Current Report Filing (8-k)

August 17 2020 - 4:15PM

Edgar (US Regulatory)

0000769520

false

0000769520

2020-08-17

2020-08-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): August 17, 2020

The

Middleby Corporation

(Exact

name of registrant as specified in its charter)

|

Delaware

|

001-09973

|

36-3352497

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

1400 Toastmaster Drive,

Elgin, Illinois 60120

(Address of principal executive offices)

Registrant’s

telephone number, including area code:

(847)

741-3300

N/A

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock, nominal value $0.01 per share

|

|

MIDD

|

|

Nasdaq Global Market

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

Credit Agreement Amendment

On August 17, 2020, The Middleby Corporation (the “Company”)

announced that Middleby Marshall Inc. (“MMI”), a subsidiary of the Company, Bank of America, N.A., as administrative

agent, and certain lenders entered into a First Amendment to Seventh Amended and Restated Credit Agreement (the “First

Amendment”), which will, subject to the Closing Conditions (as defined below), amend the Company’s existing five-year,

$3.5 billion amended and restated multi-currency credit agreement (as amended from time to time prior to the date hereof, the “Existing

Credit Agreement,” and the Existing Credit Agreement, as amended by the First Amendment, the “Credit Agreement”).

Subject to, among other things, a prepayment of term loan obligations

under the Existing Credit Agreement in an aggregate amount of at least $400,000,000 using the proceeds of unsecured debt, including

convertible notes, or equity (or a combination thereof) (collectively, the “Closing Conditions”), the First

Amendment will amend the Existing Credit Agreement to, among other things:

|

|

(i)

|

modify certain covenants and definitions thereunder, including to permit certain junior capital transactions, including convertible

notes, and certain hedging arrangements;

|

|

|

(ii)

|

modify the covenant restricting the incurrence of debt to allow the Company to incur additional debt if, on a pro forma basis

after giving effect to the incurrence of such debt, the leverage ratio of the Company does not exceed 5.5 to 1.0 and the Company

is otherwise in compliance with the secured leverage ratio;

|

|

|

(iii)

|

replace the existing leverage ratio financial covenant with a secured leverage ratio financial covenant such that the secured

leverage ratio may not exceed 3.50 to 1.00 as of the last day of any fiscal quarter of the Company, except that:

|

|

|

(A)

|

during the elevated covenant period (the “Elevated Covenant Period”) lasting from the first day of the Company’s

fourth fiscal quarter of fiscal year 2020 and continuing through the last day of the Company’s second fiscal quarter of fiscal

year 2021 (unless MMI elects to terminate such period subject to the satisfaction of a 4.00 to 1.00 leverage ratio test calculated

as of the last day of any 12-month period ending during the Elevated Covenant Period), such secured leverage ratio may not exceed:

|

|

|

i.

|

4.50 to 1.00 as of the last day of the Company’s

fourth fiscal quarter of fiscal year 2020;

|

|

|

ii.

|

4.50 to 1.00 as of the last day of the Company’s first fiscal quarter of fiscal year 2021;

|

|

|

iii.

|

4.25 to 1.00 as of the last day of the Company’s second fiscal quarter of fiscal year 2021; and

|

|

|

(B)

|

if the Elevated Covenant Period has ended, the secured leverage ratio may be adjusted to 4.00 to 1.00 for a four consecutive

fiscal quarter period in connection with certain qualified acquisitions, subject to the terms and conditions contained in the Credit

Agreement;

|

|

|

(iv)

|

add three additional pricing levels to the Commitment Fee Rate, Eurocurrency Margin, LC Fee Rate, Base Rate Margin and Canadian

Prime Rate Margin (each defined in the Credit Agreement) applicable if the leverage ratio is:

|

|

|

(A)

|

greater than or equal to 4.00 to 1.00 but less than 4.50 to 1.00;

|

|

|

(B)

|

greater than or equal to 4.50 to 1.00 but less than 5.00 to 1.00; and

|

|

|

(C)

|

greater than or equal to 5.00 to 1.00;

|

|

|

(v)

|

increase capacity for addbacks to EBITDA (as defined in the Credit Agreement) to a cap of 20% of EBITDA for certain costs,

fees and expenses including, after giving effect to the First Amendment, COVID-19 pandemic related expenses incurred on or after

January 1, 2020 and prior to the first day of the Company’s third fiscal quarter of fiscal year 2022; and

|

|

|

(vi)

|

add a condition to each new borrowing under the Credit Agreement that the aggregate cash and Cash Equivalent Investments (as

defined in the Credit Agreement) of the Company and its subsidiaries not subject to certain liens shall not exceed $500,000,000,

subject to certain exceptions.

|

The summary above is subject to the complete terms of the First

Amendment, which will be filed upon the satisfaction of the Closing Conditions.

A copy of the press release announcing recent Company developments

and the proposed Credit Agreement amendment is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Convertible Notes Offering

On August 17, 2020, the Company also announced that it proposes

to offer (the “Offering”) $550 million aggregate principal amount of convertible notes due 2025 (the “Offered

Notes”), subject to market conditions and other factors. The Offered Notes are to be offered in a private offering to qualified

institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended. The Company also intends to grant to the

initial purchasers of the Offered Notes a 13-day option to purchase up to an additional $82.5 million aggregate principal amount

of the Offered Notes. In connection with the pricing of the Offered Notes, the Company expects to enter into privately negotiated

capped call transactions with one or more of the initial purchasers of the Offered Notes and/or their respective affiliates and/or

other financial institutions. The capped call transactions will initially cover, subject to customary anti-dilution adjustments,

the number of shares of the Company’s common stock that will initially underlie the Offered Notes, assuming the initial purchasers

do not exercise their option to purchase additional Offered Notes.

A copy of the press release announcing the launch of the Offering

is attached hereto as Exhibit 99.2 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

THE MIDDLEBY CORPORATION

|

|

|

|

|

|

By:

|

/s/ Bryan E. Mittleman

|

|

|

|

Bryan E. Mittelman

|

|

|

|

Chief Financial Officer

|

Date: August 17, 2020

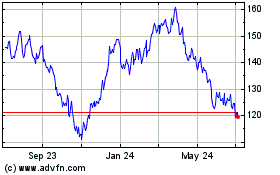

Middleby (NASDAQ:MIDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Middleby (NASDAQ:MIDD)

Historical Stock Chart

From Apr 2023 to Apr 2024