FB Financial Corporation (NYSE: FBK) (“FB Financial”), parent

company of FirstBank, today announced the completion of FirstBank’s

private placement of $100 million of its 4.50% fixed-to-floating

rate subordinated notes due 2030 (the “Notes”) to certain qualified

institutional buyers and institutional accredited investors (the

“Private Placement”). FirstBank intends to use the net proceeds

from the Private Placement for general corporate purposes.

The Notes have been structured to qualify as Tier 2 capital for

FirstBank for regulatory capital purposes. The Notes are unsecured

and have a ten-year term, maturing September 1, 2030, and will bear

interest at a fixed annual rate of 4.50%, payable semi-annually in

arrears, for the first five years of the term. Thereafter, the

interest rate will reset quarterly to an interest rate per annum

equal to then current three-month Secured Overnight Financing Rate

(“Three-Month SOFR”), plus a spread of 439 basis points, payable

quarterly in arrears, provided, however, that, in the event the

Three-Month SOFR is less than zero, the Three-Month SOFR shall be

deemed to be zero. As provided in the Notes, under specified

conditions, the interest rate on the Notes during the Floating Rate

Period may be determined based upon a rate other than Three-Month

SOFR. FirstBank is entitled to redeem the Notes, in whole or in

part, on any interest payment date on or after September 1, 2025,

and to redeem the Notes at any time in whole upon certain other

specified events. The Kroll Bond Rating Agency assigned an

investment grade rating of BBB to the Notes.

President and Chief Executive Officer, Christopher T. Holmes

stated, “We are pleased with the additional capital cushion that

this offering provides us. The favorable terms reflect the strength

of FirstBank’s balance sheet and operating results. With the

closing of the Franklin transaction and this capital on the balance

sheet, we feel that we are well positioned for the future.”

Piper Sandler & Co. served as the lead placement agent and

U.S. Bancorp Investments, Inc. and Stephens Inc. served as the

co-placement agents for the Private Placement. Waller Lansden

Dortch & Davis, LLP served as legal counsel to FirstBank and

Nelson Mullins Riley & Scarborough LLP served as legal counsel

to the placement agents.

ABOUT FB FINANCIAL CORPORATION

FB Financial Corporation (NYSE: FBK) is a bank holding company

headquartered in Nashville, Tennessee. FB Financial operates

through its wholly owned banking subsidiary, FirstBank, the third

largest Tennessee-headquartered bank, with 87 full-service bank

branches across Tennessee, South Central Kentucky, North Alabama

and North Georgia and a national mortgage business with offices

across the Southeast. FirstBank serves five of the largest

metropolitan markets in Tennessee and has approximately $11.0

billion in assets.

NO OFFER OR SOLICITATION

This press release shall not constitute an offer to sell, a

solicitation of an offer to sell, or the solicitation or an offer

to buy any securities, including the Notes. The Notes have not been

registered under the Securities Act of 1933, as amended (the

“Securities Act”), any state securities laws or any other

applicable securities laws and were offered pursuant to the

exemption from registration provided by Section 3(a)(2) of the

Securities Act. The Notes are not savings or deposit accounts and

are not insured by the Federal Deposit Insurance Corporation (the

“FDIC”) or by any other government agency.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release may

constitute forward-looking statements within the meaning of Section

27A of the Securities Act and Section 21E of the Securities

Exchange Act of 1934, as amended. These forward-looking statements

include, without limitation, statements regarding FB Financial’s

future plans, results, strategies and expectations and certain

matters pertaining to the Private Placement of the Notes, including

the use of proceeds therefrom. These statements can generally be

identified by the use of the words and phrases “may,” “will,”

“should,” “could,” “would,” “goal,” “plan,” “potential,”

“estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,”

“target,” “aim,” “predict,” “continue,” “seek,” “projection,” and

other variations of such words and phrases and similar

expressions.

These forward-looking statements are not historical facts, and

are based upon current expectations, estimates, and projections,

many of which, by their nature, are inherently uncertain and beyond

FB Financial’s control. The inclusion of these forward-looking

statements should not be regarded as a representation by FB

Financial or any other person that such expectations, estimates,

and projections will be achieved. Accordingly, FB Financial

cautions shareholders and investors that any such forward-looking

statements are not guarantees of future performance and are subject

to risks, assumptions, and uncertainties that are difficult to

predict. Although FB Financial believes that the expectations

reflected in these forward-looking statements are reasonable as of

the date of this press release, actual results may prove to be

materially different from the results expressed or implied by the

forward-looking statements. A number of factors could cause actual

results to differ materially from those contemplated by the

forward-looking statements including, without limitation, (1)

current and future economic conditions, including the effects of

declines in housing and commercial real estate prices, high

unemployment rates, and any slowdown in economic growth in the

local or regional economies in which FB Financial operates and/or

the U.S. economy generally, (2) the effects of the COVID-19

pandemic, including the magnitude and duration of the pandemic and

its impact on general economic and financial market conditions and

on FB Financial’s business and FB Financial customers' businesses,

results of operations, asset quality and financial condition, (3)

changes in government interest rate policies, (4) FB Financial’s

ability to effectively manage problem credits, (5) the risk that

the cost savings and any revenue synergies from recently completed

mergers or another acquisition may not be realized or may take

longer than anticipated to be realized, (6) disruption from

recently completed mergers with customer, supplier, or employee

relationships, (7) the possibility that the costs, fees, expenses,

and charges related to recently completed mergers may be greater

than anticipated, including as a result of unexpected or unknown

factors, events, or liabilities, (8) the risks related to the

integrations of the combined businesses following recently

completed mergers, including the risk that the integrations will be

materially delayed or will be more costly or difficult than

expected, (9) the diversion of management time on issues related to

recently completed mergers, (10) the ability of FB Financial to

effectively manage the larger and more complex operations of the

combined company following recently completed mergers, (11) the

risks associated with FB Financial’s pursuit of future

acquisitions, (12) reputational risk and the reaction of the

parties’ respective customers to recently completed mergers, (13)

FB Financial’s ability to successfully execute its various business

strategies, including its ability to execute on potential

acquisition opportunities, (14) the risk of potential litigation or

regulatory action related to recently completed mergers, (15)

general competitive, economic, political, and market conditions and

(16) the failure to obtain any necessary regulatory approvals from

the FDIC or the Commissioner of the Tennessee Department of

Financial Institutions when expected or at all with respect to

redemption or repayment of the Notes.

Additional information regarding FB Financial and factors that

could affect the forward-looking statements contained herein can be

found in FB Financial's Annual Report on Form 10-K for the fiscal

year ended December 31, 2019 and Quarterly Reports on Form 10-Q for

the quarters ended March 31, 2020 and June 30, 2020, and its other

filings with the SEC. Many of these factors are beyond FB

Financial’s ability to control or predict. If one or more events

related to these or other risks or uncertainties materialize, or if

the underlying assumptions prove to be incorrect, actual results

may differ materially from the forward-looking statements.

Accordingly, shareholders and investors should not place undue

reliance on any such forward-looking statements. Any

forward-looking statement speaks only as of the date of this press

release, and FB Financial undertakes no obligation to publicly

update or review any forward-looking statement, whether as a result

of new information, future developments or otherwise, except as

required by law. New risks and uncertainties may emerge from time

to time, and it is not possible for FB Financial to predict their

occurrence or how they will affect the company. FB Financial

qualifies all forward-looking statements by these cautionary

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200831005724/en/

MEDIA CONTACT: Jeanie M. Rittenberry 615-313-8328

jrittenberry@firstbankonline.com www.firstbankonline.com

FINANCIAL CONTACT: Robert Hoehn 615-564-1212

rhoehn@firstbankonline.com

investorrelations@firstbankonline.com

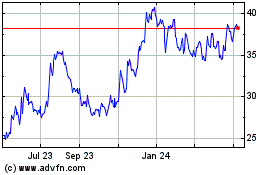

FB Financial (NYSE:FBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

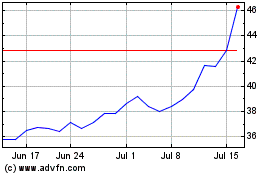

FB Financial (NYSE:FBK)

Historical Stock Chart

From Apr 2023 to Apr 2024