purchase price of $7.47 per share, and (ii) pre-funded warrants

(the “Pre-Funded Warrants”) to purchase 824,689 shares of Common Stock (collectively, the “First Closing”),

at a purchase price of $7.4699 per Pre-Funded Warrant, which represents the per share offering price per share, less a $0.0001

per share exercise price for each such Pre-Funded Warrant. In addition, on July 30, 2020, we entered into a Subscription Agreement

with an accredited investor for the purchase of 31,486 shares of Common Stock at a purchase price per share of $7.94 (the “Second

Closing” and together with the First Closing, the “Offering”). The closing of the Offering took place on July 31,

2020.

In connection with the July 2020 Private Placement we have

agreed to file this registration statement covering the resale of the shares of Common Stock sold in the offering by October 29,

2020.

The Pre-Funded Warrants are exercisable

at any time after the date of issuance. A holder of Pre-Funded Warrants may not exercise the warrant if the holder, together with

any group that the holder is a member, would beneficially own more than 4.99% (or, at the election of the purchaser, 9.99%) of

the number of shares of common stock outstanding immediately after giving effect to such exercise. A holder of Pre-Funded Warrants

may terminate, increase or decrease this percentage by providing at least 61 days’ prior notice to the Company. A holder

of Pre-Funded Warrant is also subject to a limitation on exercise of the Pre-Funded Warrant if such exercise would result in such

holder, together with any group that the holder is a member, beneficially owning more 19.99% of the number of shares of Common

Stock outstanding immediately before giving effect to such exercise, unless shareholder approval is obtained. The selling stockholders

may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

Other than the relationships described herein, to our knowledge,

none of the selling stockholders are employees or suppliers of ours or our affiliates. Within the past three years, other than

the relationships described herein, none of the selling stockholders has held a position as an officer a director of ours, nor

has any selling stockholder had any material relationship of any kind with us or any of our affiliates. All information

with respect to share ownership has been furnished by the selling stockholders, unless otherwise noted. The shares being

offered are being registered to permit public secondary trading of such shares and each selling stockholder may offer all or part

of the shares it owns for resale from time to time pursuant to this prospectus. None of the selling stockholders has any family

relationships with our officers, other directors or controlling stockholders.

Any selling stockholders who are affiliates of broker-dealers

and any participating broker-dealers are deemed to be “underwriters” within the meaning of the Securities Act of 1933,

as amended, or the Securities Act, and any commissions or discounts given to any such selling stockholder or broker-dealer may

be regarded as underwriting commissions or discounts under the Securities Act.

The term “selling stockholders” also includes any

transferees, pledgees, donees, or other successors in interest to the selling stockholders named in the table below. Unless otherwise

indicated, to our knowledge, each person named in the table below has sole voting and investment power (subject to applicable community

property laws) with respect to the shares of Common Stock set forth opposite such person’s name. We will file a supplement

to this prospectus (or a post-effective amendment hereto, if necessary) to name successors to any named selling stockholders who

are able to use this prospectus to resell the Common Stock registered hereby.

|

Name of Selling Stockholder

|

|

Shares

Beneficially

Owned

Before the

Offering (1)

|

|

|

Shares

Beneficially

Owned Before

the Offering that

are Issuable

Upon the

Exercise of

Warrants or

Options (1)(2)

|

|

|

Maximum

Number of

Shares to be

Offered in the

Offering

|

|

|

Number of Shares Beneficially

Owned Immediately After Sale of

Maximum Number of Shares in

the Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# of Shares (1)(2)

|

|

|

% of Class (1)(2)

|

|

|

Haiku Capital Ltd. (3)

|

|

|

40,160

|

|

|

|

-

|

|

|

|

40,160

|

|

|

|

-

|

|

|

|

-

|

|

|

Morgan Christopher Frank

|

|

|

40,160

|

|

|

|

-

|

|

|

|

40,160

|

|

|

|

-

|

|

|

|

-

|

|

|

Seawolf Capital, LLC (4)

|

|

|

33,467

|

|

|

|

-

|

|

|

|

33,467

|

|

|

|

-

|

|

|

|

-

|

|

|

James Besser

|

|

|

66,934

|

|

|

|

-

|

|

|

|

66,934

|

|

|

|

-

|

|

|

|

-

|

|

|

JEB Partners, L.P. (5)

|

|

|

66,934

|

|

|

|

-

|

|

|

|

66,934

|

|

|

|

-

|

|

|

|

-

|

|

|

Manchester Explorer, L.P. (5)

|

|

|

535,475

|

|

|

|

-

|

|

|

|

535,475

|

|

|

|

-

|

|

|

|

-

|

|

|

Lior Tamar Investments Ltd. (6)

|

|

|

71,167

|

|

|

|

-

|

|

|

|

34,805

|

|

|

|

36,362

|

|

|

|

*

|

|

|

Hachshara Insurance Company Ltd. (7)

|

|

|

56,493

|

|

|

|

-

|

|

|

|

56,493

|

|

|

|

-

|

|

|

|

-

|

|

|

Tachlit Compossite Structures Ltd. (8)

|

|

|

53,547

|

|

|

|

-

|

|

|

|

53,547

|

|

|

|

-

|

|

|

|

-

|

|

|

Warrantford Ltd. (9)

|

|

|

33,467

|

|

|

|

-

|

|

|

|

33,467

|

|

|

|

-

|

|

|

|

-

|

|

|

More Provident Funds Ltd. (10)

|

|

|

247,657

|

|

|

|

-

|

|

|

|

247,657

|

|

|

|

-

|

|

|

|

-

|

|

|

Pareto Optimum L.P. (11)

|

|

|

75,000

|

|

|

|

-

|

|

|

|

75,000

|

|

|

|

-

|

|

|

|

-

|

|

|

Corundum Open Innovation (CI) Fund, L.P. (12)

|

|

|

131,935

|

|

|

|

-

|

|

|

|

66,934

|

|

|

|

65,001

|

|

|

|

*

|

|

|

Masterplan Hedge Fund L.P. (13)

|

|

|

33,467

|

|

|

|

-

|

|

|

|

33,467

|

|

|

|

-

|

|

|

|

-

|

|

|

Nantahala Capital Partners Limited Partnership (14) (15)

|

|

|

18,777

|

|

|

|

127,497

|

|

|

|

8,065

|

|

|

|

138,209

|

|

|

|

1.82

|

%

|

|

Nantahala Capital Partners II Limited Partnership (14) (16)

|

|

|

52,445

|

|

|

|

359,908

|

|

|

|

56,309

|

|

|

|

356,044

|

|

|

|

4.69

|

%

|

|

NCP QR LP (14) (17)

|

|

|

14,011

|

|

|

|

153,208

|

|

|

|

22,176

|

|

|

|

145,043

|

|

|

|

1.91

|

%

|

|

Nantahala Capital Partners SI, LP (14) (18)

|

|

|

445,153

|

|

|

|

1,590,079

|

|

|

|

1,066,778

|

|

|

|

968,454

|

|

|

|

12.76

|

%

|

|

Blackwell Partners LLC - Series A (14) (19)

|

|

|

47,160

|

|

|

|

291,633

|

|

|

|

39,158

|

|

|

|

299,635

|

|

|

|

3.95

|

%

|

|

Silver Creek CS SAV, LLC (14) (20)

|

|

|

16,676

|

|

|

|

95,100

|

|

|

|

12,334

|

|

|

|

99,442

|

|

|

|

1.31

|

%

|

|

The Phoenix Insurance Company Ltd. (21)

|

|

|

133,686

|

|

|

|

-

|

|

|

|

133,686

|

|

|

|

-

|

|

|

|

-

|

|

|

Soleus Capital Master Fund, LP (22)

|

|

|

401,606

|

|

|

|

-

|

|

|

|

401,606

|

|

|

|

-

|

|

|

|

-

|

|

|

Shotfut Menayot Chool Phoenix Amitim (23)

|

|

|

535,475

|

|

|

|

-

|

|

|

|

535,475

|

|

|

|

-

|

|

|

|

-

|

|

|

Gregg D. Rock D.P.M, P.C. Defined Benefit Plan (24)

|

|

|

33,467

|

|

|

|

-

|

|

|

|

33,467

|

|

|

|

-

|

|

|

|

-

|

|

|

Christopher Davis

|

|

|

66,934

|

|

|

|

-

|

|

|

|

66,934

|

|

|

|

-

|

|

|

|

-

|

|

|

Thomas A. Masci Jr.

|

|

|

33,467

|

|

|

|

-

|

|

|

|

33,467

|

|

|

|

-

|

|

|

|

-

|

|

|

Sakumzi Justice Macozoma

|

|

|

31,486

|

|

|

|

-

|

|

|

|

31,486

|

|

|

|

-

|

|

|

|

-

|

|

* less than 1%

|

(1)

|

Beneficial ownership is determined in accordance with SEC rules and generally includes voting

or investment power with respect to securities. Shares of Common Stock subject to warrants currently exercisable, or exercisable

within 60 days of September 2, 2020, are counted as outstanding for computing the percentage of the selling stockholder holding

such options or warrants but are not counted as outstanding for computing the percentage of any other selling stockholder. Notwithstanding

the foregoing, certain selling stockholders may not have voting or investment power over such shares, and therefore may not beneficially

own such shares, due to their inability to exercise warrants or convert shares of preferred stock as a result of certain contractual

beneficial ownership limitations contained therein.

|

|

(2)

|

Assumes all of the shares of Common Stock offered (including exercise of pre-funded warrants) are sold. Percentage

ownership is based on 7,590,875 shares of Common Stock issued and outstanding on September 2, 2020.

|

|

(3)

|

Sheer Roichman has voting and dispositive power over our shares held by the selling stockholder.

|

|

(4)

|

Atwood Porter Collins has voting and dispositive power over our shares held by the selling stockholder.

|

|

(5)

|

James Besser has voting and dispositive power over our shares held by the selling stockholder.

|

|

(6)

|

Shay Lior and Yossi Tamar have shared voting and dispositive power over our shares held by the selling stockholder.

|

|

(7)

|

Roi Kadosh has voting and dispositive power over our shares held by the selling stockholder.

|

|

(8)

|

Shay Azoulay has voting and dispositive power over our shares held by the selling stockholder.

|

|

(9)

|

Menachem Raphael has voting and dispositive power over our shares held by the selling stockholder.

|

|

(10)

|

Ori Keren has voting and dispositive power over our shares held by the selling stockholder.

|

|

(11)

|

Idan Ben Naim and Shay Shalom have shared voting and dispositive power over our shares held by the selling stockholder.

|

|

(12)

|

Gilad Peleg has voting and dispositive power over our shares held by the selling stockholder.

|

|

(13)

|

Yoram Hadar has voting and dispositive power over our shares held by the selling stockholder.

|

|

(14)

|

Nantahala Capital Management, LLC is a Registered Investment

Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of the selling

stockholder as a General Partner or Investment Manager and would be considered the beneficial owner of such securities. The above

shall not be deemed to be an admission by the record owners or the selling stockholder that they are themselves beneficial owners

of these securities for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange

Act, or any other purpose. Wilmot Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed

to have voting and dispositive power over the shares held by the selling stockholder. Each selling stockholder’s Pre-Funded

Warrants and shares of Series A-1 Preferred Stock contain a contractual beneficial ownership limitation of either 4.99% or 9.99%.

Due to contractual beneficial ownership limitations for such selling stockholder's Pre-Funded Warrants and/or Series A-1 Preferred

Stock, the "% of Class" calculations contained in the table above are not reflective of the actual beneficial ownership

of such selling stockholder (or such person or persons as have been delegated voting and investment power on behalf of such selling

stockholder).

|

|

(15)

|

Consists of (i) 2,545 shares of Common Stock, and (ii) 5,520

shares of Common Stock issuable upon the exercise of Pre-Funded Warrants. Please see footnote 14 regarding contractual beneficial

ownership limitations, due to which, the “% of Class” calculations contained above may not be reflective of the actual

beneficial ownership of such selling stockholder (or such person or persons as have been delegated voting and investment power

on behalf of such selling stockholder).

|

|

(16)

|

Consists of (i) 17,766 shares of Common Stock, and (ii) 38,543

shares of Common Stock issuable upon the exercise of Pre-Funded Warrants. Please see footnote 14 regarding contractual beneficial

ownership limitations, due to which, the “% of Class” calculations contained above may not be reflective of the actual

beneficial ownership of such selling stockholder (or such person or persons as have been delegated voting and investment power

on behalf of such selling stockholder).

|

|

(17)

|

Consists of (i) 6,997 shares of Common Stock, and (ii) 15,179

shares of Common Stock issuable upon the exercise of Pre-Funded Warrants. Please see footnote 14 regarding contractual beneficial

ownership limitations, due to which, the “% of Class” calculations contained above may not be reflective of the actual

beneficial ownership of such selling stockholder (or such person or persons as have been delegated voting and investment power

on behalf of such selling stockholder).

|

|

(18)

|

Consists of (i) 336,577 shares of Common Stock, and (ii) 730,201

shares of Common Stock issuable upon the exercise of Pre-Funded Warrants. Please see footnote 14 regarding contractual beneficial

ownership limitations, due to which, the “% of Class” calculations contained above may not be reflective of the actual

beneficial ownership of such selling stockholder (or such person or persons as have been delegated voting and investment power

on behalf of such selling stockholder).

|

|

(19)

|

Consists of (i) 12,355 shares of Common Stock, and (ii) 26,803

shares of Common Stock issuable upon the exercise of Pre-Funded Warrants. Please see footnote 14 regarding contractual beneficial

ownership limitations, due to which, the “% of Class” calculations contained above may not be reflective of the actual

beneficial ownership of such selling stockholder (or such person or persons as have been delegated voting and investment power

on behalf of such selling stockholder).

|

|

(20)

|

Consists of (i) 3,891 shares of Common Stock, and (ii) 8,443

shares of Common Stock issuable upon the exercise of Pre-Funded Warrants. Please see footnote 14 regarding contractual beneficial

ownership limitations, due to which, the “% of Class” calculations contained above may not be reflective of the actual

beneficial ownership of such selling stockholder (or such person or persons as have been delegated voting and investment power

on behalf of such selling stockholder).

|

|

(21)

|

Dan Karner and Haggai Schreiber have shared voting and dispositive power over our shares held by the selling stockholder.

|

|

(22)

|

The shares reflected as beneficially owned by Soleus Capital

Master Fund, L.P., or Soleus Master Fund, in the table above. Mr. Guy Levy is the sole managing member of Soleus Capital Group,

LLC, or Soleus Group, which is the sole managing member of Soleus Capital, LLC, together with Soleus Group, the Soleus Funds, which

is the general partner of Soleus Master Fund. Accordingly, Mr. Levy and Soleus Funds may be deemed the beneficial owners of shares

of common stock held by Soleus Master Fund. Each of Mr. Levy and Soleus Funds disclaims beneficial ownership of shares held by

any of the entities named herein pursuant to Rule 13d-4 under the Exchange Act. The business address for Soleus Master Fund is

104 Field Point Road, 2nd Floor, Greenwich, Connecticut 06830.

|

|

(23)

|

Gilad Shamir and Haggai Schreiber have shared voting and dispositive power over our shares held by the selling stockholder.

|

|

(24)

|

Jeffery Coopersmith and Michael Simon Trustees have shared voting and dispositive power over our shares held by the selling stockholder.

|

We may require the selling stockholders to suspend the sales

of the Common Stock offered by this prospectus upon the occurrence of any event that makes any statement in this prospectus or

the related registration statement untrue in any material respect or that requires the changing of statements in these documents

in order to make statements in those documents not misleading.

Information concerning additional selling stockholders not

identified in this prospectus will be set forth in prospectus supplements from time to time, if and as required. Information concerning

the selling stockholders may change from time to time and any changed information will be set forth in prospectus supplements if

and when necessary.

PLAN OF DISTRIBUTION

The selling stockholders, and their pledgees, donees, transferees

or other successors in interest, may from time to time offer and sell, separately or together, some or all of the shares of Common

Stock, or the securities, covered by this prospectus. Registration of the securities covered by this prospectus does not mean,

however, that those securities necessarily will be offered or sold.

The securities covered by this prospectus may be sold from time

to time, at market prices prevailing at the time of sale, at prices related to market prices, at a fixed price or prices subject

to change or at negotiated prices, by a variety of methods including the following:

|

|

·

|

in the Nasdaq Capital Market;

|

|

|

·

|

in privately negotiated transactions;

|

|

|

·

|

through broker-dealers, who may act as agents or principals;

|

|

|

·

|

through one or more underwriters on a firm commitment or best-efforts basis;

|

|

|

·

|

in a block trade in which a broker-dealer will attempt to sell a block of securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

directly to one or more purchasers;

|

|

|

·

|

in any combination of the above.

|

In effecting sales, brokers or dealers engaged by the selling

stockholders may arrange for other brokers or dealers to participate. Broker-dealer transactions may include:

|

|

·

|

purchases of the securities by a broker-dealer as principal and resales of the securities by the broker-dealer for its account pursuant to this prospectus;

|

|

|

·

|

ordinary brokerage transactions; or

|

|

|

·

|

transactions in which the broker-dealer solicits purchasers on a best efforts basis.

|

To our knowledge, the selling stockholders have not entered

into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of the securities

covered by this prospectus. At any time a particular offer of the securities covered by this prospectus is made, a revised prospectus

or prospectus supplement, if required, will be distributed which will set forth the aggregate amount of securities covered by this

prospectus being offered and the terms of the offering, including the name or names of any underwriters, dealers, brokers or agents.

In addition, to the extent required, any discounts, commissions, concessions and other items constituting underwriters’ or

agents’ compensation, as well as any discounts, commissions or concessions allowed or reallowed or paid to dealers, will

be set forth in such revised prospectus supplement. Any such required prospectus supplement, and, if necessary, a post-effective

amendment to the registration statement of which this prospectus is a part, will be filed with the SEC to reflect the disclosure

of additional information with respect to the distribution of the securities covered by this prospectus.

LEGAL MATTERS

Sullivan & Worcester LLP, New York, New York, passed

upon the validity of the shares of Common Stock that may be offered hereby.

EXPERTS

The consolidated financial statements of DarioHealth Corp. at

December 31, 2019 and 2018, and for each of the two years in the period ended December 31, 2019, incorporated by reference

in this prospectus have been audited by Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, independent

registered public accounting firm, as set forth in their report thereon (which contains an explanatory paragraph describing conditions

that raise substantial doubt about our ability to continue as a going concern as described in Note 1c to the consolidated financial

statements) appearing elsewhere herein, and are included in reliance upon such report given on the authority of such firm as experts

in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting and information requirements

of the Exchange Act and as a result file periodic reports and other information with the SEC. These periodic reports and other

information will be available at the website of the SEC referred to below. We also make available on our website under “Investors/Filings,”

free of charge, our proxy statements, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such materials with

or furnish them to the SEC. Our website address is www.mydario.com. This reference to our website is an inactive

textual reference only, and is not a hyperlink. The contents of our website are not part of this prospectus, and you should not

consider the contents of our website in making an investment decision with respect to the Common Stock offered hereby.

We have filed a registration statement on Form S-3 under

the Securities Act with the SEC with respect to the shares of our Common Stock offered through this prospectus. This prospectus

is filed as a part of that registration statement and does not contain all of the information contained in the registration statement

and exhibits. We refer you to our registration statement and each exhibit attached to it for a more complete description of matters

involving us, and the statements we have made in this prospectus are qualified in their entirety by reference to these additional

materials.

The SEC maintains a website that contains reports and other

information about issuers, like us, who file electronically with the SEC. The address of that website is http://www.sec.gov. This

reference to the SEC’s website is an inactive textual reference only, and is not a hyperlink.

INCORPORATION OF DOCUMENTS BY REFERENCE

We are “incorporating by reference” certain documents

we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information

in the documents incorporated by reference is considered to be part of this prospectus. Statements contained in documents that

we file with the SEC and that are incorporated by reference in this prospectus will automatically update and supersede information

contained in this prospectus, including information in previously filed documents or reports that have been incorporated by reference

in this prospectus, to the extent the new information differs from or is inconsistent with the old information.

We have filed the following documents with the SEC. These documents

are incorporated herein by reference as of their respective dates of filing:

|

|

(2)

|

Our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020, and June 30,

2020, as filed with the SEC on May 12, 2020, and August 12, 2020, respectively;

|

All documents filed by us pursuant to Section 13(a), 13(c),

14 or 15(d) of the Exchange Act (1) after the date of the filing of the registration statement of which this prospectus

forms a part and prior to its effectiveness and (2) until all of the Common Stock to which this prospectus relates has been

sold or the offering is otherwise terminated, except in each case for information contained in any such filing where we indicate

that such information is being furnished and is not to be considered “filed” under the Exchange Act, will be deemed

to be incorporated by reference in this prospectus and any accompanying prospectus supplement and to be a part hereof from the

date of filing of such documents.

We will provide a copy of the documents we incorporate by reference,

at no cost, to any person who receives this prospectus. To request a copy of any or all of these documents, you should write or

telephone us at 8 HaToKhen Street, Caesarea Industrial Park, 3088900, Israel, Attention: Controller, +(972)-(4) 770 4055.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

ITEM 14.

|

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION.

|

The following is a statement of approximate expenses to be incurred

by DarioHealth Corp., or the Company, we, us or our, in connection with the distribution of the Common Stock registered under this

registration statement:

|

|

|

|

Amount

|

|

|

Registration fee under Securities Act of 1933

|

|

$

|

7,909

|

|

|

Legal fees and expenses

|

|

$

|

7,500

|

|

|

Accountant’s fees and expenses

|

|

$

|

4,000

|

|

|

Miscellaneous fees and expenses

|

|

$

|

1,500

|

|

|

Total

|

|

$

|

20,909

|

|

|

ITEM 15.

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS.

|

Section 145 of the Delaware General Corporation Law (which

we refer to as the DGCL) provides, in general, that a corporation incorporated under the laws of the State of Delaware, as we are,

may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action,

suit or proceeding (other than a derivative action by or in the right of the corporation) by reason of the fact that such person

is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as

a director, officer, employee or agent of another enterprise, against expenses (including attorneys’ fees), judgments, fines

and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding

if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests

of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe such person’s

conduct was unlawful. In the case of a derivative action, a Delaware corporation may indemnify any such person against expenses

(including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement

of such action or suit if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed

to the best interests of the corporation, except that no indemnification will be made in respect of any claim, issue or matter

as to which such person will have been adjudged to be liable to the corporation unless and only to the extent that the Court of

Chancery of the State of Delaware or any other court in which such action was brought determines such person is fairly and reasonably

entitled to indemnity for such expenses.

Our certificate of incorporation and bylaws provide that we

will indemnify our directors, officers, employees and agents to the extent and in the manner permitted by the provisions of the

DGCL, as amended from time to time, subject to any permissible expansion or limitation of such indemnification, as may be set forth

in any stockholders’ or directors’ resolution or by contract. In addition, our director and officer indemnification

agreements with each of our directors and officers provide, among other things, for the indemnification to the fullest extent permitted

or required by Delaware law, provided that no indemnitee will be entitled to indemnification in connection with any claim initiated

by the indemnitee against us or our directors or officers unless we join or consent to the initiation of the claim, or the purchase

and sale of securities by the indemnitee in violation of Section 16(b) of the Exchange Act.

Any repeal or modification of these provisions approved by our

stockholders will be prospective only and will not adversely affect any limitation on the liability of any of our directors or

officers existing as of the time of such repeal or modification.

We are also permitted to apply for insurance on behalf of any

director, officer, employee or other agent for liability arising out of his actions, whether or not the DGCL would permit indemnification.

The exhibits filed with this registration statement are set

forth on the “Exhibit Index” set forth elsewhere herein.

The undersigned registrant hereby undertakes:

(A) (1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of

the Securities Act;

(ii) To reflect in the prospectus any facts or events arising

after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually

or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would

not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be

reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes

in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect

to the plan of distribution not previously disclosed in the registration statement or any material change to such information in

the registration statement.

Provided, however , that paragraphs (i), (ii) and

(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained

in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of

the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form

of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability

under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

(3) To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under

the Securities Act to any purchaser:

(i) Each prospectus filed by the registrant pursuant to

Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed

part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2),

(b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant

to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of

the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such

form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described

in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter,

such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration

statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. Provided, however , that no statement made in a registration statement or prospectus

that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior

to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part

of the registration statement or made in any such document immediately prior to such effective date.

(B) That,

for the purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant

to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee

benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated

by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(C) Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the

SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In

the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant

will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will

be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933,

the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Caesarea, Israel

on the 8th day of September 2020.

|

|

DARIOHEALTH CORP.

|

|

|

|

|

|

|

By:

|

/s/ Erez Raphael

|

|

|

|

Name:

|

Erez Raphael

|

|

|

|

Title:

|

Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that

we, the undersigned officers and directors of DarioHealth Corp., a Delaware corporation, do hereby constitute and appoint Erez

Raphael and Zvi Ben David, and each of them, as his or her true and lawful attorney-in-fact and agent, with full power of substitution

and re-substitution, for him and in his name, place, and stead, in any and all capacities, to sign any and all amendments (including

post-effective amendments, exhibits thereto and other documents in connection therewith) to this Registration Statement and to

file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite

and necessary to be done in connection therewith, as fully to all intents and purposes as he might or could do in person, hereby

ratifying and confirming all that said attorney-in-fact and agent, or his substitute or substitutes, may lawfully do or cause to

be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed below by the following persons in the capacities and on the dates indicated.

|

Person

|

|

Capacity

|

|

Date

|

|

|

|

|

|

|

|

/s/ Erez Raphael

|

|

Chief Executive Officer

|

|

September 8, 2020

|

|

Erez Raphael

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Zvi Ben David

|

|

Chief Financial Officer, Secretary and Treasurer

|

|

September 8, 2020

|

|

Zvi Ben David

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Yoav Shaked

|

|

Chairman of the Board of Directors

|

|

September 8, 2020

|

|

Yoav Shaked

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Allen Kamer

|

|

Director

|

|

September 8, 2020

|

|

Allen Kamer

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Hila Karah

|

|

Director

|

|

September 8, 2020

|

|

Hila Karah

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Dennis Matheis

|

|

Director

|

|

September 8, 2020

|

|

Dennis Matheis

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Dennis M. McGrath

|

|

Director

|

|

September 8, 2020

|

|

Dennis M. McGrath

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Yadin Shemmer

|

|

Director

|

|

September 8, 2020

|

|

Yadin Shemmer

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Adam K. Stern

|

|

Director

|

|

September 8, 2020

|

|

Adam K. Stern

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Richard B. Stone

|

|

Director

|

|

September 8, 2020

|

|

Richard B. Stone

|

|

|

|

|

EXHIBIT INDEX

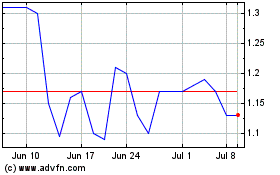

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

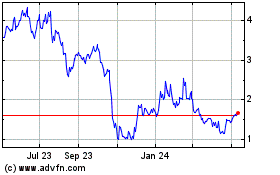

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Apr 2023 to Apr 2024