Filed by Trine

Acquisition Corp.

Pursuant to Rule

425 under the Securities Act of 1933

and deemed filed

pursuant to Rule 14a-12

under the Securities

Exchange Act of 1934

Subject Company:

Trine Acquisition Corp.

Commission File

No. 001-38835

Date: August

26, 2020

In connection with the investor presentation prepared by Trine Acquisition Corp. (“Trine”) and Desktop Metal,

Inc. (“Desktop Metal”) and previously filed with the SEC, the investor presentation was used on a telephonic call

held on August 26, 2020, a transcript of which is set forth below.

{OPERATOR SAFE HARBOR}

Good day and welcome to the Desktop Metal and Trine Acquisition Corporation conference call.

Before we begin, I

would like to note that this call may contain forward-looking statements, including Trine’s and Desktop Metal’s expectations

of future financial and business performance and conditions, the industry outlook and the timing and completion of the transaction.

Forward-looking statements are inherently subject to risks, uncertainties and assumptions, and they are not guarantees of performance.

I encourage you to read the press release issued today, the accompanying presentation that is available on Desktop Metal’s

website and Trine’s filings with the SEC for a discussion of the risks that can affect the business combination and the business

of the Desktop Metal after completion of the proposed transaction.

At this time I would now like to turn the call over to Leo Hindery

Jr., Chairman and Chief Executive Officer of Trine Acquisition Corp. Please go ahead.

Leo Hindery Jr., Chairman & CEO

of Trine Acquisition Corp

Thank you and good

day.

We are pleased to announce

today our planned business combination with Desktop Metal, a leader in next generation additive manufacturing technology. Desktop

Metal will be the only pure-play opportunity available to public market investors in the Additive Manufacturing 2.0 space and we

believe the Company is in the process of revolutionizing the industry.

Desktop Metal’s

technology will be a significant first step in replacing a mass manufacturing base which has become antiquated. The technology

will utilize transformative design to finally deliver on a previously inaccessible series of use cases pivotal to the products

and industries that will drive the economy in the 21st century, including electric vehicles, 5G communications, digital supply

chains, and spaceflight to name a few.

I founded Trine in

partnership with HPS Investment Partners, one of the world’s leading credit investment firms. Together, we sought to identify

a high growth company with secular tailwinds and high-quality management – in short, a company capable of producing compounding,

durable returns on equity.

Since completing Trine’s

IPO in March 2019, we have analyzed hundreds of target companies, but none proved as compelling an investment opportunity as Desktop

Metal. This is true for four critical reasons.

The first reason

is Desktop Metal’s incredibly robust portfolio of products and intellectual property. Groundbreaking achievements on

the hardware side, such as advancements in single pass jetting and sintering technologies, married with leading edge

engineering on the software simulation side, are solving several critical pain points for customers, while delivering

superior ROIs versus competitive offerings. The company has a distinct first-mover advantage over competitors and the

injection of capital from this transaction, a large portion of which will be dedicated to continuous product innovation, will

protect and extend this first-mover advantage.

The second reason is

Desktop Metal’s business model, which is based off the razor / razor blade concept. All the products you will hear about

are capable of generating high margins and powerful, recurring revenue streams from cohorts. The products offer turnkey solutions

including materials and services, which result in high lifetime values relative to their upfront costs. This natural switching

moat is further reinforced by a proprietary distribution network of over 80 partners across more than 60 countries, a level of

reach and sophistication in customer service that is exceptional in the industry.

The third reason is

the addressable market itself. Industry experts forecast that the additive manufacturing industry will realize explosive growth

over the next decade of reaching over 10x the 2019 market size. We believe Desktop Metal’s go-forward plan is eminently reasonable

and achievable viewed alongside these strong, secular tailwinds, and demonstrated customer demand for its solutions.

The fourth reason is

Desktop Metal’s truly remarkable team of employees, investors and board members. Ric Fulop is one of the best leaders

I have seen in my career and he brings a history of success in the additive manufacturing space, as a serial entrepreneur

and as an investor. His team, some of whom are the original inventors of 3D printing processes, has worked

together several times in the past and they have delivered a history of strong returns on invested capital. The company is governed

by a board of directors which includes some of the leading minds in management and technology, and it is truly one of the great

privileges of my career to be invited to join that board.

Beyond our own validation,

I am extremely pleased to be able to announce that we have successfully raised a $275 million PIPE which is anchored by world

class investors and operators including Miller Value Partners, Baron Capital, Chamath Palihapithya, JB Straubel, XN Capital, and

Trine’s partner, HPS.

The business combination

values Desktop Metal at an implied $2.5 billion pro forma equity value and a $1.8 billion enterprise value. The combined

company will receive approximately $575 million of gross proceeds from a fully committed common stock PIPE offering of $275

million along with the approximately $300 million of cash held in trust assuming no redemptions by Trine’s

existing public stockholders. The boards of directors of both Desktop Metal and Trine have unanimously approved the proposed business

combination which is expected to be completed in November of this year subject to, among other things, approval by Trine’s

stockholders and the satisfaction or waiver of other customary closing conditions.

With that, I’d

like to introduce Ric Fulop, Co-founder, Chairman and CEO of Desktop Metal.

Ric Fulop, Desktop Metal Co-Founder,

Chairman and CEO

Thank you Leo, good morning everyone and

thank you for your interest in Desktop Metal.

We are very

excited to bring Desktop Metal to the public markets and create the only publicly traded pure play Additive Manufacturing 2.0

company. Our business is poised for tremendous growth over the next decade, as we marry industry leading technology and

intellectual property with a strong secular growth trend in additive manufacturing.

Beginning with the addressable market and

industry growth, the additive manufacturing industry is at a critical inflection point, with spend on additive manufacturing systems,

parts, and materials estimated to surge from $12 billion today to $146 billion by 2030. This explosive growth can

be credited to the emergence of Additive Manufacturing 2.0 — a second generation of additive technologies unlocking repeatable,

cost-effective, mass production of 3D printed parts.

We think Additive Manufacturing 2.0 will

be a key enabler of success for exciting, high growth industries that will drive economic growth for years to come, including transportation,

space exploration, industrial automation, and green energy. Additive Manufacturing 2.0 allows innovative companies in these spaces

to design and manufacture complex and optimized, high-performance parts at-scale. From a production standpoint, it also enables

consolidation of production facilities and a re-engineering of global supply chains. All of these benefits deliver a remarkable

ROI.

We believe Desktop Metal is uniquely situated

to lead the industry into this new era.

Whereas prior additive technologies have

been primarily focused on prototyping, our portfolio is extraordinary in its focus on impact across the entire product lifecycle

— capturing value at every stage from R&D to high-volume mass production. This breadth also dramatically expands the

addressable market for Desktop Metal.

As we continue to

grow the business, we view our team as one of the greatest competitive strengths our company has. Our ability to innovate is

directly attributable to our R&D capabilities. If you take a look at the presentation posted on our website this morning

you will note a leadership team composed of world-renowned experts in advanced manufacturing, material science, and robotics.

Our R&D efforts are led by four MIT professors in various engineering disciplines, including Ely Sachs, the inventor of

the binder jet printing process, and guided by a leadership team with proven experience bringing emerging technologies to

market.

Our world-class team has been responsible

for the development of our four product platforms currently on the market or slated to ship in late 2020 and 2021, each of which

addresses a specific need in the market.

The first product

we launched was the Studio System – an office-friendly metal 3D printing system. This platform leverages proprietary

technology designed to eliminate the dangerous powders and high costs often associated with laser-based processes to deliver

accessible and high-quality metal printing. The Studio System has enabled functional prototyping, on-demand tooling, and

on-demand production of aftermarket and replacement parts – all within the comfort of a typical work environment or

office without the need for personal protective equipment and with minimal facilities investment required as compared to legacy technologies. The platform also

provides engineers and manufacturers with an easy and accessible turnkey solution for producing additive-optimized designs

for end-use in low volumes. The Studio System began shipping in late 2018 and is responsible for the majority of our revenue

to date with hundreds of installed systems in the field.

In the fourth

quarter of 2020, we are scheduled to begin volume shipments of Fiber, a first-of-its-kind advanced composite printer

featuring aerospace-grade continuous fiber AFP tape deposited using Desktop Metal’s new Micro AFP technology. This

printer combines the ease of traditional fuse filament fabrication technology with the performance of industrial automated

fiber placement to deliver very high resolution parts with up to 60% fiber volume fraction using materials stronger than

steel yet lighter than aluminum -- all starting at a subscription price just under $3,500 per year. This platform is one of

the most accessible high-performance composite printing solutions on the market and empowers our customers to produce a wide

range of low-cost, high-impact applications at the press of a button, including custom jigs and fixtures, conformal soft

jaws, on-demand tooling, and custom one-off composite parts.

To specifically address volume production,

Desktop Metal has a comprehensive portfolio of products using innovations that revolutionize traditional binder jetting

technology and are designed to deliver speed, reliability and part costs competitive with conventional manufacturing processes

for quantities of up to hundreds of thousands of parts. With these products, we are bridging the gap between complex one-off parts

and high-volume mass production.

The Shop System, also scheduled to begin

volume shipments in the fourth quarter of 2020, is an additive manufacturing solution specifically targeted at the machine shop

market. It’s designed for serial, mid-volume production runs of fully dense and customer-ready metal parts - up to tens of

thousands annually, and it offers a turnkey automated solution with an easy-to-use workflow for end users, including hardware,

software, and materials. We believe this makes it an ideal solution for mid-volume manufacturers that often lack in-house engineering

resources and require a complete solution.

The Production System, scheduled to begin

volume shipments in the second half of 2021, is designed for high-speed metal parts production on the factory floor. It leverages

our proprietary Single Pass Jetting technology and boasts print speeds up to 100x those of laser powder bed fusion systems - empowering

businesses to produce up to hundreds of thousands or millions of parts annually through additive manufacturing. We believe it’s

the fastest way to produce metal parts at scale. As a result of this massive throughput, the Production System can deliver part

costs competitive with conventional manufacturing processes such as casting or machining. It is also designed to enable the mass

production of complex or customized designs, produces limited waste, and enables a greener supply chain through reductions in shipping

and co-locating manufacturing with assembly or customer demand. We think the Production System is truly the additive manufacturing

revolution manufacturers have been waiting for. With no need for tooling, lower part costs, and greater manufacturing flexibility,

the customer value proposition is clear and compelling.

Initial Production Systems are at select

customers today and we have more than 90 reservations, many of which are from accounts which represent multi-unit potential as

they scale their additive manufacturing capabilities.

Turning to our

distribution strategy, we believe we have established a leading channel for metal and composite additive manufacturing

solutions. Our distribution network now covers over 60 countries around the globe and is composed of sales and distribution

professionals with decades of experience selling or digital manufacturing technologies. This enables us to sell and service

our products at-scale in markets across the globe and produces substantial sales leverage as we execute our strategy.

Fundamentally our

technologies are horizontal in nature, and we don’t expect to see material account or vertical industry concentration.

That being said, automotive is a sizable market for us and we have received strong interest across major automotive suppliers

as well as strategic investments from notable manufacturers, including Ford Motor Company and BMW with a goal of accelerating

the penetration of additive manufacturing in automotive production. In addition to automotive, we also have a meaningful

customer base of other blue-chip names across industries, including transportation, consumer, heavy industry,

machine components and manufacturing tooling. Additionally, thanks to both the capital from this transaction

and HPS’ deep relationships with its industrial borrowers across the globe, we will be exceptionally well placed to

grow our customer roster.

Our broad product

portfolio yields a compelling financial model. Our forecast calls for a rapid acceleration in sales over the next 5 years to

nearly $1 billion in annual revenue in 2025. This growth is anticipated to come as we shift from shipping one product in

volume in 2019 to four products by the end of 2021. The revenue will consist of system sales as well as strong contribution

from recurring consumables and services sales generated by our growing install base. We estimate that our volume production

solutions will generate multiples of the initial purchase revenue over their lifetime from high margin, recurring revenue

consumable sales, resulting in a strong lifetime value for each system. For example, the lifetime value of a single

Production System over 10 years can reach $6.5 million in revenue with almost $4 million in gross profit. These

favorable unit economics have a compounding effect on our financial performance and margin profile as we grow the

business.

At our core, we

are a tech company. Our strengths are in technology innovation and product development. As a result, we take an asset light

approach to the business. As I mentioned earlier, we leverage a leading distribution network for sales and support services

in the industry. Similarly, our manufacturing strategy is to partner with contract manufacturers on systems and components where they

do not pose risk to our intellectual property. Through this approach for both distribution and manufacturing, we anticipate

gaining significant operating leverage over the next few years, resulting in what we expect will be a sharp acceleration of

EBITDA and free cash flow generation.

Through the

transaction, we will add an additional $575 million in gross proceeds assuming no redemptions from the trust and will use

these funds to accelerate our growth profile by expanding our product portfolio and investing in our go to market efforts. As

part of a broader use of proceeds to support constructive consolidation in the additive manufacturing industry, we also plan

to strategically pursue targeted acquisition opportunities that offer the potential to open new markets, drive customer

lifetime value, eliminate margin stack up and accelerate our entry into new verticals.

With broad adoption of our technology in

place and upcoming volume deployment of our full suite of Additive Manufacturing 2.0 platforms, Desktop Metal is already planting

the seeds of change in blue chip organizations around the globe. Our customers are realizing the dramatic benefits of additive

manufacturing in nearly every vertical across the entire product lifecycle. As I mentioned before, this is a pivotal moment for

the additive manufacturing industry, and we view our products as leading the way in empowering businesses to finally realize the

promise additive manufacturing - re-engineered supply chains, localized production, unprecedented throughput and economics, and

full design freedom.

The increasingly

digital manufacturing landscape is going to experience a massive transformation over the next decade and we at Desktop Metal

are thrilled to be on the forefront of this fourth industrial revolution.

I would like to

thank our partners at Trine, it’s been a lot of fun to get to know you, especially Leo Hindery, Jr., Pierre Henry, and

Tom Wasserman, who have brought substantial financial expertise, knowledge, and valuable relationships to our team. We are

excited about what the future brings and we look forward to working with you to change the way the world makes

products.

Thank you very

much for your time and interest in Desktop Metal.

Forward Looking Statements

This document

contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed

transaction between Desktop Metal, Inc. ("Desktop") and Trine Acquisition Corp. ("Trine"), including

statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered by

Desktop and the markets in which it operates, and Desktop’s projected future results. These forward-looking statements

generally are identified by the words “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,”

“would,” “will be,” “will continue,” “will likely result,” and similar

expressions. Forward-looking statements are predictions, projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause

actual future events to differ materially from the forward-looking statements in this document, including but not limited to:

(i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of

Trine’s securities, (ii) the risk that the transaction may not be completed by Trine’s business combination

deadline and the potential failure to obtain an extension of the business combination deadline if sought by Trine, (iii) the

failure to satisfy the conditions to the consummation of the transaction, including the adoption of the agreement and plan of

merger by the shareholders of Trine and Desktop, the satisfaction of the minimum trust account amount following redemptions

by Trine’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a

third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event,

change or other circumstance that could give rise to the termination of the agreement and plan of merger, (vi) the effect of

the announcement or pendency of the transaction on Desktop’s business relationships, performance, and business

generally, (vii) risks that the proposed transaction disrupts current plans of Desktop and potential difficulties in Desktop

employee retention as a result of the proposed transaction, (viii) the outcome of any legal proceedings that may be

instituted against Desktop or against Trine related to the agreement and plan of merger or the proposed transaction, (ix) the

ability to maintain the listing of Trine’s securities on the New York Stock Exchange, (x) the price of Trine’s

securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries

in which Desktop plans to operate, variations in performance across competitors, changes in laws and regulations affecting

Desktop’s business and changes in the combined capital structure, (xi) the ability to implement business plans,

forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional

opportunities, and (xii) the risk of downturns in the highly competitive additive manufacturing industry. The foregoing list

of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties

described in the “Risk Factors” section of Trine’s Annual Reports on Form 10-K, Quarterly Reports on Form

10Q, the registration statement on Form S-4 and proxy statement/consent solicitation statement/prospectus discussed below and

other documents filed by Trine from time to time with the U.S. Securities and Exchange Commission (the

“SEC”). These filings identify and address other important risks and uncertainties that could cause actual

events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements

speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and

Desktop and Trine assume no obligation and do not intend to update or revise these forward-looking statements, whether as a

result of new information, future events, or otherwise. Neither Desktop nor Trine gives any assurance that either Desktop or

Trine will achieve its expectations.

Additional Information and Where to

Find It

This document relates to a proposed transaction

between Desktop and Trine. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy

or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Trine intends to file

a registration statement on Form S-4 that will include a proxy statement of Trine, a consent solicitation statement of Desktop

and a prospectus of Trine. The proxy statement/consent solicitation statement/prospectus will be sent to all Trine and Desktop

stockholders. Trine also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision,

investors and security holders of Trine and Desktop are urged to read the registration statement, the proxy statement/consent solicitation

statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed

transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be

able to obtain free copies of the proxy statement/consent solicitation statement/prospectus and all other relevant documents filed

or that will be filed with the SEC by Trine through the website maintained by the SEC at www.sec.gov. In addition, the documents

filed by Trine may be obtained free of charge from Trine’s website at www.trineacquisitioncorp.com or by written request

to Trine at Trine Acquisition Corp., 405 Lexington Avenue, 48th Floor, New York, NY 10174.

Participants in the Solicitation

Trine and Desktop and their respective

directors and executive officers may be deemed to be participants in the solicitation of proxies from Trine’s stockholders

in connection with the proposed transaction. Additional information regarding the interests of those persons and other persons

who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/consent solicitation

statement/prospectus regarding the proposed transaction. You may obtain a free copy of these documents as described in the preceding

paragraph.

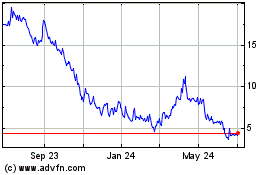

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Mar 2024 to Apr 2024

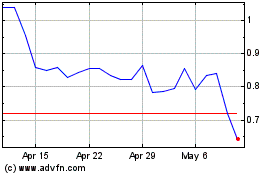

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Apr 2023 to Apr 2024