Current Report Filing (8-k)

August 25 2020 - 12:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 7, 2020

|

DIGITAL LOCATIONS, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-54817

|

|

20-5451302

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

3700 State Street, Suite 350 Santa Barbara, CA

|

|

93105

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(805) 456-7000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Ticker symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Effective July 7, 2020, Digital Locations, Inc, a Nevada corporation (the “Company”), entered into a 12% convertible note with an institutional investor in the principal amount of $33,000. The note matures on July 7, 2021. The Company received net proceeds of $30,000 after payment of $3,000 in legal fees and other fees to the lender. The lender, at its option after 180 days from the issuance of the note, may convert the unpaid principal balance of, and accrued interest on, the note into shares of the Company’s common stock at a 45% discount from the lowest trading price during the 20 consecutive trading days immediately prior to conversion. The Company may prepay the note during the 180 days from the issuance of the note at a redemption premium of 150%. After the expiration of 180 days after issuance, the Company has no right of prepayment. A copy of this note is attached to this Report as Exhibit 10.1.

Effective July 8, 2020, the Company entered into a 10% convertible note with an institutional investor in the principal amount of $40,000. The note matures on July 8, 2021. The Company received net proceeds of $35,000 after an original issue discount of $2,200 and payment of $2,800 in legal fees and other fees to the lender. The lender, at its option at any time, may convert the unpaid principal balance of, and accrued interest on, the note into shares of the Company’s common stock at a 50% discount from the lowest trading price during the 25 consecutive trading days immediately prior to conversion. The Company may prepay the note during the 180 days from the issuance of the note at a redemption premium ranging from 125% to 145%. After the expiration of 180 days after issuance, the Company has no right of prepayment. A copy of this note is attached to this Report as Exhibit 10.2.

Effective August 18, 2020, the Company entered into a 12% convertible note with an institutional investor in the principal amount of $33,000. The note matures on August 18, 2021. The Company received net proceeds of $30,000 after payment of $3,000 in legal fees and other fees to the lender. The lender, at its option after 180 days from the issuance of the note, may convert the unpaid principal balance of, and accrued interest on, the note into shares of the Company’s common stock at a 45% discount from the lowest trading price during the 20 consecutive trading days immediately prior to conversion. The Company may prepay the note during the 180 days from the issuance of the note at a redemption premium of 150%. After the expiration of 180 days after issuance, the Company has no right of prepayment. A copy of this note is attached to this Report as Exhibit 10.3.

Item 3.02. Unregistered Sales of Equity Securities.

During the period from July 6, 2020 through August 18, 2020, Digital Locations, Inc. (the “Company”) issued a total of 49,712,493 shares of its common stock to three institutional lenders in consideration for multiple conversions of convertible notes payable. The lenders converted a total of $71,638 of principal, $9,915 of accrued interest payable, and $8,250 in conversion fees. The issuances of these shares of the Company’s common stock were exempt from registration pursuant to Section 4(a)(2) and Rule 506(b) of Regulation D promulgated under the Securities Act of 1933, as amended.

The shares of common stock were issued to the three lenders as follows:

|

Lender

|

|

Number of

Shares

|

|

|

Principal

|

|

|

Accrued

Interest

|

|

|

Conversion

Fees

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lender #1:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible note dated 8/13/19

|

|

|

7,604,726

|

|

|

$

|

13,800

|

|

|

$

|

2,932

|

|

|

$

|

-

|

|

|

$

|

16,732

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lender #2:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible note dated 5/23/19

|

|

|

17,057,971

|

|

|

$

|

24,875

|

|

|

$

|

3,300

|

|

|

$

|

1,250

|

|

|

$

|

29,425

|

|

|

Convertible note dated 8/29/19

|

|

|

17,022,000

|

|

|

|

24,605

|

|

|

|

-

|

|

|

|

7,000

|

|

|

|

31,605

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lender #3:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible note dated 3/14/16

|

|

|

8,027,796

|

|

|

$

|

8,358

|

|

|

$

|

3,684

|

|

|

$

|

-

|

|

|

$

|

12,042

|

|

As a result of the conversions detailed above, the Lender #1 convertible note, dated August 13, 2019, and the Lender #2 convertible note, dated May 23, 2019, were extinguished in full.

The terms of the above convertible promissory notes are disclosed in Note 5 to the Condensed Financial Statements included in the Company’s Quarterly Report on Form 10-Q for the three months ended June 30, 2020 filed with the Securities and Exchange Commission on August 13, 2020 and are incorporated herein by reference.

Effective July 7, 2020, the Company entered into a 12% convertible note with an institutional investor in the principal amount of $33,000. Effective July 8, 2020, the Company entered into a 10% convertible note with an institutional investor in the principal amount of $40,000. Effective August 18, 2020, the Company entered into a 12% convertible note with an institutional investor in the principal amount of $33,000. The terms of these notes are fully described in Item 1.01 of this Report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

DIGITAL LOCATIONS, INC.

|

|

|

|

|

|

|

|

Date: August 24, 2020

|

By:

|

/s/ William E. Beifuss, Jr.

|

|

|

|

Name:

|

William E. Beifuss, Jr.

|

|

|

|

Title:

|

President and Chief Executive Officer

|

|

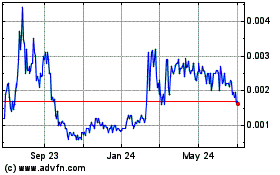

Digital Locations (PK) (USOTC:DLOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

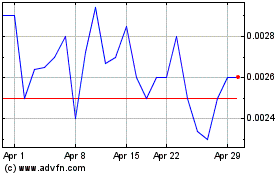

Digital Locations (PK) (USOTC:DLOC)

Historical Stock Chart

From Apr 2023 to Apr 2024