Gilat Satellite Networks Ltd. (NASDAQ, TASE: GILT), a worldwide

leader in satellite networking technology, solutions and services,

today reported its results for the second quarter ended June 30,

2020.

Key Financial Highlights:

- Revenues for Q2 2020 totaled $38.3 million compared with $59.7

million for Q2 2019.

- Q2 2020 - GAAP operating loss was $3.5 million compared to

operating income of $4.9 million in Q2 2019. Q2 2020 Non-GAAP

operating loss was $2.6 million compared to Non-GAAP operating

income of $6.3 in Q2 2019.

- Q2 2020 GAAP net loss was $4.2 million, or loss of $0.08 per

diluted share, compared with net income of $3.4 million, or income

of $0.06 per diluted share in Q2 2019. Q2 2020 non-GAAP net loss

was $3.3 million, or $0.06 per diluted share, compared with net

income of $4.8 million, or $0.09 per diluted share, in Q2

2019.

- Q2 2020 Adjusted EBITDA was $0.1 million compared with Adjusted

EBITDA of $8.9 million in Q2 2019.

Adi Sfadia, Gilat's interim CEO, commented:

"The COVID-19 pandemic continued to affect

Gilat's second quarter 2020 results, as we continued to see

postponements and delays in orders. However, during the second

quarter we began to see and are continuing to see a recovery in

most of our areas of operations which is demonstrated by a

significant increase in pipeline opportunities. We believe that as

a result of these trends, coupled with the cost reduction

initiatives we have executed and are continuing to execute, the

second half of 2020 will be meaningfully better than the first

half, for Gilat.

"I am pleased to report that Bosmat Halpern,

Gilat's AVP Finance has been appointed as Gilat's interim CFO, and

I am confident in her ability to wisely navigate Gilat's finances

through these unprecedented times."

Comtech Transaction and

Litigation

The acquisition of Gilat by Comtech

Telecommunications Corp ("Comtech") remains subject to certain

conditions to closing, including regulatory approvals in Russia. As

previously reported, Comtech filed a complaint against Gilat in the

Delaware Court of Chancery seeking declaratory judgments that

certain actions, if taken by Gilat in connection with Russia

regulatory approval would breach Gilat’s obligations under the

Merger Agreement and that Gilat has suffered a Material Adverse

Effect, as defined in the Merger Agreement, as a result of the

COVID-19 pandemic. As a consequence, Comtech contends that it is

not required to consummate the merger.

Gilat strongly rejects all such allegations, and

on July 21, 2020, Gilat filed a complaint against Comtech in the

Delaware Court of Chancery, seeking a Court order requiring Comtech

to specifically perform its obligations under the merger agreement,

including using its reasonable best efforts to obtain regulatory

approval as soon as practicable (as well as seeking all other

relief deemed proper, including damages). The Complaint also seeks

a declaratory judgment that, if Russian regulatory approval is not

obtained by the termination date of the merger agreement,

satisfaction of the Russian regulatory condition be excused, and a

declaratory judgment that Gilat has not suffered a “Material

Adverse Effect”. Trial is scheduled for early October 2020.

Key Recent Announcements

- Gilat Awarded Over $10 Million for a Five-Year Service Project

for 4G Backhaul Services in Latin America

- US Tier-1 Mobile Operator Awards Gilat a Multi-Million Dollar

Service Contract for Cellular Backhaul

- Africa Mobile Networks (AMN) Extends Gilat’s Contract of

Powering Africa’s Largest Satellite Cellular Backhaul Network

- Gilat Awarded Cellular Backhaul Project for Kcell, Kazakhstan’s

Largest Mobile Network Operator

- Gilat Selected to Extend and Expand Managed Service Cellular

Backhaul Project by a Leading Mobile Operator in Mexico

- Telefonica International Wholesale Services (TIWS) Selects

Gilat for Broadband and Cellular Backhaul Project in Argentina

- Gilat’s Airborne Technology Enables Opening-up of the Chinese

Ka-Band IFEC Market and Driving a Multi-Million Dollar Market

Opportunity

- Gilat Announces Availability of its Flagship VSAT, Achieving

Half a Gigabit of Concurrent Speeds

Non-GAAP MeasuresThe attached

summary unaudited financial statements were prepared in accordance

with U.S. Generally Accepted Accounting Principles (GAAP). To

supplement the consolidated financial statements presented in

accordance with GAAP, the Company presents Non-GAAP presentations

of net income, operating income, Adjusted EBITDA and earnings per

share. The adjustments to the Company’s GAAP results are made with

the intent of providing both management and investors a more

complete understanding of the Company’s underlying operational

results, trends and performance. Non-GAAP financial measures mainly

exclude the effect of stock based compensation, amortization of

purchased intangibles, lease incentive amortization, litigation

expenses, income related to trade secrets claims, restructuring and

reorganization costs, merger and acquisition costs and initial

recognition of deferred tax asset with respect to carry-forward

losses.

Adjusted EBITDA is presented to compare the

Company’s performance to that of prior periods and evaluate the

Company’s financial and operating results on a consistent basis

from period to period. The Company also believes this measure, when

viewed in combination with the Company’s financial results prepared

in accordance with GAAP, provides useful information to investors

to evaluate ongoing operating results and trends. Adjusted EBITDA,

however, should not be considered as an alternative to operating

income or net income for the period and may not be indicative of

the historic operating results of the Company; nor is it meant to

be predictive of potential future results. Adjusted EBITDA is not a

measure of financial performance under GAAP and may not be

comparable to other similarly titled measures for other companies.

Reconciliation between the Company's Operating income and Adjusted

EBITDA is presented in the attached summary financial

statements.

Non-GAAP presentations of net income, operating

income, Adjusted EBITDA and earnings per share should not be

considered in isolation or as a substitute for any of the

consolidated statements of operations prepared in accordance with

GAAP, or as an indication of Gilat’s operating performance or

liquidity.

About Gilat Gilat Satellite

Networks Ltd. (NASDAQ: GILT, TASE: GILT) is a leading global

provider of satellite-based broadband communications. With 30 years

of experience, we design and manufacture cutting-edge ground

segment equipment, and provide comprehensive solutions and

end-to-end services, powered by our innovative technology.

Delivering high value competitive solutions, our portfolio

comprises of a cloud based VSAT network platform, high-speed

modems, high performance on-the-move antennas and high efficiency,

high power Solid-State Amplifiers (SSPA) and Block Upconverters

(BUC).

Gilat’s comprehensive solutions support multiple

applications with a full portfolio of products to address key

applications including broadband access, cellular backhaul,

enterprise, in-flight connectivity, maritime, trains, defense and

public safety, all while meeting the most stringent service level

requirements. Gilat controlling shareholders are the FIMI

Private Equity Funds. For more information, please visit:

www.gilat.com

Safe Harbor

Statement Certain statements made herein that are not

historical are forward-looking within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements involve known and unknown risks and uncertainties that

could cause the actual results, performance or achievements of

Gilat, or the expected results of the proposed transaction with

Comtech to be materially different from any future results,

performance or achievements that may be expressed or implied by

such forward-looking statements. Due to such uncertainties and

risks, no assurances can be given that such expectations will prove

to have been correct, and readers are cautioned not to place undue

reliance on such forward-looking statements, which speak only as of

the date hereof. The forward-looking statements contained

herein include, but are not limited to, statements about the

results, performance or achievements of Gilat, Gilat’s plans,

objectives and expectations for future operations, the expected

completion of the proposed transaction with Comtech, the

satisfaction or waiver of any conditions to the proposed

transaction, and other events relating to the proposed transaction.

Forward-looking statements are often characterized by the use of

forward-looking terminology such as “may,” “will,” “expect,”

“anticipate,” “estimate,” “continue,” “believe,” “should,”

“intend,” “plan,” “project” or other similar words, but are not the

only way these statements are identified. These

forward-looking statements are based upon Gilat’s management’s

current estimates and projections of future results or

trends. In addition to the risks and uncertainties

described in the Annual Report on Form 20-F for the year ended

December 31, 2019 and in the proxy statement/prospectus dated April

3, 2020 and those described in any other documents filed with the

Securities and Exchange Commission, such risks and uncertainties

include, among others, (i) changes in general economic and business

conditions, (ii) the inability to maintain market acceptance of

Gilat's products, (iii) the inability to timely develop and

introduce new technologies, products and applications, (iv) rapid

changes in the market for Gilat's products, (v) loss of market

share and pressure on prices resulting from competition, (vi)

introduction of competing products by other companies, (vii) the

inability to manage growth and expansion, (viii) loss of key OEM

partners, (ix) the inability to attract and retain qualified

personnel, (x) the inability to protect the Company's proprietary

technology, (xi) risks associated with Gilat's international

operations and its location in Israel and (xii) risks relating to

the Merger of wholly owned subsidiary of Comtech with and into

Gilat (the “Merger”), including, among others: (1) the risk that

the conditions to the closing of the are not satisfied, including

the risk that required approvals for the Merger from governmental

authorities are not received; (2) changes or circumstances that

could give rise to the termination of the Merger Agreement; (3) the

risk that the value of the stock merger consideration will

fluctuate over time; (4) litigation relating to the Merger; (5)

uncertainties as to the timing of the consummation of the Merger

and the ability of each party to consummate the Merger; (6) risks

that the proposed Merger disrupts the current plans and operations

of Gilat or Comtech, or both; (7) the ability of Gilat and Comtech

to retain and hire key personnel; (8) competitive responses to the

proposed Merger and the impact of competitive products; (9)

unexpected costs, charges or expenses resulting from the Merger;

(10) potential adverse reactions or changes to business

relationships resulting from the announcement or completion of the

Merger; (11) the combined company’s ability to achieve the

financial and operating results, growth prospects and synergies

expected from the Merger, as well as delays, challenges and

expenses associated with integrating the existing businesses of

Comtech and Gilat; (12) the combined company’s ability to maintain

and improve relationships with customers, suppliers and other third

parties following the Merger; (13) the terms and availability of

the indebtedness that may be incurred in connection with the

Merger; (14) the timing and funding of government contracts; (15)

risks associated with international sales; (16) risks associated

with legal proceedings, customer claims for indemnification and

other similar matters; (17) risks associated with Comtech’s

obligations under its credit facility; (18) risks associated with

the outbreak and global spread of the coronavirus (COVID-19)

pandemic; and (19) legislative, regulatory, technological,

political and economic developments, including changing business

conditions in the industries in which Comtech and Gilat operate and

the overall economy. as well as the financial performance and

expectations of Comtech’s and Gilat’s existing and prospective

customers.

The foregoing list of factors is not exclusive

and you should not place undue reliance on any forward-looking

statement. All forward-looking statements contained herein are made

only as of the date of the date hereof and, except as required by

law, Gilat does not undertake any obligation to update publicly any

of these forward-looking statements to reflect events or

circumstances that may arise after the date hereof.

For additional information regarding these and

other risks and uncertainties associated with Gilat's business and

the pending acquisition of Gilat by Comtech, reference is made to

Gilat's reports filed from time to time with the Securities and

Exchange Commission.

Contact:Gilat Satellite NetworksDoreet Oren,

Director Corporate CommunicationsDoreetO@gilat.com

| GILAT

SATELLITE NETWORKS

LTD. |

|

| CONSOLIDATED

STATEMENTS OF

OPERATIONS |

|

| U.S. dollars

in thousands (except share and per share

data) |

|

| |

|

|

|

Six

months ended |

|

Three

months ended |

| |

|

|

|

June, 30 |

|

June, 30 |

|

|

|

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

|

| |

|

|

|

Unaudited |

|

Unaudited |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

$ |

85,988 |

|

|

$ |

121,794 |

|

|

$ |

38,315 |

|

|

$ |

59,685 |

|

|

|

Cost of revenues |

|

|

|

67,514 |

|

|

|

76,239 |

|

|

|

28,727 |

|

|

|

37,700 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

18,474 |

|

|

|

45,555 |

|

|

|

9,588 |

|

|

|

21,985 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

|

13,773 |

|

|

|

16,492 |

|

|

|

6,139 |

|

|

|

7,635 |

|

|

|

Less - grants |

|

|

|

472 |

|

|

|

1,094 |

|

|

|

200 |

|

|

|

539 |

|

|

|

Research and development expenses, net |

|

|

13,301 |

|

|

|

15,398 |

|

|

|

5,939 |

|

|

|

7,096 |

|

|

|

Selling and marketing expenses |

|

|

8,650 |

|

|

|

11,288 |

|

|

|

3,584 |

|

|

|

5,417 |

|

|

|

General and administrative expenses (*) |

|

|

7,791 |

|

|

|

9,527 |

|

|

|

2,973 |

|

|

|

4,585 |

|

|

|

Merger and acquisition costs |

|

|

2,951 |

|

|

|

- |

|

|

|

546 |

|

|

|

- |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

32,693 |

|

|

|

36,213 |

|

|

|

13,042 |

|

|

|

17,098 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

|

(14,219 |

) |

|

|

9,342 |

|

|

|

(3,454 |

) |

|

|

4,887 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Financial expenses, net |

|

|

|

(1,429 |

) |

|

|

(1,400 |

) |

|

|

(457 |

) |

|

|

(579 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before taxes on income |

|

|

(15,648 |

) |

|

|

7,942 |

|

|

|

(3,911 |

) |

|

|

4,308 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Taxes on income |

|

|

|

332 |

|

|

|

1,713 |

|

|

|

314 |

|

|

|

903 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

|

$ |

(15,980 |

) |

|

$ |

6,229 |

|

|

$ |

(4,225 |

) |

|

$ |

3,405 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted earnings (loss) per share |

|

$ |

(0.29 |

) |

|

$ |

0.11 |

|

|

$ |

(0.08 |

) |

|

$ |

0.06 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares used in |

|

|

|

|

|

|

|

|

| |

computing earnings (loss) per share |

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

|

55,499,300 |

|

|

|

55,262,453 |

|

|

|

55,505,342 |

|

|

|

55,327,318 |

|

|

| |

Diluted |

|

|

|

55,499,300 |

|

|

|

56,014,927 |

|

|

|

55,505,342 |

|

|

|

56,070,351 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

(*) Including restructuring cost |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| GILAT

SATELLITE NETWORKS LTD. |

|

| RECONCILIATION

BETWEEN GAAP AND NON-GAAP STATEMENTS OF OPERATIONS |

|

| FOR

COMPARATIVE PURPOSES |

|

| U.S. dollars

in thousands (except share and per share data) |

|

| |

|

Three months

ended |

|

Three months

ended |

|

| |

|

June 30, 2020 |

|

June 30, 2019 |

|

| |

|

GAAP |

|

Adjustments (1) |

|

Non-GAAP |

|

GAAP |

|

Adjustments (1) |

|

Non-GAAP |

|

| |

|

Unaudited |

|

Unaudited |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

$ |

9,588 |

|

|

|

54 |

|

|

$ |

9,642 |

|

|

$ |

21,985 |

|

|

312 |

|

|

$ |

22,297 |

|

|

Operating expenses |

|

13,042 |

|

|

|

(831 |

) |

|

|

12,211 |

|

|

|

17,098 |

|

|

(1,077 |

) |

|

|

16,021 |

|

|

Operating income (loss) |

|

(3,454 |

) |

|

|

885 |

|

|

|

(2,569 |

) |

|

|

4,887 |

|

|

1,389 |

|

|

|

6,276 |

|

|

Income (loss) before taxes on income |

|

(3,911 |

) |

|

|

885 |

|

|

|

(3,026 |

) |

|

|

4,308 |

|

|

1,389 |

|

|

|

5,697 |

|

|

Net income (loss) |

|

(4,225 |

) |

|

|

885 |

|

|

|

(3,340 |

) |

|

|

3,405 |

|

|

1,389 |

|

|

|

4,794 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share (basic and diluted) |

$ |

(0.08 |

) |

|

$ |

0.02 |

|

|

$ |

(0.06 |

) |

|

$ |

0.06 |

|

$ |

0.03 |

|

|

$ |

0.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares used in |

|

|

|

|

|

|

|

|

|

|

|

|

|

computing earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

55,505,342 |

|

|

|

|

|

55,505,342 |

|

|

|

55,327,318 |

|

|

|

|

55,327,318 |

|

|

Diluted |

|

|

55,505,342 |

|

|

|

|

|

55,505,342 |

|

|

|

56,070,351 |

|

|

|

|

56,218,672 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Adjustments reflect the effect of non-cash stock-based

compensation as per ASC 718, amortization of intangible assets

related to shares acquisition transactions, merger and

acquisition costs, trade secrets and other litigation

expenses and restructuring and re-organization costs. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months

ended |

|

Three months

ended |

|

| |

|

June 30,

2020 |

|

June 30,

2019 |

|

| |

|

|

|

Unaudited |

|

|

|

|

|

Unaudited |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income (loss) |

|

|

$ |

(4,225 |

) |

|

|

|

|

|

$ |

3,405 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash stock-based compensation expenses |

|

|

|

49 |

|

|

|

|

|

|

|

49 |

|

|

|

|

|

Amortization of intangible assets related to acquisition

transactions |

|

|

|

5 |

|

|

|

|

|

|

|

234 |

|

|

|

|

|

Restructuring and re-organization costs |

|

|

|

- |

|

|

|

|

|

|

|

29 |

|

|

|

|

| |

|

|

|

|

54 |

|

|

|

|

|

|

|

312 |

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash stock-based compensation expenses |

|

|

|

235 |

|

|

|

|

|

|

|

373 |

|

|

|

|

|

Amortization of intangible assets related to acquisition

transactions |

|

|

|

50 |

|

|

|

|

|

|

|

49 |

|

|

|

|

|

Trade secrets and other litigation expenses |

|

|

|

- |

|

|

|

|

|

|

|

100 |

|

|

|

|

|

Merger and acquisition costs |

|

|

|

546 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

Restructuring and re-organization costs |

|

|

|

- |

|

|

|

|

|

|

|

555 |

|

|

|

|

| |

|

|

|

|

831 |

|

|

|

|

|

|

|

1,077 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income (loss) |

|

|

$ |

(3,340 |

) |

|

|

|

|

|

$ |

4,794 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| GILAT

SATELLITE NETWORKS

LTD. |

|

| RECONCILIATION

BETWEEN GAAP AND NON-GAAP STATEMENTS OF OPERATIONS |

|

| FOR

COMPARATIVE PURPOSES

|

|

| U.S. dollars

in thousands (except share and per share

data) |

|

| |

|

Six months

ended |

|

Six months

ended |

|

| |

|

June 30, 2020 |

|

June 30, 2019 |

|

| |

|

GAAP |

|

Adjustments (1) |

|

Non-GAAP |

|

GAAP |

|

Adjustments (1) |

|

Non-GAAP |

|

| |

|

Unaudited |

|

Unaudited |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

$ |

18,474 |

|

|

|

116 |

|

|

$ |

18,590 |

|

|

$ |

45,555 |

|

|

638 |

|

|

$ |

46,193 |

|

|

Operating expenses |

|

32,693 |

|

|

|

(3,937 |

) |

|

|

28,756 |

|

|

|

36,213 |

|

|

(1,906 |

) |

|

|

34,307 |

|

|

Operating income (loss) |

|

(14,219 |

) |

|

|

4,053 |

|

|

|

(10,166 |

) |

|

|

9,342 |

|

|

2,544 |

|

|

|

11,886 |

|

|

Income (loss) before taxes on income |

|

(15,648 |

) |

|

|

4,053 |

|

|

|

(11,595 |

) |

|

|

7,942 |

|

|

2,544 |

|

|

|

10,486 |

|

|

Net income (loss) |

|

(15,980 |

) |

|

|

4,053 |

|

|

|

(11,927 |

) |

|

|

6,229 |

|

|

2,544 |

|

|

|

8,773 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share (basic and diluted) |

$ |

(0.29 |

) |

|

$ |

0.08 |

|

|

$ |

(0.21 |

) |

|

$ |

0.11 |

|

$ |

0.05 |

|

|

$ |

0.16 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares used in |

|

|

|

|

|

|

|

|

|

|

|

|

|

computing earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

55,499,300 |

|

|

|

|

|

55,499,300 |

|

|

|

55,262,453 |

|

|

|

|

55,262,453 |

|

|

Diluted |

|

|

55,499,300 |

|

|

|

|

|

55,499,300 |

|

|

|

56,014,927 |

|

|

|

|

56,180,698 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Adjustments reflect the effect of non-cash stock-based

compensation as per ASC 718, amortization of intangible assets

related to shares acquisition transactions, merger and

acquisition costs, trade secrets and other litigation

expenses and restructuring and re-organization costs. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six months

ended |

|

Six months

ended |

|

| |

|

June 30,

2020 |

|

June 30,

2019 |

|

| |

|

|

|

Unaudited |

|

|

|

|

|

Unaudited |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income (loss) |

|

|

$ |

(15,980 |

) |

|

|

|

|

|

$ |

6,229 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash stock-based compensation expenses |

|

|

|

106 |

|

|

|

|

|

|

|

143 |

|

|

|

|

|

Amortization of intangible assets related to acquisition

transactions |

|

|

|

10 |

|

|

|

|

|

|

|

466 |

|

|

|

|

|

Restructuring and re-organization costs |

|

|

|

- |

|

|

|

|

|

|

|

29 |

|

|

|

|

| |

|

|

|

|

116 |

|

|

|

|

|

|

|

638 |

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash stock-based compensation expenses |

|

|

|

601 |

|

|

|

|

|

|

|

1,150 |

|

|

|

|

|

Amortization of intangible assets related to acquisition

transactions |

|

|

|

101 |

|

|

|

|

|

|

|

101 |

|

|

|

|

|

Trade secrets and other litigation expenses |

|

|

|

11 |

|

|

|

|

|

|

|

100 |

|

|

|

|

|

Merger and acquisition costs |

|

|

|

2,951 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

Restructuring and re-organization costs |

|

|

|

273 |

|

|

|

|

|

|

|

555 |

|

|

|

|

| |

|

|

|

|

3,937 |

|

|

|

|

|

|

|

1,906 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income (loss) |

|

|

$ |

(11,927 |

) |

|

|

|

|

|

$ |

8,773 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| GILAT

SATELLITE NETWORKS

LTD. |

|

| SUPPLEMENTAL

INFORMATION |

|

| U.S. dollars

in

thousands |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Six

months ended |

|

Three

months ended |

| |

|

|

|

|

|

|

June 30, |

|

June 30, |

|

| |

|

|

|

|

|

|

|

2020 |

|

|

|

2019 |

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

|

|

Unaudited |

|

Unaudited |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating income (loss) |

|

|

|

|

$ |

(14,219 |

) |

|

$ |

9,342 |

|

$ |

(3,454 |

) |

|

$ |

4,887 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-cash

stock-based compensation expenses |

|

|

|

|

|

|

|

707 |

|

|

|

1,293 |

|

|

284 |

|

|

|

422 |

|

|

Trade secrets and other litigation expenses |

|

|

|

|

11 |

|

|

|

100 |

|

|

- |

|

|

|

100 |

|

|

Restructuring and re-organization costs |

|

|

|

|

273 |

|

|

|

584 |

|

|

- |

|

|

|

584 |

|

|

Merger and acquisition costs |

|

|

|

|

|

2,951 |

|

|

|

- |

|

|

546 |

|

|

|

- |

|

|

Depreciation and amortization (*) |

|

|

|

|

5,382 |

|

|

|

5,786 |

|

|

2,718 |

|

|

|

2,909 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

$ |

(4,895 |

) |

|

$ |

17,105 |

|

$ |

94 |

|

|

$ |

8,902 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) Including amortization of lease incentive |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT REVENUE: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Six

months ended |

|

Three

months ended |

|

| |

|

|

|

|

|

|

June 30, |

|

June 30, |

|

| |

|

|

|

|

|

|

|

2020 |

|

|

|

2019 |

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

|

|

Unaudited |

|

Unaudited |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Networks |

|

|

|

|

|

$ |

44,790 |

|

|

$ |

66,836 |

|

$ |

21,779 |

|

|

$ |

30,408 |

|

|

Mobility Solutions |

|

|

|

|

|

33,207 |

|

|

|

43,499 |

|

|

14,006 |

|

|

|

22,587 |

|

|

Terrestrial Infrastructure Projects |

|

|

|

|

7,991 |

|

|

|

11,459 |

|

|

2,530 |

|

|

|

6,690 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

|

|

|

|

$ |

85,988 |

|

|

$ |

121,794 |

|

$ |

38,315 |

|

|

$ |

59,685 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GILAT SATELLITE NETWORKS

LTD. |

|

|

CONSOLIDATED BALANCE

SHEETS |

|

|

U.S. dollars in

thousands |

|

| |

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

|

|

Unaudited |

|

Audited |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

59,601 |

|

|

$ |

74,778 |

|

|

|

Restricted cash |

|

|

25,579 |

|

|

|

27,067 |

|

|

|

Trade receivables, net |

|

|

28,560 |

|

|

|

47,731 |

|

|

|

Contract assets |

|

|

32,060 |

|

|

|

23,698 |

|

|

|

Inventories |

|

|

32,489 |

|

|

|

27,203 |

|

|

|

Other current assets |

|

|

15,581 |

|

|

|

23,007 |

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

193,870 |

|

|

|

223,484 |

|

|

|

|

|

|

|

|

|

|

LONG-TERM ASSETS: |

|

|

|

|

|

|

Long-term restricted cash |

|

|

117 |

|

|

|

124 |

|

|

|

Severance pay funds |

|

|

6,425 |

|

|

|

6,831 |

|

|

|

Deferred taxes |

|

|

18,291 |

|

|

|

18,455 |

|

|

|

Operating lease right-of-use assets |

|

|

6,353 |

|

|

|

5,211 |

|

|

|

Other long term receivables |

|

|

9,699 |

|

|

|

10,156 |

|

|

|

|

|

|

|

|

|

|

Total long-term assets |

|

|

40,885 |

|

|

|

40,777 |

|

|

|

|

|

|

|

|

|

|

PROPERTY AND EQUIPMENT, NET |

|

|

78,781 |

|

|

|

82,584 |

|

|

| |

|

|

|

|

|

|

INTANGIBLE ASSETS, NET |

|

|

1,302 |

|

|

|

1,523 |

|

|

| |

|

|

|

|

|

|

GOODWILL |

|

|

43,468 |

|

|

|

43,468 |

|

|

| |

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

358,306 |

|

|

$ |

391,836 |

|

|

| |

|

|

|

|

|

|

GILAT SATELLITE NETWORKS

LTD. |

|

|

CONSOLIDATED BALANCE SHEETS

(Cont.) |

|

|

U.S. dollars in

thousands |

|

| |

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

|

| |

|

|

2020 |

|

|

|

2019 |

|

|

| |

|

Unaudited |

|

Audited |

|

| |

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

| |

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

Current maturities of long-term loans |

|

$ |

4,000 |

|

|

$ |

4,096 |

|

|

|

Trade payables |

|

|

20,129 |

|

|

|

20,725 |

|

|

|

Accrued expenses |

|

|

48,194 |

|

|

|

54,676 |

|

|

|

Advances from customers and deferred revenues |

|

|

23,124 |

|

|

|

27,220 |

|

|

|

Operating lease liabilities |

|

|

2,145 |

|

|

|

1,977 |

|

|

|

Other current liabilities |

|

|

10,552 |

|

|

|

12,261 |

|

|

| |

|

|

|

|

|

|

Total current liabilities |

|

|

108,144 |

|

|

|

120,955 |

|

|

| |

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

Long-term loans, net of current maturities |

|

|

- |

|

|

|

4,000 |

|

|

|

Accrued severance pay |

|

|

6,681 |

|

|

|

7,061 |

|

|

|

Long-term advances from customers |

|

|

1,180 |

|

|

|

2,866 |

|

|

|

Operating lease liabilities |

|

|

4,153 |

|

|

|

3,258 |

|

|

|

Other long-term liabilities |

|

|

1,218 |

|

|

|

108 |

|

|

| |

|

|

|

|

|

|

Total long-term liabilities |

|

|

13,232 |

|

|

|

17,293 |

|

|

| |

|

|

|

|

|

|

SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

Share capital - ordinary shares of NIS 0.2 par value |

|

|

2,644 |

|

|

|

2,643 |

|

|

|

Additional paid-in capital |

|

|

928,054 |

|

|

|

927,348 |

|

|

|

Accumulated other comprehensive loss |

|

|

(6,433 |

) |

|

|

(5,048 |

) |

|

|

Accumulated deficit |

|

|

(687,335 |

) |

|

|

(671,355 |

) |

|

| |

|

|

|

|

|

|

Total shareholders' equity |

|

|

236,930 |

|

|

|

253,588 |

|

|

| |

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

358,306 |

|

|

$ |

391,836 |

|

|

| |

|

|

|

|

|

| GILAT

SATELLITE NETWORKS

LTD. |

|

| CONSOLIDATED

STATEMENTS OF CASH

FLOWS |

|

| U.S. dollars

in

thousands |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Six

months ended |

|

Three

months ended |

|

| |

|

|

June 30, |

|

June 30, |

|

| |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

|

| |

|

|

Unaudited |

|

Unaudited |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(15,980 |

) |

|

$ |

6,229 |

|

|

$ |

(4,225 |

) |

|

$ |

3,405 |

|

|

|

Adjustments required to reconcile net income to net

cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5,271 |

|

|

|

5,681 |

|

|

|

2,667 |

|

|

|

2,859 |

|

|

|

Capital loss from disposal of property and equipment |

|

|

23 |

|

|

|

- |

|

|

|

56 |

|

|

|

- |

|

|

|

Stock-based compensation of options |

|

|

707 |

|

|

|

1,293 |

|

|

|

284 |

|

|

|

422 |

|

|

|

Accrued severance pay, net |

|

|

26 |

|

|

|

382 |

|

|

|

(17 |

) |

|

|

97 |

|

|

|

Deferred income taxes, net |

|

|

140 |

|

|

|

1,385 |

|

|

|

(494 |

) |

|

|

702 |

|

|

|

Decrease (increase) in trade receivables, net |

|

|

18,364 |

|

|

|

2,506 |

|

|

|

4,757 |

|

|

|

(5,325 |

) |

|

|

Decrease (increase) in contract assets |

|

|

(8,362 |

) |

|

|

(232 |

) |

|

|

(3,511 |

) |

|

|

198 |

|

|

|

Decrease (increase) in other assets (including short-term,

long-term and deferred charges) |

|

|

6,710 |

|

|

|

(29 |

) |

|

|

5,037 |

|

|

|

50 |

|

|

|

Decrease (increase) in inventories |

|

|

(5,698 |

) |

|

|

(6,137 |

) |

|

|

937 |

|

|

|

(2,478 |

) |

|

|

Increase (decrease) in trade payables |

|

|

(510 |

) |

|

|

3,933 |

|

|

|

(2,885 |

) |

|

|

4,855 |

|

|

|

Decrease in accrued expenses |

|

|

(5,809 |

) |

|

|

(7,076 |

) |

|

|

(4,157 |

) |

|

|

(4,907 |

) |

|

|

Decrease in advance from customers |

|

|

(5,725 |

) |

|

|

(8,405 |

) |

|

|

(2,898 |

) |

|

|

(5,318 |

) |

|

|

Increase (decrease) in current and non current liabilities |

|

|

685 |

|

|

|

(1,950 |

) |

|

|

(2,126 |

) |

|

|

(2,813 |

) |

|

|

Net cash used in operating activities |

|

|

(10,158 |

) |

|

|

(2,420 |

) |

|

|

(6,575 |

) |

|

|

(8,253 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(1,879 |

) |

|

|

(3,587 |

) |

|

|

(928 |

) |

|

|

(1,573 |

) |

|

|

Net cash used in investing activities |

|

|

(1,879 |

) |

|

|

(3,587 |

) |

|

|

(928 |

) |

|

|

(1,573 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

Exercise of stock options |

|

|

- |

|

|

|

375 |

|

|

|

- |

|

|

|

37 |

|

|

|

Dividend payment |

|

|

- |

|

|

|

(24,864 |

) |

|

|

- |

|

|

|

(24,864 |

) |

|

|

Repayment of long-term loans |

|

|

(4,096 |

) |

|

|

(4,231 |

) |

|

|

- |

|

|

|

(108 |

) |

|

|

Net cash used in financing activities |

|

|

(4,096 |

) |

|

|

(28,720 |

) |

|

|

- |

|

|

|

(24,935 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash, cash equivalents

and restricted cash |

|

|

(539 |

) |

|

|

21 |

|

|

|

156 |

|

|

|

(76 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Decrease in cash, cash equivalents and restricted

cash |

|

|

(16,672 |

) |

|

|

(34,706 |

) |

|

|

(7,347 |

) |

|

|

(34,837 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash at the beginning

of the period |

|

|

101,969 |

|

|

|

104,204 |

|

|

|

92,644 |

|

|

|

104,335 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash at the end of

the period |

|

$ |

85,297 |

|

|

$ |

69,498 |

|

|

$ |

85,297 |

|

|

$ |

69,498 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

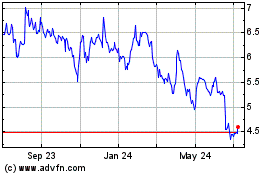

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Mar 2024 to Apr 2024

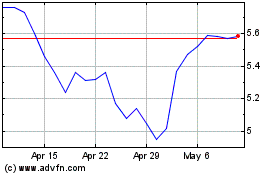

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Apr 2023 to Apr 2024