|

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Important Notice Regarding The Availability of Proxy Materials for the Hallador Energy Company Annual Meeting of Shareholders to be Held on October 9, 2020.

|

Dear Fellow Shareholders,

It is our pleasure to invite you to our 2020 Annual Meeting of Shareholders (our "Meeting" or "2020 Annual Meeting") to be held on October 9, 2020, at 10:00 a.m. Eastern Standard Time, at the Hilton Garden Inn, Terre Haute, 750 Wabash Avenue, Terre Haute, Indiana 47807. At the Meeting, we will ask our Shareholders to:

|

|

|

|

|

|

1.

|

Elect six directors named in the Proxy Statement to serve for a one-year term;

|

|

|

2.

|

Approve, on an advisory basis, the Named Executive Officers' compensation;

|

|

|

3.

|

Ratify the appointment of Plante & Moran, PLLC, as our independent registered public accounting firm for 2020;

|

|

|

4.

|

Transact such other business as may properly come before the Meeting.

|

Shareholders of record on the close of business on August 20, 2020 (the "Record Date") are entitled to vote at the Meeting and any postponement or adjournment thereof. We hope that you will attend the Meeting. In the event you cannot attend, we strongly urge you to vote your shares by following the instruction on the included Notice Card.

The Proxy Statement and Annual Report on Form 10-K are available at http://materials.proxyvote.com/40609P. At the close of business on August 20, 2020, there were 30,465,665 shares of our Common Stock, par value $.01, outstanding and entitled to vote.

Thank you for your continued interest and support.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

Brent K. Bilsland

|

|

|

Chairman of the Board, President and CEO

|

|

REVIEW THE PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS

|

|

|

|

|

|

Via The Internet

|

|

By Telephone

|

|

You may vote by Internet 24 hours a day through 11:59 p.m., Eastern Standard Time, on October 8, 2020, by following the instructions listed on the Notice Card.

|

|

You may vote by telephone 24 hours a day through 11:59 p.m., Eastern Standard Time, on October 8, 2020, by following the instructions listed on the Notice Card.

|

|

|

|

|

By Mail

|

|

In-Person

|

|

You can only vote by mail if you request and receive a paper copy of the proxy materials and proxy card. You may request proxy materials by following the instructions listed on the Notice Card. You may then vote by completing, signing, dating, and returning a proxy card.

|

|

Attend the Meeting in person. If you plan to attend the Annual Meeting, you will be required to present photo identification and verification of the number of shares held as of October 9, 2020, to gain access to the meeting.

|

|

|

|

Notice to Shareholders: Our 2020 Proxy Statement and Annual Report on Form 10-K for December 31, 2019, are available free of charge on our website at www.halladorenergy.com.

|

1183 East Canvasback Drive, Terre Haute, Indiana 47802

TABLE OF CONTENTS

|

HALLADOR ENERGY COMPANY

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD OCTOBER 9 2020

|

This Proxy Statement is furnished by the Board of Directors (the "Board") of Hallador Energy Company (the "Company," "Hallador," "we" or "us") to holders of our common stock in connection with the solicitation by the Board of proxies to be voted at the 2020 Annual Meeting of Shareholders (the "Meeting,")

GENERAL MEETING INFORMATION

Date and Location of Meeting

Our Meeting will be held on October 9, 2020, at 10:00 a.m. Eastern Time, at the Hilton Garden Inn Terre Haute, 750 Wabash Avenue, Terre Haute, Indiana 47807, or at such other time and place if the Meeting is postponed or adjourned. References in this Proxy Statement to the 2020 Annual Meeting also refer to any adjournments, postponements or changes in time or location of the Meeting, to the extent applicable.

Who can attend the Meeting?

We invite all Hallador shareholders as of the Record Date or their named representatives and members of their immediate family to the Meeting. We reserve the right to limit the number of representatives who may attend. Proof of ownership and identification is required to attend the Meeting. A recent brokerage statement or a letter from your bank or broker are examples of evidence of ownership. Cameras, recording devices, and other electronic devices are not allowed at the Meeting.

We ask that you RSVP to Hallador by October 1, 2020, via email to investorrelations@halladorenergy.com, or by phone to 812-299-2800.

What is the purpose of the Meeting?

At the Meeting, our Shareholders will act upon the matters outlined in the "Notice of Annual Meeting of Shareholders," which appears on the cover page of this Proxy Statement, including

|

|

|

|

|

|

1.

|

Elect six directors named in the Proxy Statement to serve for a one-year term;

|

|

|

2.

|

Approve, on an advisory basis, the Named Executive Officers' compensation;

|

|

|

3

|

Ratify the appointment of Plante & Moran, PLLC, as our independent registered public accounting firm for 2020;

|

|

|

4.

|

Transact such other business as may properly come before the Meeting.

|

DELIVERY OF THE PROXY MATERIALS

Mailing Date

On or about August 28, 2020, we mailed a Notice of Internet Availability of Proxy Materials (the "Notice of Availability") to our shareholders containing instructions on how to access the proxy materials and submit your proxy online. We have made these proxy materials available to you over the Internet or, upon your request, have delivered paper copies of these materials to you by mail, in connection with the solicitation of proxies by the Board for the Meeting.

Shareholders Sharing an Address

Registered Shareholders—Each registered shareholder (meaning you own shares in your name on the books of our transfer agent, Computershare Trust Company, N.A.) will receive one Notice of Availability, regardless of whether you have the same address as another registered shareholder.

Street Name Shareholders—If you own shares in "street name" (that is, in the name of a bank, broker or another holder of record), applicable rules permit brokerage firms and our company, under certain circumstances, to send one Notice of Availability to multiple shareholders who share the same address. This practice is known as "householding." Householding saves printing and postage costs by reducing duplicate mailings. If you hold your shares through a broker, you may have consented to reduce the number of copies of materials delivered to your address. If you wish to revoke a "householding" consent you previously provided to a broker, you must contact that broker to revoke your consent. If your household is receiving multiple copies of the Notice of Availability and you wish to request delivery of a single copy, you should contact your broker directly.

Table of Contents

VOTING INFORMATION

Who is entitled to vote?

Only shareholders of record at the close of business on August 20, 2020 (the "Record Date") are entitled to receive notice of the Meeting and to vote the shares of common stock of the Company ("Common Stock"). The holders of the Common Stock may vote on all matters presented at the Meeting and will vote together as a class. Each outstanding share of Common Stock entitles the holder to one vote. As of the Record Date, there were 30,465,665 shares of Common Stock outstanding.

As of the Record Date, the Company's officers and directors are the record and beneficial owners of a total of 9,252,748 shares (30.4%) of the Company's outstanding Common Stock. Management intends to vote all of its shares in the manner recommended by the Board for each matter to be considered by the shareholders.

What constitutes a quorum?

One-third of the outstanding common shares entitled to vote, represented in person or by proxy, constitutes a quorum for the Meeting.

How do I vote?

Shareholders of record may vote using one of the following four methods:

|

|

●

|

over the Internet, which you are encouraged to do so if you have access to the Internet;

|

|

|

●

|

by completing, signing and returning the included proxy card, for those who requested to receive printed proxy materials in the mail; or

|

|

|

●

|

by attending the Annual Meeting and voting in person.

|

The Notice provides instructions on how to access your proxy, which contains instructions on how to vote via the Internet or by telephone. For shareholders who request to receive a paper proxy card in the mail, instructions for voting via the Internet, by telephone, or by mail are set forth on the proxy card.

If you hold shares in street name, the organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. The shareholder of record will provide you with instructions on how to vote your shares. Internet and telephone voting will be offered to shareholders owning shares through most brokerage firms and banks. Additionally, if you would like to vote in person at the Annual Meeting, contact the brokerage firm, bank or other nominee who holds your shares to obtain a proxy from them and bring it with you to the Annual Meeting. You will not be able to vote at the Annual Meeting unless you have a proxy from your brokerage firm, bank or other nominee.

You may read, print and download our 2019 Form 10-K, 2019 Proxy Statement and Proxy Card at http://materials.proxyvote.com/40609P. On an ongoing basis, shareholders may request to receive proxy materials in printed form by mail or electronically by email.

To ensure that your vote is counted at the Meeting, regardless of whether you plan to attend, you should vote by using the Internet or telephone voting options on your Proxy Card or by mailing in your Proxy Card. If you return an executed Proxy Card without marking your instructions, your executed Proxy Card will be voted by the recommendations of the Board. In connection therewith, the Board has designated Brent K. Bilsland, Chairman, President and CEO, and Lawrence D. Martin, CFO, as proxies. If you indicate a choice concerning any matter to be acted upon on your proxy card or voting instruction card, your shares will be voted per your instructions.

Information for Beneficial Owners

If you hold your Hallador shares in a brokerage, bank, or another institutional account, you are considered the beneficial owner of those shares, but not the record holder, meaning that you vote by providing instructions to your broker rather than directly to the Company. If you do not provide voting instructions to your broker, then under applicable rules, your broker may only exercise discretionary authority to vote on routine matters. Of the items described in this proxy statement, it is our understanding that routine matters consist of Proposal 3. By contrast, a broker may not exercise discretionary authority to vote on non-routine matters. This lack of discretionary authority is called a "broker non-vote." Of the items described in this proxy statement, it is our understanding that non-routine matters consist of Proposals 1 and 2. Broker non-votes will be treated as shares present for quorum purposes, but not considered entitled to vote on that matter.

If you would like to vote your shares at the Meeting, you must obtain a proxy from your financial institution and bring it with you to hand in with your ballot.

What if I do not specify how my shares are to be voted?

|

|

●

|

FOR Proposal No. 1 – "Election of Directors for a one-year term" if you submit a proxy but do not indicate any voting instructions, your shares will be voted per the recommendations of Board

|

|

|

●

|

FOR Proposal No. 2 – "Advisory Vote Approving Named Executive Officers' Compensation," if you submit a proxy but do not indicate any voting instructions, your shares will be counted as a vote approving the compensation of the Company's Named Executive Officers.

|

|

|

●

|

FOR Proposal No. 3 – "Ratify the appointment of Plante & Moran, PLLC, as our independent registered public accounting firm for 2020."

|

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your Proxy Card, you may change your vote at any time before the proxy is exercised by filing with the Secretary of the Company at our address above either a notice of revocation or a duly executed proxy bearing a later date. If you attend the Meeting in person, you may revoke your proxy and vote in person.

What if other matters come up at the Meeting?

The matters described in this Proxy Statement are the only matters we know to be voted on at the Meeting. If other matters are properly presented at the Meeting, the proxy holders will vote your shares as they see fit.

Can I vote in person at the Meeting rather than by completing the Proxy Card?

Although we encourage you to complete and return the Proxy Card to ensure that your vote is counted, you can attend the Meeting and vote your shares in person.

How are votes counted?

We will hold the Meeting if holders of one-third of the total shares of Common Stock entitled to vote either sign and return their Proxy Cards or attend the Meeting. If you sign and return your Proxy Card, your shares will be counted to determine whether the Company has a quorum even if you abstain or fail to vote on any of the proposals listed on the Proxy Card.

Where can I find the voting results of the Annual Meeting?

We will announce the preliminary voting results at the Meeting. The final voting results will be reported in a Current Report on Form 8-K, which we are required to file with the SEC within four business days following the Meeting.

Who pays for this proxy solicitation?

We will bear all of the solicitation costs and will supply copies of the solicitation materials to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. Also, we may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. In addition to sending you these materials, some of the Company's employees may contact you by telephone, by mail, or in person. None of these employees will receive any extra compensation for doing this.

What vote is required to approve each item?

Election of Directors for a one-year term. At the Meeting, six director-nominees are standing for election to the Board. Each director-nominee will serve on the Board until his successor is duly elected and qualified. Each director-nominee will be elected if he receives approval from a majority of the votes represented in person or by proxy at the Meeting. A properly executed proxy marked "Withheld" for the election of any director-nominee will count as an "Against" vote for such director-nominee indicated. Your broker may not vote your shares on this proposal unless you give voting instructions. Broker non-votes do not affect the vote.

Say-on-Pay. At the Meeting, we are asking shareholders to vote to approve on an advisory basis on the compensation paid to the Named Executive Officers. A majority of the shares of Common Stock represented at the Meeting and entitled to vote on this proposal must vote FOR the proposal to approve it. A properly executed proxy marked "Abstain" for the say-on-pay will count as a "Against" vote on this proposal. Your broker may not vote your shares on this proposal unless you give voting instructions. Broker non-votes do not affect the vote. Your vote will not directly change or otherwise limit or enhance any existing compensation or award arrangement of any of our named executive officers, but the outcome of the say-on-pay vote will be taken into account by the Compensation Committee when considering future compensation arrangements.

Ratification of Auditors. At the Meeting, we are asking shareholders to vote to ratify the appointment of Plante & Moran, PLLC, as our independent registered public accounting firm for 2020. A majority of the shares of Common Stock represented at the Meeting and entitled to vote on this proposal must vote FOR the proposal to approve it. A properly executed proxy marked "Abstain" for the ratification of auditors will count as a "Against" vote on this proposal. Your broker may vote your shares on this proposal unless you give voting instructions. Broker non-votes do not affect the vote; however, this proposal is considered a routine matter, and therefore no broker non-votes are expected to exist in connection with the proposal.

Other Matters. For most other matters that properly come before the Meeting, the affirmative vote of a majority of shares of Common Stock, present in person or represented by proxy and voted at the Meeting, will be required.

BOARD OF DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Our Management Team

Hallador is led by Brent K. Bilsland, our Chairman, President, and Chief Executive Officer, whose biography appears below under "Board of Directors and Nominees," and Mr. Lawrence D. Martin, our Chief Financial Officer, whose biography appears under "Named Executive Officer."

PROPOSAL NO. 1: ELECTION OF DIRECTORS FOR A ONE-YEAR TERM.

|

|

The Board recommends that you vote FOR all of the Nominees.

|

At our 2019 Annual Meeting, our shareholders elected a Board of six directors.

Our current directors are listed below and nominated for re-election at the Meeting. Each of the directors elected at the Meeting will serve a one-year term expiring at the next annual meeting of shareholders or until their successors are elected and qualified, or until he resigns or is removed. Each nominee agreed to be named in this proxy statement and to serve if elected.

Under Hallador's Bylaws, in an uncontested election, directors are elected by the approval of a majority of the shares present and entitled to vote. Your broker may not vote your shares on this proposal unless you give voting instructions. A withheld vote on any nominee will have the effect of an "against" vote. However, broker non-votes do not affect the vote. Any director who receives a greater number of votes "against" his or her election than votes "for" in an uncontested election must tender his or her resignation.

We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected. However, if any nominee should become unable for any reason or unwilling to serve, the proxies may be voted for another person nominated as a substitute by the Board, or the Board may reduce the number of Directors.

Board of Directors and Nominees

Below is information about each nominee, including biographical data for at least the past five years and an assessment of the skills and experience of each nominee.

|

Name

|

|

|

|

Position(s) and year appointed

|

|

Brent K. Bilsland

|

|

47

|

|

Chairman (2018), CEO (2014), President and Director (2009)

|

|

David C. Hardie

|

|

69

|

|

Director (1989)

|

|

Steven R. Hardie

|

|

66

|

|

Director (1994)

|

|

Bryan H. Lawrence

|

|

78

|

|

Director (1995)

|

|

David J. Lubar

|

|

65

|

|

Director (2018)

|

|

Charles R. Wesley, IV

|

|

41

|

|

Director (2018)

|

BRENT K. BILSLAND, Chairman of the Board, President, and CEO, has served on the Board since 2009. Mr. Bilsland was elected Chairman of the Board in March 2018, appointed CEO in January 2014, and has been a director and our President since 2009. He was President of Sunrise Coal, LLC, our primary operating subsidiary, from July 2006 through November 2017, and Vice President of Knapper Corporation, a private corporation, from 1998 to 2004. Mr. Bilsland is a graduate of Butler University located in Indianapolis, Indiana.

Mr. Bilsland brings broad industry experience and significant operational capabilities to our Company. He has an intimate understanding of our business and its operations that benefit us. In 2015 and 2016, Mr. Bilsland served as the Chairman of the Indiana Coal Council. Mr. Bilsland's investment in our Common Stock, combined with his wife and children, is 4.1% (1,239,483 shares). Additionally, he has 137,500 RSUs that vest equally over the next two years on December 16, 2020, and December 16, 2021.

DAVID C. HARDIE, a Director, has served on the Board since 1989. He serves as Chair of our Audit Committee. From July 1989 through January 2014, Mr. Hardie was our Chairman of the Board. He is the Chairman of the Board and Chief Executive Officer of Hallador Investment Advisors Inc., which manages Hallador Cash Fund LP, Hallador Alternative Assets Fund, Moka Fund, and Hallador Balanced Fund. Mr. Hardie is also the Managing Member of a group of three restaurants in Sacramento, California. He serves as a director and partner of other private entities that are owned by members of his family and also serves as a director of Parasol Tahoe Community Foundation. Mr. Hardie is a graduate of California Polytechnic University, San Luis Obispo. He also attended the Owner/President Management program at the Harvard Business School.

Mr. David C. Hardie, who controls 6.0% of our Common Stock, has been a board member for the last 31 years. His significant broad experience, as well as an intimate knowledge of our Company, is a tremendous benefit to us in planning and executing our corporate strategy.

STEVEN R. HARDIE, a Director, has served on the Board since 1994. He is the manager of NextG LLC, a family investment partnership formed in 2016. For the past 34 years, he has been a private investor and serves as director and partner of other private entities owned by members of his family.

Mr. Steven R. Hardie, who controls 5.2% of our Common Stock, has been a board member for the last 26 years. His experience and intimate knowledge of our Company adds significant value to the Board. As with most of our other board members, he too has a significant indirect monetary investment in our Company and accordingly has a vested interest in our success.

BRYAN H. LAWRENCE, a Director, has served on the Board since 1995. Mr. Lawrence is a founder and senior manager of Yorktown Partners LLC, the manager of the Yorktown group of investment partnerships, which make investments in companies engaged in the energy industry. The Yorktown partnerships were formerly affiliated with the investment firm of Dillon, Read & Co. Inc., where Mr. Lawrence had been employed since 1966, serving as a Managing Director until the merger of Dillon Read with SBC Warburg in September 1997. Mr. Lawrence also serves as a director of Carbon Natural Gas Company, Ramaco Resources, Inc., and Star Group, LP (each a United States publicly-traded company) and certain non-public companies in the energy industry in which Yorktown partnerships hold equity interests. Mr. Lawrence is a graduate of Hamilton College and also has an MBA from Columbia University.

Mr. Lawrence, who controls 4.8% of our Common Stock, has been a board member for the last 25 years. He sits on numerous boards for both private and public companies that are involved in the energy business. His experience with us and in other energy companies, gives us a significant benefit. As with most of our other board members, he too has a significant indirect monetary investment in our Company and accordingly has a vested interest in our success.

DAVID J. LUBAR, a Director, has served on the Board since August 2018. Mr. David Lubar is President and CEO of Lubar & Co, a private investment company. He began his career in 1977 at Norwest Bank (n/k/a Wells Fargo Bank) in Minneapolis, where he spent six years in commercial and correspondent banking. Mr. Lubar joined Lubar & Co. in 1983 and has served as a lead investor to over 20 companies in a wide range of industries and various stages of development. He currently serves as a director of each of the Lubar Companies as well as Northwestern Mutual Life Insurance Co., BMO Financial Corp., Milwaukee Brewers Baseball Team, and several other private companies. He also serves in many community leadership positions throughout the Milwaukee area. Mr. Lubar has a Bachelor of Arts degree from Bowdoin College and a Master of Business Administration from the University of Minnesota.

Mr. Lubar controls 9.2% of our Common Stock and has extensive public and private company board expertise in the areas of finance and private equity. His experience provides him insight from the view of an investor and board member.

CHARLES R WESLEY, IV, a Director, has served on the Board since August 2018. Mr. Wesley has served as President of Thoroughbred Resources LP (a Yorktown Partners affiliate) since 2014 and CEO since 2016. Mr. Wesley served as Chief Planning and Commercial Officer of Ramaco Resources and, before joining Thoroughbred, Senior Director of Finance and Senior Counsel at CenturyLink (formerly Level 3 Communications), where he was also responsible for the operation and ultimate disposition of the company's coal mining operations. Prior to CenturyLink, he worked at the law firms of Akin, Gump, Strauss, Hauer & Feld, and Strasburger & Price, focusing on international energy transactions. He began his career with a coal company as a mining engineer and is an active investor in natural resources and financial technology. Mr. Wesley is a board member across multiple industries and philanthropic organizations. Mr. Wesley holds a Juris Doctorate from the University of Kentucky College of Law and a Bachelor of Science in Mining Engineering from Virginia Polytechnic Institute.

Mr. Wesley brings a wealth of invaluable coal mining industry knowledge and experience to the Board, along with public company experience. His vast knowledge of the industry assists the Board in driving future and potential growth and expansion opportunities.

Named Executive Officer

LAWRENCE D. MARTIN, CPA, age 54, was appointed Executive Vice President of Hallador in March 2019 and has been our Chief Financial Officer since 2016. Since 2017, Mr. Martin has also served as our President of Sunrise Coal. Prior to the role he was Sunrise’s Chief Financial Officer from 2007-2017. Before joining Sunrise Coal, he worked 19 years for CliftonLarsonAllen, LLP, becoming a Senior Manager before his employment with Sunrise Coal. Mr. Martin is a graduate of Indiana State University and received his Bachelor of Science degree in Accounting in 1988.

Board and its Committees

Chairman

Our Board does not have a fixed policy regarding the roles for the Chairman of the Board ("Chairman") and CEO on whether they should be served independently or jointly. Currently, Mr. Bilsland holds both positions. We see the dual role as a bridge between management and the Board. We believe that a Chairman who understands the day-to-day business and the important issues to be addressed by the Board is currently in the Company and the shareholders' best interest. Our Board members have a significant monetary stake in the Company and believe they can provide oversight to the combined role.

Due to the limited size of our Board, we do not have a Lead Independent Director.

Independent and Non-Management Directors

After considering the standards for independence adopted by Nasdaq, the SEC, and various other factors as described herein, the Board has determined that all of our current directors, other than Mr. Bilsland, are independent. Mr. David C. Hardie and Mr. Charles R. Wesley, IV are the only non-employee directors that receive compensation from us.

Board Meetings and Attendance

During 2019, the Board held six meetings, and each of the committees held the number of meetings included in the description of the committees set forth below. Each board member up for re-election attended at least 75% of the Board and Committee meetings, which he served on during the year.

We do not have a specific policy regarding attendance at the annual shareholders meeting. All directors, however, are encouraged to attend if available. Five of six directors participated at the 2019 Annual Meeting of Shareholders, one in person and four via conference call.

Executive Sessions of Non-Management Directors

To promote open discussions, our non-management directors meet in executive sessions regularly after scheduled board meetings.

Committees

Our Board has three separately designated standing committees: an Audit Committee, a Compensation Committee, and a Nominating Committee. The committee charters are available on our website, www.halladorenergy.com.

The membership and purposes of each of the committees are described below.

|

Audit Committee

|

|

|

David C. Hardie - Chair and Financial Expert

Bryan H. Lawrence

David J. Lubar

|

All of our Audit Committee members are "independent" as defined by the Nasdaq listing standards, including those standards applicable specifically to audit committee members. No member of the Audit Committee has served as one of our officers or employees at any time. All members of the Audit Committee are "non-employee directors" as defined in SEC rules. In addition to regularly scheduled meetings, the committee meets separately in executive sessions with representatives of our independent auditor. The Audit Committee approves the appointment and services of the independent auditor and reviews the general scope of the audit and audit-related services, matters relating to internal controls, and other matters related to accounting and reporting functions.

The Audit Committee assists the Board in fulfilling its oversight responsibilities concerning:

(i) The integrity of the financial reports and other financial information provided by us to the public or any governmental body;

(ii) our compliance with legal and regulatory requirements;

(iii) our systems of internal controls over financial reporting;

(iv) the qualifications and independence of our independent auditors;

(v) our auditing, accounting, and financial reporting processes generally; and

(vi) the performance of such other functions as the Board may assign from time to time.

To this end, the Audit Committee will maintain free and open communication with the Board, the independent auditors, and any other person responsible for our financial management. The Board also determined that Mr. David C. Hardie qualifies as an audit committee financial expert under the applicable SEC rules.

|

|

|

The Audit Committee met four times in 2019.

|

|

Compensation Committee

|

|

|

David J. Lubar - Chair

David C. Hardie

Steven R. Hardie

Bryan H. Lawrence

|

All of our Compensation Committee members are "independent" as defined by the Nasdaq listing standards, including those standards that apply specifically to compensation committee members. No member of the Compensation Committee has served as one of our officers or employees at any time. All members of the Compensation Committee are "non-employee directors." The purpose of our Compensation Committee is to:

(i) oversee our executive and director compensation;

(ii) oversee and administer our stock incentive plans;

|

|

|

The Compensation Committee did not meet in 2019, but actions were taken by unanimous written consent.

|

|

Nominating Committee

|

|

|

Charles R. Wesley, IV - Chair

David C. Hardie

Steven R. Hardie

Bryan H. Lawrence

David J. Lubar

|

All members of the Nominating Committee are "independent" as defined by the Nasdaq listing standards, including those standards that apply specifically to nominating committee members. No member of the Nominating Committee has served as one of our officers or employees at any time. All members of the Nominating Committee are "non-employee directors." The purpose of our Nominating Committee is to:

(i) assist our Board by identifying individuals qualified for election and re-election as Board members and to recommend to our Board, the director nominees for each annual meeting of shareholders, subject to the provisions of any shareholder or similar agreement binding on us;

(ii) recommend to the Board director nominees for each committee of the Board, subject to the provisions of any shareholder or similar agreement binding on us, and act on specific matters within its delegated authority, as determined by the Board from time to time.

|

|

|

The Nominating Committee met once in 2019.

|

Criteria for Director Nominations

General criteria for the nomination of director candidates include experience and successful track record, integrity, skills, ability to make analytical inquiries, understanding of our business environment, and willingness to devote adequate time to director duties, and diversity (although no formal policy exists, considered along with the aforementioned factors), all in the context of the perceived needs of the Board at that time. Stock ownership could also be a consideration.

Board of Directors Diversity

The Company seeks to maintain a Board comprised of talented and dedicated Directors with a diverse mix of expertise, experience, skills and backgrounds. The skills and backgrounds collectively represented on the Board should reflect the diverse nature of the business environment in which the Company operates. As new members of the Board are considered, diversity considerations should include - but not be limited to - business expertise, geography, age, gender and ethnicity.

The Company is committed to a merit-based system for Board composition within a diverse and inclusive culture which solicits multiple perspectives and views and is free of conscious or unconscious bias. When assessing Board composition or identifying suitable candidates for appointment to the Board, the Company will consider candidates on merit with due consideration to the benefits of diversity and the needs of the Board. The Board and its Nominating Committee are especially cognizant of the benefits of gender and ethnic diversity and intend to nominate such a candidate to the board in the next twelve months.

Board Risk Oversight

Our Board has ultimate responsibility for general oversight of risk management processes. The Board receives regular reports from Mr. Bilsland on areas of risk we face. Our risk management processes are intended to identify, manage, and control risks so that they are appropriate considering our scope, operations, and business objectives. The full Board engages with the appropriate members of management to enable its members to understand and provide input and oversight of our risk identification, risk management, and risk mitigation strategies. The Audit Committee also meets without management present to, among other things, discuss our risk management culture and processes. In the event, a committee receives a report from a member of management regarding areas of risk, the Chairman of the relevant committee will report on the discussion to the full Board to the extent necessary or appropriate. This enables the Board to coordinate risk oversight, particularly concerning interrelated or cumulative risks that may involve multiple areas for which more than one committee has responsibility.

Certain Relationships and Related Party Transactions

Any transaction with a related person must be approved in advance by our Audit Committee. The Audit Committee approves only those related person transactions that are determined to be in, or not inconsistent with, the best interests of the Company and our Shareholders, taking into account all available facts and circumstances as the Audit Committee determines in good faith to be necessary. In reviewing and approving such transactions, the Audit Committee shall obtain or shall direct management to obtain on its behalf, all information that the Audit Committee believes to be relevant and important to a review of the transaction before its approval. The Audit Committee may adopt any further policies and procedures relating to the approval of related person transactions that it deems necessary or advisable from time to time.

Anti-Hedging and Anti-Pledging Policy

We maintain an insider trading policy that applies to our officers and directors that prohibits trading our securities when in possession of material non-public information. It prohibits the hedging of our securities, including short sales or purchases or sales of derivative securities based on our securities, and, unless our Audit Committee approves an exemption, the pledging of our securities. Since the adoption of our insider trading policy, the Audit Committee has not granted any such exemptions to the policy's general prohibition on pledging.

Ownership Policy

We have not adopted a formal stock ownership policy for our directors and executive officers, but through existing direct and indirect holdings plus the vesting of the RSUs, these individuals beneficially own a significant amount in our stock.

Code of Conduct

Our Board adopted the Company's Code of Conduct, which provides general statements of our expectations regarding ethical standards that we expect our directors, officers, and employees to adhere to while acting on our behalf. The Code of Conduct provides, among other things, that our directors, officers, and employees will: (i) comply with all laws, rules, and regulations applicable to us; (ii) avoid conflicts of interest; (iii) protect our assets and maintain our confidentiality; (iv) honestly and accurately maintain records and make required disclosures; and (v) promote ethical behavior and report violations of laws, rules, regulations or the Code of Conduct.

The Code of Conduct is available on our website, www.halladorenergy.com.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act and related regulations require our Section 16 officers and directors and persons who beneficially own more than 10% of our common stock to file with the SEC. We believe all of these reports were timely filed based upon our review of the reports filed with the SEC.

DIRECTOR AND EXECUTIVE COMPENSATION

Director Compensation

Only two of our directors receive compensation for their services on the Board.

|

Director Name

|

Position

|

|

2019 fees earned or

paid in cash

|

|

|

2018 fees earned or

paid in cash

|

|

|

David C. Hardie

|

Independent Director and Chairman of the Audit Committee

|

|

$

|

20,000

|

|

|

$

|

20,000

|

|

|

Charles R. Wesley, IV

|

Independent Director and Chairman of the Nominating Committee

|

|

$

|

50,000

|

|

|

$

|

50,000

|

|

Executive Compensation

The Company is a "smaller reporting company" (SRC) as defined by the Securities and Exchange Commission ("SEC"). SRC's are eligible to use scaled-down disclosures in their SEC filings and reports. For 2019 and 2020, the Company meets the definition of an SRC. One of the significant SRC benefits is a reduction in the amount of executive compensation disclosure, including deletion of the requirement to provide the compensation, discussion and analysis section in our annual proxy statement. Nevertheless, we are cognizant that our compensation disclosure provides important information to our shareholders and have elected to present a more limited executive compensation analysis.

Compensation Discussion and Analysis

Compensation of our named executive officers ("NEOs") is determined under our executive compensation plan, which is overseen by the compensation committee. Our Board controls 29.4% of Common Stock, and our Compensation Committee is comprised of four directors who together control 25.3 % of our shares outstanding. The Compensation Committee determines how the NEOs should be compensated.

For 2019, we had two NEOs, Brent K. Bilsland, our Chairman, President, and Chief Executive Officer and Lawrence D. Martin, our Chief Financial Officer. Our NEOs do not have:

|

|

●

|

Excessive perquisites such as company aircraft, car leases, or country club memberships.

|

|

|

●

|

Post-employment benefits other than our 401(k) plan, which is available to all employees.

|

|

|

●

|

Separate health benefit programs. They participate in the same health plan offered to all of the employees and their families.

|

Our CEO received a housing allowance that offset the increased housing expense for his move from Indiana to Colorado. The housing allowance, which covered rent through July 2020, was grossed up for all applicable payroll taxes.

Our Compensation Committee does not use outside consultants to determine executive compensation. Our Board believes that based on their many years of business experience, and their significant investment in the Company, they have the requisite knowledge to decide on our NEOs compensation.

Our compensation is designed to retain and reward our NEO's by establishing a base salary that provides a degree of financial certainty and stability coupled with RSU awards that vest over time to help ensure that they have a stake in the Company's long-term success by providing an incentive to improve the overall growth, profitability, and value of our company while aligning their interests with those of our shareholders.

Based on W-2s, in 2019, at minimum, ~26% of our NEOs' compensation was attributable to the vesting of RSUs, and in 2018, 46% of their compensation was due to the vesting of RSUs

Our NEOs' 2019 compensation was set under the Four-Year Compensation Plan (The Four-Year Plan) adopted in June 2017. Our compensation components are:

|

|

●

|

Annual Base Salary (not attached to performance goals) – salaries set for 2018-2021.

|

|

|

●

|

RSUs that vest/lapse annually equally over four years. The first vesting was on December 14, 2018. Such RSUs were issued under the shareholder approved Amended and Restated Restricted Stock Unit Plan.

|

|

|

●

|

Retention Bonus in the event of a change of control due to (1) the acquisition by any person or group of related persons (as determined pursuant to section 13(d)(3) of the Securities Exchange Act of 1934) of beneficial ownership of securities of the Corporation representing fifty percent (50%) or more of the total number of votes that may be cast for the election of Board members, or (ii) shareholder approval of (A) any agreement for a merger or consolidation in which the Corporation will not survive as an independent corporation or other entity, or (B) any sale, exchange or other disposition of all or substantially all of the Corporation's assets, including, without limitation, the sale, exchange or other disposition of the equity securities or assets of Sunrise Coal, LLC.

|

The Four-Year Plan was terminated on March 5, 2020 and replaced with the two-year 2020 Plan (the "2020 Plan"). The compensation components of the 2020 Plan are:

|

|

●

|

Annual Base Salary (not attached to performance goals) – salaries set for 2020-2021.

|

|

|

●

|

RSUs that vest annually equally over two years. The first vesting will be on December 16, 2020. Such RSUs were issued under the shareholder approved Amended and Restated Restricted Stock Unit Plan.

|

|

|

●

|

Retention Bonus in the event of a change of control due to (1) the acquisition by any person or group of related persons (as determined pursuant to section 13(d)(3) of the Securities Exchange Act of 1934) of beneficial ownership of securities of the Corporation representing fifty percent (50%) or more of the total number of votes that may be cast for the election of Board members, or (ii) shareholder approval of (A) any agreement for a merger or consolidation in which the Corporation will not survive as an independent corporation or other entity, or (B) any sale, exchange or other disposition of all or substantially all of the Corporation's assets, including, without limitation, the sale, exchange or other disposition of the equity securities or assets of Sunrise Coal, LLC.

|

|

|

●

|

Performance Bonus is an amount based on performance relative to the target goals as of the relevant date. The performance plan term and conditions are consistent with the Company's goals for the performance period of January 1, 2020, to December 31, 2020.

|

NAMED EXECUTIVE OFFICERS (NEOs) COMPENSATION

Outlined in the table below, is our NEOs compensation for 2017-2019.

Summary Compensation Table Under Item 402 of Regulation S-K

|

Name and Principal

Position

|

Fiscal Year

|

|

Salary

|

|

|

Bonus

|

|

|

Stock Awards

|

|

|

Dividends on

outstanding

RSUs

|

|

|

Other

|

|

|

Total

|

|

|

Brent K. Bilsland

|

2019

|

|

$

|

385,000

|

|

|

$

|

44,423

|

|

|

|

|

|

|

$

|

33,000

|

|

|

$

|

218,031

|

(1)

|

|

$

|

680,454

|

|

|

Chairman, President and

|

2018

|

|

|

385,000

|

|

|

|

44,423

|

|

|

|

|

|

|

|

44,000

|

|

|

|

72,407

|

(2)

|

|

|

545,830

|

|

|

CEO

|

2017

|

|

|

350,000

|

|

|

|

40,385

|

|

|

$

|

4,004,750

|

|

|

|

38,000

|

|

|

|

10,800

|

(3)

|

|

|

4,443,935

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lawrence D. Martin

|

2019

|

|

|

231,000

|

|

|

|

17,769

|

|

|

|

|

|

|

|

18,000

|

|

|

|

11,200

|

(3)

|

|

|

277,969

|

|

|

Executive Vice President and

|

2018

|

|

|

231,000

|

|

|

|

35,769

|

|

|

|

|

|

|

|

24,000

|

|

|

|

11,000

|

(3)

|

|

|

301,769

|

|

|

CFO

|

2017

|

|

|

210,000

|

|

|

|

34,154

|

|

|

|

2,550,300

|

|

|

|

21,600

|

|

|

|

10,800

|

(3)

|

|

|

2,826,854

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Consists of 401(k) matching contributions and $206,831 housing allowance related to Mr. Bilsland's relocation to Colorado.

|

|

(2)

|

Consists of 401(k) matching contributions and $61,407 housing allowance related to Mr. Bilsland's relocation to Colorado.

|

|

(3)

|

Includes 401(k) matching contributions.

|

Compensation per W-2s and "At-Risk" Compensation

|

Name and Principal

Position

|

Fiscal Year

|

|

Salary

|

|

|

Bonus

|

|

|

Value Realized

on

RSU Vesting

|

|

|

Dividends on outstanding

RSUs

|

|

|

Other (1)

|

|

|

Total W-2

Compensation

|

|

|

Percentage of

"At-Risk"

Compensation

|

|

|

Brent K. Bilsland

|

2019

|

|

$

|

385,000

|

|

|

$

|

44,423

|

|

|

$

|

188,375

|

|

|

$

|

33,000

|

|

|

$

|

206,831

|

|

|

$

|

857,629

|

|

|

|

26

|

%

|

|

Chairman, President and CEO

|

2018

|

|

|

385,000

|

|

|

|

44,423

|

|

|

|

370,593

|

|

|

|

44,000

|

|

|

|

61,407

|

|

|

|

905,423

|

|

|

|

46

|

%

|

|

|

|

|

2017

|

|

|

350,000

|

|

|

|

40,385

|

|

|

|

2,334,500

|

|

|

|

38,000

|

|

|

|

|

|

|

|

2,762,885

|

|

|

|

86

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lawrence D. Martin

|

2019

|

|

|

231,000

|

|

|

|

17,769

|

|

|

|

102,750

|

|

|

|

18,000

|

|

|

|

|

|

|

|

369,519

|

|

|

|

33

|

%

|

|

Executive Vice President and CFO

|

2018

|

|

|

231,000

|

|

|

|

35,769

|

|

|

|

202,125

|

|

|

|

24,000

|

|

|

|

|

|

|

|

492,894

|

|

|

|

46

|

%

|

|

|

|

|

2017

|

|

|

210,000

|

|

|

|

34,154

|

|

|

|

1,671,600

|

|

|

|

21,600

|

|

|

|

|

|

|

|

1,937,354

|

|

|

|

87

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Housing allowance related to Mr. Bilsland's relocation in Colorado.

|

Outstanding Equity Awards at December 31, 2019

The following table sets forth information concerning the outstanding stock awards held on December 31, 2019, by the named executive officers.

|

Name and Principal Position

|

|

Number of Shares

or RSUs That Have Not Vested

|

|

|

Market Value of Shares or RSUs

That Have Not Vested (3)

|

|

|

Brent K. Bilsland

|

|

|

137,500

|

(1)

|

|

$

|

408,375

|

|

|

Chairman, President and CEO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lawrence D. Martin

|

|

|

75,000

|

(2)

|

|

|

222,750

|

|

|

Executive Vice President and CFO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) 68,750 RSUs will vest each year on December 16, 2020 and December 16, 2021.

|

|

|

(2) 37,500 RSUs will vest each year on December 16, 2020, and December 16, 2021.

|

|

|

|

|

(3) Market value is calculated at the number of common shares indicated multiplied by $2.97, which was the closing price of the Company's common shares on December 31, 2019, as reported by the Nasdaq Stock Market.

|

|

2020 Named Executive Officers (NEOs) Compensation

|

Name and Principal

Position

|

|

Salary

|

|

|

Dividends on

outstanding

RSUs

|

|

|

Total

|

|

|

RSU Awards

That Vest On

December 16, 2020

|

|

|

Brent K. Bilsland

|

|

$

|

500,000

|

|

|

$

|

5,500

|

|

|

$

|

505,500

|

|

|

|

68,750

|

|

|

Chairman, President and CEO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lawrence D. Martin

|

|

|

300,000

|

|

|

|

3,000

|

|

|

$

|

303,000

|

|

|

|

37,500

|

|

|

Executive Vice President and CFO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPOSAL NO. 2: ADVISORY VOTE APPROVING NAMED EXECUTIVE OFFICERS' COMPENSATION.

|

|

The Board recommends that you vote FOR Hallador's named executive officers' compensation.

|

In accordance with Section 14A of the Securities Exchange Act of 1934, we are asking our shareholders for an advisory vote to approve the compensation of our named executive officers as disclosed in this Proxy Statement as set forth in the "Summary Compensation Table" in accordance with the compensation disclosure rules of the SEC.

The Board recommends that shareholders support the following resolution for the reasons described in the Compensation Discussion and Analysis and the other tables in this Proxy Statement.

RESOLVED, that the shareholders approve, on an advisory basis, Hallador's compensation of its named executive officers, as disclosed in Hallador's Proxy Statement for the 2020 Meeting of Shareholders, pursuant to the compensation disclosure rules of the SEC, including the Summary Compensation Table and all other tables and narrative disclosures regarding named executive officer compensation.

This advisory proposal is not binding.

A majority of the shares of Common Stock represented at the Meeting and entitled to vote on this proposal must vote FOR the proposal to approve it. Your broker may not vote your shares on this proposal unless you give voting instructions. Broker non-votes do not affect the vote. Your vote will not directly change or otherwise limit or enhance any existing compensation or award arrangement of any of our named executive officers, but the outcome of the say-on-pay vote will be taken into account by the Compensation Committee when considering future compensation arrangements.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS

Restricted Stock Unit Plan And Stock Bonus Plan

On December 31, 2019, we had 488,500 RSUs outstanding and 1,383,848 available for future issuance. As of August 20, 2020, there are 447,000 RSUs outstanding and 1,379,650 RSUs available for future issuance.

Our stock bonus plan was authorized in late 2009 with 250,000 shares, of which 86,383 shares are available for future issuance. We did not issue shares from the Stock Bonus Plan in 2019.

Security Ownership of Certain Beneficial Owners and Management

The following table and accompanying footnotes show information as of August 20, 2020, regarding the beneficial ownership of our common stock by (i) each person who is known by us to own more than 5% beneficially of our common stock; (ii) each member of our Board of directors and our NEOs; and (iii) all members of our Board of directors and our executive officers as a group. The number of shares and percentages of beneficial ownership set forth below is based on 30,465,665 shares of our common stock issued and outstanding as of August 20, 2020.

We do not have any RSUs that vest within 60 days of the date of this report.

|

Name and Address

of Beneficial Owner

|

Shares of Common Stock

Beneficially Owned

|

Percent (1)

|

|

5% Shareholders:

|

|

|

|

Lubar Equity Fund LLC

700 North Water Street, Suite 1200

Milwaukee, WI 53202

|

2,788,685

|

9.2

|

|

Extract Capital Master Fund, LLC

55 Fifth Avenue, Suite 1702

New York, NY 10003

|

1,968,218

|

6.5

|

|

Hallador Alternative Assets Fund (2)

940 Southwood Blvd., Suite 201

Incline Village, NV 89451

|

1,671,465

|

5.5

|

|

DIRECTORS AND NAMED EXECUTIVE OFFICERS:

|

|

|

|

David J. Lubar (3)

833 E. Michigan Street, Suite 1500

Milwaukee, WI 53202

|

2,788,685

|

9.2

|

|

David C. Hardie (4)

940 Southwood Blvd., Suite 201

Incline Village, NV 89451

|

1,840,934

|

6.0

|

|

Steven R. Hardie (5)

P. O. Box 6629

Incline Village, NV 89450

|

1,596,160

|

5.2

|

|

Bryan H. Lawrence (6)

410 Park Avenue

New York, NY 10022

|

1,465,744

|

4.8

|

|

Brent K. Bilsland (7)

|

1,239,483

|

4.1

|

|

Lawrence D. Martin

|

307,395

|

1.0

|

|

Charles R. Wesley IV

|

14,347

|

*

|

|

Named Executive Officers and Directors rounded as a group (7) persons

|

9,252,748

|

30.4

|

|

|

*

|

Ownership is less than 1%

|

|

|

(1)

|

Based on shares issued and outstanding as of August 20, 2020.

|

|

|

(2)

|

Hallador Alternative Assets Fund LLC ("HAAF") beneficially owns 1,671,465 shares. HAAF is a Delaware limited liability company. HAAF is a private equity investment fund directed or controlled by its managing members, Hallador Management LLC, and David C. Hardie.

|

|

|

(3)

|

These shares are owned indirectly through Lubar Equity Fund LLC. The Fund is managed and controlled by Lubar & Co., Inc., of which Mr. Lubar is a director and President of Lubar & Co. Mr. Lubar may be deemed to share voting and dispositive power as to these shares. Mr. Lubar disclaims beneficial ownership in these shares except to the extent of his respective pecuniary interest therein.

|

|

|

(4)

|

Mr. David C. Hardie's shares include 1,671,465 shares owned by HAAF. He also individually owns 169,469 shares directly.

|

|

|

(5)

|

Mr. Steven R. Hardie individually owns 139,089 shares directly.

Mr. Steven R. Hardie's shares include 21,489 shares beneficially owned by the Steven Robert Hardie Trust; 13,481 shares beneficially owned by the Sandra Hardie Trust; and 1,422,101 shares owned by NextG Partners, LLC, a Nevada limited liability company. Steven R. Hardie is a member and manager of NextG Partners, LLC, owning 38% of its membership interests. He disclaims beneficial ownership of the other 62% of the shares held by NextG Partners or 881,703 shares.

Mr. Steven R. Hardie is also the trustee of the Steven Robert Hardie Trust. Mr. Steven R. Hardie's spouse, Sandra Hardie, is the trustee of the Sandra W. Hardie Revocable Family Trust. Mr. Steven R. Hardie disclaims any beneficial ownership in any other shares held by the above-described entities.

|

|

|

(6)

|

Mr. Lawrence owns 499,746 shares directly and includes 604,904 shares owned by Yorktown Energy Partners, VI LP, and 361,094 shares owned by Yorktown Energy Partners, VII LP, of which Mr. Lawrence disclaims beneficial ownership of these shares, except to the extent of his pecuniary interest therein.

|

|

|

(7)

|

Includes 462,857 shares owned by Mr. Bilsland's spouse and minor children. Mr. Bilsland disclaims beneficial ownership of such shares.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Review and Approval of Transactions With Related Persons

All related party transactions involving related persons and us are reviewed and approved by our Board. Related person transactions are those that meet the minimum threshold for disclosure in the proxy statement under relevant SEC and Nasdaq stock exchange rules (generally, transactions involving amounts exceeding $120,000 in which a related person has a direct or indirect material interest).

Director Independence

The Board has determined that all of our current non-employee directors are independent within the meaning of SEC and Nasdaq rules. The Board determined that all of the directors serving on the Audit Committee, Compensation Committee, and Nominating Committee are independent within the meaning of SEC and Nasdaq rules.

INDEPENDENT AUDITOR'S FEES AND SERVICES

Auditors

Our audit committee approved the engagement of Plante & Moran, PLLC ("Plant Moran") as our independent registered public accounting firm.

Our consolidated financial statements for the fiscal years ended December 31, 2019, and 2018 have been audited by Plante Moran, who has served as our independent registered public accounting firm for those years.

For 2019 and 2018, our audit partner was Brent Peterson age (54), and Nathan Gordon (age 41) was the concurring partner. For 2020 our audit partner is Nathan Gordon (41), and Doug Reeb (46) is our concurring partner.

Audit Fees

Audit fees for 2019 were $338,000 for the audit plus an additional $16,000 for the 401k plan. Audit fees for 2018 were $342,000 plus an additional $15,500 for the 401(k) audit.

Pre-Approval Policy

The Audit Committee adopted a formal policy concerning approval of audit and non-audit services to be provided by Plante Moran. The policy requires that all services Plante Moran provides to us be pre-approved by the Audit Committee. The Audit Committee approved all services provided by Plante Moran during 2019 and 2018.

Audit Committee Report

Review of Fiscal Year 2019 Consolidated Financial Statements

The Audit Committee of the Board of Directors is comprised of independent directors and operates under a written charter adopted by the Board of Directors. The Audit Committee Charter is reviewed and updated as needed per applicable rules of the SEC and The Nasdaq Stock Market.

The Audit Committee serves in an oversight capacity. Management is responsible for the Company's internal controls over financial reporting. The independent auditors are responsible for performing an independent audit of the Company's financial statements per the standards of the Public Company Accounting Oversight Board ("PCAOB") and issuing a report thereon. The Audit Committee's primary responsibility is to monitor and oversee these processes and to select and retain the Company's independent auditors. In fulfilling its oversight responsibilities, the Audit Committee reviewed with management the Company's audited financial statements and discussed not only the acceptability but also the quality of the accounting principles, the reasonableness of the significant judgments and estimates, critical accounting policies and the clarity of disclosures in the audited financial statements prior to issuance.

The Audit Committee reviewed and discussed the audited financial statements as of and for the year ended December 31, 2019, with the Company's independent auditors, Plante & Moran, PLLC ("Plante Moran"), and discussed not only the acceptability but also the quality of the accounting principles, the reasonableness of the significant judgments and estimates, critical accounting policies and the clarity of disclosures in the audited financial statements prior to issuance. The Audit Committee discussed with Plante Moran the matters required to be discussed by the applicable requirements of the PCAOB and the SEC. The Audit Committee has received the written disclosures and the letter from Plante Moran required by the applicable requirements of the PCAOB regarding independent auditor communications with the Audit Committee concerning independence and has discussed with Plante Moran.

Based on the review and discussions with our independent registered public accounting firm, Plante Moran, the Audit Committee has recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2019, for filing with the SEC.

MEMBERS OF THE AUDIT COMMITTEE:

David C. Hardie – Chairman of the Committee

Bryan H. Lawrence

David J. Lubar

PROPOSAL NO. 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

The Board's Audit Committee has appointed Plante & Moran, PLLC, as Hallador's independent registered public accounting firm, to audit Hallador's financial statements for the fiscal year ending December 31, 2020. As a matter of good corporate governance, the Audit Committee submits its selection of Plante Moran to our Shareholders for ratification and will consider the vote of our Shareholders when appointing our independent registered public accounting firm in the future. For additional information regarding Hallador's relationship with Plant Moran, please refer to the "Audit Committee Report" and "Audit Fees" sections above.

|

|

The Board recommends that you vote FOR the ratification of the Appointment of Plante & Moran, PLLC, the independent registered public accounting firm for 2020.

|

OTHER INFORMATION

Proposals by Security Holders

The Board did not receive any proposals for consideration to be voted upon at the Meeting.

Other Matters

The Board does not intend to bring any other matters before the Meeting and has not been informed that any other matters are to be presented by others.

Shareholder Proposals for the 2021 Annual Meeting

Under SEC Rule 14a-8, if a shareholder wants us to include a proposal in our proxy statement and form of proxy for presentation at our 2021 Annual Meeting of Shareholders, the proposal must be received by us at our principal executive offices at 1183 East Canvasback Drive, Terre Haute, Indiana 47802 by April 29, 2021, unless the date of our 2021 Annual Meeting of Shareholders is more than 30 days from the anniversary date of our 2020 Annual Meeting of Shareholders, in which case the deadline is a reasonable time before we print and mail our proxy materials for the 2021 Annual Meeting of Shareholders. The proposal should be sent to the attention of the Corporate Secretary of Hallador Energy Company.

Rule 14a-4 of the SEC's proxy rules allow a company to use discretionary voting authority to vote on matters coming before an annual meeting of shareholders for the prior year's annual meeting of shareholders or the date specified by an overriding advance notice provision in the company's bylaws. Our bylaws do not contain such an advance notice provision. Accordingly, for our 2021 annual meeting, shareholders' written notices must be received by us before July 13, 2021, for any proposal a shareholder wishes to bring before the meeting but for which such shareholder does not seek to have a written proposal considered for inclusion in the proxy statement and form of proxy. If we change the date of next year's meeting by more than 30 days from the date of this year's meeting, then the deadline is a reasonable time before we begin to print and mail our proxy materials for the 2021 Annual Meeting of Shareholders. Your notice should be addressed to Secretary, Hallador Energy Company, 1183 East Canvasback Drive, Terre Haute, Indiana 47802.

In order to curtail controversy as to the date on which a proposal was received by us, it is suggested that proponents submit their proposals by certified mail-return receipt requested. Such proposals must also meet the other requirements established by the SEC for shareholder proposals.

Communications with the Board of Directors

Because of our relatively small size, to date, we have not developed formal processes by which shareholders or other interested parties may communicate directly with Directors. Until formal procedures are developed and posted on our website (www.halladorenergy.com ), any communication to one or more members of our Board of Directors may be made by sending them in care of Investor Relations, Hallador Energy Company, 1183 East Canvasback Drive, Terre Haute, Indiana 47802. Shareholders should clearly note on the mailing envelope that the letter is a "Shareholder-Board Communication." All such communications will be forwarded to the intended recipients.

Incorporation by Reference

Neither the compensation committee report nor the audit committee report shall be deemed soliciting material or filed with the SEC. Neither of these reports shall be considered to be incorporated by reference into any of our prior or future SEC filings except to the extent that we specifically incorporate such information by reference. Also, this document includes certain website addresses, that are intended to provide inactive, textual references only. The information on these websites is not part of this proxy statement.

Availability of SEC Filings, Code of Conduct and Committee Charters

Copies of our reports on Forms 10-K (including the financial statements and financial statement schedules), 10-Q, 8-K and all amendments to those reports filed with the SEC, Code of Conduct and the charters of the audit, compensation, and nominating committees, and any stock ownership reports filed by our executive officers, directors, and 10%+ beneficial owners for our common stock are posted on, and free of charge, on our website, www.halladorenergy.com, by telephone to (812) 299-2800 or by mail to Investor Relations, Hallador Energy Company, 1183 East Canvasback Drive, Terre Haute, Indiana 47802.

We do not intend for information contained in our website to be part of this proxy statement.

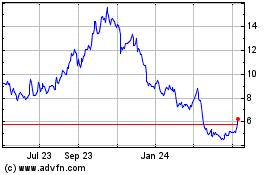

Hallador Energy (NASDAQ:HNRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

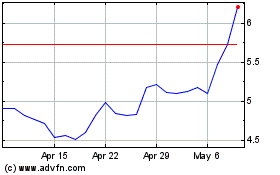

Hallador Energy (NASDAQ:HNRG)

Historical Stock Chart

From Apr 2023 to Apr 2024