Report of Foreign Issuer (6-k)

August 17 2020 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of August 2020.

Commission File Number 0-26046

China Natural Resources, Inc.

(Translation of registrant's name into English)

Room 2205, 22/F, West Tower, Shun Tak Centre,

168-200 Connaught Road Central, Sheung Wan, Hong Kong

(Address of principal executive offices)

Indicate by check mark whether the registrant files of will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This report on Form 6-K is hereby incorporated by reference into the Registration Statement on Form F-3 (File No. 333-233852) of China Natural Resources, Inc. (the “Company”).

Acquisition of Feishang Anthracite Resources Limited Shares in Exchange for Newly Issued Company Shares

On August 17, 2020, the Company entered into a Sale and Purchase Agreement (“Sale and Purchase Agreement”) with Feishang Group Limited (“Feishang Group”), pursuant to which the Company issued 9,077,166 shares of the Company’s common stock, no par value, to Feishang Group, in exchange for 120,000,000 shares of Feishang Anthracite Resources Limited, a company that is traded on the main board of the Hong Kong Stock Exchange under ticker 1738 (“1738”), with an approximate aggregate value of HK$87,522,000 (determined at a price of HK$1.006 per share, representing the average closing price of 1738 on the five trading days before August 17, 2020, adjusted for a 27.5% discount based on an independent valuation report). Feishang Group is the largest stockholder in the Company, and is wholly owned by Mr. Li Feilie, who also beneficially owns 53.53% of the outstanding equity of 1738.

The description of the Sale and Purchase Agreement herein is qualified in its entirety by reference to the Sale and Purchase Agreement, which is filed as Exhibit 4.1 to this Form 6-K.

Update on Nasdaq Compliance Matters

As previously reported in the Company’s Report on Form 6-K dated March 30, 2020, on March 24, 2020, the Company received written notice from the Nasdaq Listing Qualifications department (the “Notice”) of the Company’s noncompliance with Nasdaq Listing Rule 5550(b)(2), and that the Company had until September 21, 2020 to regain compliance with the Nasdaq requirements for continued listing. The Notice also stated that at that time, the Company also did not meet the requirements of Nasdaq Listing Rules 5550(b)(1) and 5550(b)(3). Pursuant to the Nasdaq Listing Rules, a company need only meet the requirements of one of the three subsections of Nasdaq Listing Rule 5550(b) to be in compliance with Nasdaq’s standards for continued listing.

As a result of the transaction, the equity of the Company’s stockholders in the Company, which was a deficiency of $3.96 million as of December 31, 2019, has increased by approximately $15.5 million. The Company thus believes it satisfies the minimum $2.5 million shareholders’ equity requirement for continued listing on The Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(b)(1), and that it has regained compliance with the standards set forth in the Nasdaq Listing Rules. The Staff of the Nasdaq Listing Qualifications department will review and confirm the Company’s compliance with such listing standards after the Company files the annual report on Form 20-F for the fiscal year ended December 31, 2020, which is due on April 30, 2021.

Press Release

On August 17, 2020, the Company issued a press release discussing the foregoing matters, which is filed as Exhibit 15.1 to this Form 6-K.

Forward-Looking Statements:

This Current Report on Form 6-K includes forward-looking statements within the meaning of the U.S. federal securities laws. These statements include, without limitation, statements regarding the intent, belief and current expectations of the Company, its directors or its officers with respect to the impact on the Company’s financial position as a result of the transaction with Feishang Group and the assessment of the Staff of the Nasdaq Listing Qualifications Department when they next consider the Company’s compliance with the Nasdaq Listing Rules. Forward-looking statements are not a guarantee of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking statement as a result of various factors. Among the risks and uncertainties that could cause the Company’s actual results to differ from its forward-looking statements are: the results of the next assessment by the Staff of the Nasdaq Listing Qualifications department of the Company’s compliance with the Nasdaq Listing Rules; uncertainties regarding governmental, economic and political circumstances in the PRC; uncertainties associated with metal price volatility; uncertainties related to the Company’s ability to fund operations; uncertainties relating to possible future increases in operating expenses, including costs of labor and materials; uncertainties regarding the impact of COVID-19 pandemic; uncertainties regarding the political situation between the PRC and the United States, and potential negative impacts on companies with operations in the PRC that are listed on exchanges in the United States; and other risks detailed from time to time in the Company’s filings with the U.S. Securities and Exchange Commission. When, in any forward-looking statement, the Company, or its management, expresses an expectation or belief as to future results, that expectation or belief is expressed in good faith and is believed to have a reasonable basis, but there can be no assurance that the stated expectation or belief will result or be achieved or accomplished. Except as required by law, the Company undertakes no obligation to update any forward-looking statements.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

CHINA NATURAL RESOURCES, INC.

|

|

|

|

|

|

|

Date: August 17, 2020

|

By:

|

/s/ Wong Wah On Edward

|

|

|

|

|

Wong Wah On Edward

|

|

|

|

|

Chairman and Chief Executive Officer

|

|

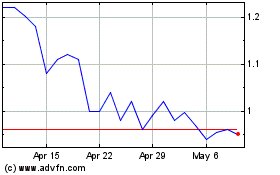

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Apr 2023 to Apr 2024